The last week of the year 2023 registered the expected drop in demand due to the Christmas holiday period. Increased solar energy production in countries such as Germany and France contributed to price declines in the EPEX SPOT market. However, wind and solar energy production fell in Italy and the Iberian Peninsula, contributing to price increases in these markets. Gas prices continued their downward trend, approaching €30/MWh.

Solar photovoltaic, solar thermoelectric and wind energy production

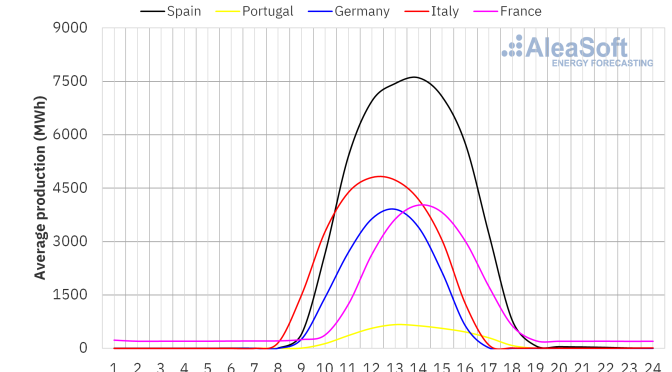

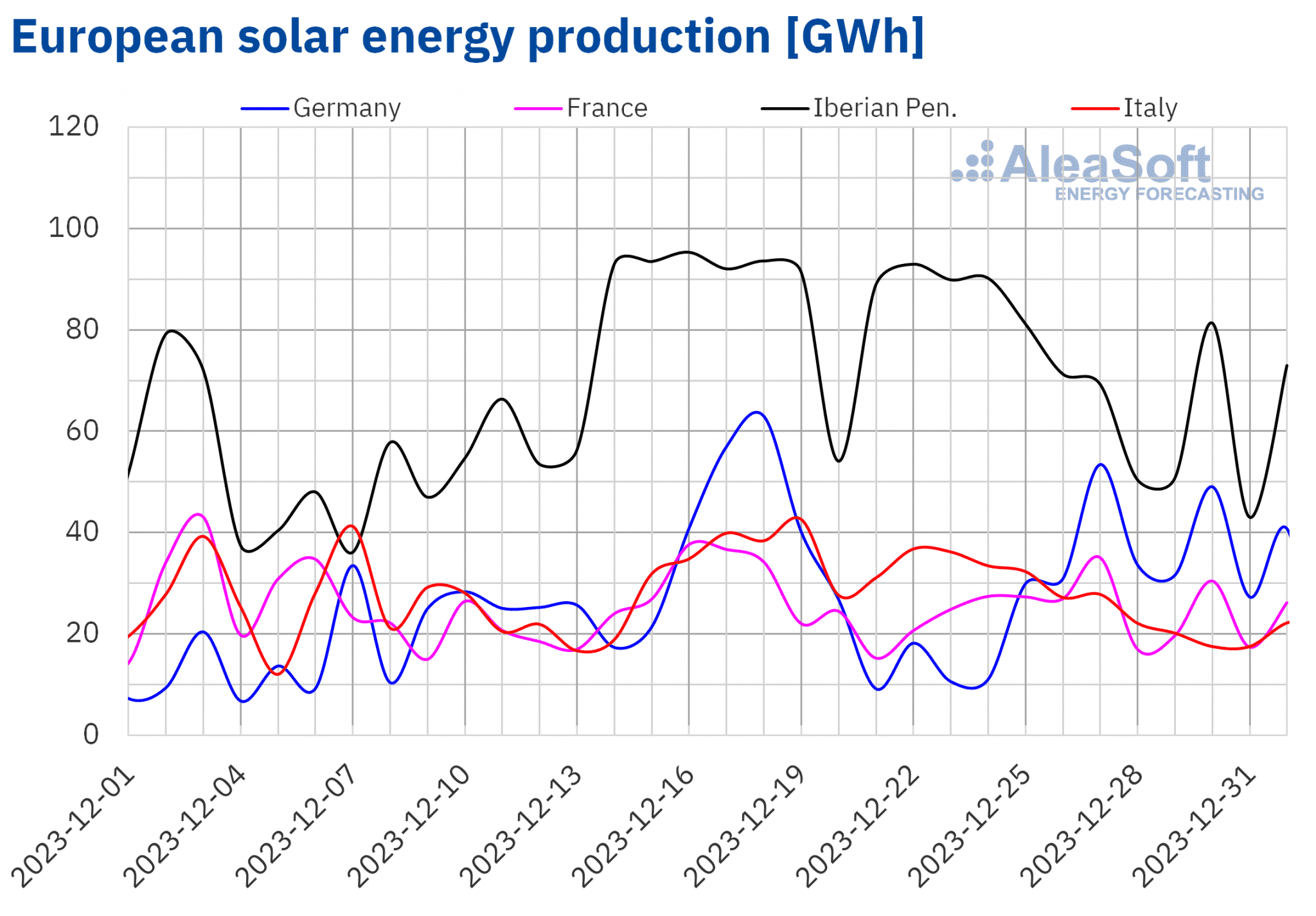

In the week of December 25, changes in solar energy production compared to the previous week showed no clear trend in the main European electricity markets. In the German and French markets, solar energy production increased by 43% and 2.9%, respectively. In the Southern European markets, the opposite was true. In Italy and the Iberian Peninsula, solar energy production fell by 33% and 26%, respectively.

For the week of January 1, according to AleaSoft Energy Forecasting’s solar energy production forecasts, it will decrease in Germany, Italy and Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

