In the week of February 19, European electricity market prices fell compared to the previous week, with the MIBEL market showing the lowest prices. The increase in wind energy production and the decrease in gas and CO2 prices favored this behavior. Portugal and France registered the highest wind energy production for a February month, and Spain and Portugal broke again the record for the highest photovoltaic energy production for a February month, reached the previous week.

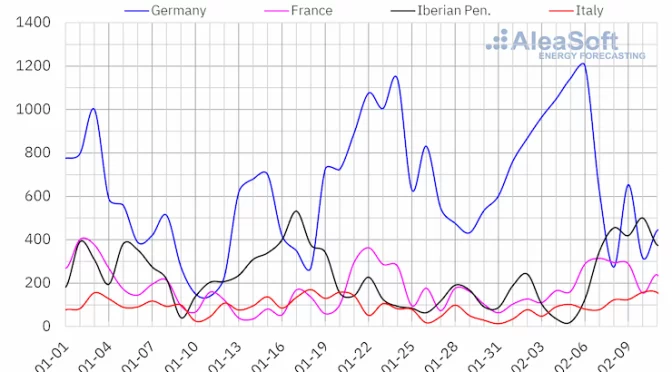

Solar photovoltaic, solar thermoelectric and wind energy production

During the week of February 19, solar energy production registered an increase in most major European electricity markets compared to the previous week, maintaining the upward trend for the second consecutive week. Increases ranged from 9.3% in Portugal to 17% in Germany. However, there were exceptions in the Italian and French markets, where solar energy production decreased by 23% and 13%, respectively, reversing the previous week’s upward trend.

As in the previous week, that of February 12, some markets registered a return of daily photovoltaic energy production to levels last seen in the fall, a trend that will become increasingly common as spring approaches. On February 20, the Spanish and Portuguese markets set records for a February month again, generating 118 GWh and 13 GWh, respectively, slightly surpassing the highs reached during the previous week. In addition, the German market set its highest solar photovoltaic energy production since October, with 156 GWh generated on February 25.

For the week of February 26, according to AleaSoft Energy Forecasting’s solar energy production forecasts, the trend of the week of February 19 will continue, with solar energy production increasing in the Spanish and German markets and decreasing in the Italian market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

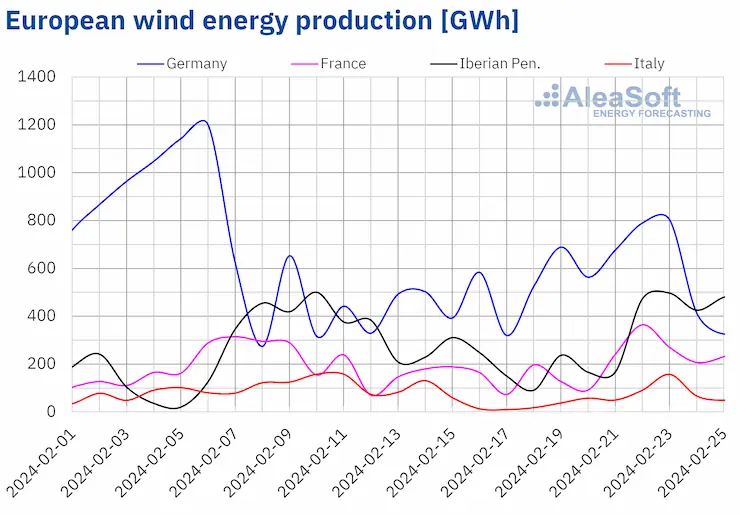

During the week of February 19, wind energy production registered a week?on?week increase in the main European electricity markets, reversing the downward trend registered the previous week. Increases ranged from 31% to 79% in the Italian and Portuguese markets, respectively.

In addition, the Portuguese and French markets registered the highest daily wind energy production ever observed in a February month. France reached this record on February 22, generating 365 GWh, a level not registered since the beginning of the year. On the other hand, Portugal reached its highest wind energy production for a February month on February 25, generating 107 GWh using this technology. This value also represents the highest registered since mid?October in the Portuguese market.

