The signs of climate change are everywhere. More and more countries have rallied under the banner of net zero carbon dioxide emissions by mid-century. To achieve this goal, the world needs an energy transition. The pathway outlined in IRENA’s World Energy Transitions Outlook: 1.5°C Pathway indicates that renewable power generation, energy efficiency and electrification of end-use sectors have a key role to play. This vision is echoed in other leading energy scenarios.

Some recent analyses have suggested that this implies a huge increase in minerals and metals demand. The European Joint Research Centre has focused on this topic for years, as has the German raw materials agency. In 2020, the World Bank issued a report on the mining implications of rising clean energy demand, and a more recent International Energy Agency study also highlighted the role of critical materials in the energy transition. Copper, silver and rare earth metals have received notable attention, but other materials such as graphite and titanium have also been mentioned in this context. The list of critical minerals and metals identified varies, as there is no generally accepted definition of criticality.

Copper, lithium and other strategic minerals and metals have experienced significant price increases in recent months. This has raised considerable interest from investors as well as from naysayers of the energy transition, who are now weighing in. The term “greenflation” has been introduced to describe rising prices for metals and minerals – such as copper, aluminium and lithium – that are essential to solar and wind power, electric cars and other renewable technologies. In their view, the current greenflation means that we are less likely to achieve our climate goals by limiting the worst effects of global warming.

We argue that such concerns are overblown:

- For many materials, the quantities required for the energy transition are not that significant compared to total consumption – energy applications constitute in many cases only a fraction of total use.

- Significant substitution potential exists in such new applications, but also for some existing applications.

- Recycling can reduce the need for primary production.

- The necessary resources exist – it is a matter of expanding the production volume.

This short paper elaborates the cases of copper and rare earth metals.

We should properly measure reserves, resources and demand impacts, accounting for innovation and all types of uses.

Clean electricity plays a central role in the energy transition, and we need to make the switch as soon as possible. Electricity must become the main source of final energy and the main feedstock for clean energy carriers such as hydrogen. Electric vehicles, heat pumps and green hydrogen for industry must become ubiquitous. But that requires copper, and it requires rare earth metals.

Let’s take a closer look at wind power generation. Rare earth metals, notably neodymium and dysprosium, are used in the magnets of power generators. However, not every type of wind turbine uses such rare earth metals. Western producers generally avoid rare earth-dependent magnets for onshore turbines, whereas Chinese producers deploy them. These metals are more widely used for offshore wind turbines because they save space, which helps to reduce cost.

Wind turbines also need copper. Copper is used in the physical turbine, but more importantly it is used in the power line that connects the wind turbine to the grid, and in the transformers. A UK study found that around one-third of the copper used on wind farms is used in the turbine and two-thirds in the cabling between the turbine and the sub-station. This effect is even more pronounced for offshore turbines, where siting a project 100 kilometres offshore triples copper demand. Notably, the same study highlights that continental Europe specifies aluminium for use in onshore underground cables, reducing copper needs by two-thirds. Standards can make a big difference with regard to materials intensity and deserve a closer look.

Today’s power generation worldwide includes around 30% renewables. IRENA’s 1.5°C pathway indicates that this percentage needs to increase to around 90% by 2050, with more than 60% of all power coming from solar photovoltaics (PV) and wind. Therefore, we need 8 000 gigawatts (GW) of wind and 15000 GW of solar PV by 2050. This requires on average 250 GW of wind and 350 GW of solar capacity additions per year between now and 2050. By 2030, a three-fold increase is needed from 2020 levels.

Such rapid growth may impact copper markets. Copper demand from onshore and offshore wind turbines may grow to 2 million tonnes per year. Compared with today’s copper demand of 30 million tonnes per year, this represents 7% growth: not trivial, but at the same time not a showstopper. Meanwhile, copper needs for solar PV power generation are growing by 4 million tonnes per year. Moreover, power generation represents only part of the total need for minerals and metals. Power grids and electric vehicles are two other key growth markets for the energy transition where copper is widely used.

