In the first week of August, gas and CO2 prices rose, leading to price increases in most of the main European electricity markets. The Italian market registered the highest daily price of the year on July 29 and the Iberian market the second highest on August 5. The French market broke the historical record for photovoltaic production on July 29, and those of Italy, Spain and Portugal reached the highest production for an August month using this technology.

Solar photovoltaic, solar thermoelectric and wind energy production

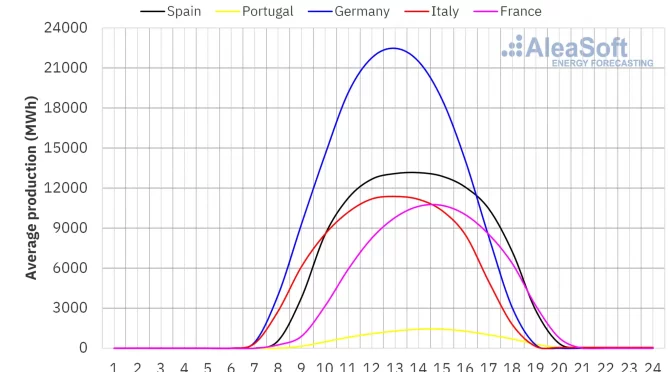

In the week of July 29, solar energy production increased in Germany, France and Italy compared to the previous week. The German market registered the largest increase of 11%, followed by increases of 3.5% in the French market and 0.1% in the Italian market. In France, solar energy generation increased for the fourth consecutive week. On the Iberian Peninsula, however, the upward trend of the previous week reversed. In Portugal there was a decrease of 9.5%, while in Spain, which includes solar photovoltaic and thermoelectric energy, the decrease was 6.2%.

In the last week of July, the French market again broke the all-time record for solar PV production on Monday, July 29, with 129 GWh. On the other hand, the French and Italian markets registered the highest daily PV production for the month of August on Thursday, August 1, with 105 GWh and 124 GWh respectively. The Spanish market, despite the inter-week decline, registered the highest daily photovoltaic production for an August month on Thursday, August 1, with 199 GWh of generation, while on Friday, August 2, the Portuguese market registered its highest daily photovoltaic production for an August month with 22 GWh of generation.

For the week of August 5, according to AleaSoft Energy Forecasting‘s solar energy production forecasts, production is expected to increase in Germany and Spain and decrease in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

In the first week of August, wind energy production increased in the Portuguese and Italian markets for the second week in a row. The Italian market registered the largest percentage increase of 26%, followed by an increase of 11% in the Portuguese market. In contrast, the French, German and Spanish markets registered decreases in wind energy generation. The German market registered the largest decrease of 42%, continuing the downward trend for the fourth consecutive week. The Spanish market registered a decrease of 9.8%, while the French market registered a decrease of 4.9%, continuing the downward trend for the second consecutive week.

For the week of August 5, according to AleaSoft Energy Forecasting‘s wind energy production forecasts, production using this technology will decrease in France, Italy and the Iberian Peninsula, but will increase in Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

During the week of July 29, electricity demand in the main European electricity markets varied heterogeneously from week to week. Demand increased in the German, French, Spanish and Belgian markets. Spain, where demand increased for the seventh consecutive week, registered the largest increase of 2.6%, while the German market registered the smallest increase of 0.2%. The Belgian and French markets increased by 2.3% and 1.5% respectively. On the other hand, demand fell in the Portuguese, British, Italian and Dutch markets. The Italian market registered the largest decrease of 1.6%, while the Dutch market registered the smallest decrease of 0.8%. The Portuguese market fell by 1.5%, followed by the UK market, which fell by 1.1%. The UK and Dutch markets fell for the third and fourth consecutive weeks respectively.

During the first week of August, average temperatures increased in most of the markets analyzed compared to the fourth week of July, with the exception of Portugal where there was a decrease of 0.2%. The markets of France and the United Kingdom registered the largest increases of 2.3°C and 2.1°C, respectively. In Belgium, average temperatures rose by 1.8°C. In the Spanish, Italian, German and Dutch markets, increases ranged from 0.6°C in Italy to 1.3°C in the Netherlands.

For the week of August 5, AleaSoft Energy Forecasting‘s demand forecasts anticipate an increase in electricity demand in the Belgian and Dutch markets compared to the previous week. On the other hand, demand is expected to decrease in the rest of the main European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

During the week of July 29, prices in most of the main European electricity markets were higher than the previous week.