For the week of February 26, AleaSoft Energy Forecasting’s wind energy production forecasts indicate that the upward trend will continue in Spain and Italy and it will reverse in Germany, France and Portugal.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

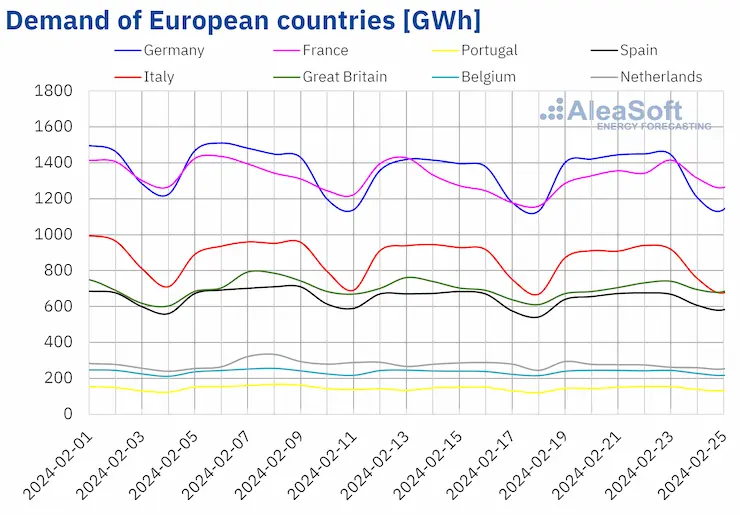

Electricity demand

During the week of February 19, electricity demand increased in most major European electricity markets, reversing the decrease registered the previous week. In the analyzed markets, the Iberian Peninsula registered both the smallest and the largest increase in demand. In the case of Spain, it registered the smallest increase, 0.4%, while Portugal reached the largest rise, 4.5%, attributable in part to the recovery of demand after the holiday of Tuesday of Carnival celebrated the previous week in this market.

The Dutch and Italian markets exhibited a trend contrary to the rest of the analyzed markets. The Dutch market registered a drop of 1.9%, marking the second consecutive week of declines in demand in this market. As for Italy, the downward trend persisted for the fifth consecutive week, this time registering a drop of 1.3%.

In the fourth week of February, most analyzed European markets registered a decrease in average temperatures from the previous week, falling from 2.5 °C in Belgium and Great Britain to 1.0 °C in Germany. The exception was Italy, where average temperatures increased by 0.9 °C.

In the week of February 25, according to AleaSoft Energy Forecasting’s demand forecasts, the upward trend will continue and demand will increase in all analyzed European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

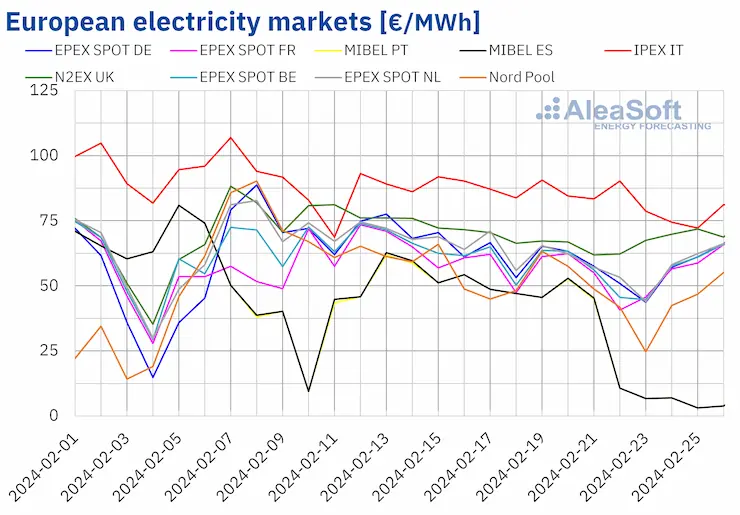

European electricity markets

In the first days of the week of February 19, prices in the main European electricity markets registered a downward trend. In most cases, prices started to recover in the last days of the week. However, when taking into account the whole of the fourth week of February, weekly averages were lower than those of the previous week in all markets analyzed at AleaSoft Energy Forecasting. The MIBEL market of Spain and Portugal reached the largest drop, which was 54%. In contrast, the IPEX market of Italy and the N2EX market of the United Kingdom registered the smallest declines, 7.6% and 8.2%, respectively. In the rest of the analyzed markets, prices fell between 13% in the EPEX SPOT market of Belgium and France, and 17% in the Nord Pool market of the Nordic countries.

In the fourth week of February, weekly averages were below €60/MWh in most analyzed European electricity markets. The exceptions were the British market, with an average of €66.74/MWh, and the Italian market, with an average of €82.03/MWh. In contrast, the Portuguese and Spanish markets registered the lowest weekly prices, €24.36/MWh and €24.45/MWh, respectively. In the rest of the analyzed markets, prices ranged from €46.48/MWh in the Nordic market to €57.51/MWh in the Dutch market.

