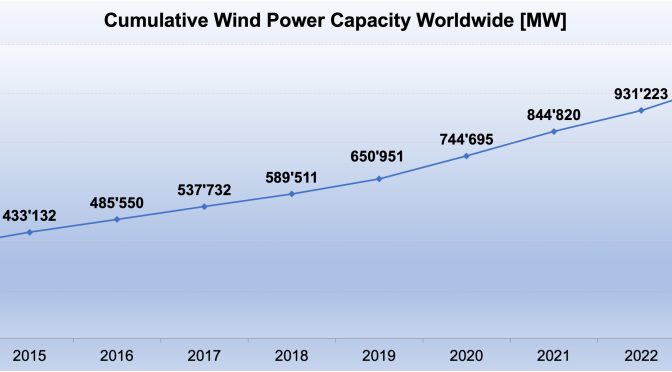

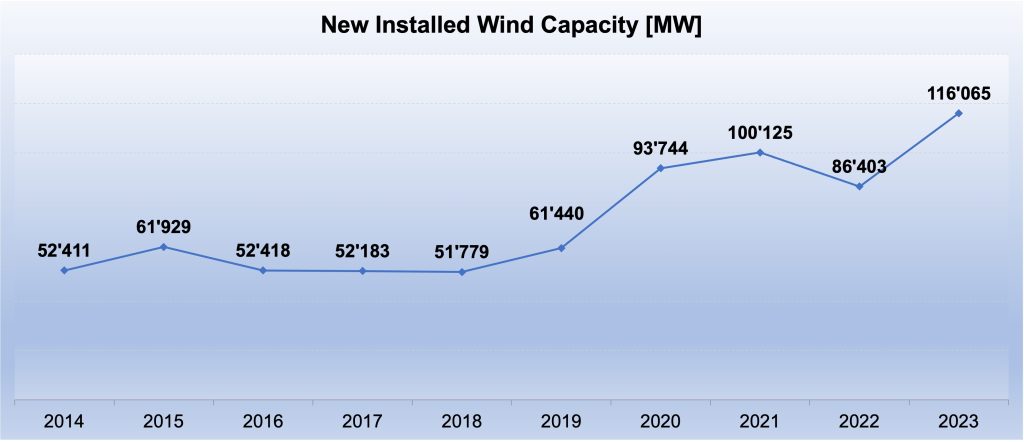

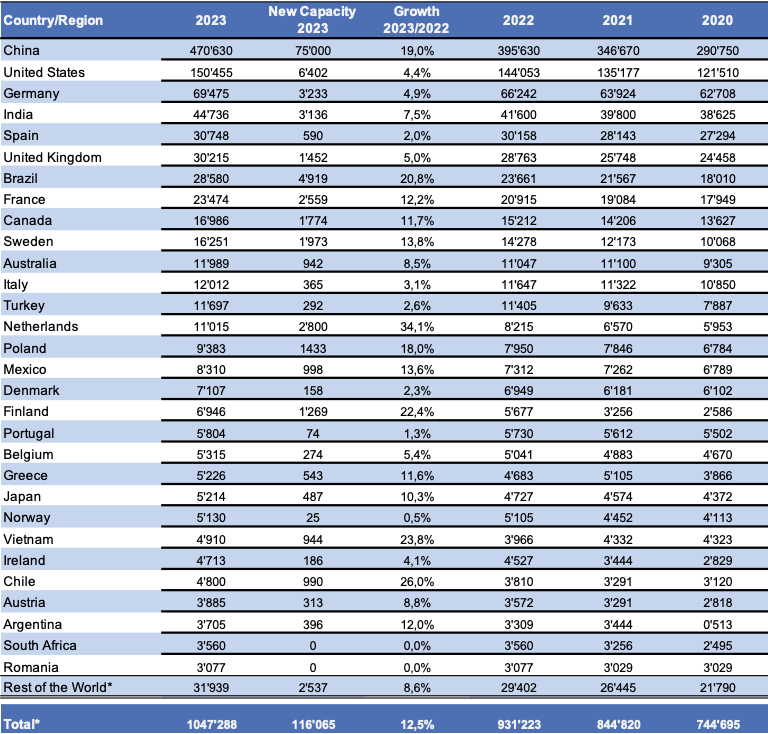

The year 2023 ended with a new record for new wind turbine installations: In total, the world added 116’065 Megawatt of new capacity within one year, more than ever before. According to preliminary statistics published today by the World Wind Energy Association, global wind power capacity has now passed one million Megawatt and has reached 1’047’288 Megawatt – very close to the prediction published by WWEA in autumn 2023.

The volume of the capacity added is 34% higher than in 2022, when the world added only 86 Gigawatt. This results in a global growth rate of 12,5%, significantly higher than in 2022, when wind capacity grew by only 10,2%.

