It was reported that India will carry out a round of renewable energy bidding in the first quarter of 2024, which requires bidders to submit a program must contain more than 50% of the CSP capacity. This news got great attention in the past weeks on the possibility of CSP revival in India. But how about the challenges to hinder the development of India’s solar thermal power generation in the past years, such as DNI data, land, financing, grid access, local supply chain and so on? Mr. Rajan Varshney, Deputy Managing Director of NTPC, India’s state-owned power utility, shared his insight to CSP Focus in a recent interview.

CSP Focus: Why is CSP catching up interest off-late in India especially when the last experience around a decade back was not good?

Rajan: I think at that time there were some issues which were not directly CSP technology related but extraneous like related to policy, death of key person etc., the tender in 2011 for both for CSP and PV required both to be built in 3 years and no storage PPA was there thereby plant could run only during daytime and could supply only infirm power. The permitted time for CSP was less especially when barely 700 MW CSP capacity was working across globe. At that time, people didn’t think of storage, rather they thought, if we put the storage, it will cost more. Thus the inherent advantage of CSP was ignored. With slightly more CAPEX, you can run this plant for 24 hours of the day and give a firm power. In three years if you have to do CSP, you have to first identify the technology, then the technology provider, then funding, then financial closure, then you will order, then the supply in months, then you will start erecting, so it was very difficult to do it in 3 years, no one of the bidders could do it. it was not a technology failure rather it was a policy failure.

Now is the right time for CSP because already a lot of infirm power is getting injected into the grid and balancing power is required for firming it up which as such is supposed to be only coal. As PV & Wind capacity increases, increasingly more and more coal-based power will be required to make it firm and to supply electricity when Sun is not there. So by increasing PV we cannot avoid coal unless we install CSP plus storage in Gujarat and Rajasthan. Also the coal based capacity has to run at reduced load and at times to avoid operating below technically minimum, curtailment of the infirm power is resorted to or otherwise coal based plant has to be tripped for some time.

The other reason is that now the CSP prices have plummeted a lot whereas Capex for coal-based plants and coal cost and hence Opex is increasing with time. The electricity price overall has increased 0.71Rs/KWh in last year. So cost of new coal based plants has increased and is presently around 9 to 10 Cr per MW and OPEX is also higher than CSP as coal has to be bought and burnt to produce heat. Now CSP can be much cheaper both on Capex of around 15 Cr per MW (life being more than 70 years) and Opex being hardly 1% of Capex. Further the CSP price is decreasing with China installing more than 30 CSP plants with storage, out of which around 20 will be running in 2024. The vendors have built supply chains and they are now bidding aggressively. CSP CAPEX has decreased with time owing to scaling up also and with improvements in technology. Now more vendors are coming up and bidding aggressively. With time, most of the CSP components can be made even in India, so the CSP cost will come down further.

CSP Focus: Is the Government and the related regulatory ministry also shared the same comments to CSP?

Rajan: Ministry has also agreed that now CSP is viable proposition and it should be implemented, after my presentations to various agencies including MNRE.

CSP Focus: How about the funding problem? How do the lenders think of CSP?

Rajan: I also talked to funding agencies and explain them how good the technologies. and in this proposed tender it will be IPP based, 30% will be brought by the vendors themselves and 70% will be the loan. and the loan will be disbursed proportionately. So the loan agencies will have the confidence.

CSP Focus: One more question is the DNI data, I think during the last auction DNI was also one of the causes to the failure.