As for hourly prices, from February 23 to 26, the MIBEL market registered twenty?three hours with prices below €1/MWh. Of these, there were eight hours with a price of €0/MWh.

During the week of February 19, the decrease in the average price of gas and CO2 emission rights and the increase in wind energy production led to lower prices in the analyzed European electricity markets. The increase in solar energy production also contributed to lower prices in the German and Iberian markets. In the case of the Italian market, demand fell, which also helped prices to decrease.

AleaSoft Energy Forecasting’s price forecasts indicate that in the last week of February, prices might increase in most European electricity markets. The increase in demand and the drop in wind energy production will lead to this behavior. However, prices in the Iberian and Italian markets might continue to fall, influenced by the increase in wind energy production in Spain and Italy, as well as by the increase in Spanish solar energy production.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

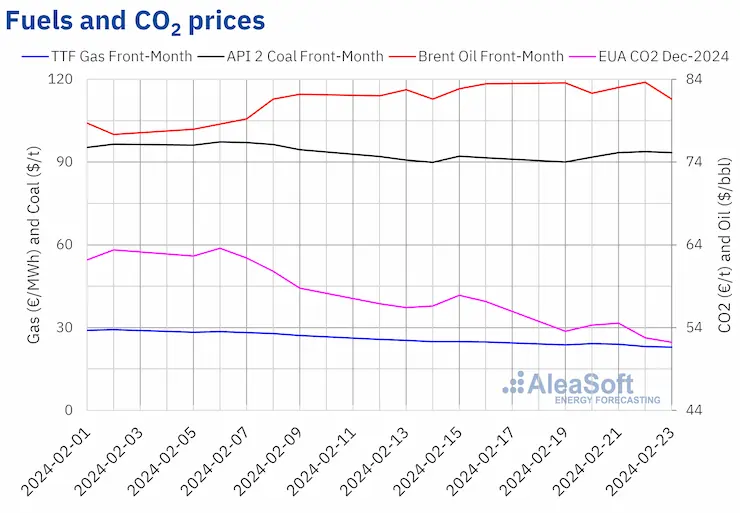

In most sessions of the fourth week of February, settlement prices of Brent oil futures for the Front?Month in the ICE market increased. As a result, on Thursday, February 22, they registered their weekly maximum settlement price, $83.67/bbl. This price was 1.0% higher than the previous Thursday and the highest since the first half of November 2023. However, after a 2.5% drop on Friday, February 23, these futures reached their weekly minimum settlement price, $81.62/bbl.

Increased instability in the Middle East, influenced by the US veto of a UN Security Council resolution for a humanitarian ceasefire in Gaza, contributed to the increase in prices in the fourth week of February. However, concerns about demand evolution exerted their downward influence on Brent oil futures prices, leading to their decline at the end of the week. Expectations that interest rates will remain high in the coming months in the United States due to a pickup in inflation added to these concerns. In addition, US oil stocks increased, influenced by refinery outages.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, in the fourth week of February, they continued to register decreases. As a consequence of this downward trend, on Friday, February 23, they registered their weekly minimum settlement price, €22.93/MWh. According to the data analyzed at AleaSoft Energy Forecasting, this price was 7.6% lower than the previous Friday and the lowest since May 2021.

Seasonally low demand levels, abundant supplies of liquefied natural gas and high levels of European reserves exerted a downward influence on TTF gas futures prices in the fourth week of February.

As for settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2024, during the fourth week of February, they were below €55/t. The weekly maximum settlement price, registered on February 21, was €54.55/t. In contrast, these futures reached their weekly minimum settlement price, €52.21/t, on Friday, February 23. According to data analyzed at AleaSoft Energy Forecasting, this settlement price was 8.7% lower than the previous Friday and the lowest since June 2021.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

The next webinar of AleaSoft Energy Forecasting and AleaGreen will take place on March 14. This will be the third webinar of 2024, the year of the 25th anniversary of the foundation of AleaSoft Energy Forecasting. On this occasion, experts from EY will participate for the fourth time in the monthly webinar series. In addition to the prospects for European energy markets, the webinar will analyze regulation, financing of renewable energy projects, PPA, self?consumption, portfolio valuation, the green hydrogen auction and the Innovation fund.