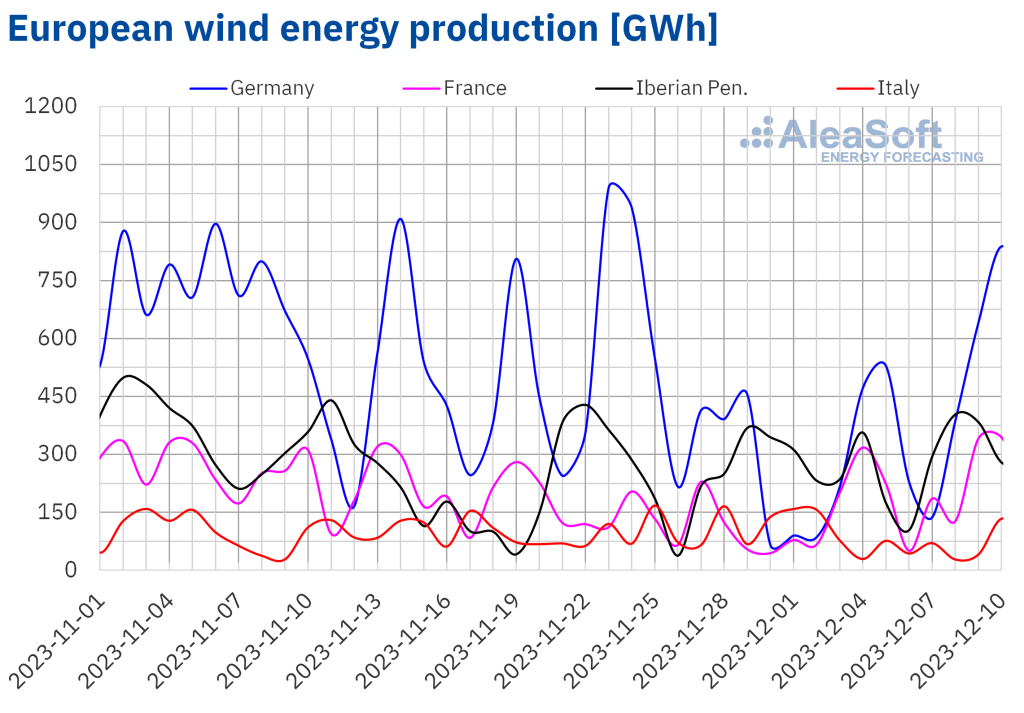

In the first week of December, gas prices declined, approaching levels seen in early October, before the Hamas attack on Israel. CO2 futures also declined. On December 8, they registered the lowest settlement price since October 2022. Wind energy production increased in most major European electricity markets. In this context, and with electricity demand generally lower, prices in almost all markets decreased compared to the previous week’s prices.

