RWE, one of the world’s leaders in offshore wind, has awarded two key contracts to Lamprell Energy Limited for the future supply of transition pieces to its two east coast UK offshore wind projects currently under development, Norfolk Vanguard West and Norfolk Vanguard East.

The award underlines RWE’s continued commitment to progressing the development of both projects which, once fully constructed and operational would have a combined total installed capacity of 2.8 gigawatts (GW).

RWE and Lamprell marked the signing of the contracts with a small event at the WindEnergy Hamburg 2024 conference. The scope of work within the contracts requires the manufacture and supply of 2 x 92 transition pieces for both wind farms, and the transportation of the structures to RWE’s official marshalling port, once this has been decided.

Lamprell will fabricate the transition pieces using its state-of-the-art serial production line, commissioned in 2023. The facility successfully completed its first project in 2024, delivering over 60 similar structures for a Scottish wind farm.

Vanguard West and Vanguard East are part of a trio of offshore wind farms along with Norfolk Boreas, making up the Norfolk Offshore Wind Zone off the UK east coast. RWE acquired the three projects in March 2024, and has since continued to develop them at pace as part of its commitment to growing green in the UK. Together all three RWE Norfolk projects would be capable of generating enough clean energy to supply the equivalent of around 4 million typical UK homes. The projects are set to play an important part in supporting the UK’s aim to quadruple offshore wind capacity by 2030, deliver a net zero power system, and secure a reliable source of long-term clean, domestic power.

Dr Holger Himmel, Chief Financial Officer (CFO), RWE Offshore Wind: “We are pleased to have secured this key contract for Norfolk Offshore Wind Zone with Lamprell as our preferred supplier for the transition pieces. We are looking forward to a fruitful and productive relationship with Lamprell and we continue to work closely with our delivery partners to progress the development of these important projects towards offshore construction and operation.”

Ian Prescott, CEO of Lamprell: “We are honoured to be partnering with RWE on the Norfolk Vanguard projects. This contract award highlights Lamprell’s commitment to delivering high-quality wind turbine foundation structures that support the global transition towards renewable energy. We are grateful to RWE for their trust and look forward to a long and successful partnership as we work together to contribute to the UK’s renewable energy ambitions.”

Each of RWE’s three Norfolk projects has a planned capacity of 1.4 GW. They would be constructed approximately 47 to 80 kilometres off the coast of Norfolk in East Anglia. The projects already have seabed rights, grid connections, Development Consent Orders and all other key permits. Onshore construction of the substations and undergrounded cable route between Necton and Happisburgh has already begun. As an important next step in the development of the projects, RWE will enter the Norfolk Vanguard projects into a future Contracts for Difference auction.

Once operational, the three Norfolk projects will be capable of generating enough electricity to power the equivalent of more than 4 million typical UK homes – more than all the households in the London region.

