In the third week of September, prices in most major European electricity markets were higher than the previous week. The decline in solar and wind energy production in most markets favored this trend. Despite the weekly decline, wind energy production reached levels not seen in several months in Spain, Portugal and France on the 17th. Gas and CO2 futures fell, and the latter registered its lowest settlement price since April 6.

Solar photovoltaic, solar thermal and wind energy production

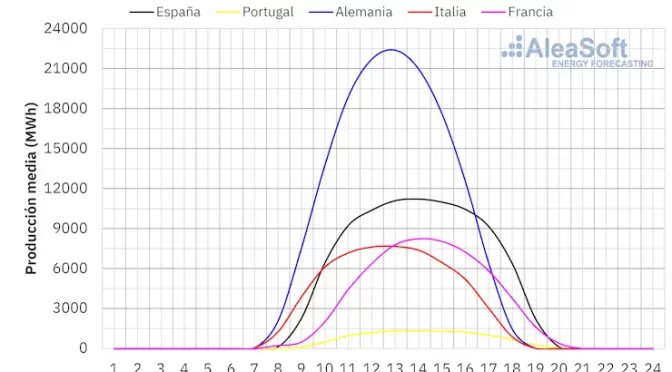

In the week of September 16, solar energy production decreased in most major European electricity markets compared to the previous week. The Portuguese and Spanish markets showed the largest declines, 25% and 24%, respectively. Such large declines were last seen on the Iberian Peninsula in late March and early April 2024. The French market showed the smallest drop, 12%, reversing the upward trend of the previous week. In contrast, in the German market, solar energy production increased by 36% after two weeks of declines.

In the week of September 23, according to AleaSoft Energy Forecasting’s solar energy production forecasts, solar energy production will increase in Spain, but it will fall in Germany and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

In the third week of September, weekly wind energy production also decreased in most major European markets, reversing the upward trend of the previous week. The Italian market registered the largest drop, 78%, while in Portugal, Germany and Spain wind energy production fell by 27%, 18% and 15%, respectively. The exception was the French market, where wind energy production increased by 5.4%.

Despite the declines in weekly production, on Tuesday, September 17, daily wind energy production reached levels not seen in several months. During that day, the Spanish market generated 257 GWh, the highest daily production since June 1. Likewise, the French market generated 232 GWh, a value not seen since mid?April, and the Portuguese market generated 63 GWh, the highest production since mid?May.

In the week of September 23, according to AleaSoft Energy Forecasting’s wind energy production forecasts, the downward trends will be reversed. Production with this technology will increase in Germany, Italy and the Iberian Peninsula. However, wind energy production will decline in the French market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Electricity demand

In the week of September 16, the week?on?week evolution of electricity demand did not show a homogeneous trend in the main European electricity markets, in contrast to the downward trend observed in the previous week. Great Britain topped the list of markets where demand increased, with a rise of 3.0%. It was followed by the Portuguese market, where demand increased for the second consecutive week, this time by 2.1%. The Belgian and French markets registered the smallest increases, 0.8% and 0.1%, respectively. In the Spanish market, demand remained similar to the previous week, while the Italian, German and Dutch markets registered a decrease in demand. In the Italian market, demand fell for the third consecutive week, down 4.6%. In the German and Dutch markets, demand fell for the second consecutive week, with decreases of 2.3% and 2.1%, respectively.

At the same time, average temperatures increased in most analyzed markets. Increases ranged from 2.9 °C in France to 4.0 °C in the Netherlands. In contrast, in Italy, Spain and Portugal, average temperatures decreased by 2.1 °C, 0.6 °C and 0.4 °C, respectively.

In the week of September 23, according to AleaSoft Energy Forecasting’s demand forecasts, it will increase in the German, French, Belgian, Dutch and British markets. On the other hand, demand will decrease in the Iberian Peninsula and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

European electricity markets

In the third week of September, average prices in most major European electricity markets increased compared to the previous week. The exceptions were the EPEX SPOT market of France, the Netherlands and Belgium, with decreases of 17%, 2.9% and 0.7%, respectively. The Nord Pool market of the Nordic countries registered the largest percentage price increase, 91%. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices increased between 0.5% in the EPEX SPOT market of Germany and 18% in the MIBEL market of Spain and the N2EX market of the United Kingdom.

