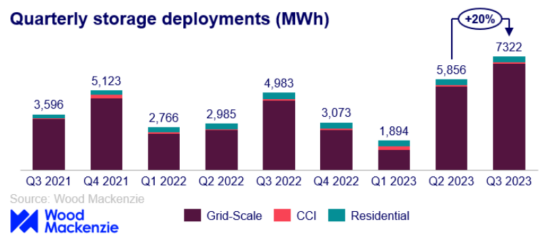

The U.S. storage market hit a new high in Q3 2023, installing the most capacity in a quarter to date with 7,322 megawatt hours (MWh) becoming operational in the third quarter of 2023.

As outlined in the American Clean Power Association (ACP) and Wood Mackenzie’s latest US Energy Storage Monitor report, the U.S. grid-scale segment saw quarterly installations increase 27% quarter-on-quarter (QoQ) to 6,848 MWh, a record-breaking third quarter for both megawatts (MW) and megawatt-hours (MWh) installed.

“Energy storage deployment is growing dramatically, proving that it will be essential to our future energy mix. With another quarterly record, it’s clear that energy storage is increasingly a leading technology of choice for enhancing reliability and American energy security,” said ACP Chief Policy Officer Frank Macchiarola. “This industry will serve as the backbone of our modern grid. As we continue to build a strong domestic supply chain, streamlined permitting and evolving market rules can further accelerate the deployment of storage resources.”

The cumulative volume installed between Q1 and Q3 of this year, which totals 13,518 MWh, has already surpassed the total volume in all of 2022 which ended at 11,976 MWh.

“However, the Q3 installation record could have been greater were it not for the roughly 80% of projects in the pipeline expected for Q3 being delayed to a later date,” explained Vanessa Witte, senior research analyst with Wood Mackenzie’s energy storage team.

The residential segment bounced back from the low volume recorded in Q2 to install 166.7 MW and 381.4 MWh in Q3, a 29% increase QoQ in MW-terms. The largest increase was in California, which almost doubled its installed capacity QoQ to install 78.4 MW. All other states?deployed a combined total of?88.31 MW, falling just short of the?89.53 MW deployed?in the previous quarter.?

In contrast, deployment in the community, commercial, and industrial (CCI) storage segment fell 7% QoQ, with installations finalizing at 30.3 MW and 92.9 MWh. Installations in California were notably higher, with a 35% increase QoQ, though Massachusetts did not record any community storage deployments,?bringing down the overall volume.?

The U.S. storage market is forecasted to install approximately 63 GW between 2023 and 2027 across all segments, a 5% decline from the Q2 forecast, according to the latest report.

For grid-scale, while the segment’s 2023 forecast increased just slightly due to strong Q3 volume, the remainder of the forecast lowered by 7% on average. “The segment is facing multiple headwinds that have emerged this year, resulting in a volatile near-term pipeline and difficulty in bringing projects to mechanical completion,” Witte commented.

“Grid-scale declines were more focused on challenges not only with supply and permitting, but also with the backlog of applications in most ISOs interconnection queues that are preventing projects to move through the development process,” Witte continued.

The 2023 residential forecast increased by 4% as the California market began to pick up in Q3 after the passage of NEM 2.0. The residential segment is expected to double between 2023 and 2025, but growth slows later in the forecast period as solar penetration in California heightens. In other states, incentive programs and solar compensation rates will continue to be the biggest predictor of growth, even as the market faces near-term economic headwinds.

Interconnection queue challenges and a lack of state policy incentives limited the CCI segment. The 2023 CCI segment forecast declined 12% QoQ, as per Wood Mackenzie’s latest analysis. This was largely caused by low installation volumes between Q1 and Q3. “This segment is more reliant on a variety of factors, such as state incentives, community solar programs and standalone potential in various states,” Hanna Nuttall added, a research analyst with Wood Mackenzie’s energy storage team.

Nuttall continued, “The CCI segment is still forecasted to double in 2024 as California opens its community solar and storage program. Commercial and industrial storage is expected to become a larger share of the forecast in 2025 and beyond, which will bring more geographic diversity to the US market.”