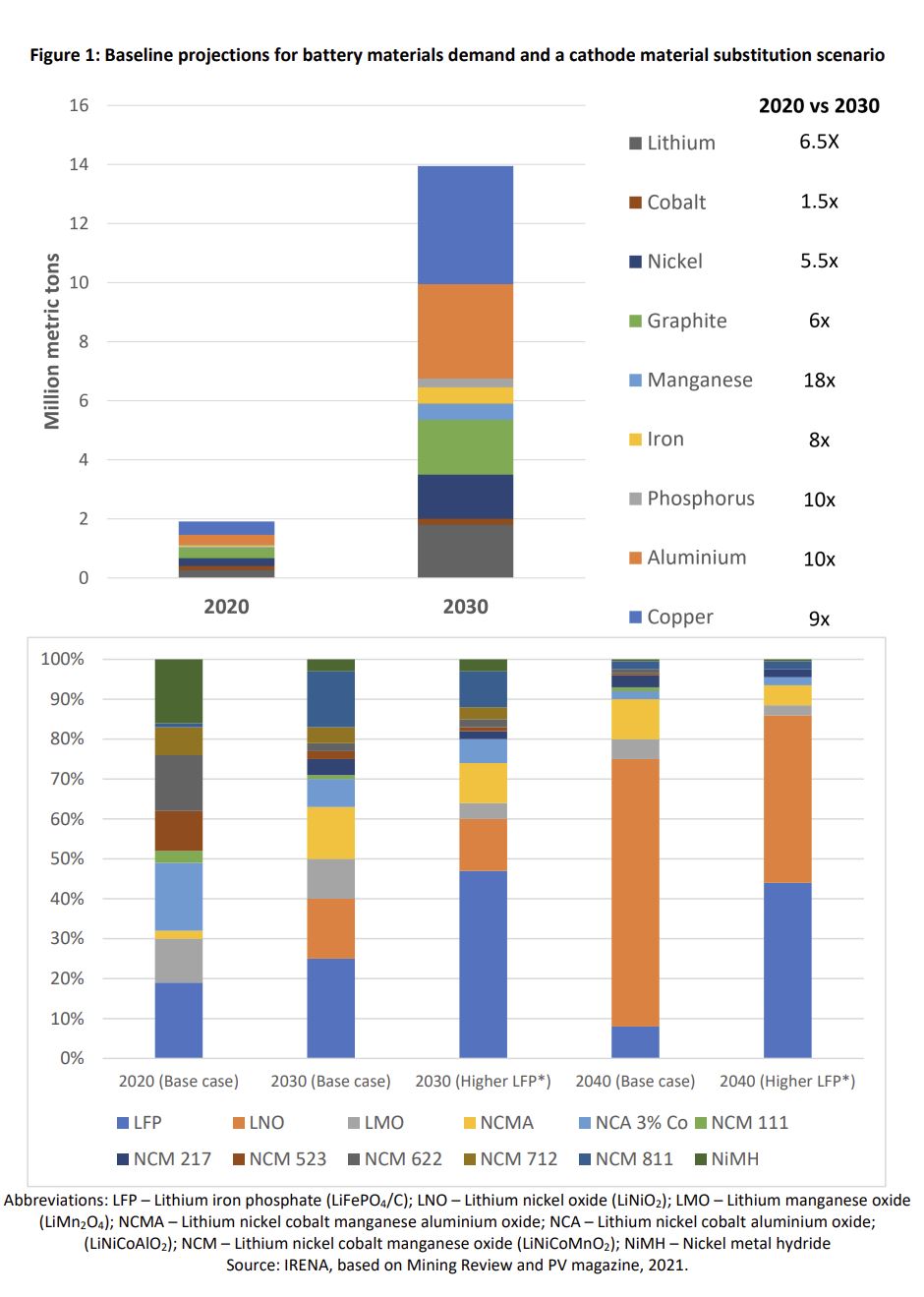

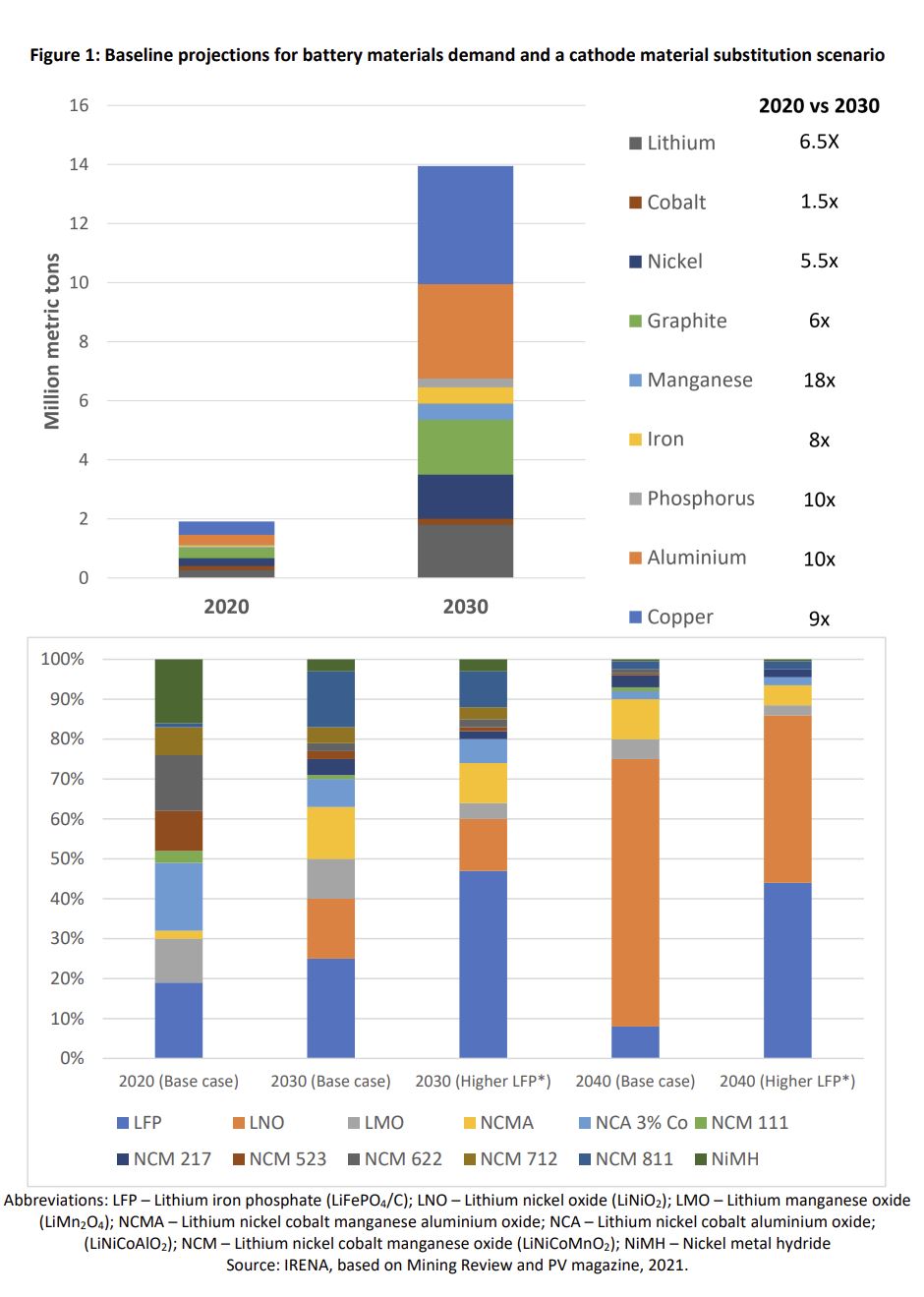

Automotive applications account for around 9% of today’s copper use. Electric vehicles can double or quadruple copper use to 40-80 kilograms per vehicle, compared to internal combustion engine vehicles. Given a production volume of 100 million vehicles, this would require 4-8 million tonnes of copper per year, equivalent to 14% to 28% of today’s copper use. But innovation may reduce this need. The battery pack alone accounts for around 40 kilograms of copper; additional copper cabling and wiring in motors accounts for the remainder of the metal’s increased use. But copper needs can vary widely for battery packs, and the composition of batteries continues to evolve rapidly. BloombergNEF projects 4 million tonnes of copper demand for lithium-ion batteries by 2030 (Figure 1) – this is around 13% of today’s copper supply, a significant growth area.

Copper is unique in that use of the metal is ubiquitous in the energy transition. Higher prices will promote higher recycling rates: today, half of post-consumer copper waste is lost, while a third of production is based on recycling. Also, mining of old mine tailings offers the potential for quick ramp-up of copper supply. Materials substitution can also ease supply bottlenecks. For example, aluminium can replace copper in electricity wiring. The technical properties are not the same, but aluminium is widely used for transmission and distribution grids. Key users such as air conditioning manufacturers are already shifting from copper to aluminium. This will ease the supply constraints.

