Gas and CO2 price rises drive European electricity markets, but the Iberian market resists.

In the third week of April, prices rose in most major European electricity markets. The exception was the Iberian market, which had the lowest prices for the eleventh consecutive week. Gas and CO2 futures rose to prices not seen since the first half of January. The increase in demand also favored price rises in the electricity markets. In the Iberian Peninsula, renewable energy production increased, helping to drive prices down. On April 19, Spain reached the highest photovoltaic energy production for an April month.

Solar photovoltaic, solar thermoelectric and wind energy production

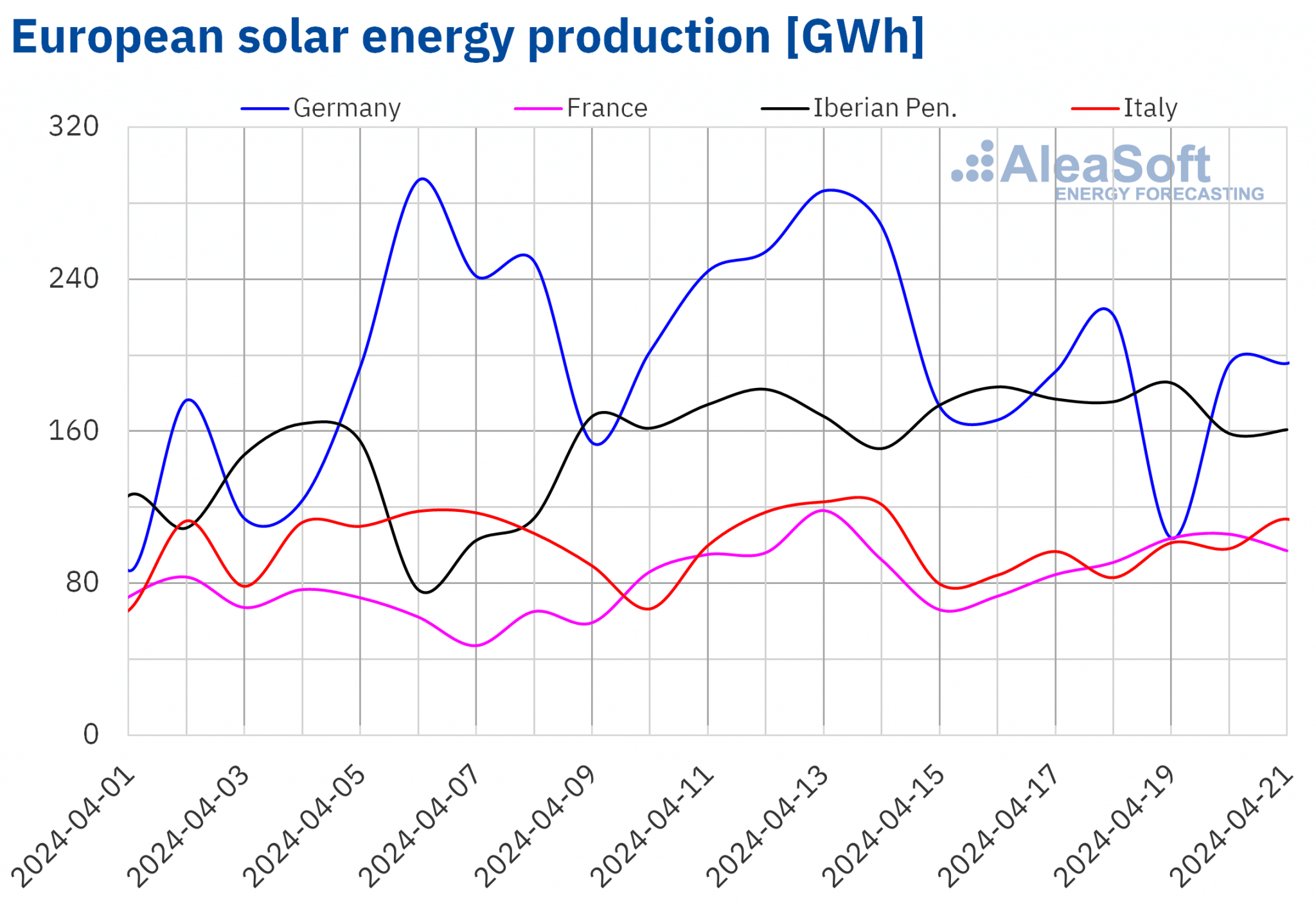

During the week of April 15, solar energy production increased for the third consecutive week in the Spanish and French markets compared to the previous week. This time the increase was 10% in Spain and 1.5% in France. On the other hand, the German, Italian and Portuguese markets registered decreases of 25%, 9.2% and 0.3%, respectively.

