Lower prices in the iberian electricity market, while prices rise in the rest of the european markets.

In the third week of August, wind production together with the decrease in demand and average temperatures contributed to the drop in prices in the Iberian market of Spain and Portugal. In the rest of Europe’s major electricity markets, most of them saw higher prices than the previous week and lower solar production. TTF gas futures prices remained below the €40/MWh of the previous week.

Solar photovoltaic, solar thermoelectric and wind energy production

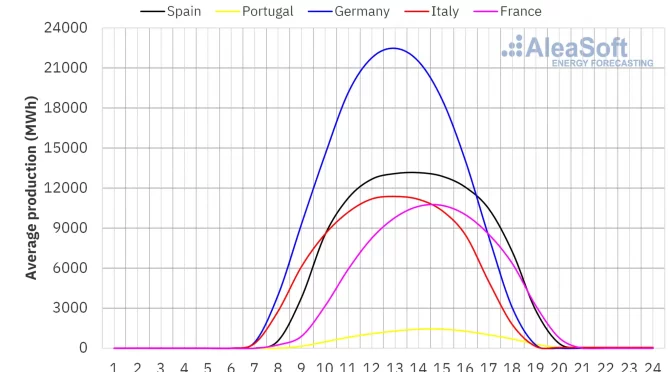

In the week of August 12, solar energy production decreased in all major European electricity markets compared to the previous week. The French and Italian markets registered the largest decreases of 19% and 13% respectively. In the remaining markets decreases ranged from 9.2% in Germany to 0.3% in Portugal.

In the week of August 19, according to solar energy production forecasts of AleaSoft Energy Forecasting, the previous week’s trend will reverse, with solar production increasing in Germany and Spain. In Italy the solar production will continue decreasing.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

In the week of August 12, wind production increased in the Iberian and French markets compared to the previous week. In this case, the increases were 43% in the Portuguese market, 15% in the French market and 9.2% in the Spanish market. On the other hand, the German and Italian markets recorded decreases in wind generation of 20% and 7.1% respectively.

During the fourth week of August, according to the wind energy production forecasts of AleaSoft Energy Forecasting, the previous week trends will reverse. The wind production will increase in Germany and Italy but will decrease in France and the Iberian Peninsula.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

In the week of August 12, the electricity demand of the main European electricity markets showed a heterogeneous behaviour, compared to the previous week. In the countries where August 15 was a holiday celebrating the Assumption of the Virgin Mary, electricity demand decreased. The Italian market recorded the largest decrease of 12%, while the French market recorded the smallest drop of 3.7%. In the Spanish and Portuguese markets demand dropped by 9.6% and 7.9% respectively. In the Belgian market, demand increased by 2.2% despite August 15 being a holiday. This increase in the Belgian demand meant the third consecutive week of electricity consumption growth in the country.

In the rest of the markets, demand increased. The Dutch market recorded the largest increase of 13%. In Germany and Great Britain, the increase was 2.3% and 2.0%, respectively.

During the week, the average temperatures increased between 1.8°C in Germany and 0.1°C in Italy. In Spain, Great Britain and Portugal the temperature dropped between 1.3°C and 0.4°C. In France, average temperatures remained similar to the previous week.

For the week of August 19, according to AleaSoft Energy Forecasting‘s demand forecasts, the changes in demand will continue to be heterogeneous. Demand will increase in the German, Italian, Spanish and Portuguese markets, while it will decrease in the French, Belgian, Dutch and British markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

In the third week of August, the weekly average prices of most of the main European electricity markets were higher compared to the previous week. The French EPEX SPOT market recorded the highest price increase of 115%, followed by the Belgian EPEX SPOT market with a rise of 42%. In the German and Dutch EPEX SPOT markets and the Nord Pool market of the Nordic countries, prices increased between 27% in Germany and 24% in the Nordic market. The Italian IPEX market recorded the smallest increase of 1.2%. The exception was the Spanish and Portuguese MIBEL market, where prices decreased by 13% compared to the previous week of August 5.