Average battery prices are expected to decline further, inching closer to the coveted tipping point of USD 100 per kilowatt-hour. This puts pressure on battery suppliers and vehicle manufacturers to increase performance and reduce materials needs. Cathode metals make up 30% to 45% of the overall battery materials cost, depending on the type of composition under consideration. The need for longer-range electric vehicles and decoupling battery costs from the ever-volatile cobalt prices have already prompted manufacturers to increasingly shift towards higher nickel compositions. Lithium iron phosphate cathode use may grow substantially, thus reducing nickel and cobalt demand (Figure 1). Similar efforts will happen for other scarce metals including copper.

While everyone focuses on batteries, electric vehicles will also raise demand for permanent magnets and therefore demand for the rare earth metals neodymium and dysprosium. These are the same permanent magnets used in wind generators. Rare earth minerals are typically produced in a mix, and neodymium accounts for around 10% of total production. Such co-production creates additional supply challenges if a quick ramp-up of only one mineral is needed. Environmental and health concerns have proven to be barriers for the accelerated expansion of supply.

Recycling can help to reduce primary materials needs, and important efforts are aimed at recycling of wind turbines and solar PV panels, as well as batteries. But the build-up of the massive capital stock that is needed will take both time and materials. Recycling will trail the demand for energy transition materials for decades to come. Therefore, significant new mining activity will be needed.

Supply risks must be managed properly.

Whereas advocates of the energy transition call for expanding the supply of minerals and materials, the mining industry is wary due to experience with past supply cycles. Lithium is a good example, where prices were sky-high a few years ago, only to crash as new supply came onstream faster than demand growth. Today’s price is half of what it was at the end of 2017. Other metals have seen similar demand-supply cycles, and the long-term price trend has been downhill. This time may be different, but it remains too early to tell.

Investors expect a bonanza. Stock prices of copper and lithium miners are up, and new projects are being explored feverishly. This is much needed because development of new mines can take decades and is fraught with uncertainties. The Resolution copper mine in the US state of Nevada is such a case, with USD 2 billion invested over the past 30 years without any copper produced so far. Separately, Rio Tinto Group’s planned USD 2.4 billion lithium-borate mine in Serbia faces tough questions as well as calls for further environmental guarantees.

Such new mining activities must be managed properly, and concerns must be taken seriously. Rio Tinto’s iron mining activities destroyed an important prehistoric site in Australia in 2020 and made headlines worldwide, tarnishing the mining behemoth’s reputation. Such negligence must be avoided, and mine tailings need to be managed properly. Local populations also expect the creation of local jobs and economic development from mining projects. Too many actors in this sector are still aiming for quick profits. Seabed metal mining is an area to watch in this context.

Another type of supply risk relates to the geographical distribution of supply. China has built a dominant position for rare earths supply but also for many other minerals and metals. Supply chains are being reviewed in light of vulnerabilities that have become visible in recent years and rising geopolitical tensions. There is a role for governments in managing this process, with a clear trade-off between cheap supply from abroad on one hand and geopolitical concerns on the other.

International governance must be enhanced for critical materials.

The energy transition is critical for the future of mankind. The risks associated with climate change dwarf those associated with critical materials supply, and the current discourse on materials scarcity as a showstopper is misleading. However, the attention being given to critical materials is warranted. The energy transition will affect minerals and metals consumption substantially. But the right policy frameworks and design decisions today can avoid scarcity problems in the future. The rapid expansion of electromobility in particular raises questions about materials scarcity, while renewable power generation and power grids contribute to a lesser degree. The rapid roll-out of electric vehicles and battery production witnessed today will certainly put a strain on minerals and metals supply in the years to come. But these problems can be resolved. The energy transition is here to stay and will create new economic opportunities.

While a long list of strategic minerals exists, not all of them are essential for the energy transition. Materials with unique properties such as neodymium, copper and lithium seem, for now, more critical than graphite, cobalt and indium, where alternatives exist. There is a need to better understand the materials requirements of the energy transition in light of rapid innovations that are taking place on the production side. On the supply side, long-term resource availability is less of a concern than the capability to ramp up supply in the near term.

Many of these critical resources are found in remote locations where mining can offer a welcome source of new, sustainable economic activity. But experience shows that this will not happen on its own – strong governance is needed. A more precise and transparent assessment of needs and government interventions is required. Every mineral and metal are different, and the specific issues need to be understood in order to manage the transition properly.

Individual vehicle manufacturers seeking to ensure their strategic supplies through contracts will not resolve the overarching geopolitical issues. Only a global approach to strategic minerals makes sense. Apart from national efforts – such as the US State Department’s Energy Resource Governance Initiative and the European raw materials alliance – there is a role for international agencies such as IRENA. As the world’s only energy transitions agency with truly global membership, IRENA is well placed to bring countries together on this topic, foster a higher level of transparency and facilitate the effective management of critical materials supply at the global level.