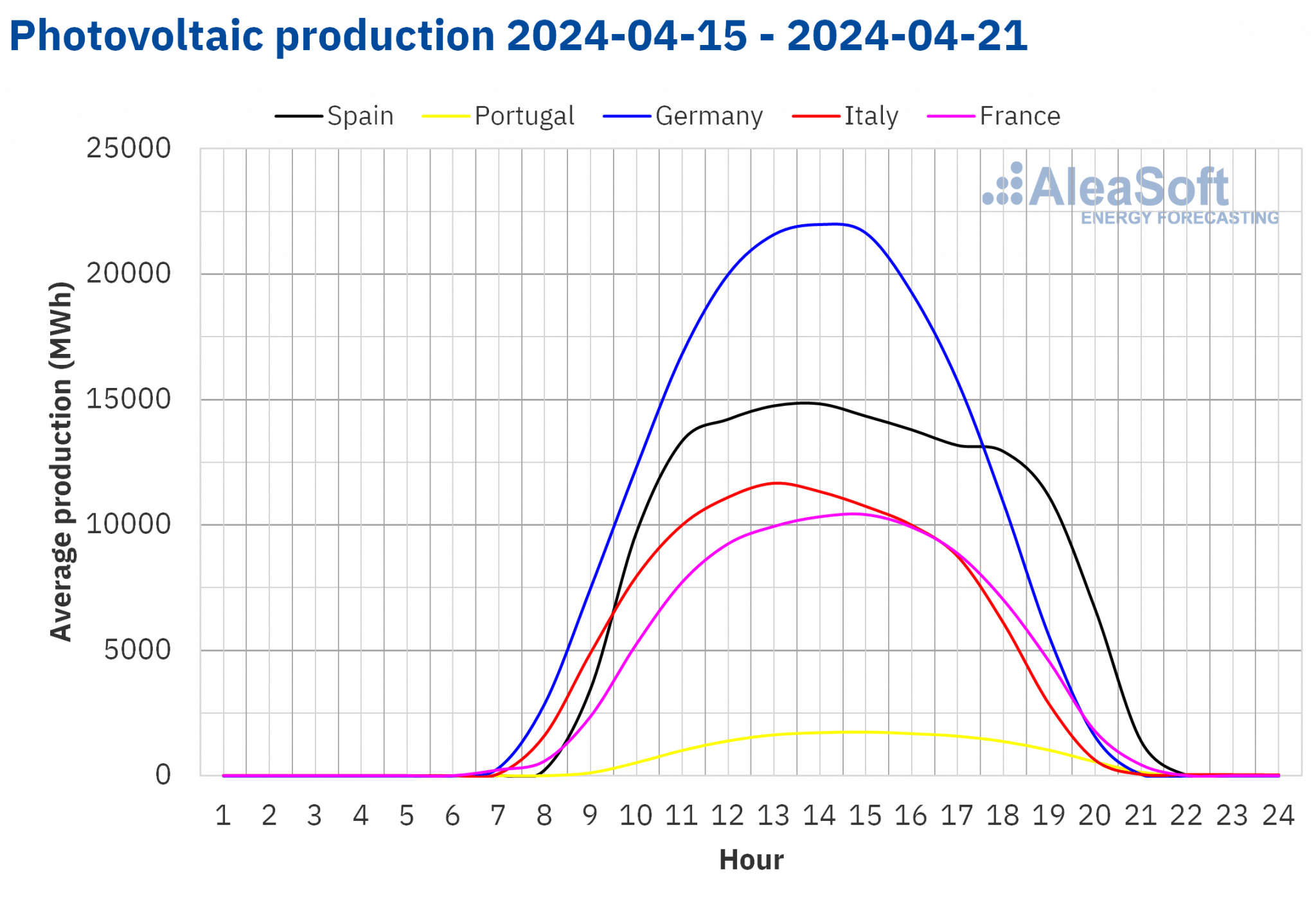

On Friday, April 19, the Spanish market achieved the highest solar photovoltaic energy production for an April month in its history, with the generation of 154 GWh using this technology.

For the week of April 22, according to AleaSoft Energy Forecasting’s solar energy production forecasts, production will increase in Germany, while it will decrease in Italy and Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