The MIBEL market in Spain and Portugal registered the largest percentage price increase of 13%. On this market, the average daily price closed at or above €100/MWh between Monday, July 29 and Thursday, August 1, as well as on Monday, August 5. This has only happened on three days in 2024, in January and on July 18. The daily price of €109.82/MWh on August 5 was the second highest so far in 2024, after €113.83/MWh on January 9. In the rest of the main European electricity markets where prices rose, increases ranged from 3.3% in the UK’s N2EX market to 6.8% in France’s EPEX SPOT market. The only market analyzed by Alea Energy Forecasting where prices were lower than in the week of July 22 was the Nordic countries’ Nord Pool market, which registered the lowest weekly price with a decrease of 3.2% to €24.11/MWh.

Italy’s IPEX market registered the highest weekly average price of €120.13/MWh. In the first week of August, the two highest daily prices so far in 2024 on this market were €125.89/MWh on Monday, July 29, and €124.99/MWh on Sunday, August 4. In the rest of the main European electricity markets, weekly prices ranged from €53.42/MWh in the French market to €95.44/MWh in the Portuguese market.

Although the general trend of the week was one of increasing prices, most markets registered negative price hours on July 29 and 30, as well as those of Belgium, Germany and the Netherlands on Sunday, August 4. The lowest price of the week, €3.45/MWh, was registered on the EPEX SPOT market in the Netherlands on July 29 between 11:00 and 12:00. No negative prices were registered on the Italian, UK and Iberian markets during the first week of August.

The main reason for the price increases during the week of July 29 is the increase in gas and CO2 prices. In addition, the almost universal rise in temperatures increased demand in some markets, coupled with a decline in wind energy production in Germany, France and Spain and solar energy production in the Iberian Peninsula.

AleaSoft Energy Forecasting‘s price forecasts indicate that weekly prices in the week of August 5 will be lower than in the first week of August in most markets. This behavior will be favored by lower demand in most markets, increased wind energy production in Germany, and increased solar energy production in Germany and Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

In the week of July 29, Brent oil futures for the Front?Month in the ICE market fell from the previous week. Almost every day of the week, settlement prices for the barrel were below $80, which has not happened since June 7. In the middle of the week, on July 31, the highest settlement price of the week was $80.72/bbl. After that, prices fell to a weekly low of $76.81/bbl on Friday, August 2. According to data analyzed by AleaSoft Energy Forecasting, this value is 5.3% lower than the previous Friday and is the lowest settlement price since January 10 of this year.

In the first days of the first week of August, Brent oil prices continued the downward trend that ended the previous week. However, prices rebounded on Wednesday, July 31, as tensions in the Middle East escalated following the assassination of Hamas leader Ismail Haniyeh in Iran. In addition, the American Petroleum Institute (API) reported an unexpected draw in US crude oil inventories. However, prices fell at the end of the week on fears of a recession in the US after news that unemployment rose 4.3% in July. In addition, a slowdown in manufacturing activity in China led to a decline in demand for crude oil.

As for TTF gas futures in the ICE market for the Front?Month, they registered a significant price increase in the first week of August. The weekly average of settlement prices was 10% higher than the previous week. The lowest settlement price of the week was €34.29/MWh on Monday, July 29. Thereafter, prices continued to rise until a settlement price of €36.97/MWh was registered on Thursday, August 1. According to data analyzed by AleaSoft Energy Forecasting, this is the highest settlement price since December 8, 2023. Although the settlement price on Friday, August 2 dropped to €36.65/MWh, this value was still 11% higher than on Friday of the previous week.

Increased tensions in the Middle East due to recent events have led to fears of a possible escalation of the conflict. This instability has raised concerns about gas supplies, particularly the flow of Israeli gas to Egypt and the potential impact on the transit of LNG through the Strait of Hormuz and the Suez Canal, both of which are critical to the global supply of LNG. In addition, high temperatures in Europe led to increased demand for gas for refrigeration.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2024 also rose in line with gas prices. The weekly average of settlement prices was 4.4% higher than in the week ending July 22. On Monday, July 29, the settlement price of €68.68/t was 1.2% higher than the last session of the previous week. In the following days, prices continued to rise until Thursday, August 1, when the settlement price was €71.18/t. According to data analyzed by AleaSoft Energy Forecasting, this price is the highest since June 7. On Friday, August 2, the settlement price fell to €70.58/t. Despite the decline, this value was still 4.0% higher than on Friday of the previous week.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy storage

AleaSoft Energy Forecasting has six divisions to support the development of renewable energy, including AleaStorage. This division specializes in revenue calculation, optimization and storage management for energy storage systems, such as batteries, and hybrid systems of renewable technologies, such as wind or solar energy, with energy storage systems. AleaStorage reports are based on hourly price simulations and optimization algorithms that take into account the technical characteristics of the system and the ability to sell energy in the markets.