Download the short paper on the Materials for the Energy Transition.

Dolf Gielen Director, IRENA Innovation and Technology Center IRENA

Carlo Papa Managing Director Enel Foundation

The signs of climate change are everywhere. More and more countries have rallied under the banner of net zero carbon dioxide emissions by mid-century. To achieve this goal, the world needs an energy transition. The pathway outlined in IRENA’s World Energy Transitions Outlook: 1.5°C Pathway indicates that renewable power generation, energy efficiency and electrification of end-use sectors have a key role to play. This vision is echoed in other leading energy scenarios.

Some recent analyses have suggested that this implies a huge increase in minerals and metals demand. The European Joint Research Centre has focused on this topic for years, as has the German raw materials agency. In 2020, the World Bank issued a report on the mining implications of rising clean energy demand, and a more recent International Energy Agency study also highlighted the role of critical materials in the energy transition. Copper, silver and rare earth metals have received notable attention, but other materials such as graphite and titanium have also been mentioned in this context. The list of critical minerals and metals identified varies, as there is no generally accepted definition of criticality.

Copper, lithium and other strategic minerals and metals have experienced significant price increases in recent months. This has raised considerable interest from investors as well as from naysayers of the energy transition, who are now weighing in. The term “greenflation” has been introduced to describe rising prices for metals and minerals – such as copper, aluminium and lithium – that are essential to solar and wind power, electric cars and other renewable technologies. In their view, the current greenflation means that we are less likely to achieve our climate goals by limiting the worst effects of global warming.

We argue that such concerns are overblown:

- For many materials, the quantities required for the energy transition are not that significant compared to total consumption – energy applications constitute in many cases only a fraction of total use.

- Significant substitution potential exists in such new applications, but also for some existing applications.

- Recycling can reduce the need for primary production.

- The necessary resources exist – it is a matter of expanding the production volume.

This short paper elaborates the cases of copper and rare earth metals.

We should properly measure reserves, resources and demand impacts, accounting for innovation and all types of uses.

Clean electricity plays a central role in the energy transition, and we need to make the switch as soon as possible. Electricity must become the main source of final energy and the main feedstock for clean energy carriers such as hydrogen. Electric vehicles, heat pumps and green hydrogen for industry must become ubiquitous. But that requires copper, and it requires rare earth metals.

Let’s take a closer look at wind power generation. Rare earth metals, notably neodymium and dysprosium, are used in the magnets of power generators. However, not every type of wind turbine uses such rare earth metals. Western producers generally avoid rare earth-dependent magnets for onshore turbines, whereas Chinese producers deploy them. These metals are more widely used for offshore wind turbines because they save space, which helps to reduce cost.

Wind turbines also need copper. Copper is used in the physical turbine, but more importantly it is used in the power line that connects the wind turbine to the grid, and in the transformers. A UK study found that around one-third of the copper used on wind farms is used in the turbine and two-thirds in the cabling between the turbine and the sub-station. This effect is even more pronounced for offshore turbines, where siting a project 100 kilometres offshore triples copper demand. Notably, the same study highlights that continental Europe specifies aluminium for use in onshore underground cables, reducing copper needs by two-thirds. Standards can make a big difference with regard to materials intensity and deserve a closer look.

Today’s power generation worldwide includes around 30% renewables. IRENA’s 1.5°C pathway indicates that this percentage needs to increase to around 90% by 2050, with more than 60% of all power coming from solar photovoltaics (PV) and wind. Therefore, we need 8 000 gigawatts (GW) of wind and 15000 GW of solar PV by 2050. This requires on average 250 GW of wind and 350 GW of solar capacity additions per year between now and 2050. By 2030, a three-fold increase is needed from 2020 levels.

Such rapid growth may impact copper markets. Copper demand from onshore and offshore wind turbines may grow to 2 million tonnes per year. Compared with today’s copper demand of 30 million tonnes per year, this represents 7% growth: not trivial, but at the same time not a showstopper. Meanwhile, copper needs for solar PV power generation are growing by 4 million tonnes per year. Moreover, power generation represents only part of the total need for minerals and metals. Power grids and electric vehicles are two other key growth markets for the energy transition where copper is widely used.