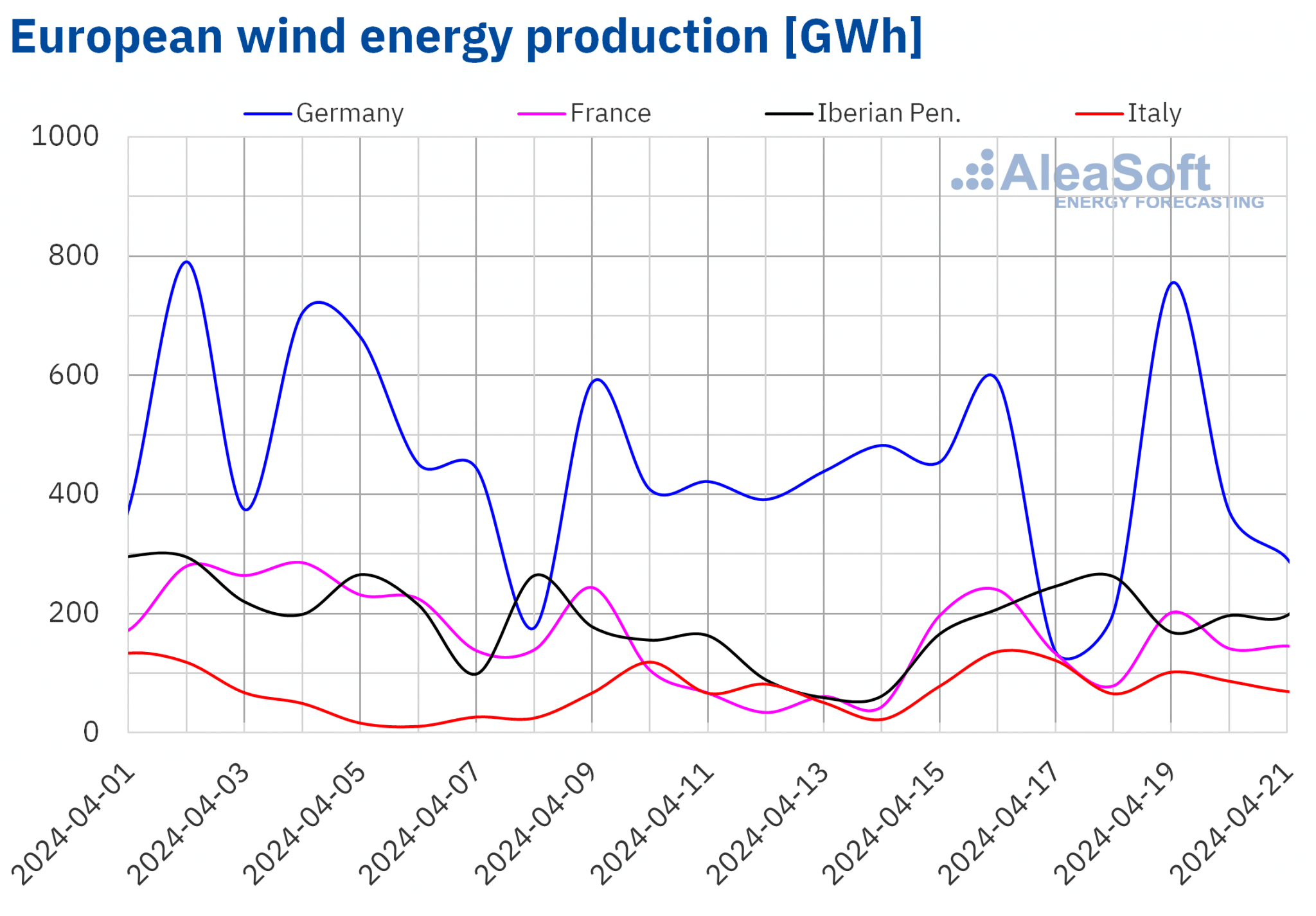

In the third week of April, wind energy production increased in most major European markets compared to the previous week. The French market registered the largest increase, which was 64%, followed by a 60% increase in the Spanish market. The Italian market registered increases for the second consecutive week, in this case by 53%. The Portuguese market registered the smallest increase, with a 3.7% rise. On the other hand, the German market continued its downward trend for the second consecutive week with a decline for the week as a whole of 3.6%.

According to AleaSoft Energy Forecasting’s wind energy production forecasts for the last week of April, production using this technology will increase in the markets of the Iberian Peninsula, while for the markets of Germany, France and Italy it will be lower than in the previous week.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

