European electricity markets in February reached their lowest prices since the first half of 2021.

In February, prices in the main European electricity markets fell, most of them reaching the lowest levels since the first half of 2021. Photovoltaic energy reached the production record for a February month in Spain and Portugal, a milestone that wind energy production also reached in Spain. Gas and CO2 futures prices also declined, reaching their lowest levels since May and July 2021, respectively.

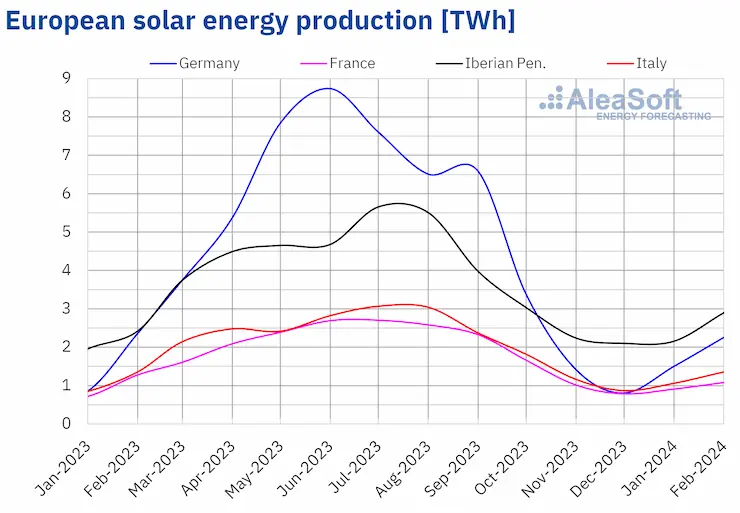

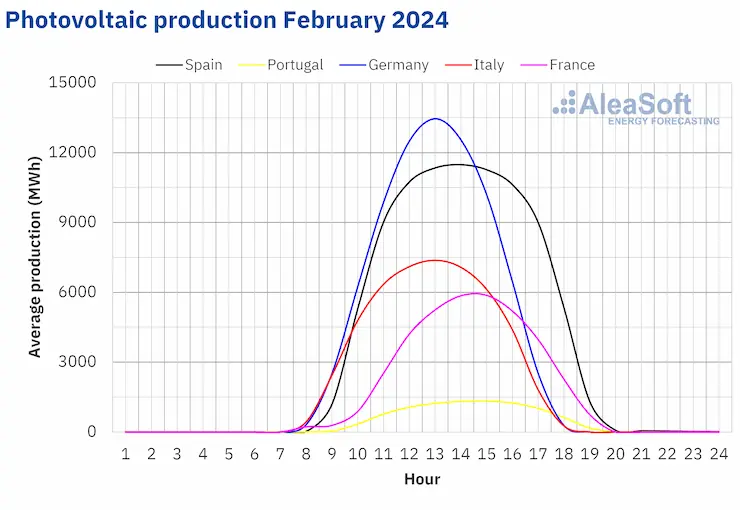

Solar photovoltaic, solar thermoelectric and wind energy production

In February 2024, year?on?year variations in solar energy production were heterogeneous in the main European electricity markets. Most markets registered declines, ranging from 18% in France to 3.4% in Italy. On the Iberian Peninsula, the variations were opposite. In the Portuguese and Spanish markets, solar energy production increased by 18% and 11%, respectively.

In addition, during the second month of 2024, Spain and Portugal broke historical records for photovoltaic energy production compared to the same month in previous years. The Spanish market generated 2447 GWh and the Portuguese market, 263 GWh. The year?on?year increase observed in photovoltaic energy production was due to the increase in installed capacity over the last twelve months. According to Red Eléctrica data, between February 2023 and February 2024, Mainland Spain added 4773 MW of photovoltaic capacity. During the same period, the Portuguese market added 768 MW of this technology to the system.

