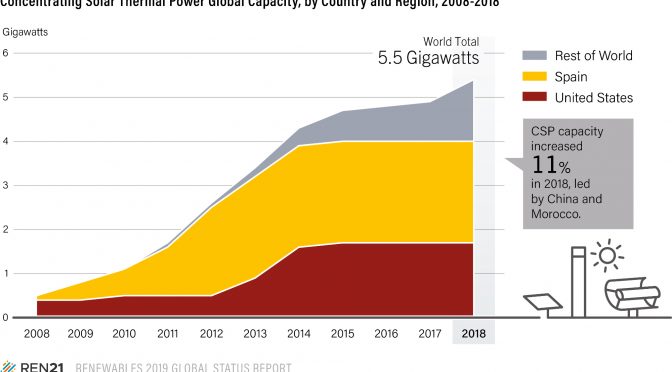

An estimated 550 MW of concentrating solar thermal power (CSP) came online in 2018, increasing cumulative global capacity more than 11% to just under 5.5 GW. CSP is also known as solar thermal electricity (STE).

This

annual increase represents the largest gain since 2014, and it occurred

despite delays in several projects that had been scheduled to begin

operation in 2018.

By year’s end, the pipeline of Concentrated Solar

Power projects under construction reached around 2 GW in 10 countries

across Africa, Asia, the Middle East and South America, with most of

this capacity being built in the United Arab Emirates (0.7 GW) and China

(just over 0.5 GW).

All but 3 of the 23 plants under construction by the end of 2018 planned to include thermal energy storage (TES).

For the third consecutive year, new capacity came online only in emerging markets. This trend is expected to continue because nearly all commercial Concentrated Solar Power capacity under construction by the end of 2018 was in emerging countries. China and Morocco led the market in new additions, followed by South Africa and Saudi Arabia.

Parabolic trough and tower technologies continued to dominate the market. Parabolic trough plants represented around 70% of new capacity additions in 2018, with the balance made up by tower plants. By year’s end, the plants under construction included just over 1 GW of trough systems, 0.8 GW of tower systems and 65 MW of Fresnel plants (at two facilities in China).

In China, three new CSP plants with a combined capacity of 200 MW entered operation in 2018: the 100 MW Shouhang Dunhuang Phase II tower project (11 hours TES), the 50 MW Supcon Delingha tower project (7 hours TES) and the 50 MW CGN Delingha parabolic trough project (9 hours TES). These concentrating solar thermal projects form part of a national strategic plan to build local experience in the implementation of CSP by targeting more than 5 GW of capacity by 2022. Under this plan, China’s central government in 2018 reduced the number of planned CSP projects qualifying for preferential FITs from 20 to 16; in addition, the government reduced FITs for plants that were initially targeted for completion in 2018 but delayed into 2019 and 2020.

India was the only other country in Asia to have CSP capacity under construction by the end of 2018. The 25 MW Gujarat Solar One facility (9 hours TES) was expected to enter operation in late 2019, and the 14 MW Dadri Integrated Solar Combined-Cycle plant also was under construction.

In North Africa, Morocco brought capacity online with the completion of the 200 MW Noor II facility (7 hours TES), and the adjacent 150 MW Noor III plant (7 hours TES) was at an advanced stage of construction by year’s end; once the plant is operational, Morocco’s total CSP capacity will exceed 0.5 GW. Two of these plants without TES are integrated solar combined-cycle (ISCC) facilities, hybrid plants that use both solar energy and natural gas to produce electricity.

Storage capacity for CSP facilities with TES is typically reported in “hours” of storage. For CSP plants that incorporate TES, the thermal storage capacity is provided, in parentheses, in hours.

South Africa ranked third for capacity additions in 2018. The commissioning of the 100 MW Ilanga-1 plant (4.5 hours TES) increased the country’s total operating CSP capacity by just over 30%, to 400 MW. In addition, the 100 MW Kathu Solar Park (4.5 hours TES) was commissioned in early 2019, bringing much-needed dispatchable power onto the country’s grid during a period of capacity shortages and rolling blackouts.

Nonetheless, the long-term future of CSP in South Africa is uncertain: an updated draft Integrated Resource Plan, released by the government in early 2019, included no allocation for CSP beyond plants that already were under construction.

In Saudi Arabia, operations commenced at the 50 MW Waad al Shamal Integrated Solar Combined Cycle (ISCC) plant, and construction continued at the country’s 43 MW Duba 1 ISCC facility. Construction on CSP facilities also was under way elsewhere in the Middle East. Kuwait’s 50 MW (10 hours TES) Shagaya plant was expected to reach commercial operation in 2019, and construction began on the United Arab Emirates’ 700 MW CSP plant at the Mohammed bin Rashid Al Maktoum

Solar Park. In Israel, work continued on the 110 MW (4.5 hours TES) Ashalim Plot A parabolic trough facility, which entered commercial operation in April 2019, and on the 121 MW Ashalim Plot B tower facility, expected to come online later in the year. In total, just over 1 GW of CSP capacity was under construction in the Middle East at the end of 2018.