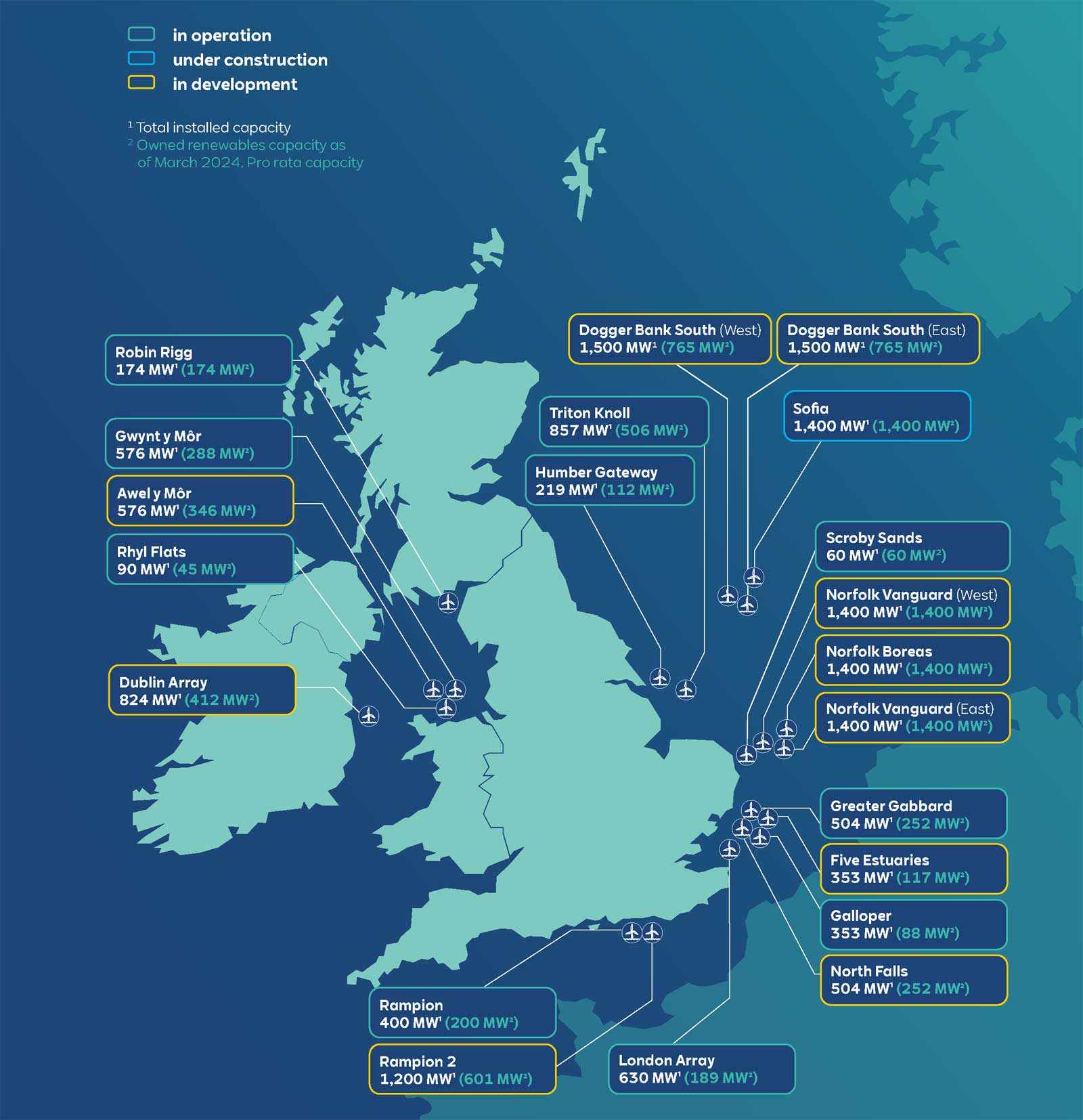

RWE is a leading partner in the delivery of the UK’s Net Zero ambitions and energy security. It already operates 10 offshore wind farms across the UK. Including the three Norfolk offshore wind projects, RWE is developing 10 offshore wind projects across the UK and Ireland, representing a combined potential installed capacity of around 10.5 GW, with RWE’s pro rata share amounting to 7.5 GW.

Furthermore, RWE is constructing the 1.4 GW Sofia offshore wind project in the North Sea off the UK’s east coast. RWE’s unparalleled track record of more than 20 years in offshore wind has resulted in 19 offshore wind farms in operation. The company’s goal is to triple its global offshore wind capacity from 3.3 GW today to 10 GW in 2030.

Find out more about RWE’s offshore wind portfolio in the UK by clicking the link here.

UK & Ireland offshore wind power portfolio

Following completion of the acquisition of the three Norfolk offshore wind projects, RWE is developing ten offshore wind projects in the UK & Ireland representing a combined potential installed capacity of over 10.5 GW, with RWE’s pro rata share amounting to around 7.5 GW.

RWE’s development pipeline includes four of the UK’s seven offshore wind extension projects which have received Agreements for Lease and, which once fully developed and constructed, will represent a potential total installed capacity of around 2.6 GW (RWE pro rata share 1.3 GW): Awel y Môr in North Wales, Rampion 2 off the Sussex Coast, Five Estuaries and North Falls off the coast of East Anglia.

With partner Masdar, RWE is also jointly developing the Dogger Bank South (DBS) Offshore Wind Farm projects in the North Sea, and is leading the project’s development, construction and operation on behalf of the partnership. The DBS projects comprise two separate sites, DBS East and DBS West, and have an estimated combined installed capacity of 3 GW.

RWE is also significantly well advanced with the construction of the 1.4 GW Sofia offshore wind project, located in the North Sea off the UK’s east coast.

Our offshore projects are constructed, operated and maintained via a range of ports and offices around the UK Coastline, including in the North East, Lincolnshire, East Anglia, Sussex, as well as Wales and the North West of England. Together both our Triton Knoll and Sofia projects represent a collective investment of £5 billion, and support a significant number of direct and indirect jobs in the Humber, North East and wider UK, throughout construction and longer-term operation.

RWE’s unparalleled track record of more than 20 years in offshore wind has resulted in 19 offshore wind farms in operation internationally, with a goal to triple its global offshore wind capacity from 3.3 GW today to 10 GW in 2030.

Supply Chain benefits with offshore wind

Offshore wind developments are proven, significant economic opportunities for the regions in which they operate, generating supply chain benefits, direct and indirect jobs and contracts. RWE has scale and experience and is in it for the long haul – we work with partners and suppliers to facilitate the kind of innovations, cost reductions and step changes that have made the UK a world leader in the sector.

Throughout the construction of our projects, we put our suppliers at the very heart, encouraging supply chain and economic growth, and establishing a lasting regional economic legacy in areas local to our sites. RWE projects use a dedicated Supplier Portal to help UK suppliers register for potential contracts. RWE’s Sofia Offshore Wind Farm provides a useful source of information for those looking to maximise opportunities in the sector. Supply Chain Homepage Offers central access to all important information, forms and contacts

Innovation & technology

Floating offshore wind

RWE is aiming to become a market-leading floating wind player in strategic markets around the world. We welcome the UK Government’s target of delivering 5GW of Floating Wind capacity and are actively investigating a number of floating wind opportunities in the UK to support that – including in the Celtic Sea. Floating Wind presents an important economic opportunity for ports and industry, driving fresh investment, regional and national growth, and new, skilled jobs and careers for the future; RWE is committed to maximising these for UK and regional economies.

How does it work?

Floating wind uses the same turbines as conventional ‘seabed-fixed’ offshore wind but they are deployed on top of floating structures that are secured to the seabed with mooring lines and anchors. Electricity is transmitted to shore via subsea cables. As a less mature technology than seabed-fixed, floating wind is currently more expensive but costs are expected to fall rapidly so that it should be relatively cost competitive by 2030.