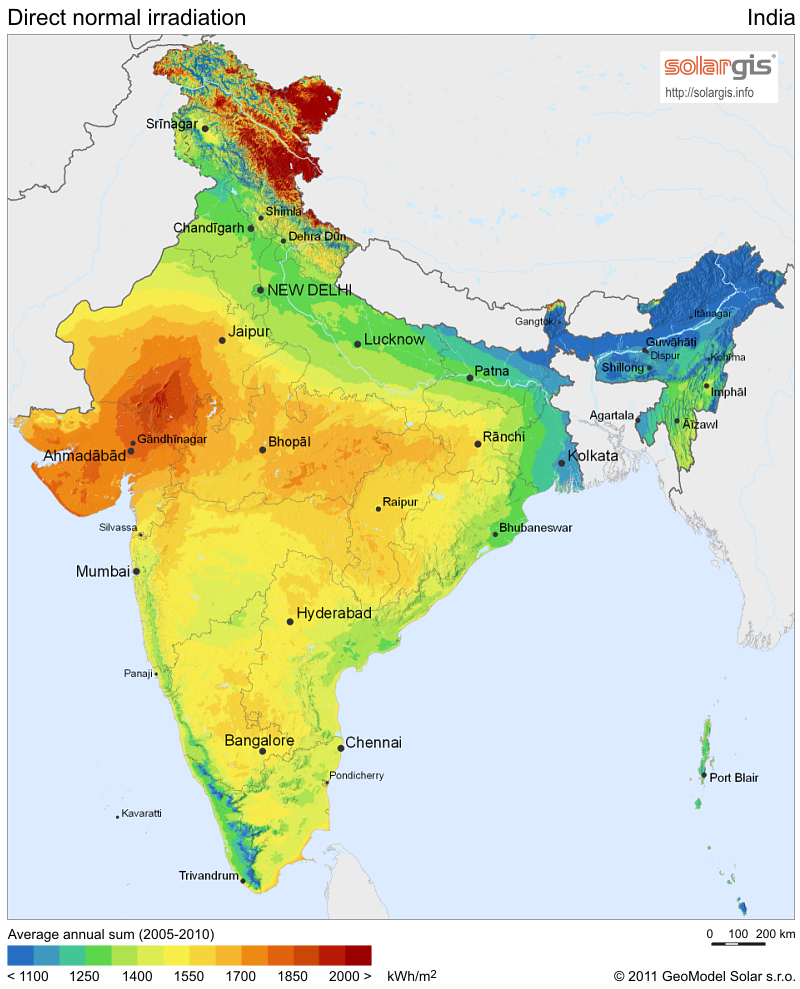

Rajan: This time we propose to fix the DNI like you have to design for fixed DNI of 1700KWh/?. If actual DNI comes higher, you can sell the excess power but if actual DNI comes lower, corresponding relaxation in the contracted electricity to be sold will be provided.

Also now lot of data is available and it is getting continuously collected through satellites and some more advancements are there, now we know much better.

But still to keep out the uncertainty we have kept that margin that vendors can design for 1700 KWh/? DNI although DNI at some locations can be 2000 KWh/? also.

Source: SOLARGIS

CSP Focus: What about the technology? Do you have any preference for technologies?

Rajan: No, we are saying you bring any technology, as long as you are comfortable in putting your money. So we are not binding them, but we want the output at least 80 percent of the contracted power. And we care about the rate of electricity. There will be a reverse bidding, and the best rates will get discovered by reverse bidding.

CSP Focus: Will there be local content requirement in the next CSP tender?

Rajan: No local content requirement for the first tenders. from wherever you do, you do it on your risk and on your cost. Loan will be there, but you have to repay

CSP Focus: Where will this project be located, Gujarat or Rajasthan?

Rajan: Initially these tenders will be for Gujarat; we want to give provide best conditions so that first projects run very well and is attractive, More of such tenders will be published and if the LCOE comes out fine. It will be like a chain reaction. When some FDRE tender is out, then interested companies will start finding vendors in India to develop CSP components, and then custom duty and other costs like transportation etc can be reduced. Most likely cost will be lesser when. most of the things will be made in India with less transportation costs.

CSP Focus: What about the timeline, have you already fixed the timeline for the next tender?

Rajan: Actually, this plan and timeline is that it has to be done soon but it is still work in progress. First, we will explore through this tender what is the response, then we will set our targets

CSP Focus: Who will be the party to release the bids, SECI?

