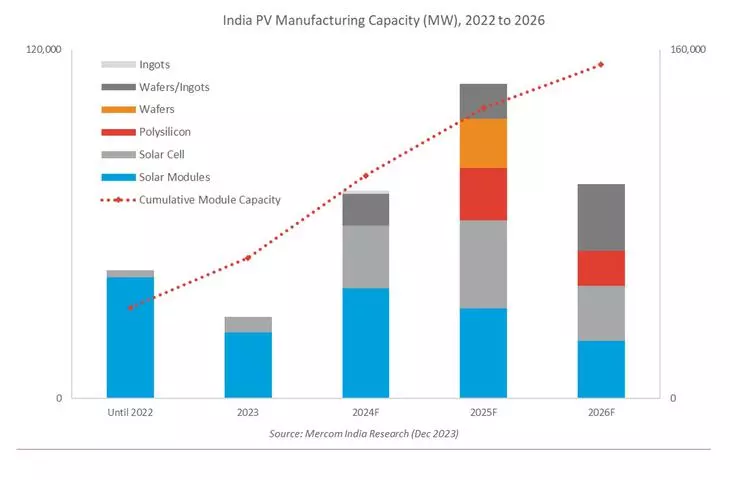

India has added a whopping 24 GW of solar module and cell capacity in 2023. Gujarat led the total new capacity addition followed by Rajasthan and Tamil Nadu.

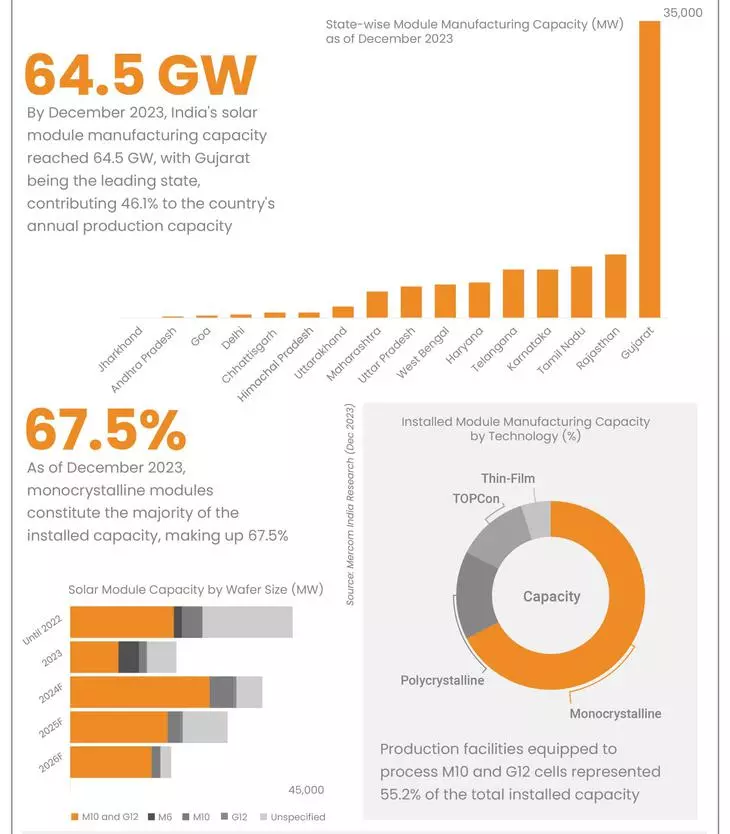

During the calendar year, the country added 20.8 GW of solar modules and 3.2 GW of solar cell capacity, taking the cumulative solar module manufacturing capacity to 64.5 GW and solar cell manufacturing capacity of 5.8 GW as of December 2023, according to a report by Mercom India.

Gujarat led the country’s photovoltaic (PV) manufacturing capacity among the States, accounting for 46.1 per cent of the country’s solar modules capacity as of December 2023. Rajasthan and Tamil Nadu ranked second and third for solar module production capacities, accounting for 9.3 per cent and 7.6 per cent.

Telangana accounted for 39 per cent of annual solar cell production capacity, the highest in the country. Gujarat and Himachal Pradesh were second and third, with solar cell production contributing 34.7 per cent and 13.9 per cent of total capacities in the country.

Last month, R K Singh, Union Minister for New and Renewable Energy and Power said India has achieved self-sufficiency in the production of solar modules/panels but the country is yet to achieve substantial capacity in the production of solar cells.

The new manufacturing capacity additions in 2023 were primarily driven by the anticipated reimposition of the Approved List of Models and Manufacturers (ALMM) order starting in April 2024, as well as potential export opportunities.

In total manufacturing capacity, the top 10 manufacturers accounted for 62 per cent of the module and 100 per cent of cell production capacity as of December 2023.

About 60 per cent of the installed module manufacturing capacity was equipped to manufacture solar modules in M10 and G12 wafer sizes. Only 22.2 GW of the total module production capacity was enlisted under the ALMM order per the updated list–I issued by MNRE as of January 2024, it said.

Monocrystalline modules accounted for 67.5 per cent of the country’s module production capacity, followed by polycrystalline, tunnel oxide passivated contact (TOPCon), and thin film modules.

Based on the current pipeline, monocrystalline modules are anticipated to represent 59.7 per cent of the annual module production capacity and 50.5 per cent of the cell production capacity by 2026, followed by TOPCon, Heterojunction (HJT), and other technologies.

Global complexities

“As Indian manufacturers continue to invest in expanding their solar panel production capacities, they need to carefully navigate through the complexities of geopolitical tensions and trade disputes. Cheaper Chinese products will continue to challenge the competitiveness of locally-produced modules,’ said Raj Prabhu, CEO of Mercom Capital Group.

A policy change in the US, post-elections, could potentially shrink export opportunities and demand for solar energy in India needs to ramp up significantly to consume the projected increase in module production in the coming three years, he added.

Import of solar modules was the highest-ever in a year at 16.2 GW in 2023, up 158 compared with 10.3 GW of imports in 2022. Domestic manufacturers exported 4.8 GW of solar modules in 2023, up 204 per cent compared with 1.6 GW in 2022.

India imported 15.6 GW of solar cells in 2023, up 169 per cent y-o-y from 5.8 GW. India’s solar cell exports reached 286.3 MW in 2023, up 2,765 per cent from 10 MW in 2022.

Module manufacturing capacity is projected to surpass 150 GW, and cell capacity is expected to reach over 75 GW by 2026.