The Asia Pacific (APAC) region possesses some of the most attractive onshore and offshore wind resource globally and could play a pivotal role in the global energy transition. Within the decade, onshore wind capacity could more than double to 1,084 GW. For offshore wind, more than 122 GW of new capacity could come online by 2030, with the cumulative regional total reaching 162 GW by 2030.

To support the substantial new additions of onshore and offshore wind capacity, urgent scale up of a robust, resilient supply chain is paramount to enabling country and region-wide renewables targets to be met.

This study shows that APAC’s current supply chain setup is not sufficient to build out wind projects to the levels required to meet net zero targets. A collaborative, cross-border approach to scaling industries in APAC countries shows the region’s supply chain could be grown to meet increased regional and global demands while becoming more competitive, diversified, and resilient.

The report outlines four challenges that need to be address:

- Volatile policy and market demand are preventing industry from adjusting and scaling production capacity.

- Lack of coordinated investments in large infrastructure such as grids, ports, and roads as well as major equipment like vessels are impeding regional connectivity and trade.

- Political pressure around supply chain security and inflexible local content targets have driven up the cost and caused the delay of delivery.

- Race for larger wind turbines continues in APAC region, especially in China, which makes standardisation and industrialisation an unachievable task.

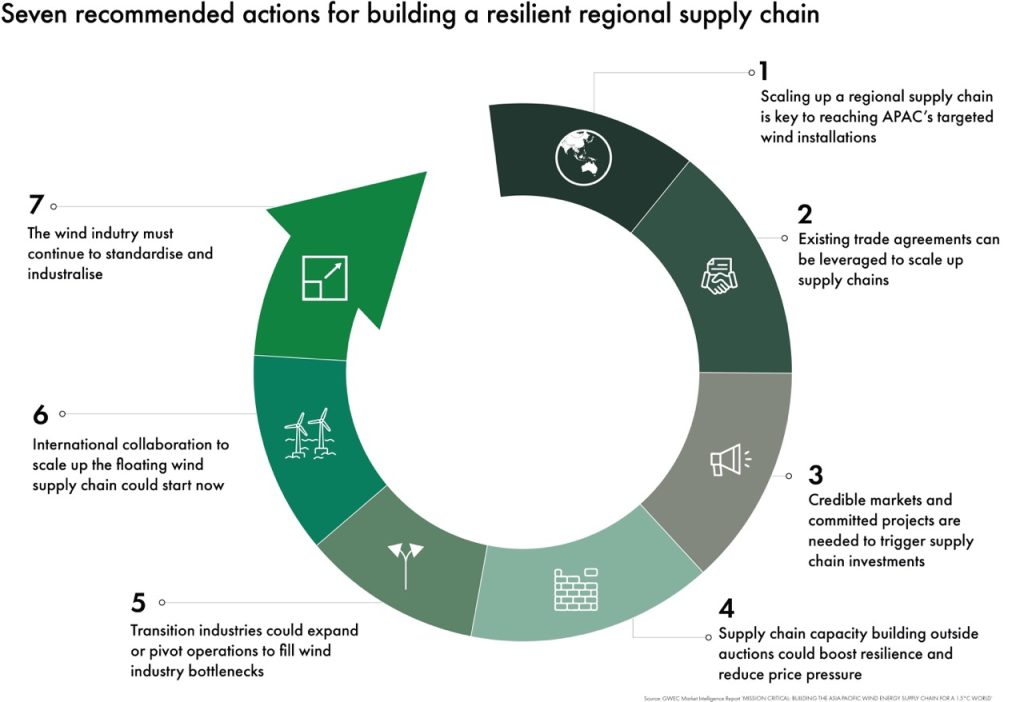

The report outlines seven recommendations to solve these challenges:

- Regional supply chain scale up is needed urgently if APAC is to meet 2030 targeted wind installations.

- Existing trade agreements can be leveraged to scale up supply chains.

- Credible markets and committed pipelines are needed to trigger supply chain investments.

- Public support for supply chain capacity building outside of auctions could boost resilience and sustainability while reducing price pressure on developers, especially for near term projects.

- Transition industries could be encouraged to expand or pivot operations to fill wind industry.

- International collaboration to scale up the floating wind supply chain could start already now.

- The wind industry must continue to standardise and industrialise.