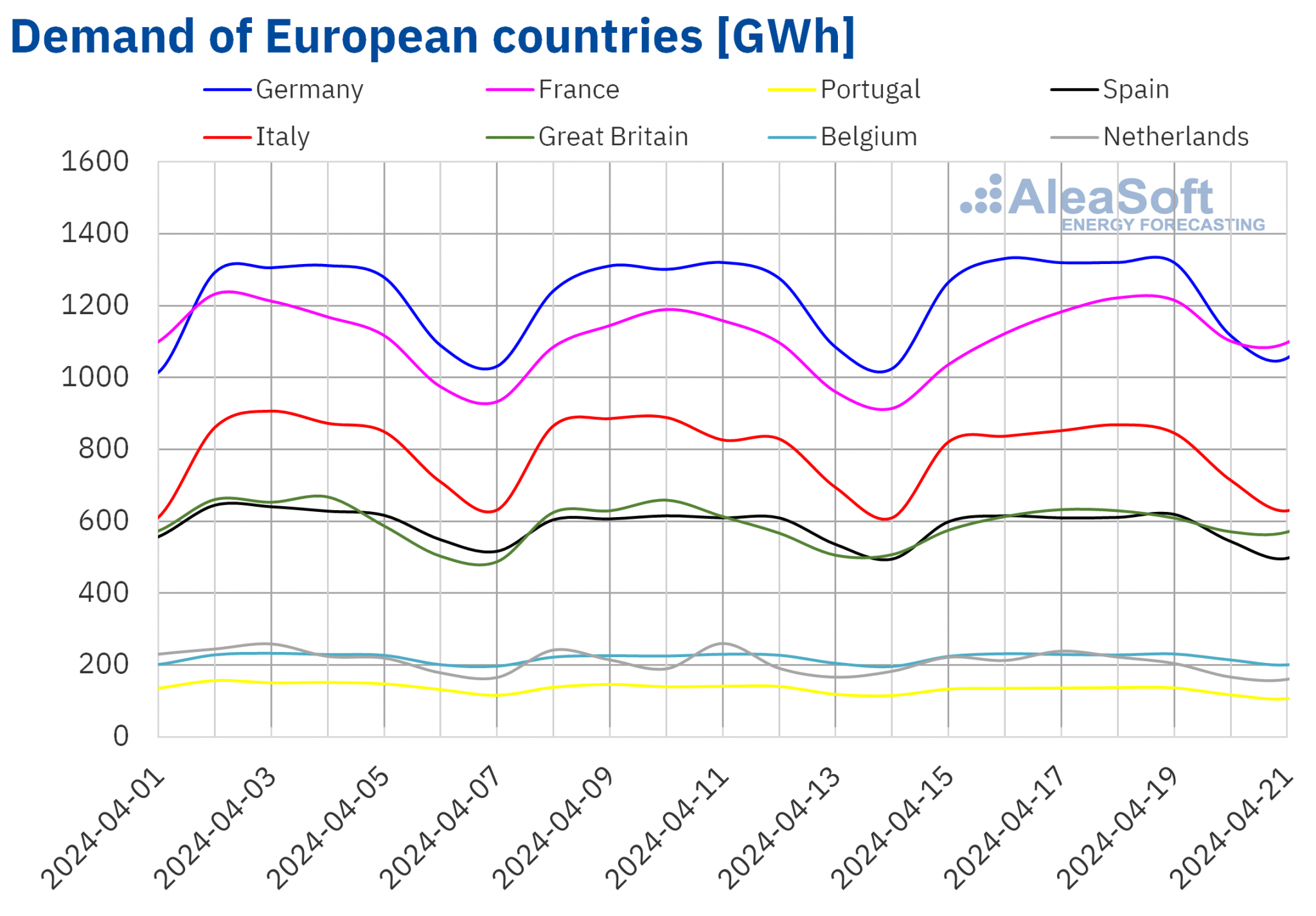

Electricity demand

In the third week of April, electricity demand increased in most major European electricity markets compared to the previous week. The French market registered the largest increase, 5.7%, followed by the British market, with an increase of 2.3%. The German and Belgian markets registered increases for the second consecutive week, this time of 2.0% and 1.8% respectively. The Spanish market was the one with the smallest increase in demand, 0.5%. On the other hand, the markets of the Netherlands, Portugal and Italy registered decreases of 6.1%, 3.9% and 0.6%, respectively. In the case of the Netherlands, it is the fifth consecutive week with drops in demand, and in Portugal, it is the third week.

During the week of April 15, average temperatures decreased in most analyzed markets, thus favoring an increase in demand in most of them. The decreases ranged from 7.2 °C in Germany to 0.4 °C in Spain. In Portugal, temperatures were similar to those of the previous week.

For the fourth week of April, according to AleaSoft Energy Forecasting’s demand forecasts, it will increase in France, Great Britain, Belgium, Spain and the Netherlands, while it will decrease in Portugal, Italy and Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