Amongst the top ten countries, Brazil with 20,8% and China with 19,0% have the highest growth rates. The Netherlands (34%), Finland (22%), Vietnam (24%) and Chile (26%) all had growth rates well above the global average and are now amongst the most dynamic markets, while the previous leaders – the US, Germany, India, Spain and the UK – became underperformers, remaining well below 10%.

Long-term developments: Strong growth continues

With 1’047’288 Megawatt of installed capacity, the world has reached a new milestone. The threshold of 1 million Megawatt of global wind capacity has been crossed 25 years after the world installed 10’000 Megawatt and 15 years after reaching 100’000 Megawatt.

Further growth is expected in the coming years, driven by new policies which have started to take effect in many countries around the world in response to the escalating climate and the fossil fuel crises.

Many countries have stepped up their ambitions to build wind farms on a large scale, both onshore and offshore, backed by concrete policy measures. As a result, the short-term growth potential is also estimated to be high. A tripling of wind power capacity before the end of this decade and a tenfold increase by the middle of the century are not only feasible, but a realistic option.

Repowering, i.e. replacing old and smaller wind turbines by newer, larger and more efficient machines, is an important option for further increasing wind power generation with enormous potential. WWEA has estimated that repowering alone can double today’s wind power generation.

Share of wind power in electricity generation and consumption

The world’s installed wind power capacity now meets around 10% of global electricity demand – another important milestone. More than ten countries now have a wind power share of more than 20%, led by Denmark, which generates an astonishing 56% of its electricity from wind. Germany, the Netherlands, Portugal, the UK and Uruguay are among the countries that generate around a third or more of their electricity from wind.

These countries demonstrate that the world as a whole can achieve a 40-50% share of wind power in total electricity generation, as outlined by the WWEA in a long-term scenario. Given the trend towards electrification in the transportation and heating/colling sectors, wind power will play an even more substantial role in the future of global energy supply. Wind power will also be essential for propelling cars and heating/cooling homes.

Barriers to faster deployment

Energy markets are still heavily distorted by fossil fuel subsidies, which have reached new heights in the last two years – due to the fossil energy supply crisis which resulted from the Russian invasion in Ukraine. Removing these subsidies is essential to create a level playing field for zero-emission renewables.

Another major obstacle is time-consuming approval and planning procedures. As WWEA noted some time ago, the average planning and permitting process takes more than five years – in some countries even ten years and more. Permitting should be kept to a reasonable period of time, under normal circumstances two years should be sufficient.

Good community engagement is another prerequisite for faster growth, as local citizens can become active drivers of wind energy development. While a lack of good community engagement can delay or prevent wind projects, community-based wind is a key driver, as many cases have shown.

A more recent trend is that an increasing number of jurisdictions have begun to establish legal standards for this purpose – community energy laws that require wind farm investors to engage in certain forms of community involvement, be it in the form of community shares, low electricity prices, payments to the local community, etc.

Regional perspectives

ASIA

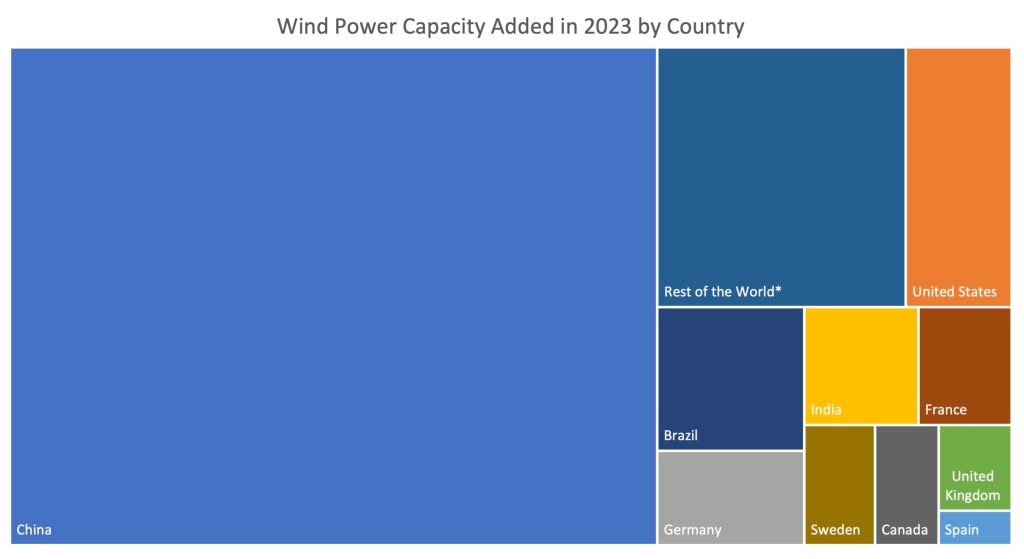

China once again plays an exceptional role in driving global wind power development – according to estimates, the country added 75 Gigawatt in 2023. The new record was only broken thanks to China, which accounts for 65% of the global market for new wind turbines – up from 58% in 2022. Never before has a single country played such a dominant role in global wind power development as China in the year 2023. With an annual growth rate of 19,2%, one of the highest rates of any major market, China is expected to pass the half-Terawatt mark in 2024, another milestone for global wind power development.