Rajan: It will be SECI, although there is internal consultation going on in some other companies may also float more CSP tenders. SECI has already working on it.

NTPC may release the bid on EPC basis later as NTPC is still looking into doing first feasibility report and then follow EPC route and it is expected that it will be much cheaper to order various set of components through separate tenders.

SECI will only be the buyer. It will be the tendering agency which will open and release the bid and issue the PPA. Behind the works it will arrange the land, get it cleared and sign supply agreement with the Discoms so that they can honor that PPA. They cannot keep this power with them. and the vendors have to build – own – operate the plant, they don’t have to transfer. The PPA is normally for 25 years, they can run the project still if they want up to lease period because the land will be on 99 years lease. at least 80% of the contracted power will be mandatorily supplied via SECI and the rest can be treated as Merchant Power and thus can be sold through Power market or directly to consumers.

CSP Focus: With SECI and around 20 companies in the discussion meeting including some big companies, who do you think will be interested in these projects and would like to go for the bidding.

Rajan: Many bidders will be there. Already IPPs are doing for Wind and PV, they will do their parts, but at least 51% of the energy have to be injected from the CSP part, so they will tie up with the CSP venders, the supply chain, or integrators, and form consortia who will be able to build it in a proper way. And that is why we have made it that much attractive so that you can sell extra electricity during the PPA period also without any objection from SECI and without any NOC required.

You can earn from the utility Services like voltage regulation, frequency regulation, ramping, then you can have the carbon credits also with you, then you can continue to supply even after your Capex is recovered and till you want to operate the plant. Moreover, you can sell the project at any stage, you can win the tender and then you can sell it to somebody as long as he abides by the terms of the contract signed by you. Similarly, once you erect, some other party can come in. Then even after 25 years when the PPA is over you can sell it or in between also the project can be sold many times. So, we have not bound any conditions on the ownership part.

CSP Focus: Does NTPC have any CSP projects in pipeline?

Rajan: The pipeline will be built once the feasibility report is done. Actually, we have to still come out with the tender for feasibility, we have taken quotations from various vendors for doing the feasibility. In CSP what happens salvage value will be too high after many years, glass will be costing very high, salt will be converted to fertilizer and it will have a huge value, so we don’t want to invest and let somebody enjoy the returns.

CSP Focus: Do you have any idea which local companies are going to bid for the CSP?

Rajan: Several developers were contacted and awareness about CSP was created. And for desirous companies, visit to CSP plants with storage were also facilitated. Some have given conformation also. They have discussed with various vendors, and they have given me what their estimated LCOE will be and what capacity they will bid for.

I have combined this PV and Wind with CSP. Because PV and Wind vendors will be here, they already do it, that they will find some other partner for CSP Part. but CSP based electricity supply has to be at least 51% just to make it that vendor is not doing some small amount of CSP and a lot of PV and Wind. If I keep on installing PV and Wind, then to stabilize it if I don’t have CSP or some other renewable firm power, I will have to go for coal and other things.

Most big and small vendors also in discussion. because they are big companies and may not require any partner at times, maybe for the first project they will partner.

I really cannot comment on others but yes many vendors are looking for suitable partners and are in talks.

India’s ambitious National Solar Mission (JNNSM) a decade ago included a tender for 470MW of solar thermal power projects. In the end, the 470MW of solar thermal power projects were awarded to the seven lowest bidders through reverse bidding. But due to various reasons, despite the government granted extension, only three projects, with a total capacity of 200MW were into operation, the rest of the project remain undeveloped till today.

But over the past decade, India’s PV projects were developing very fast. At present, India’s PV and Wind generation has accounted for more than 10% of total electricity generation of the nation, which causes huge impact to the grid system, raises the urgent need for a large number of clean and stable power. The government at this time reconsiders the CSP, which is also in line with the trend of the times. Looking forward to India’s 2024 Q1 renewable energy tender can be released soon.

Disclaimer: The views and opinions expressed here by the interviewee are solely his current opinions and do not necessarily reflect the official policy or position of any institute, organization or company.