Solar thermal, photovoltaic, and wind energy production

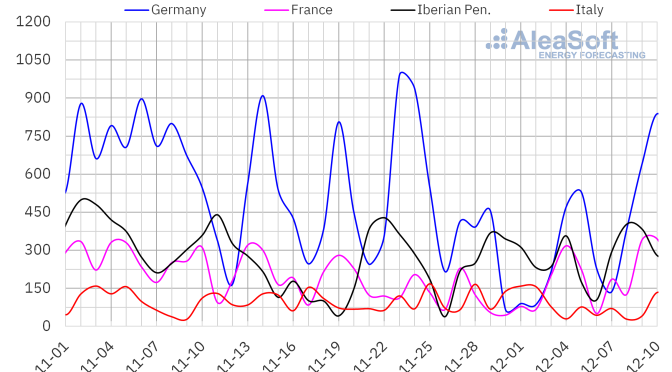

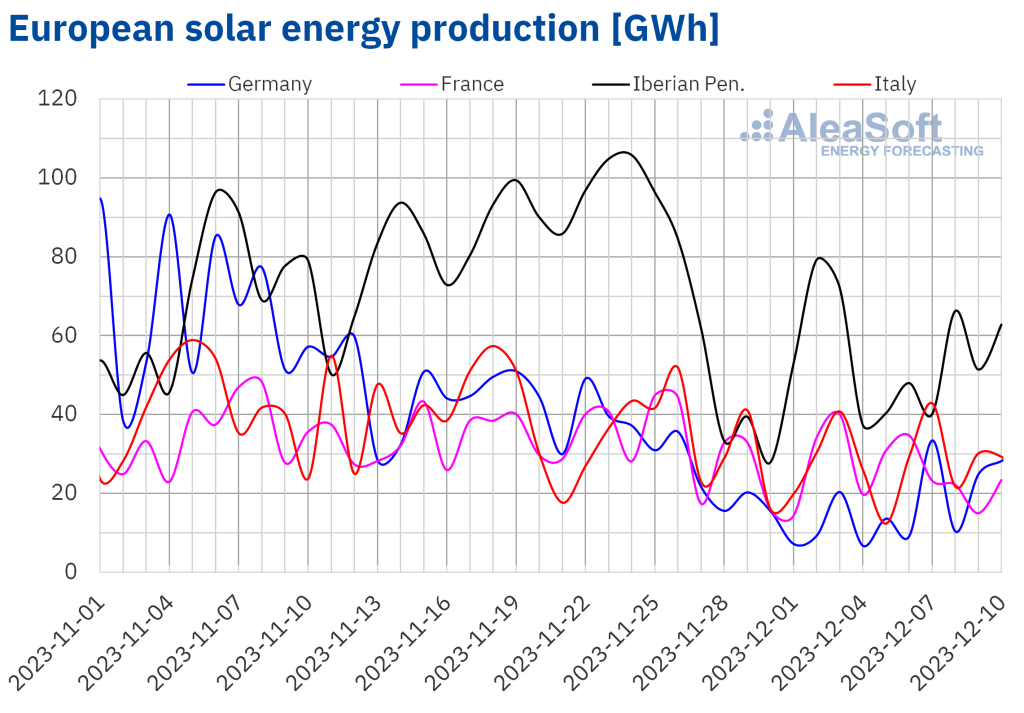

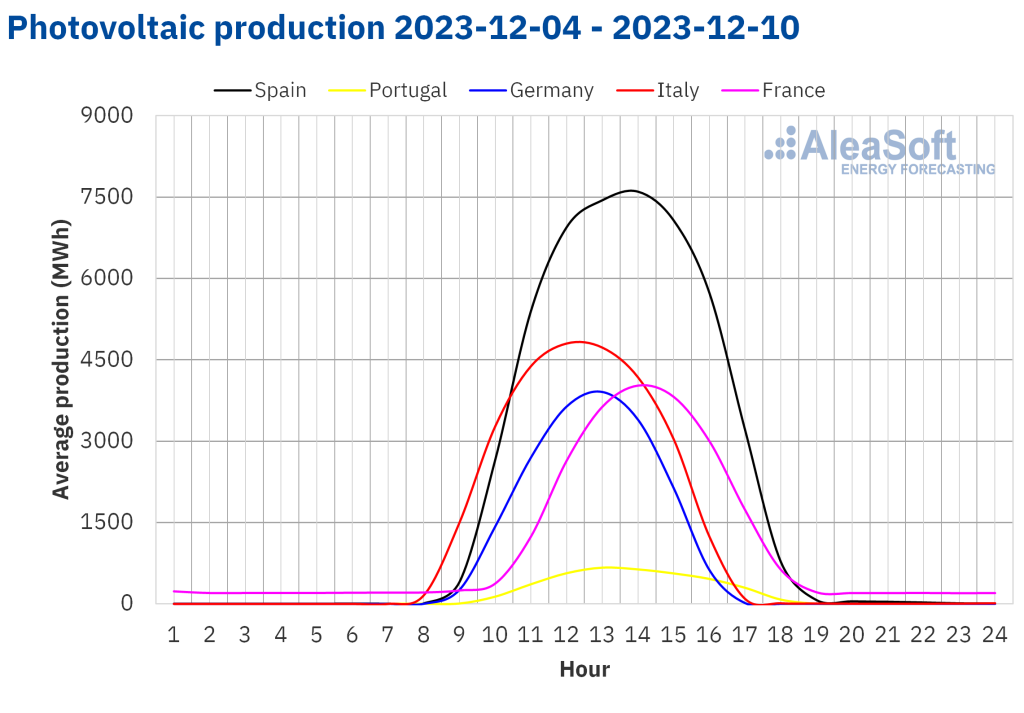

In the week of December 4, solar energy production showed a week?on?week drop in most of the main European electricity markets. Declines ranged from 23% in Portugal to 3.9% in Spain. On the other hand, in the German market, solar energy production increased by 15%. According to AleaSoft Energy Forecasting’s solar energy production forecasts, it will increase in Germany and Spain, while it will decrease in Italy in the week of December 11.