With an additional 3,1 Gigawatt added in 2023, India has maintained its position as the fifth largest market for new wind capacity, just behind Germany. Given the country’s ambitious targets, India is expected to remain fourth in terms of overall capacity in the coming years. New impetus in India is expected to come from repowering and from offshore wind – which is expected to start in the coming years.

Japan with 5,2 Gigawatt and Vietnam with 4,9 Gigawatt are the third and fourth largest markets in Asia – with Vietnam being the Asian country with the highest growth rate of 23,6% in 2023.

EUROPE

Europe as a continent has recovered from its weak market performance of recent years, but still lags behind in terms of growth rates. After several weak years, Germany took the lead in new installations, with 3,2 Gigawatt, bringing total capacity to 69,5 Gigawatt. The Netherlands added large offshore wind farms, increasing its total capacity by 2,8 Gigawatt to 11 Gigawatt. In total, seven European countries exceeded a market volume 1 Gigawatt for new turbines: Germany and the Netherlands, France (2,6 Gigawatt new, now 23,5 Gigawatt), Sweden (2 Gigawatt new, total 16,3 Gigawatt), the United Kingdom (1,4 Gigawatt new, 30,2 Gigawatt in total), Poland (1,4 Gigawatt added, 9,4 Gigawatt overall) and Finland (1,3 Gigawatt additional, overall 6,9 Gigawatt).

Medium sized markets in Europe included Greece (543 Megawatt added), Italy (plus 365 Megawatt), Austria (313 Megawatt), Belgium (274 Megawatt) and Croatia (266 Megawatt). Even Ukraine added146 Megawatt to its wind capacity, despite having to defend itself against the Russian invasion.

The main driver in Europe, apart from climate change, is now the intention to get rid of imported fossil fuels. The European Commission, as well as most EU member states, have therefore put renewable energy at the top of the energy agenda.

NORTH AMERICA

In another major milestone, the United States passed 150 Gigawatt of total wind capacity, but the market was much weaker than in the previous year, adding only 6,4 Gigawatt – much less than in 2022 and in 2021, when 13,7 GW were added, more than double the capacity of 2023. Project delays due to permitting have been cited as a major obstacle, and the offshore wind market has made little progress. However, the Inflation Reduction Act is expected to have a positive and concrete impact on new wind farms in the near future, starting in 2024.

Canada installed 1,8 Gigawatt and now has 17 Gigawatt of capacity – with a strong year expected in 2024. Mexico passed the 8 Gigawatt threshold in 2023.

SOUTH AMERICA

Brazil finally established itself as the world’s third largest market for new wind turbines, adding 4,9 Gigawatt of capacity in just one year. With a 20,8% year-on-year in installed capacity, Brazil had the highest growth of the top ten wind markets. The country still ranks seventh in terms of total capacity, but it is expected to move up to the 5th place by 2024, overtaking Spain and the United Kingdom. In South America, Brazil is the clear leader in wind power with a total capacity of 28,6 Gigawatt.

Chile is the second largest South American market with 4,8 Gigawatt of installed capacity, followed by Argentina (4 Gigawatt) and Uruguay (1,5 Gigawatt).

OCEANIA

In Australia, new installations were lower than in previous years, with additional 942 Megawatt – after 1,4 Gigawatt added in 2022 – bringing total capacity to 11,5 Gigawatt. Unfortunately, the slowdown in new investment will need to be overcome for robust growth to resume in the coming years, in contrast to the progress made in some states, including South Australia which is committed to achieve 100% renewable power already by 2027 – a target already achieved by Tasmania.

In New Zealand, after several years of no major new installations, three new wind farms were commissioned in 2023, bringing total capacity to 1264 MW.

AFRICA

The African continent showed in the year 2023 little momentum in terms of new capacity. Only Morocco, the third largest market, showed significant growth, adding 616 Megawatt to bring total capacity to just over 2 Gigawatt. Egypt added 183 Megawatt and has now 1,9 Gigawatt. Mauritania installed its first major wind project and has now 135 Megawatt installed. Many African countries are focusing on rural electrification, where rather small wind turbines can be used alongside with solar.