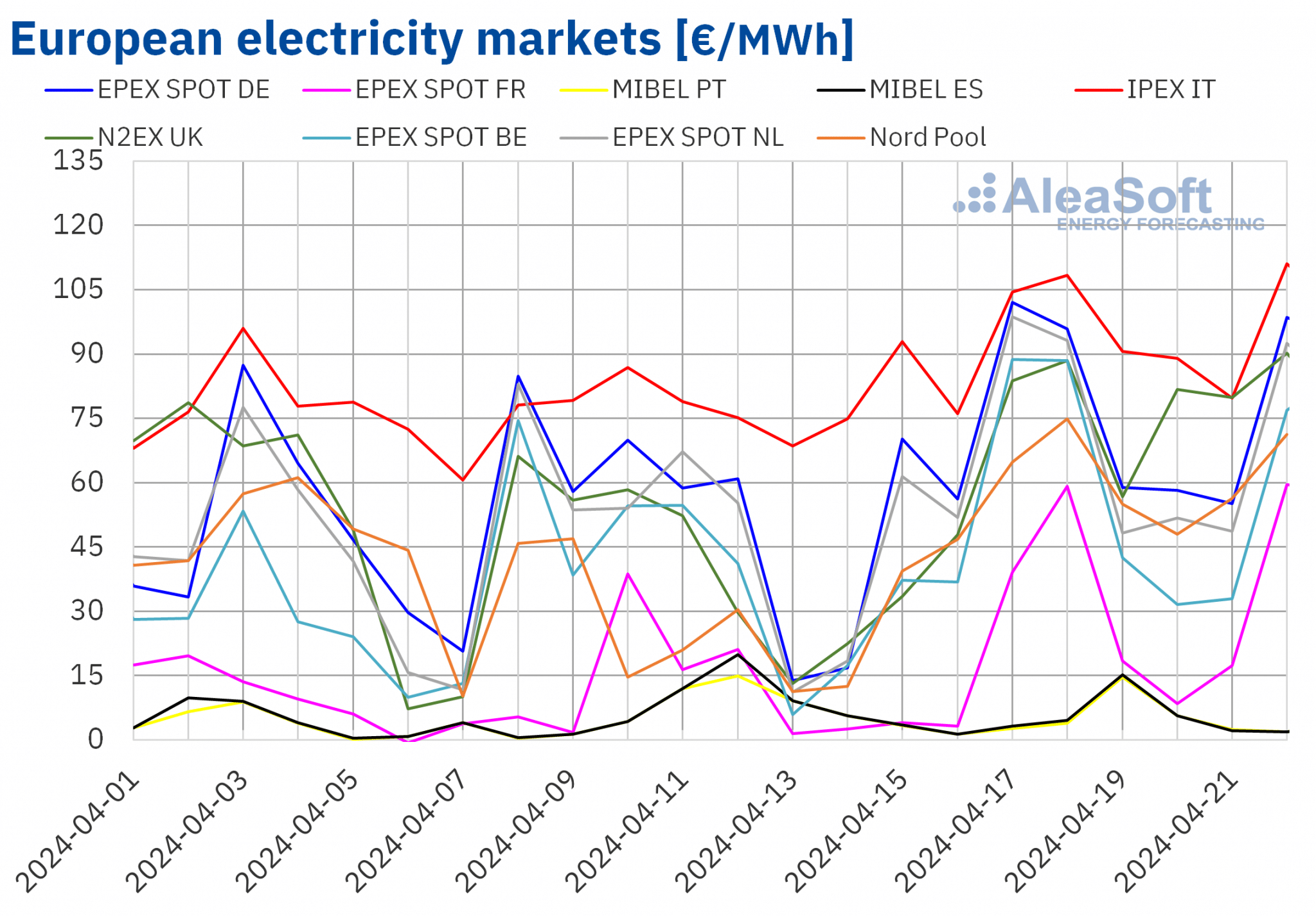

European electricity markets

In the third week of April, prices increased in most major European electricity markets compared to the previous week. The exception was the MIBEL market of Portugal and Spain, with decreases of 29% and 33%, respectively. The Nord Pool market of the Nordic countries reached the largest percentage price rise, 111%. In contrast, the IPEX market of Italy registered the smallest percentage increase, 18%. In the other markets analyzed at AleaSoft Energy Forecasting, prices increased between 25% in the EPEX SPOT market of Belgium and 72% in the EPEX SPOT market of France.

In the third week of April, weekly averages exceeded €50/MWh in most analyzed European electricity markets. The exceptions were the Portuguese, Spanish and French markets, with averages of €4.85/MWh, €5.09/MWh and €21.38/MWh, respectively. With these weekly averages, the MIBEL market has already registered eleven consecutive weeks with the lowest prices in the analyzed markets. On the other hand, the German and Italian markets registered the highest weekly averages, €70.93/MWh and €91.59/MWh, respectively. In the rest of the analyzed markets, prices ranged from €51.20/MWh in the Belgian market to €67.44/MWh in the N2EX market of the United Kingdom.