With longer days, solar energy production increased in February compared to January in all markets analyzed at AleaSoft Energy Forecasting. The increase ranged from 27% in the French market to 61% in the German market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

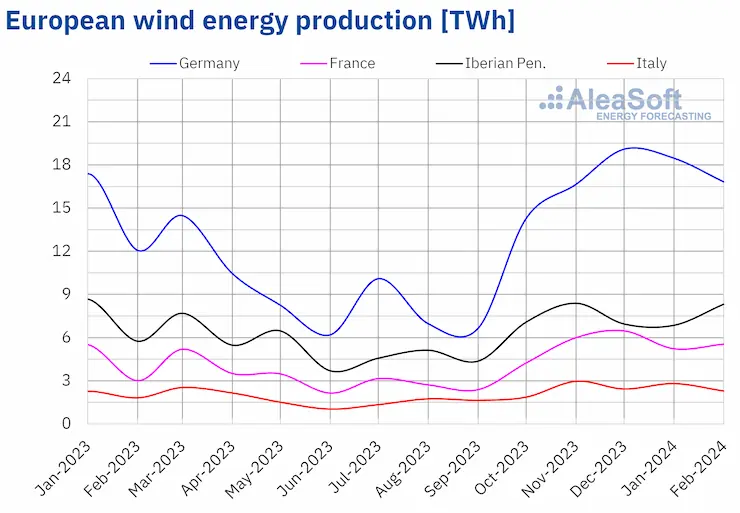

Wind energy production increased year?on?year in all major European electricity markets in February 2024. Increases ranged from 22% in the Italian market to 78% in the French market. In addition, in the Spanish market, wind energy production in February 2024 was 6790 GWh, beating the historical record compared to the same month in previous years.

Between February 2023 and February 2024, 616 MW of wind energy were installed in Mainland Spain.

The upward trend in wind energy production was also observed in the comparison with the previous month. In most markets, month?on?month production increased. Rises ranged from 13% to 34% in the French and Portuguese markets, respectively. The exceptions were the Italian and German markets, with corresponding drops of 13% and 2.6%.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

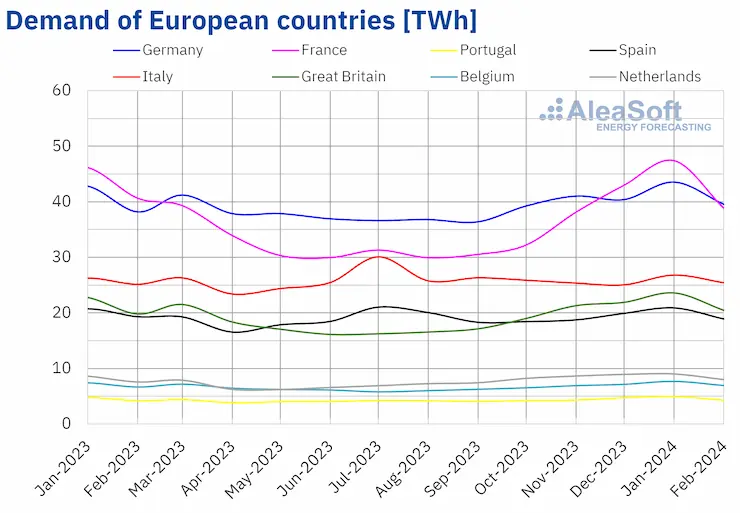

Electricity demand

In February 2024, electricity demand decreased in most major European electricity markets compared to the same period in 2023. The French market registered the largest decline, 7.7%, while Great Britain had the smallest drop, 0.2%. In contrast, the German, Belgian and Dutch markets registered increases in demand ranging from 0.1% to 2.1%.

The downward trend was even more widespread when comparing electricity demand in February 2024 with that of January 2024. Once again, the French market registered the largest decline, 12%. The remaining falls ranged from 7.6% in Portugal to 2.9% in Germany. The Italian market was the only one where demand increased, by 1.4% compared to the previous month.

Average temperatures in February 2024 were higher than in the same month in 2023. Increases ranged from 1.2 °C in Great Britain to 3.8 °C in Germany.

