In July, prices in the electricity markets of Spain, Portugal, France and Italy rose compared to June, driven by higher temperatures that boosted electricity demand. Lower wind energy production in most markets also contributed to this trend. In the markets further north on the continent, the rise in temperatures and demand was less pronounced. In these markets, prices fell in line with lower gas and CO2 prices. Monthly photovoltaic energy production was an all?time high in Germany, Spain, Italy, France and Portugal.

Solar photovoltaic, solar thermoelectric and wind energy production

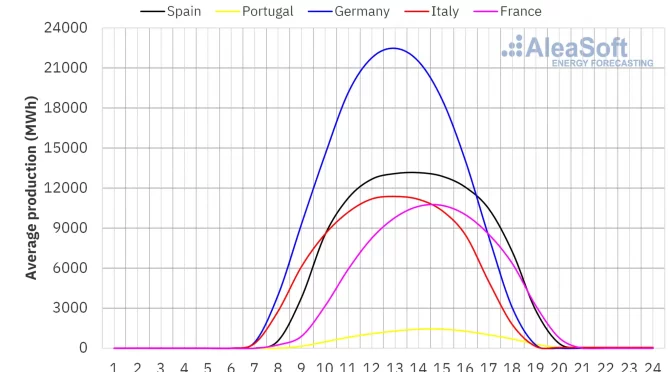

In July 2024, all major European electricity markets registered increases of more than 10% in solar energy production compared to the same month last year. The Portuguese market topped the list with 48% growth. In the rest of the analysed markets, solar energy production increased between 13% in France and 24% in Germany.

Compared to June 2024, solar energy production in July was also higher in all major European electricity markets. Once again, the Portuguese market topped the list with a 28% increase. In this case, the German market registered the smallest month?on?month increase, 1.7%.

In July 2024, the five analysed markets broke historical records for monthly solar photovoltaic energy production. The German market topped the list with a production of 9462 GWh, followed by the Spanish market with 5740 GWh. The Italian and French markets produced 3632 GWh and 3064 GWh, respectively. The Portuguese market closed the list with a production of 642 GWh.

These production records reflect the year?on?year increase in installed photovoltaic capacity. According to data from Red Eléctrica, between July 2023 and July 2024, Spain added 3990 MW to the peninsular system. In the same period, the Portuguese market gained 918 MW of new photovoltaic capacity.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

In July 2024, wind energy production decreased in all major European electricity markets compared to July 2023. The decreases ranged from 12% in the Italian market to 30% in the French market.

Compared to the previous month, wind energy production increased by 1.4% in the Portuguese market. The other analysed markets registered decreases ranging from 3.5% in France to 14% in Italy.

These declines occurred despite the fact that installed wind energy capacity has continued to increase. According to data from Red Eléctrica, between July 2023 and July 2024, Spain added 874 MW of wind energy capacity to the peninsular system. In the same period, the Portuguese market added 6 MW of new wind energy capacity.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Electricity demand

In July 2024, electricity demand increased in most major European electricity markets compared to the same period in 2023. The Belgian market registered the largest increase, 7.5%, while the Spanish market registered the smallest increase, 0.4%. The exception to the upward trend in most markets was the Dutch market, where demand fell by 4.8%.

Comparing electricity demand in July with that of June 2024, most markets registered increases again. The Belgian market was the only market where demand decreased compared to the previous month, by 3.2%. The Italian market reached the highest increase, 18%. In the other analysed markets, increases ranged from 0.1% in Germany to 13% in Spain.

In most major European electricity markets, July 2024 was less warm than the same month in 2023. The decrease in average temperatures ranged from 0.1 °C in the Netherlands to 0.6 °C in Spain. In Italy and Germany, average temperatures increased by 0.2 °C and 0.4 °C, respectively. In Great Britain and Belgium they were similar to those in July 2023.