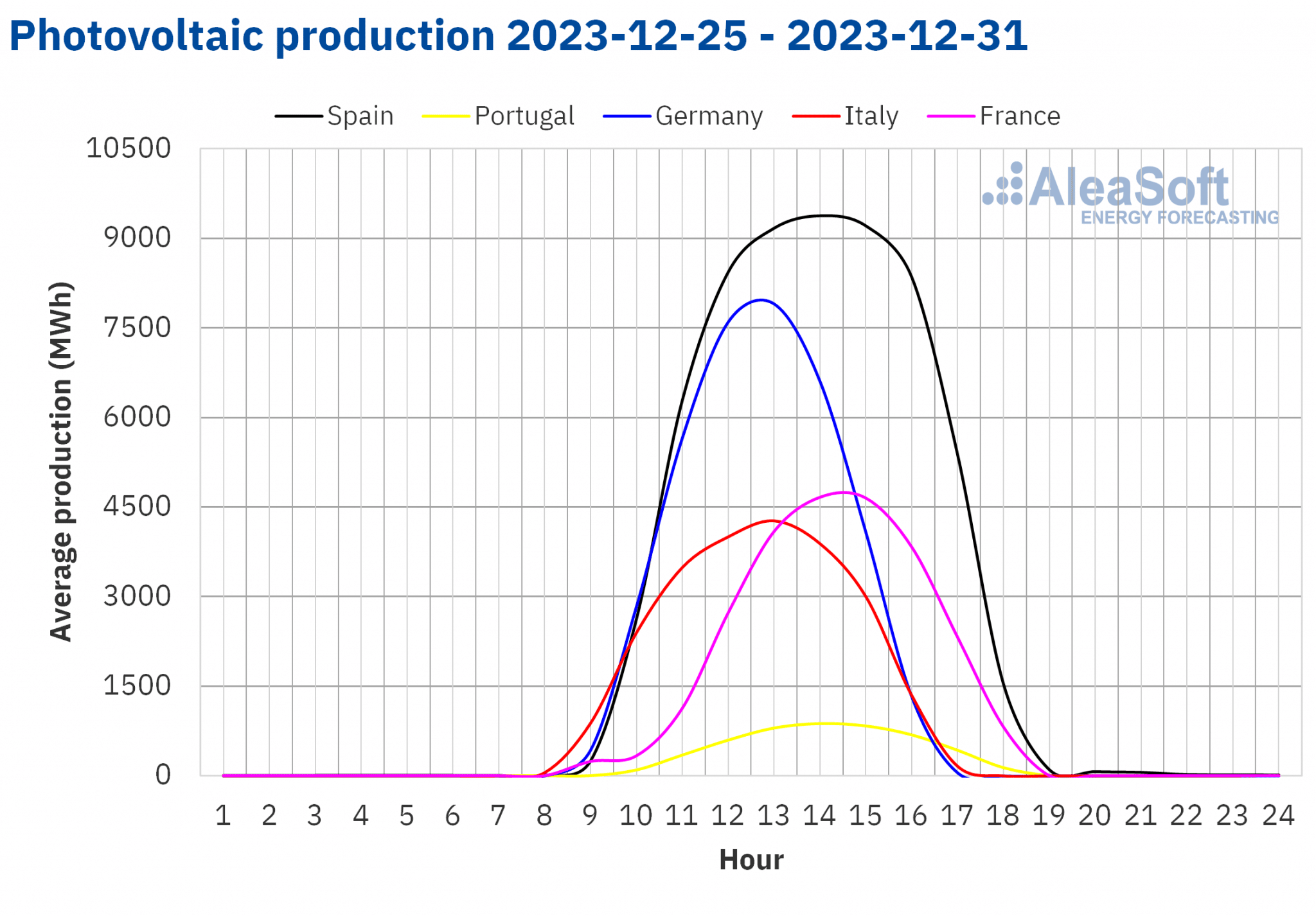

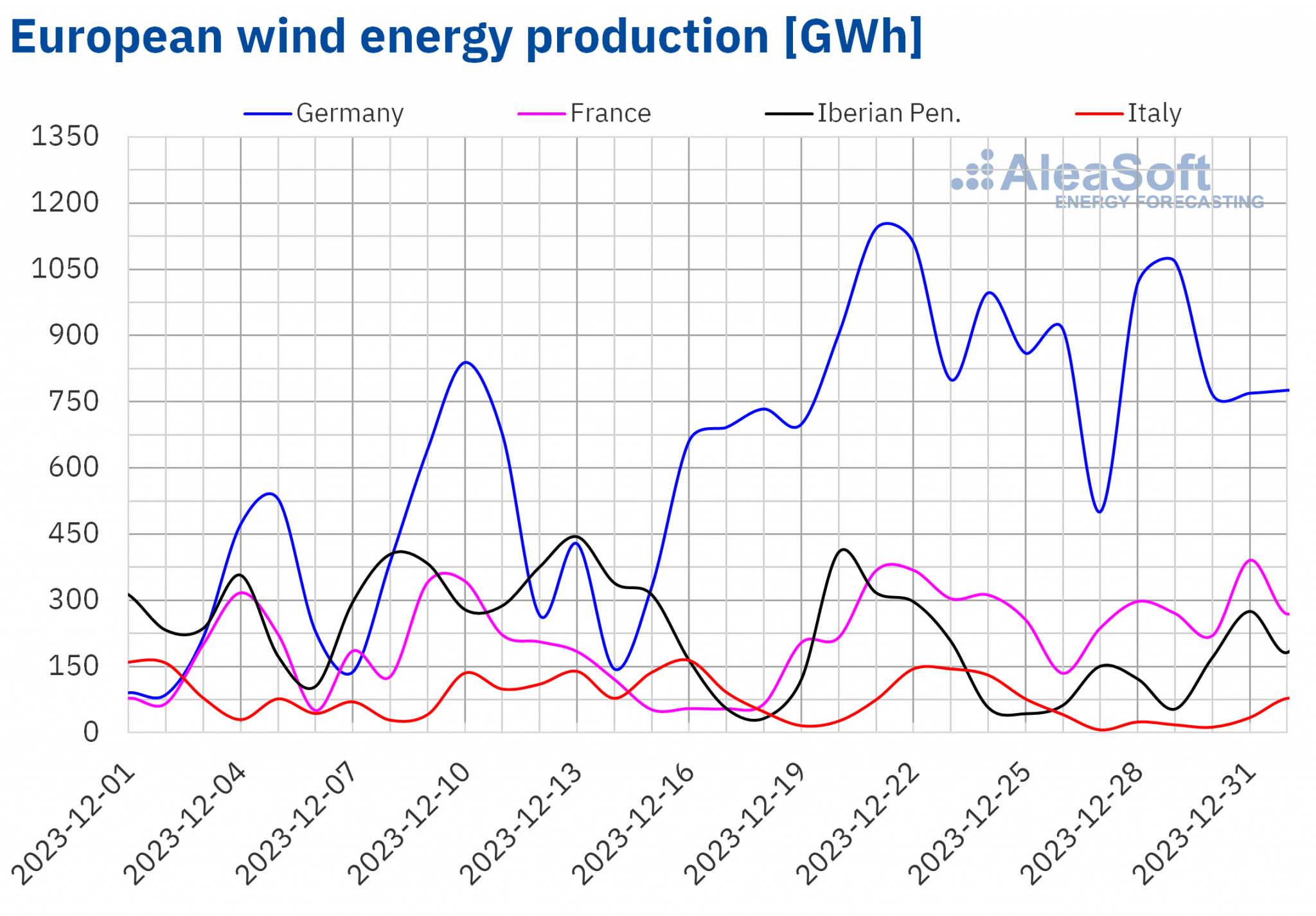

For wind energy production, during the last week of 2023, there was a weekly decline in all major European electricity markets. The drop ranged from 63% in Italy to 1.6% in France. Despite the drop in production for the week overall, on December 31 the French market generated 391 GWh of wind energy, the highest daily value according to historical data.

For the week of January 1, AleaSoft Energy Forecasting’s wind energy production forecasts indicate that it will increase in Spain, Portugal and Italy, but it will decrease in France and Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