In the third week of September, weekly averages were below €81/MWh in most analyzed European electricity markets. The exceptions were the N2EX market of the United Kingdom and the IPEX market of Italy, with averages of €95.81/MWh and €111.60/MWh, respectively. The Nordic market registered the lowest weekly average, €25.84/MWh. In the rest of the analyzed markets, prices ranged from €42.86/MWh in the French market to €80.26/MWh in the German market.

Regarding hourly prices, several of the analyzed markets registered zero or negative prices in the third week of September. The lowest price of the week, ?€3.95/MWh, was registered on Saturday, September 21, from 14:00 to 15:00, in the German, French, Dutch and Belgian markets. On the other hand, on September 16 and 17, the Spanish, Portuguese and French markets registered zero prices for several hours, while on September 18, 19 and 20, the German, Dutch and Belgian markets registered negative prices in some hours. On Sunday, September 22, the German market registered negative price hours again. In contrast, the Italian market, where no zero or negative prices were reached, registered the highest hourly price of the week, €180.32/MWh, on September 16 from 18:00 to 19:00.

During the week of September 16, declining wind and solar energy production in most major European markets contributed to the increase in electricity market prices, despite the decline in gas and CO2 prices for the week as a whole. Increased electricity demand in some markets also helped this trend.

AleaSoft Energy Forecasting’s price forecasts indicate that, in the fourth week of September, prices will decrease in most analyzed European electricity markets, favored by the recovery of wind energy production in most markets and solar energy production in Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

In the third week of September, settlement prices of Brent oil futures for the Front?Month in the ICE market increased in most sessions and were above $72/bbl. On Monday, September 16, these futures registered their weekly minimum settlement price, $72.75/bbl. As a result of the upward trend, on Thursday, September 19, these futures reached their weekly maximum settlement price, $74.88/bbl. According to data analyzed at AleaSoft Energy Forecasting, this price was the highest since September 3. On Friday, September 20, the settlement price declined slightly to $74.49/bbl, but it was still 4.0% higher than the previous Friday.

In the third week of September, declining US crude reserves and supply concerns following Hurricane Francine exerted their upward influence on Brent oil futures prices. The US interest rate cut also contributed to higher prices. However, concerns about the evolution of demand in China continued, preventing further increases. On the other hand, increased instability in the Middle East might lead to further price increases in the fourth week of September.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, they remained below €36/MWh during the third week of September. On Tuesday, September 17, these futures reached their weekly maximum settlement price, €35.55/MWh. Subsequently, prices declined and on Thursday, September 19, these futures registered their weekly minimum settlement price, €33.08/MWh. According to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since July 27. On Friday, September 20, the settlement price increased to €34.44/MWh. This price was still 3.4% lower than the previous Friday.

During the third week of September, maintenance work continued in Norway. In addition, maintenance work on the Medgaz pipeline, which is scheduled to continue during the fourth week of September, affected the gas flow from Algeria. However, high European reserve levels allowed TTF gas futures prices to remain below €36/MWh. On the other hand, news of a possible deal to supply gas from Azerbaijan via Ukraine contributed to the price drop on Thursday, September 19, although this news was later rectified.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2024, on Tuesday, September 17, they registered their weekly maximum settlement price, €64.34/t. On September 18 and 19, settlement prices declined. On Thursday, September 19, these futures reached their weekly minimum settlement price, €62.82/t. According to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since April 6. On Friday, September 20, the settlement price increased to €63.39/t. However, this price was still 2.5% lower than the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing of renewable energy projects

On Thursday, September 19, AleaSoft Energy Forecasting and AleaGreen held the 47th webinar in their monthly webinar series. On this occasion, the webinar analyzed the evolution and prospects of European energy markets, energy storage, especially batteries and green hydrogen, as well as the current situation and prospects for self?consumption. In addition, there was an explanation of Aleasoft services for energy retailers. Xavier Cugat, Product Director at Pylontech, and Francisco Valverde, independent professional for the development of renewable energies, participated in the analysis table of the webinar in Spanish.

The next webinar in the series, number 48, will take place on October 17. This webinar will feature speakers from Deloitte, who participate for the fifth time. The analyzed topics will be the evolution and prospects of European energy markets for the winter 2024?2025, the financing of renewable energy projects and the importance of forecasting in audits and portfolio valuation.