In contrast, average temperatures in July were higher than in the previous month in all analysed markets, in line with the advance of summer. Month?to?month variations ranged from 1.9 °C in Great Britain to 3.8 °C in Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

European electricity markets

In the month of July 2024, the monthly average price was below €75/MWh in most major European electricity markets. The exceptions were the N2EX market of the United Kingdom and the IPEX market of Italy, with averages of €82.46/MWh and €112.32/MWh, respectively. The Nord Pool market of the Nordic countries registered the lowest monthly price, €24.47/MWh. In the other European electricity markets analysed at AleaSoft Energy Forecasting, the averages ranged from €47.03/MWh in the EPEX SPOT market of France to €74.12/MWh in the MIBEL market of Portugal.

Compared to June, average prices fell in the electricity markets further north in Europe. In contrast, the Italian, Portuguese, Spanish and French markets registered increases of 8.9%, 28%, 29% and 38%, respectively. In the other markets, prices fell between 2.0% in the British and Dutch markets and 21% in the German market.

Comparing average prices in July with those registered in the same month of 2023, prices fell in most analysed markets. In this case, the exceptions were the Italian and British markets, with slight increases, 0.2% and 0.5%, respectively. On the other hand, the French market registered the largest percentage drop, 39%. In the other markets, price declines ranged from 9.4% in the Dutch market to 30% in the Nordic market.

As a consequence of the registered price declines, in July 2024, the Nordic market registered the lowest average since October 2023. However, the Portuguese market registered the highest monthly average since November 2023, while the Italian and Spanish markets registered the highest monthly averages since January and February 2024, respectively.

In July 2024, lower gas and CO2 emission allowance prices compared to the previous month, as well as a general increase in solar energy production compared to June, favoured the decrease in prices in most European electricity markets. However, increased demand contributed to higher prices in some markets. In addition, in the Spanish, French and Italian markets, wind energy production fell, also contributing to higher prices in these markets.

On the other hand, in July 2024, the fall in the average price of CO2 emission allowances and the general increase in solar energy production compared to July 2023 led to a year?on?year decrease in prices in most European electricity markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market registered a monthly average price of $83.88/bbl in the month of July. This value was 1.1% higher than that reached by the Front?Month futures in June, $83.00/bbl. It was also 4.6% higher than that of the Front?Month futures traded in July 2023, $80.16/bbl.

During July, OPEC+ production cuts and fears about the effects of wildfires on Canadian production drove Brent oil futures prices higher. Expectations of increased demand due to summer travel and the possibility of lower US interest rates from September also exerted an upward influence on prices. However, concerns about demand in China and the dollar strength limited price increases, which were less than 5.0% compared to both June 2024 and July 2023.

As for TTF gas futures in the ICE market for the Front?Month, the average value registered during the month of July was €32.68/MWh. According to data analysed at AleaSoft Energy Forecasting, compared to the average of the Front?Month futures traded in June, €34.47/MWh, the July average decreased by 5.2%. In contrast, compared to the Front?Month futures traded in July 2023, when the average price was €29.48/MWh, there was an increase of 11%.

During July, problems at the Freeport liquefied natural gas export plant exerted an upward influence on TTF gas futures prices. High Asian demand also affected LNG supply, contributing to higher prices compared to July 2023. However, demand levels in Europe and high reserves pushed futures prices lower than in the previous month.

As for CO2 emission allowance futures in the EEX market for the reference contract of December 2024, they reached an average price of €68.17/t in July. According to data analysed at AleaSoft Energy Forecasting, this represents a 2.2% decrease compared to the previous month’s average, which was €69.69/t. Compared to the July 2023 average, €92.51/t, the July 2024 average was 26% lower.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analyses necessary in the financing and valuation of renewable energy projects

AleaSoft Energy Forecasting and AleaGreen provide long?term price curve forecasting reports for electricity markets globally. These forecasts are necessary for renewable energy project financing, risk management and hedging, PPA negotiation, M&A transactions, portfolio valuation and audits, long?term energy trading and other uses related to renewable energy development.

Long?term price forecasts of AleaSoft Energy Forecasting and AleaGreen have hourly granularity, 30?year horizons and confidence bands. In addition, they include forecasts of the price captured by photovoltaic and wind energy with annual granularity.

AleaSoft Energy Forecasting and AleaGreen also provide long?term forecasts of energy sale price curves for extra?peninsular electricity systems and territories.