Elsewhere, construction restarted at Chile’s 110 MW (17.5 hours TES) Cerro Dominador CSP plant, which was expected to be operational in 2020. Construction had been delayed due to financial challenges at the project’s developer and contractor, Abengoa (Spain).

In France, the 9 MW eLLO Fresnel facility, under construction at the end of 2018, entered operation in early 2019.

Spain remained the global leader in existing CSP capacity, with 2.3 GW in operation at the end of 2018, followed by the United States, with just over 1.7 GW. These two countries accounted for around 75% of the global CSP capacity in operation at year’s end, but no new capacity has entered commercial operation in Spain since 2013 and in the United States since 2015. Neither country had new facilities under construction as of the end of 2018; however, in early 2019 Spain’s government announced a target of 5 GW of new CSP capacity by 2030.

Almost 17 GWhi of thermal energy storage, based almost entirely on molten salts, was operational in conjunction with CSP plants across five continents by the end of 2018. With the exception of ISCC plants, all CSP plants that entered operation between the end of 2014 and the end of 2018 incorporated a TES system. TES continues to be viewed as central to the operational value of CSP by enabling it to be a dispatchable source of power, increasing its capacity factor, providing a source of grid flexibility and allowing for the integration of higher shares of variable renewable energy in power systems. The total TES capacity in MWh is derived from the sum of the individual storage capacities of each CSP facility with TES operational at the end of 2018.

Individual TES capacities are calculated by multiplying the reported hours of storage for each facility The Concentrated Solar Power industry continued to diversify geographically in 2018, with developers and construction companies from a broader range of countries and regions involved in active projects. This followed several years of industry growth outside the traditional CSP markets of Spain and the United States.

The capital costs of building new CSP systems fell sharply between 2016 and early 2018, according to an analysis of 16 CSP deals concluded during this period. Costs declined due to the wider deployment of both tower projects (which offer cost benefits under certain market conditions) and TES, as well as to ongoing innovations in technology and project design, an increase in project size and the emergence of more CSP suppliers (particularly in China), which is driving greater market competition. Procurement mechanisms, including competitive auctions, also have helped reduce costs.

In China, FITs for CSP (which the central government sees as a key energy technology) have supported the development of local CSP skills and processes and allowed for the rapid growth of a new national industry.35 In 2018, Chinese projects under construction were estimated to be 40% cheaper than facilities being built elsewhere in the world.

CSP developers have focused on TES due to its potential to improve the operational value of CSP plants. While solar PV with battery storage became increasingly cost-effective in 2018, a study released in early 2019 showed that CSP with TES may be more competitive for long-duration (greater than four hours) storage applications.

No new tenders or auctions for new CSP capacity were finalised in 2018, although the construction contract for what is expected to be the world’s largest CSP plant (700 MW) upon completion, in Dubai, was awarded by the Saudi developer ACWA Power to the Chinese firm Shanghai Electric. ACWA Power was the leading CSP project developer globally in 2018, with just over 1 GW of projects either brought into operation or under construction during the year.

At least 14 other developers – including 7 from China and others from France, Israel, Kuwait, Saudi Arabia, South Africa, Spain and the United States – were active on projects completed or under construction in 2018. The leading CSP contractors (ranked in terms of MW completed and/or under construction) included Shanghai Electric (China), Sener (Spain), Abengoa (Spain), Acciona (Spain), SEPCO3 (China), GE Renewable Energy (United States) and TSK (Spain).

Several CSP plants are being built or developed in parallel with solar PV facilities. Hybrid projects that include both CSP and solar PV can allow for lower levelised costs of electricity by using relatively low-cost solar PV generation during daylight hours and CSP with TES for power dispatch at night, or during daylight hours with poor irradiance. Examples include the Mohammed bin Rashid Al Maktoum Solar Park in the United Arab Emirates,

where the 700 MW CSP facility is being built next to just over 1 GW of solar PV capacity; and the Cerro Dominador facility in Chile, which is under construction adjacent to an existing 100 MW solar PV plant. In Australia, developers of the Aurora CSP plant applied for a permit in 2018 to build 70 MW of solar PV alongside their planned CSP facility.

Several CSP-related research and development activities were under way during the year, many of which focused on achieving higher operating temperatures in CSP heat exchangers, allowing for higher efficiency and lower running costs. New research support announced in 2018 included USD 72 million in funding from the US Department of Energy for research aimed at developing three competing heattransfer mediums (liquid, solid and gaseous) intended to work in conjunction with a high-temperature CO2 power cycle. An alternative to conventional steam-driven power generation, the CO2 power cycle offers the potential to raise thermal power cycle efficiency as much as 10%. The DOE also announced

USD 12.4 million in funding for 15 research projects focused on developing high-temperature components for CSP systems.

For example, tower plants typically can achieve higher specific yield values and hence greater cost efficiency at higher and lower latitudes (greater than approximately 30° to 35° south or north). The capital costs of building new CSP systems fell sharply between 2016 and early 2018.

http://helioscsp.com/concentrated-solar-power-increasing-cumulative-global-capacity-more-than-11-to-just-under-5-5-gw-in-2018/

http://helionoticias.es/la-termosolar-aumenta-la-capacidad-global-acumulada-en-mas-del-11-hasta-55-gw-en-2018/