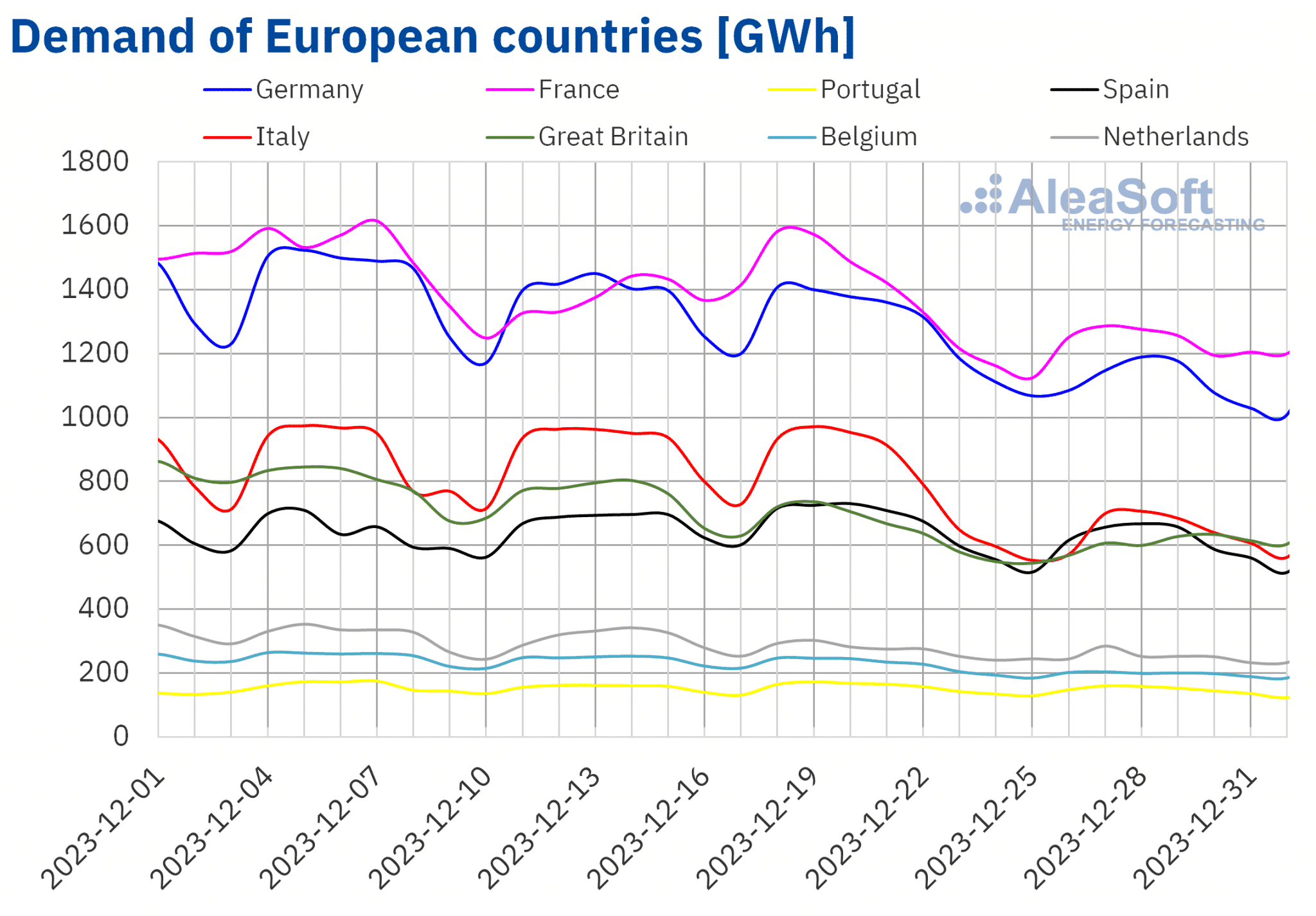

Electricity demand

In the week of December 25, electricity demand decreased in all major European electricity markets compared to the previous week. A drop in demand was expectable as most European countries celebrated the Christmas holidays. The Italian market registered the largest decline, 23%, while the Portuguese market registered the smallest drop, 7.0%.

During that week, the average temperature increased in most analyzed countries. The increase ranged from 1.8 °C in Germany to 0.3 °C in the Netherlands. Only the Iberian Peninsula and Great Britain registered cooler conditions with a temperature decrease between 0.9 °C and 2.1 °C.

For the week of January 1, according to AleaSoft Energy Forecasting’s demand forecasts, electricity demand will increase in all analyzed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