Regarding hourly prices, despite the increase in weekly average prices, in the third week of April, almost all analyzed European markets registered negative prices. The exceptions were the Italian and Nordic markets. The Belgian market reached the lowest hourly price, ?€35.00/MWh, on Sunday, April 21, from 11:00 to 12:00. On the other hand, from Monday, April 15, to Sunday, April 22, the Portuguese and Spanish markets registered 33 and 34 hours with negative prices, respectively.

During the week of April 15, the rise in the average price of gas and CO2 emission allowances, as well as the increase in demand in most analyzed markets, exerted an upward influence on European electricity market prices. In the case of the German market, moreover, wind and solar energy production fell. In contrast, in the Iberian Peninsula and France, production using these technologies increased. This contributed to these markets registering the lowest weekly averages.

AleaSoft Energy Forecasting’s price forecasts indicate that prices might also increase in the analyzed European electricity markets in the fourth week of April, influenced by increased demand in most markets. In addition, wind energy production might decrease considerably in markets such as France and Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

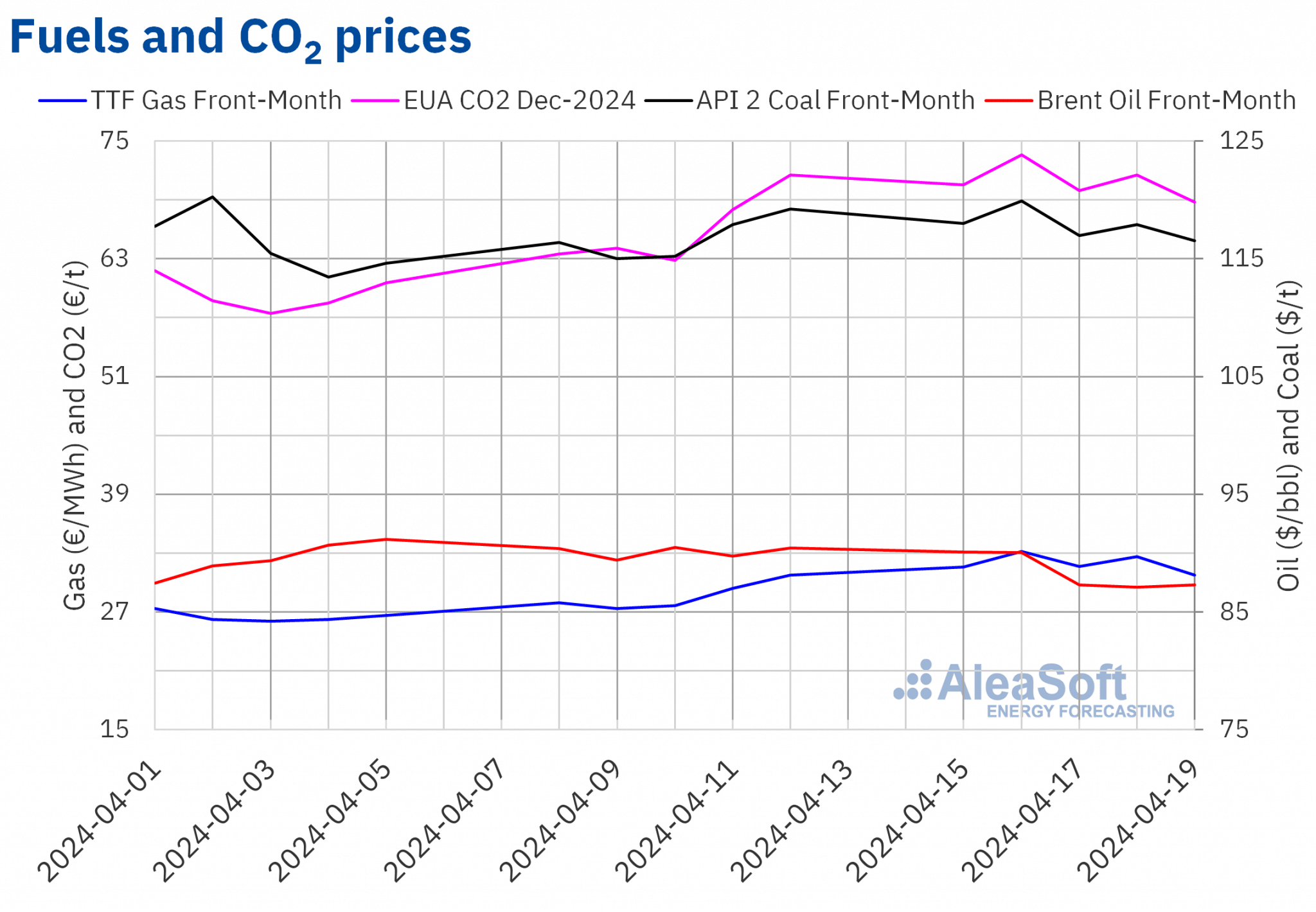

Brent, fuels and CO2

Settlement prices of Brent oil futures for the Front?Month in the ICE market declined throughout most of the third week of April. On Monday, April 15, these futures reached their weekly maximum settlement price, $90.10/bbl. This price was already 0.3% lower than the previous Monday. The declines continued until Thursday, April 18. On that day, the futures registered their weekly minimum settlement price, $87.11/bbl. According to data analyzed at AleaSoft Energy Forecasting, this price was 2.9% lower than the previous Thursday and the lowest since late March. On Friday, April 19, prices rose slightly to $87.29/bbl. This settlement price was still 3.5% lower than the previous Friday.

At the beginning of the third week of April, increased tension in the Middle East contributed to Brent oil futures settlement prices above $90/bbl. However, the evolution of the conflict led to lower prices. In addition, US crude reserves increased, also exerting a downward influence on prices.