In the first week of December, gas prices declined, approaching levels seen in early October, before the Hamas attack on Israel. CO2 futures also declined. On December 8, they registered the lowest settlement price since October 2022. Wind energy production increased in most major European electricity markets. In this context, and with electricity demand generally lower, prices in almost all markets decreased compared to the previous week’s prices.

Solar photovoltaic, solar thermoelectric and wind energy production

In the week of December 4, solar energy production showed a week?on?week drop in most of the main European electricity markets. Declines ranged from 23% in Portugal to 3.9% in Spain. On the other hand, in the German market, solar energy production increased by 15%. According to AleaSoft Energy Forecasting’s solar energy production forecasts, it will increase in Germany and Spain, while it will decrease in Italy in the week of December 11.

Electricity demand

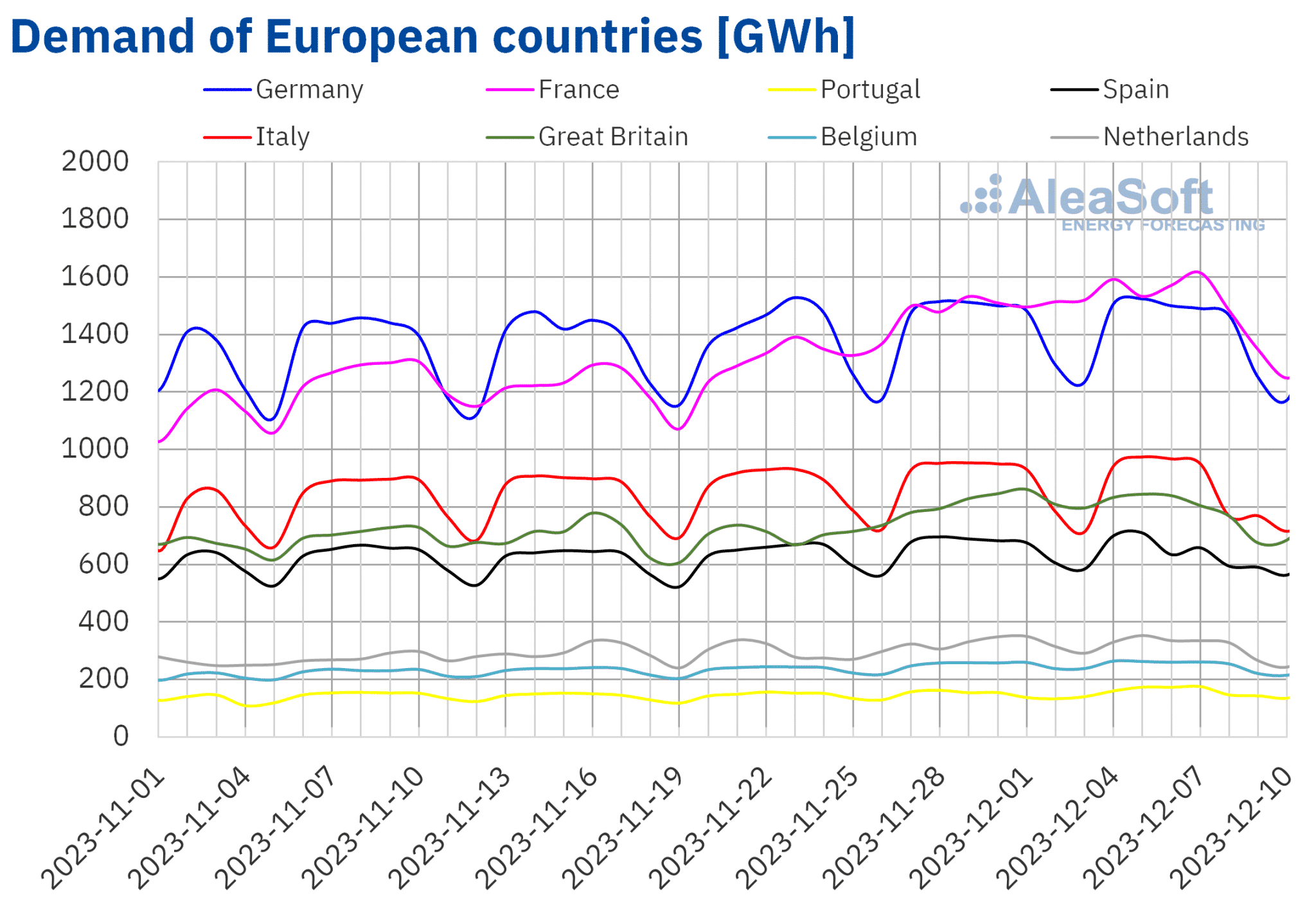

In the week of December 4, most of the major European electricity markets registered a decrease in electricity demand compared to the previous week. Demand declines ranged from 4.7% in Great Britain to 1.0% in Germany. The Portuguese market was the exception to this trend, with an increase in demand of 6.4%.