In addition, the Italian market recorded the highest weekly average price of €130.21/MWh. The German and Dutch markets followed, with average prices of €96.41/MWh and €89.88/MWh, respectively. In the rest of the major European electricity markets, weekly prices ranged from €21.42/MWh in the Nord pool market to €81.79/MWh in the Iberian MIBEL market.

During the week of August 12, the Dutch, Belgian and German markets recorded hours with negative prices. The Dutch market recorded negative prices for a few hours on August 12 and 15, with the lowest price of the week being €-10.06/MWh registered between 2 p.m. and 3 p.m. on August 12. The German market recorded a negative price of €-0.04/MWh on August 15 between 2 p.m. and 3 p.m. In the Belgian market the negative prices were recorded between 3 p.m. and 5 p.m. on Sunday, August 18, with values of €-5.48/MWh and €-0.38/MWh, respectively. The Iberian market registered prices of €0/MWh between 10 a.m. and 5 p.m. on August 15 and between 11 a.m. and 6 p.m. on August 18.

Increased demand in some of the major European energy markets, combined with reduced solar and wind production in Germany and Italy and solar production in France and the Iberian Peninsula, contributed to price increases in most markets. In the Iberian market, however, increased wind production combined with lower demand led to lower prices.

AleaSoft Energy Forecasting‘s price forecasts indicate that in the week of August 19, weekly prices on the Iberian Peninsula, Great Britain, Belgian and the Dutch markets will increase compared to the previous week, as most of them will observe increased demand and, in the case of the Iberian market, reduced wind production. On the other hand, prices in the German, French and Italian markets will fall. This price decline will be favored by increased wind production in Italy and Germany, in addition to increased solar production in Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

In the week of August 12, Brent oil futures for the Front-Month in the ICE market recorded a change in trend compared to the previous week. On Monday, August 12, they recorded the highest settlement price of the week of $82.30/bbl. Over the next two days, futures fell to $79.76/bbl on August 14. The next day, on Thursday August 15, prices rose by 1.6% to fall to the weekly low of $79.68/bbl, on Friday, August 16. According to the data analyzed by AleaSoft Energy Forecasting, this value was similar to that of the previous Friday. Still, the weekly average was 3.5% higher than the previous week.

Brent oil prices rose in the third week of August as fears of a recession in the United States eased and despite a continued decline in demand in the Chinese market. The geopolitical situation, with new talks on the Gaza Strip in Qatar and the risk of a regional escalation of the conflict, which could affect the supply of crude oil, also contributed to the rise in prices.

During the third week of August, TTF gas futures for the Front-Month in the ICE market, decreased slightly compared to the last day of the previous week, although the weekly average of the settlement price increased by 3.5% compared to the previous week. The lowest settlement price of the week, €38.97/MWh, was recorded on August 14. Thereafter, prices increased every day to reach a settlement price of €39.64/MWh by Friday, August 16, 1.9% lower than the previous Friday.

The eased fears of possible cuts in gas supply from Ukrainians and Russian pipelines allowed prices to fall slightly during the third week of August compared to Friday of the previous week.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2024, prices increased in the session of Monday, August 12, to the maximum of the week of €72.65/t. The lowest settlement price of €71.29/t was recorded on Tuesday, August 13. It later rose again to €72.52/t, on Friday, August 16. The weekly average settlement price was 2.9% higher than in the week of August 5.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for European energy markets and energy storage

Among the divisions of AleaSoft Energy Forecasting there is AleaWhite, the division specialized in providing information on the energy sector. AleaWhite offers personalized reports on the energy markets and the Alea Energy DataBase, an online data platform useful for analysis and research on these markets. In addition, AleaWhite disseminates energy sector news through its weekly news summary and organizes webinars on current topics in the energy sector.

In August, there are promotions of energy markets forecasts, which use a scientific methodology based on Artificial Intelligence, time series analysis and statistical models.