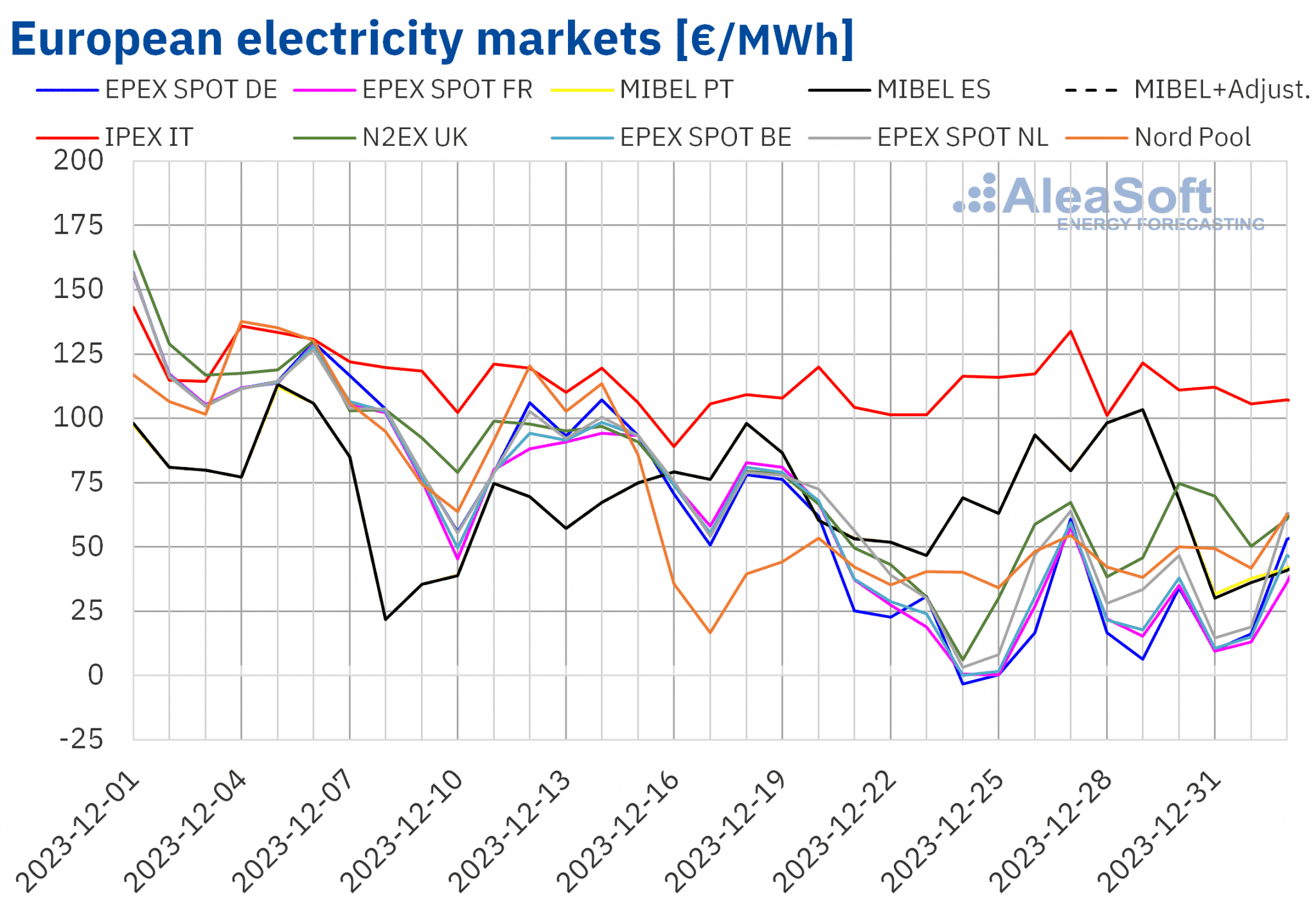

European electricity markets

In the week of December 25, prices in some of the main European electricity markets fell, while in other markets prices increased compared to the previous week. In the EPEX SPOT market of the Netherlands, Belgium, France and Germany, prices fell by 32%, 44%, 47% and 50%, respectively. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices rose between 6.9% in the IPEX market of Italy and 16% in the MIBEL market of Portugal.

In the fourth week of December, weekly averages were below €55/MWh in most analyzed European electricity markets. The exceptions were the Spanish, Portuguese and Italian markets, with averages of €76.61/MWh, €76.86/MWh and €116.17/MWh, respectively. In the rest of the analyzed markets, prices ranged from €20.69/MWh in the German market to €54.98/MWh in the N2EX market of the United Kingdom.

On the other hand, the German, Belgian, French and Dutch markets registered negative hourly prices on most days of the last week of December, as well as on January 1. In the early morning hours of December 25, the German, Belgian and Dutch markets reached their lowest prices since August 8, while the French market reached its lowest price since July 16. The lowest hourly price, ?€13.37/MWh, was in the German market. The British market also registered negative prices on December 25, 28 and 29 and January 1. In the case of the Spanish and Portuguese markets, there was a price of €0/MWh on Sunday, December 31, from 4:00 to 6:00.

During the week of December 25, the general drop in electricity demand and the increase in solar energy production in countries such as Germany and France contributed to the price decreases registered in the EPEX SPOT market. However, wind and solar energy production fell in Italy and the Iberian Peninsula. This led to higher prices in these markets.

AleaSoft Energy Forecasting’s price forecasts indicate that in the first week of January prices might increase in most European electricity markets. The recovery in demand and the decrease in wind energy production in some markets might contribute to this behavior. However, the IPEX and MIBEL markets might register price decreases. A significant rise in wind energy production in these markets would lead to these price decreases.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