The Asia-Pacific (APAC) region’s current supply chain setup is not sufficient to build enough wind projects to meet the region’s net zero targets, according to Mission Critical: Building the Asia Pacific Wind Energy Supply Chain for a 1.5°C World, a new report from the Global Wind Energy Council. The report outlines how industry, government, civil society, and the financial community can collectively drive systematic change to build a supply chain that meets regional and global demand for the wind installations required for Net Zero targets.

Despite record-breaking wind capacity growth in recent years, the effort to triple renewable energy by 2030 is falling short[1]. Wind is falling behind, and with its role as the most effective technology in replacing carbon per MW due to its robust capacity factors, this risks undermining global climate and energy targets and making the energy transition harder to achieve.

The potential for clean, secure wind energy in the Asia Pacific market is huge. The Asia Pacific (APAC) region is expected to make up 61% of the new capacity built worldwide between 2024 and 2030. Total onshore wind capacity in APAC could double to 1,084 GW within the decade, with another 122 GW of potential capacity from offshore wind by 2030. As the industry looks to get wind energy back on the front foot and ramp up the pace of new capacity installations, the APAC region has an important role in delivering the new capacity that ensures wind energy fulfils its key role in delivering net zero.

GWEC CEO Benjamin Backwell said, “GWEC is delighted to present our first regional supply chain report. A net-zero compliant supply chain for the wind industry is key to the sector fulfilling its obligations to the fight against climate change, and seizing the enormous business opportunities the energy transition represents.

“The APAC region is the world’s largest wind market, but the supply chain concentration risk is high. Excluding China, the region is unlikely to meet the level of wind power installation required to meet climate targets. Key to closing the gap is political commitment and cooperation which scales up the local supply chain to unlock the growth potential in the APAC region.

“Action on the supply chain is action to increase renewable energy generation – and nothing is more urgent than accelerating wind power installations across the APAC region to meet both net zero targets and 3xRenewables ambitions. Wind energy means clean and secure energy, with additional jobs and new industry. This report provides the foundation for governments, key partners, and stakeholders to work together to build a supply chain for a 1.5°C world and unlock the enormous benefits of the energy transition to the APAC region.”

ERM Partner Breanne Gellatly said: “ERM is pleased to be involved in such an impactful study. There are challenges to overcome but considering the breadth and depth of capabilities across the region we believe that with urgent action, APAC’s supply chain can be scaled to meet this decade’s net zero targets and 3xRenewables ambitions.

“Through our extensive consultations it was apparent that there is a strong appetite from this region for companies to grow in the wind sector – either through scaling up or transitioning adjacent operations to wind e.g., mining, shipbuilding, automotive, and electronics. To achieve this growth, suppliers will need to make significant investments that require credible markets, committed pipelines and access to a regional marketplace. In parallel, APAC countries will need to play a complementary role to ensure frameworks are in place that support scale and cost efficiencies.

“The investments made now to create a sustainable and resilient regional supply chain will serve APAC beyond their 2030 targets and set the stage for continued growth over the next decade.”

The APAC Supply Chain report, written in partnership with ERM, is GWEC’s first regional wind energy supply chain report. The report takes a deep dive into the wind energy supply chain, from nacelles to components to materials. It also picks out strengths and opportunities with case studies focused on six markets – Australia, Indonesia, Japan, Philippines, South Korea and Vietnam – which can be scaled up or transitioned to supply the wind industry.

The report also provides recommendations for policy makers to turn targets into turbines. It set out how to build a reliable, competitive, and resilient supply chain in APAC to support the global energy transition.

Report Recommendations

Recommendation 1: Regional supply chain scale-up is needed urgently if APAC is to meet 2030 targeted wind installations.

Recommendation 2: Existing trade agreements can be leveraged to scale up supply chains.

Recommendation 3: Credible markets and committed pipelines are needed to trigger supply chain investments.

Recommendation 4: Public support for supply chain capacity building outside of auctions could boost resilience and sustainability while reducing price pressure on developers, especially for near-term projects.

Recommendation 5: Transition industries could be encouraged to expand or pivot operations to fill wind industry supply chain bottlenecks.

Recommendation 6: International collaboration to scale up the floating wind supply chain could start already now.

Recommendation 7: The wind industry must continue to standardise and industrialise.

The report was launched at GWEC’s Wind Energy Summit 2024, in Incheon, South Korea. The event brings together industry, government, and key stakeholders to drive forward the growth of wind energy in the APAC region. Find out more here: https://www.apacwindenergysummit.kr/