The drop in demand was related to less cold average temperatures in central and northern Europe compared to the previous week. Average temperature increases ranged from 1.6 °C in Germany to 3.9 °C in Belgium and Great Britain. In southern Europe, however, average temperatures were cooler than the previous week, with variations ranging from ?3.5 °C in Italy to ?0.7 °C in Portugal.

In addition, on December 8, Italy, Portugal and Spain celebrated the Immaculate Conception Day. For Spain, it was the second public holiday of the week, following the Constitution Day celebrated on December 6.

According to AleaSoft Energy Forecasting’s demand forecasts, electricity demand will continue to decline in most of the analyzed markets in the week of December 11. Only the Iberian Peninsula and Italian markets will register an increase in demand as working hours recover after the holidays of the week of December 4.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

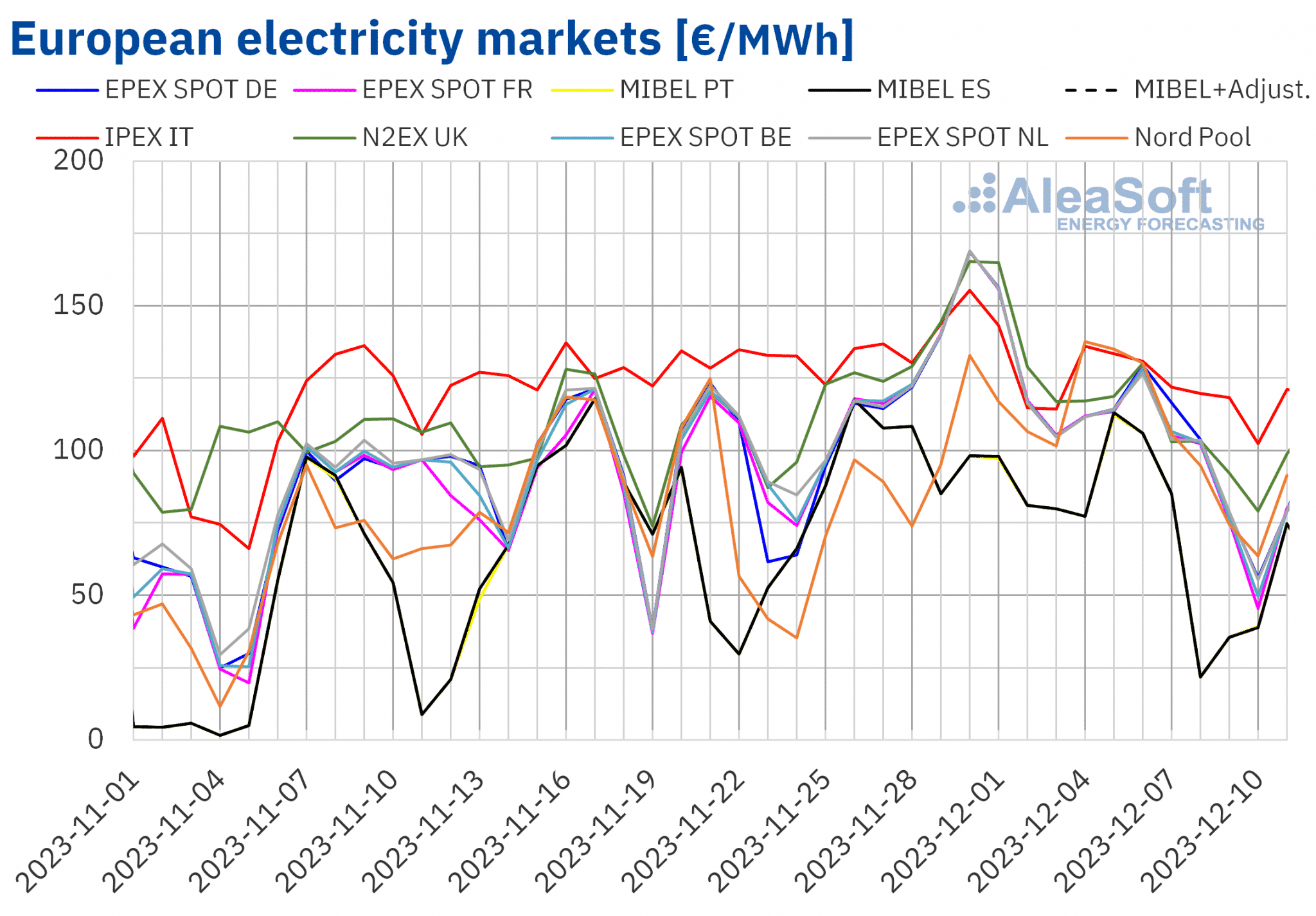

In the week of December 4, prices in major European electricity markets decreased compared to the previous week. The exception was the Nord Pool market of the Nordic countries, with an increase of 3.6%. On the other hand, the MIBEL market of Spain and Portugal registered the largest price drop, 27%, while the IPEX market of Italy had the smallest decline, 8.1%. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices fell between 23% in the EPEX SPOT market of Germany and 26% in the EPEX SPOT market of Belgium and France.

