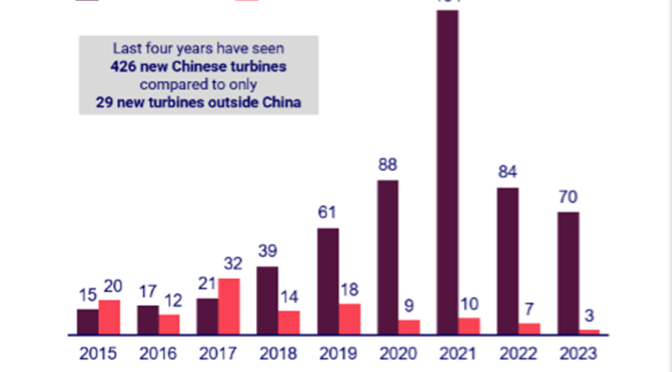

Western OEMs reduce the pace of NPI and focus on product standardisation while Chinese peers continue the frenetic pace of new wind turbine introduction.

Western supply chain will simplify to avoid major turbine design changes

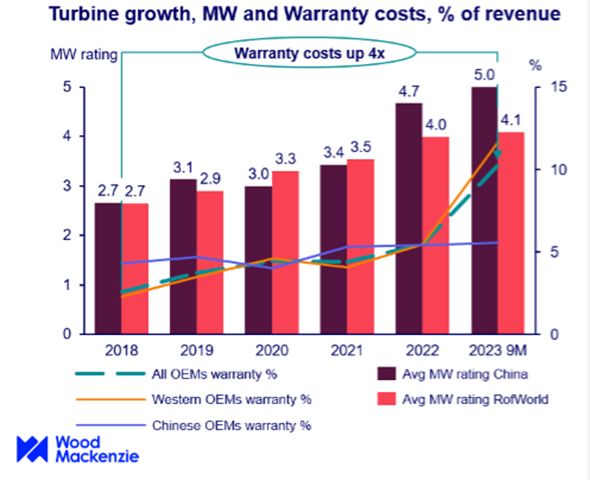

New turbine designs require economies of scale to deliver value. Many new and larger turbine designs were introduced by Western OEMs over the past five years, and these new turbines have struggled to reach manufacturing economies of scale in a depressed market. While larger turbines promise substantial cost reduction through more efficient material use and reduced turbine counts, these massive turbines are exposed to higher logistics expenses and require significant new supply chain investment for larger components. In addition, the increased size and complexity of the components also increase the risk of quality issues. Ultimately, the innovation arms race has led to shorter product lifecycles, inadequate testing periods, and complex product portfolios. The perfect storm that hit wind supply chain since the beginning of the 2020 is forcing Western wind OEMs and suppliers to slow down the introduction of new products and reduced the appetite for radical design changes.

The arms race continues in China, while the West slows down. Since 2020, when the Chinese Feed-in-Tariff (FIT) phased out, more than 400 different turbine models have been launched by nearly a dozen competing OEMs. Nine Chinese wind OEMs have revealed plans for 10 MW + onshore wind turbine platforms, a turbine scale that is unheard of in other markets. Similar trends exist in offshore, where the announcements of the first 20 MW + platforms took place in China. Turbine growth is driven by fierce competition in China, as the market is expected to grow by 6.2% annually in the next ten years. Furthermore, the additional cost pressure in the post-subsidy era is favouring larger turbines to reduce CAPEX. The development of GW-scale wind bases also favours the development of gigantic turbines.

Aggressive turbine growth in China may prove unsustainable. Turbine growth in China is remarkable but may be subject to the same pressures faced by the West in recent years. Chinese turbine prices dropped by over 30% in the course of 2023, indicating that a profit crunch may be looming for Chinese wind companies. Goldwind registered a financial loss on their manufacturing divisions for the first half of 2023, profitability was only maintained through their O&M division and project development arm. Quality and reliability issues are also growing within Chinese OEMs, with increasing warranty expenses and further repair costs expected as the latest generation of turbines move to serial production.

Standardisation does not need to reduce innovation. Technology advancement has always been pivotal to wind energy industry progress, but the current environment requires a streamlined industrial approach to technology, not radical technological change. We expect that the decade ahead will focus on six key themes to help the industry return to profitability:

- Slow down the turbine arms race – Slowing the pace of new product will extend the lifecycle of turbines and realise a return on R&D.

- Cap offshore MW ratings – We suggest a turbine cap of 25 MW to allow the supply chain to develop and standardise.

- Product portfolio simplification – Reduce turbine variants by globalising products and avoiding customisation will enable economies of scale and industrialisation.

- Automation is key – Automation of factory processes and repetitive production of identical components will enable the economies of scale necessary to reduce costs.

- Collaborate while competing – OEMs should work together to standardise processes for non-strategic components and processes. Strategic components like blades and drivetrains may never be shared or commoditised, due to significant IP barriers and competitive advantages.

Learn more

For more detail and insights, you can purchase the full Global wind turbine technology trends 2023 report here.

Endri Lico

Principal Analyst, Global Wind Supply Chain and Technology