The 531 MW Mendubim solar plant in Brazil has come into operation. This marks a 30% increase in Equinor’s equity power production in Brazil.

“Mendubim represents an important contribution to Equinor’s diversified energy offering in Brazil that includes a robust oil and gas portfolio and an attractive renewables position,” says Veronica Coelho, Equinor’s country manager in Brazil.

Mendubim will annually produce 1.2 TWh of power.

Around 60% of the power will be sold on a 20-year USD-denominated power purchase agreement (PPA) with Alunorte, one of the world’s leading suppliers of alumina for the aluminium industry.

The remaining production will be sold in the power market in Brazil.

The asset is expected to deliver real base project returns in the middle of Equinor’s guided range for renewables of 4-8%.

Important achievement by the Mendubim partnership

The project is developed and operated as a joint venture between Scatec, Hydro Rein and Equinor. All three partners have an equal economic interest of 30% in the project. In conjunction with the start of commercial operations, Alunorte has exercised its call option and now holds the remaining 10%.

Olav Kolbeinstveit, senior vice president for onshore and markets within Renewables at Equinor, says:

“Launching a major new solar plant in Brazil in partnership with Scatec and Hydro Rein is an important achievement. Equinor has conducted business in Brazil for over two decades, and we see the country as a core area for long-term profitable growth. By investing in renewable energy, we are supporting Brazil’s ambitions towards a diverse energy mix and helping to meet the expected power demand growth in the country.”

Terje Pilskog, CEO of Scatec, states, “This project marks a pivotal milestone in realizing our strategic objectives and reinforces our position in a prominent renewable energy growth market, bolstered by our partners Equinor and Hydro Rein. The burgeoning solar energy market in Brazil aligns with our commitment to sustainable progress, and we are excited to advance this impactful project with approximately 3 million tonnes of carbon dioxide equivalents avoided”.

Olivier Girardot, CEO of Hydro Rein, states, “We are thrilled to complete the first of Hydro Rein’s renewable energy projects in Brazil. Our mission is to develop renewable energy solutions for more sustainable industries, and Mendubim does just that. Most of the power output will go to Hydro’s alumina refinery Alunorte in Pará, supporting one of the largest decarbonization projects in the world. We are very proud to take part in this development together with Equinor and Scatec.”

Building a power portfolio in Brazil

Brazil is the largest power market in South America, with expected significant demand growth. Deregulation of the power market is ongoing, and the de-regulated market is now accounting for about 40% of total consumption.

With Mendubim in operation, Equinor increases its equity power production in Brazil by around 30%, bringing it to over 1,4 TWh during 2024. Through Mendubim, Equinor also for the first time enters the de-regulated power market in Brazil.

Equinor’s total renewables power generation in 2023 was ~ 2 TWh with an outlook to double it in 2024.

“We are working to build a material and profitable power portfolio in Brazil. Our energy trading house Danske Commodities will increasingly manage this portfolio in the Brazilian market, leveraging their trading and portfolio risk management capabilities to maximize value creation”, says Kolbeinstveit.

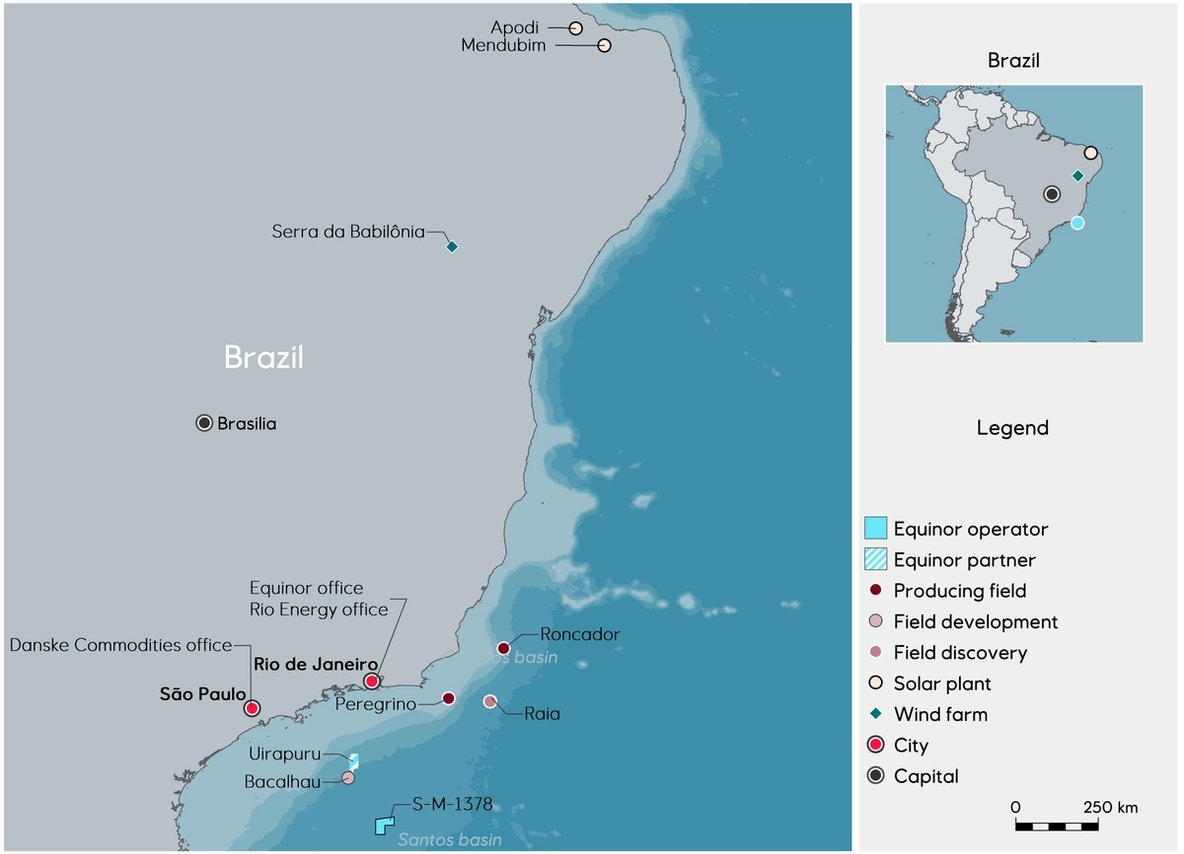

Equinor’s renewables position in Brazil includes three assets in commercial production: the 162 MW Apodi solar plant (44%), the 531 MW Mendubim solar plant (30%) and the 223 MW Serra da Babilônia 1 onshore wind farm (100%). There is also an over 1,5 GW pipeline of solar and onshore wind projects being matured by Equinor’s fully owned subsidiary Rio Energy.