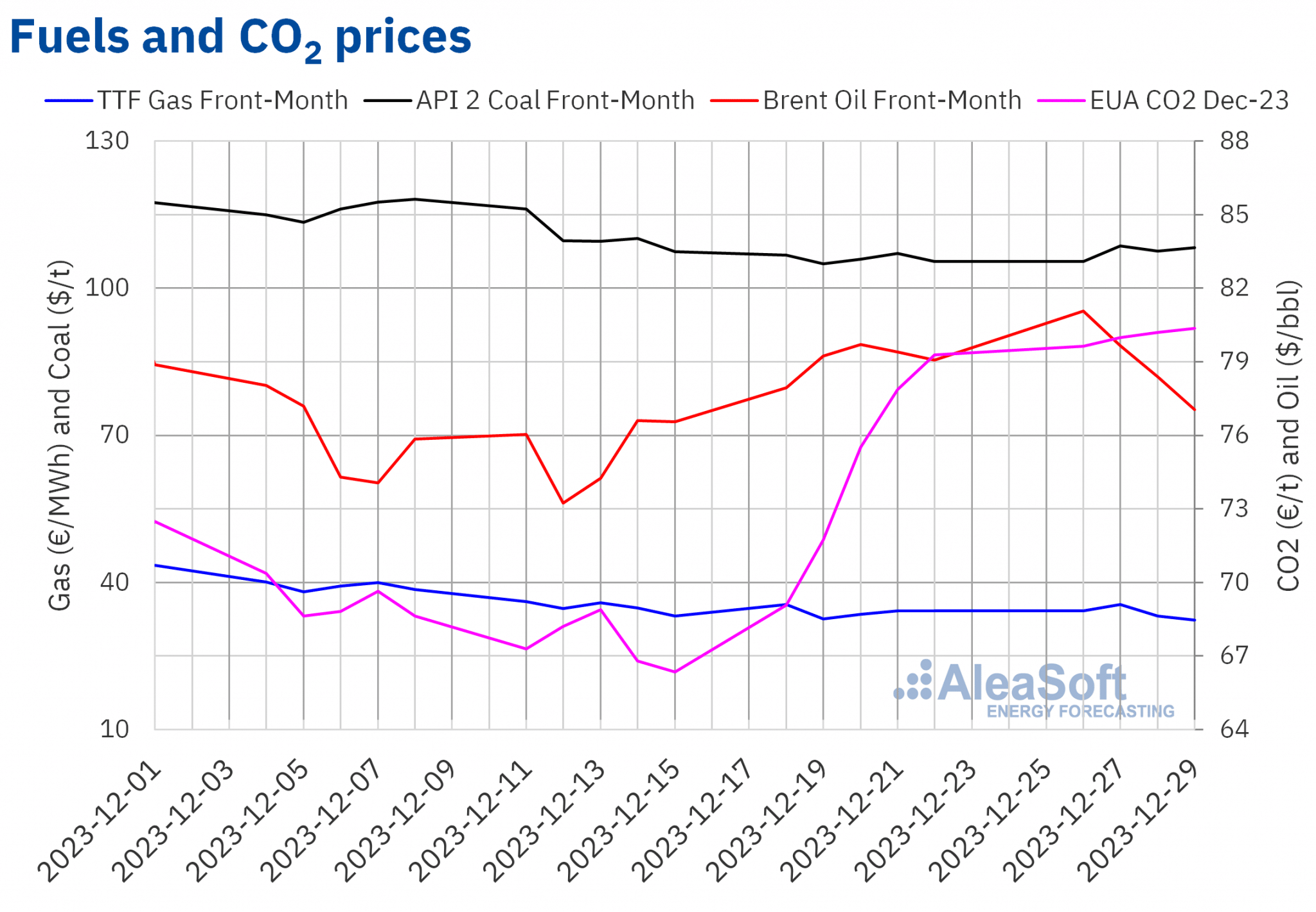

Brent, fuels and CO2

Brent oil futures for Front?Month in the ICE market started the last week of December up $2/bbl from the price of the last session of the previous week. Thus, on Tuesday, December 26, these futures registered their weekly maximum settlement price, $81.07/bbl. But for the rest of the week, prices declined. As a result, on Friday, December 29, they reached their weekly minimum settlement price, $77.04/bbl.

In the last week of December, high production levels in countries such as the United States, Brazil or Guyana and concerns about the evolution of demand continued to exert their downward influence on Brent oil futures prices. The announcement by some companies of their intention to resume shipping through the Red Sea also contributed to the decline in prices in the last sessions of the week.

As for TTF gas futures in the ICE market for the Front?Month, on Wednesday, December 27, they reached the weekly maximum settlement price, €35.51/MWh. But on Thursday the price fell by 6.8%. After falling another 2.3%, these futures registered their weekly minimum settlement price, €32.35/MWh, on Friday, December 29. According to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since the first week of September.

In the last week of December, the high levels of European reserves, forecasts of mild temperatures in Northwestern Europe and uncertainty about the evolution of industrial demand led to settlement prices of TTF gas futures remaining below €40/MWh.

As for settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, during the last week of December, they continued the upward trend of the previous week. As a result, on Friday, December 29, they reached their weekly maximum settlement price, €80.37/t. This price was the highest since the second half of October.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy transition

The first webinar of 2024, in the series of monthly webinars organized by AleaSoft Energy Forecasting and AleaGreen, will take place on January 18 and will feature speakers from PwC Spain for the fourth time in this series of webinars. It will analyze the evolution of European energy markets and prospects for 2024, as well as the vision of the PPA market for the consumer in the current context.