As for TTF gas futures in the ICE market for the Front?Month, in the third week of April, settlement prices remained above €30/MWh. The upward trend of the previous week continued until Tuesday, April 16. On that day, these futures reached their weekly maximum settlement price, €33.14/MWh. According to data analyzed at AleaSoft Energy Forecasting, this price was 21% higher than the previous Tuesday and the highest since the first half of January. On Friday, April 19, they reached their weekly minimum settlement price, €30.76/MWh. Despite being the lowest settlement price of the week, this price level has also not been seen since the first half of January.

In the third week of April, the evolution of the Middle East conflict and concerns about its effects on supply caused TTF gas futures prices to reach the highest values in recent months. In addition, increased demand in Asia is also resulting in a decline in LNG supplies to Europe.

As for CO2 emission allowances futures in the EEX market for the reference contract of December 2024, settlement prices exceeded €70/t in most sessions in the third week of April. On Tuesday, April 16, these futures reached their weekly maximum settlement price, €73.62/t. According to data analyzed at AleaSoft Energy Forecasting, this price was 15% higher than the previous Tuesday and the highest since the first half of January. In contrast, on Friday, April 19, these futures registered their weekly minimum settlement price, €68.81/t. This price was 3.8% lower than the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy transition

On Thursday, April 11, the 43rd webinar in the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen took place. The webinar had the participation, for the third time, of Raúl García Posada, Director at ASEALEN, the Spanish Energy Storage Association. This webinar focused on regulation, current situation and prospects for the coming months of energy storage. It also analyzed the evolution and prospects of European energy markets.

AleaSoft Energy Forecasting and AleaGreen will hold the next webinar in their series on Thursday, May 9. On this occasion, the webinar will analyze the evolution and prospects of European energy markets, as well as the vision of the future of the energy sector. Luis Atienza Serna, who was Minister of Agriculture, Fisheries and Food of the Spanish Government between 1994 and 1996, will participate in the analysis table of the Spanish version of the webinar.