In the first week of December, weekly averages were below €110/MWh in almost all analyzed European electricity markets. The exception was the Italian market, with an average of €123.21/MWh. In contrast, the Portuguese and Spanish markets registered the lowest weekly averages, €68.15/MWh and €68.21/MWh, respectively. In the rest of the analyzed markets, prices ranged from €97.53/MWh in the French market to €106.24/MWh in the N2EX market of the United Kingdom.

On the other hand, the Spanish and Portuguese markets reached the lowest hourly prices in the first week of December. In fact, since November 29, the MIBEL market has registered every day the lowest daily prices among the main European electricity markets. This market registered the minimum hourly price of the week of December 4, €4.30/MWh, on December 8 from 3:00 to 7:00 and from 11:00 to 16:00. In contrast, the Nordic market registered the highest price, €214.53/MWh, on December 5, from 8:00 to 9:00. This price was the highest in this market since the second half of December 2022.

During the week of December 4, the drop in the average price of gas and CO2 emission rights and the fall in electricity demand in most markets led to lower prices in the European electricity markets. The increase in wind energy production in countries such as Germany, France and Portugal also had a downward influence on prices.

AleaSoft Energy Forecasting’s price forecasts indicate that in the second week of December prices might continue to fall in most major European electricity markets. Declining demand in some markets and increased solar energy production in markets such as Germany and Spain, as well as increased wind energy production in Italy, might contribute to this behavior.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

