Energy storage has grown exponentially in Europe in recent years – and that pace is set to continue across the continent. So, how is the market evolving, and how can industrial players best position themselves to thrive in this fastmoving environment?

We recently published an in-depth report – and infographic – that explores the changing competitive landscape for grid-scale European energy. Fill out the form at the top of the page to download the infographic, which contains a selection of key data from the report, or read on for an introduction to the topic:

What’s the size and shape of the market?

The European grid-scale project pipeline is large and diverse. We looked at all storage technologies apart from pumped hydro, identifying 1502 projects across 33 European countries with secured grid connections and that are either announced, under construction or already operational.

Together these projects represent 62 gigawatts (GW) of storage capacity. Although hundreds of players are active in the market, the top 15 asset owners account for more than a third of overall operational and planned capacity. Notably, the UK accounts for more than half the project pipeline by capacity – Germany has nearly as many projects planned, but smaller projects sizes mean it accounts for only 10% of total capacity.

Who’s involved in European energy storage?

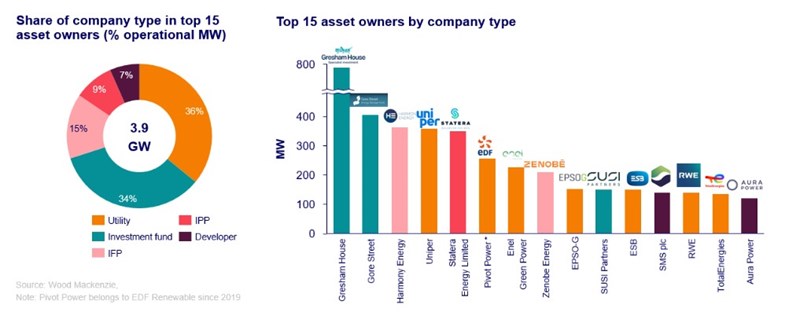

We categorise energy storage market players into six groups: developers, Investment fund, Independent power producers (IPPs), Independent flex provider (IFPs), utilities and local authorities.

Currently, while investment funds are the lead owners of operational grid-scale storage projects, utilities own the largest share of the operational capacity.

However, the owner landscape looks different when all project pipelines are considered. Power companies with development capabilities play a significant role when all project pipelines are analysed, but many of these projects might not be realised, as 65% of all European projects are still in the early development stage.

How is the market changing?

We’ve identified several key trends as the European energy storage market matures:

- The role of utilities and power companies is increasing: As the power sector changes, the growing challenge of integrating a high percentage of renewables means that utilities, IPPs and IFPs are becoming more active in the energy storage market.

- Developers are retaining ownership: Since early 2020, developers have increasingly been holding on to operational projects for extended periods, seeking to gain from early-stage revenue generation and maximise returns before divesting.

- Investment funds are becoming less active: Outside of the UK, the increasing role of power companies and utilities contrasts with a diminishing presence for investment funds, as they become more cautious about potential returns.

- Companies with standalone storage projects are more ambitious in their plans than companies with a hybrid project portfolio: While the majority of European grid-scale pipeline are standalone projects, 57% of top owners and developers include other technologies in their profile. However, 43% of companies with standalone profiles plan to bring more storage capacity to the market than companies with hybrid portfolio.

- The UK is home to the majority of leading companies in the European storage market: While most UK-based companies invest in storage projects only in the UK, companies based outside of the UK often invest in assets in several markets.

- M&A is taking share across European energy storage landscape: Strategic acquisitions have become the route to the market for established players to expand their footprint in the energy storage landscape. In particular, utilities have become more active and started acquiring smaller battery players to improve their market positions.

- Anna Darmani

Principal Analyst, Energy Storage EMEA

Cecilie Kristiansen

Research Associate, Energy Storage EMEA