Average temperatures in February were also less cold than in January in all analyzed markets. Southern Europe registered moderate increases, ranging from 1.4 °C to 2.4 °C. In the remaining markets, temperature changes were larger, ranging from 3.1 °C in Great Britain to 5.3 °C in Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

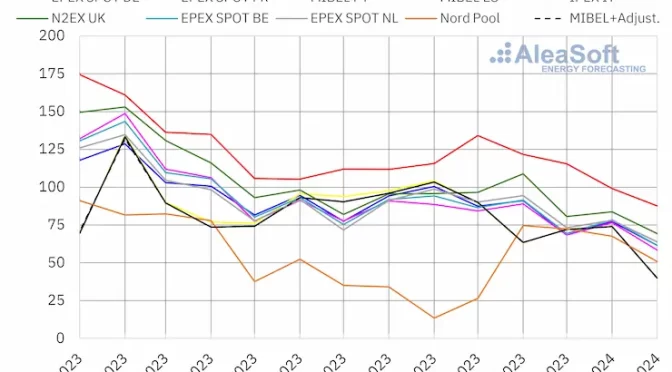

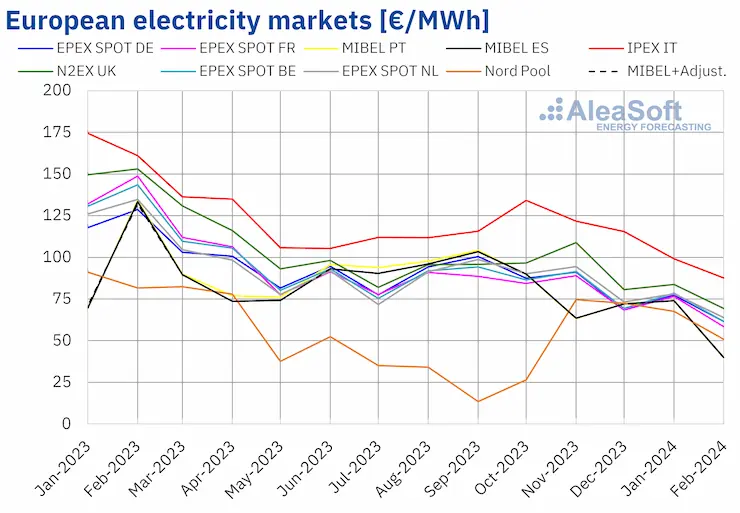

European electricity markets

In the month of February 2024, the monthly average price was less than €65/MWh in most major European electricity markets. The exceptions were the averages of the N2EX market of the United Kingdom and the IPEX market of Italy, which were €69.44/MWh and €87.63/MWh, respectively. The MIBEL market of Portugal and Spain registered the lowest monthly prices, €39.86/MWh and €40.00/MWh, respectively. In the rest of the European electricity markets analyzed at AleaSoft Energy Forecasting, the averages were between €50.92/MWh of the Nord Pool market of the Nordic countries and €63.89/MWh of the EPEX SPOT market of the Netherlands.

In February, monthly prices of European electricity markets continued the downward trend that began in 2023. Compared to the month of January, average prices decreased in all European electricity markets analyzed at AleaSoft Energy Forecasting. The Spanish and Portuguese markets registered the largest drop, 46% in both cases. On the other hand, the smallest decrease, 12%, corresponded to the Italian market. In the rest of the markets, prices fell between 17% in the British market and 25% in the Nordic market.

Comparing February’s average prices with those registered in the same month of 2023, prices also fell in all analyzed markets. In this case, the Spanish and Portuguese markets also had the largest decline, 70%. In contrast, the lowest price drop, 38%, was in the Nordic market. In the remaining markets, price declines ranged from 46% in the Italian market to 61% in the French market.

As a result of these declines, February prices in most European electricity markets were the lowest since the first half of 2021. The exception was the Nordic market, which had the lowest prices in the last four months. In the case of the MIBEL market of Spain and Portugal, monthly prices of February 2024 were the lowest prices registered after February 2021 averages. The British market and the Italian market reached the lowest prices since March and June 2021, respectively. For the German, Belgian, French and Dutch markets, February 2024 prices had the lowest values since May 2021.

In February 2024, the fall in the average price of gas and CO2 emission rights, the decline in electricity demand in most markets and the general increase in wind energy production led to a year?on?year price decrease in European electricity markets. In addition, solar energy production also increased compared to the previous year on the Iberian Peninsula.