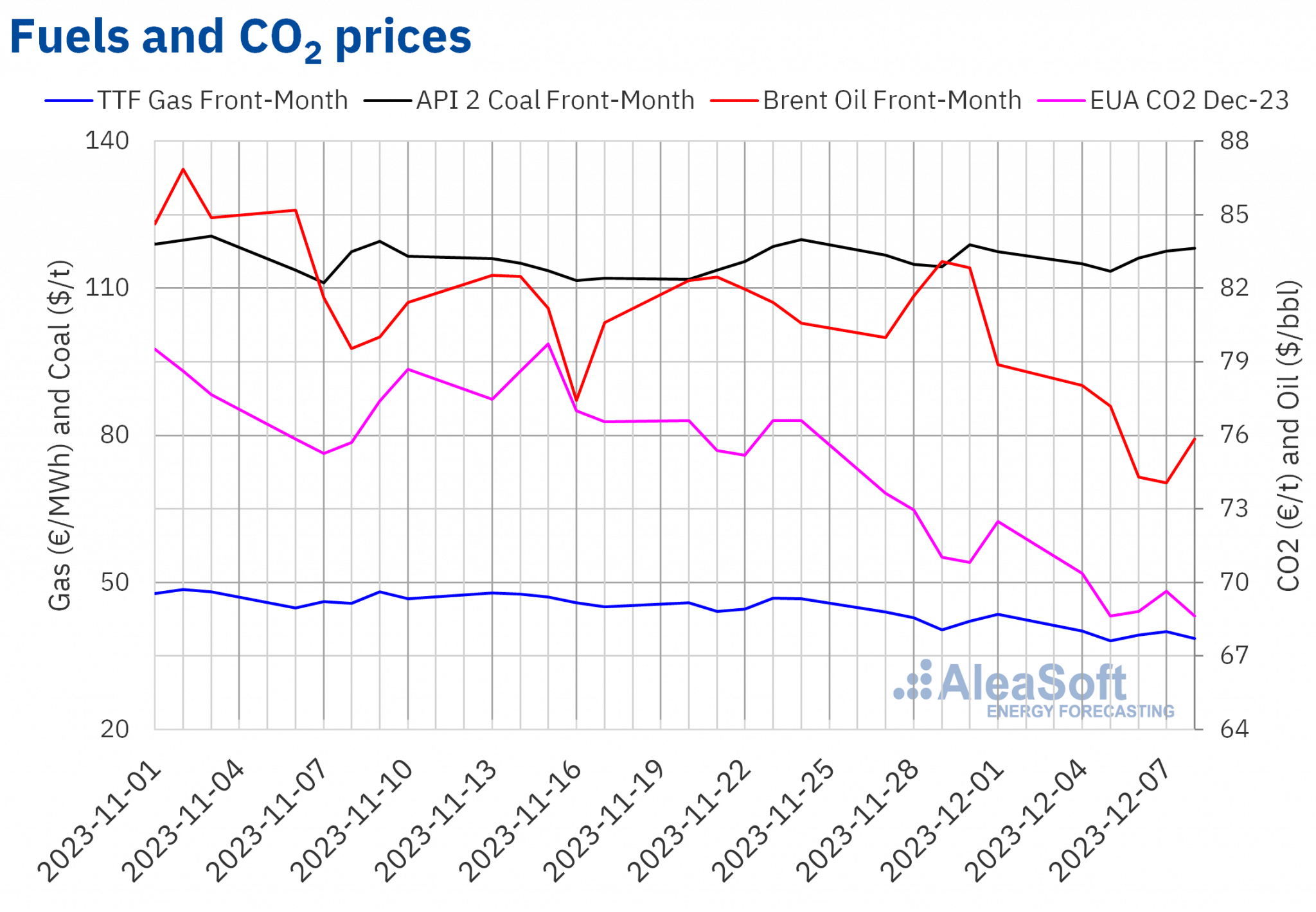

Brent oil futures for the Front?Month in the ICE market began the last week of November with a slight price decline from the previous week. Despite this, on Monday, December 4, these futures registered their weekly maximum settlement price, $78.03/bbl. The downward trend continued until reaching the weekly minimum settlement price, $74.05/bbl, on Thursday, December 7. This price was the lowest since the end of June. In contrast, on Friday, December 8, prices increased by 2.4% to $75.84/bbl.

High production levels in the United States and data on declining crude oil imports in China led to Brent oil futures price declines. However, at the end of the first week of December, the announcement of the US government’s plans to refill its strategic reserves exerted its upward influence on prices. The call by Saudi Arabia and Russia for more OPEC+ countries to make production cuts also contributed to the turnaround.

As for TTF gas futures in the ICE market for the Front?Month, on Monday, December 4, they reached the weekly maximum settlement price, €40.10/MWh. This price was already 7.8% lower than the last session of the previous week. After falling another 4.9%, these futures registered their weekly minimum settlement price, €38.13/MWh, on Tuesday, December 5. According to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since early October. In the last three sessions of the first week of December, prices were slightly higher, but remained below €40/MWh. On Friday, December 8, the settlement price was €38.60/MWh.

In the first week of December, abundant supply and high levels of European stocks led to TTF gas futures settlement prices below €40/MWh. Milder temperatures, following the cold snap, also had a downward influence on prices.

As for CO2 emission rights futures in the EEX market for the reference contract of December 2023, they reached their weekly maximum settlement price, €70.37/t, on Monday, December 4. This price was 2.9% lower than that of the last session of the previous week. In the rest of the sessions of the first week of December, settlement prices were below €70/t. On Friday, December 8, these futures registered their weekly minimum settlement price, €68.63/t. This price was the lowest since October 2022 for the December 2022 reference contract.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy transition

Next Thursday, December 14, AleaSoft Energy Forecasting and AleaGreen will hold their last webinar of 2023. This edition marks the fourth anniversary since these webinars began to be held on a monthly basis. During the webinar, AleaSoft Energy Forecasting and AleaGreen will present the services they offer to the energy sector and how they can be useful for the various players in the sector. In addition, the webinar will analyze the evolution of the energy markets during 2023, as well as the prospects for 2024.