On the other hand, in February 2024, the average price of gas and CO2 emission rights, as well as demand in most markets, also decreased compared to the previous month. Solar energy production increased compared to January, which is normal for the season. In addition, wind energy production grew in most analyzed markets. These factors contributed to the decline in European electricity market prices.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

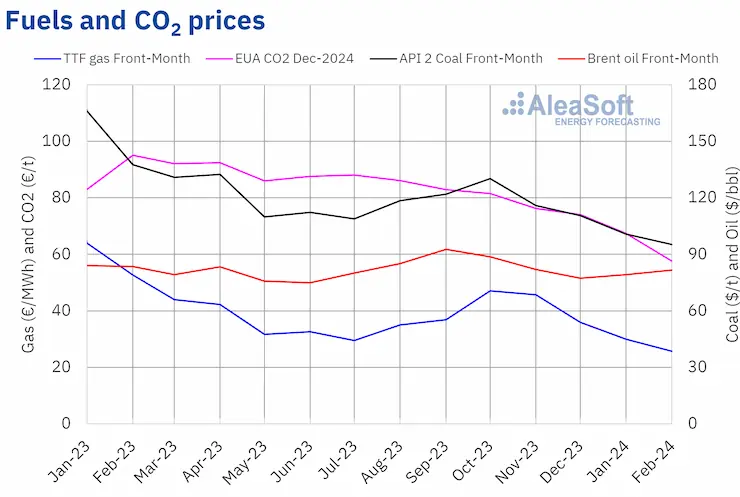

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market registered a monthly average price of $81.72/bbl in the month of February. This was 3.2% higher than the January price, $79.15/bbl. However, it was 2.2% lower than the corresponding to the Front?Month futures traded in February 2023, which was $83.54/bbl.

During February, concerns about demand evolution continued to exert their downward influence on Brent oil futures prices. However, instability in the Middle East and OPEC+ production cuts contributed to register settlement prices above $80/bbl in most sessions in the second month of 2024.

As for TTF gas futures in the ICE market for the Front?Month, the average value registered during the month of February was €25.76/MWh. According to data analyzed at AleaSoft Energy Forecasting, compared to the average Front?Month futures traded in January, €29.91/MWh, the February average decreased by 14%. Compared to the Front?Month futures traded in the month of February 2023, when the average price was €52.65/MWh, there was a 51% drop.

In February, instability in the Middle East and disruptions in the supply from Norway exerted an upward influence on TTF gas futures prices. The evolution of temperature and wind energy production forecasts also influenced the price evolution. However, the abundant supply of liquefied natural gas and the still high levels of European reserves led prices to fall during this month. As a result, the average price for February 2024 was the lowest since May 2021.

As for CO2 emission rights futures in the EEX market for the reference contract of December 2024, they reached an average price of €57.61/t in February. According to data analyzed at AleaSoft Energy Forecasting, this represents a 15% decrease compared to the previous month’s average, €67.43/t. When compared to the February 2023 average, €99.42/t, the February 2024 average was 42% lower. As a result of these price declines, the February 2024 average was the lowest since July 2021.

The decline in demand had a downward influence on CO2 emission rights futures prices during the month of February. The fall in gas prices contributed to this decline in demand, as the use of this fuel for electricity generation implies a lower demand for CO2 emission rights compared to the use of coal.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

AleaSoft Energy Forecasting has developed Alea Energy DataBase. It is an online platform for the visualization and analysis of data related to energy markets, such as electricity prices or demand. Alea Energy DataBase allows customizing the visualization of the series. Among other options, it is possible to configure alerts that provide useful signals for energy trading and hedging.

AleaSoft Energy Forecasting and AleaGreen will hold their next webinar on Thursday, March 14, 2024, year of the 25th anniversary of the foundation of AleaSoft Energy Forecasting. This webinar will feature guest speakers from EY for the fourth time in the monthly webinar series. The webinar content will include the prospects for European energy markets, regulation, financing of renewable energy projects, PPA, self?consumption, portfolio valuation, the green hydrogen auction and the Innovation fund.