Automotive applications account for around 9% of today’s copper use. Electric vehicles can double or quadruple copper use to 40-80 kilograms per vehicle, compared to internal combustion engine vehicles. Given a production volume of 100 million vehicles, this would require 4-8 million tonnes of copper per year, equivalent to 14% to 28% of today’s copper use. But innovation may reduce this need. The battery pack alone accounts for around 40 kilograms of copper; additional copper cabling and wiring in motors accounts for the remainder of the metal’s increased use. But copper needs can vary widely for battery packs, and the composition of batteries continues to evolve rapidly. BloombergNEF projects 4 million tonnes of copper demand for lithium-ion batteries by 2030 (Figure 1) – this is around 13% of today’s copper supply, a significant growth area.

Copper is unique in that use of the metal is ubiquitous in the energy transition. Higher prices will promote higher recycling rates: today, half of post-consumer copper waste is lost, while a third of production is based on recycling. Also, mining of old mine tailings offers the potential for quick ramp-up of copper supply. Materials substitution can also ease supply bottlenecks. For example, aluminium can replace copper in electricity wiring. The technical properties are not the same, but aluminium is widely used for transmission and distribution grids. Key users such as air conditioning manufacturers are already shifting from copper to aluminium. This will ease the supply constraints.

Average battery prices are expected to decline further, inching closer to the coveted tipping point of USD 100 per kilowatt-hour. This puts pressure on battery suppliers and vehicle manufacturers to increase performance and reduce materials needs. Cathode metals make up 30% to 45% of the overall battery materials cost, depending on the type of composition under consideration. The need for longer-range electric vehicles and decoupling battery costs from the ever-volatile cobalt prices have already prompted manufacturers to increasingly shift towards higher nickel compositions. Lithium iron phosphate cathode use may grow substantially, thus reducing nickel and cobalt demand (Figure 1). Similar efforts will happen for other scarce metals including copper.

While everyone focuses on batteries, electric vehicles will also raise demand for permanent magnets and therefore demand for the rare earth metals neodymium and dysprosium. These are the same permanent magnets used in wind generators. Rare earth minerals are typically produced in a mix, and neodymium accounts for around 10% of total production. Such co-production creates additional supply challenges if a quick ramp-up of only one mineral is needed. Environmental and health concerns have proven to be barriers for the accelerated expansion of supply.

Recycling can help to reduce primary materials needs, and important efforts are aimed at recycling of wind turbines and solar PV panels, as well as batteries. But the build-up of the massive capital stock that is needed will take both time and materials. Recycling will trail the demand for energy transition materials for decades to come. Therefore, significant new mining activity will be needed.

Supply risks must be managed properly.

Whereas advocates of the energy transition call for expanding the supply of minerals and materials, the mining industry is wary due to experience with past supply cycles. Lithium is a good example, where prices were sky-high a few years ago, only to crash as new supply came onstream faster than demand growth. Today’s price is half of what it was at the end of 2017. Other metals have seen similar demand-supply cycles, and the long-term price trend has been downhill. This time may be different, but it remains too early to tell.

Investors expect a bonanza. Stock prices of copper and lithium miners are up, and new projects are being explored feverishly. This is much needed because development of new mines can take decades and is fraught with uncertainties. The Resolution copper mine in the US state of Nevada is such a case, with USD 2 billion invested over the past 30 years without any copper produced so far. Separately, Rio Tinto Group’s planned USD 2.4 billion lithium-borate mine in Serbia faces tough questions as well as calls for further environmental guarantees.

Such new mining activities must be managed properly, and concerns must be taken seriously. Rio Tinto’s iron mining activities destroyed an important prehistoric site in Australia in 2020 and made headlines worldwide, tarnishing the mining behemoth’s reputation. Such negligence must be avoided, and mine tailings need to be managed properly. Local populations also expect the creation of local jobs and economic development from mining projects. Too many actors in this sector are still aiming for quick profits. Seabed metal mining is an area to watch in this context.

Another type of supply risk relates to the geographical distribution of supply. China has built a dominant position for rare earths supply but also for many other minerals and metals. Supply chains are being reviewed in light of vulnerabilities that have become visible in recent years and rising geopolitical tensions. There is a role for governments in managing this process, with a clear trade-off between cheap supply from abroad on one hand and geopolitical concerns on the other.

International governance must be enhanced for critical materials.

The energy transition is critical for the future of mankind. The risks associated with climate change dwarf those associated with critical materials supply, and the current discourse on materials scarcity as a showstopper is misleading. However, the attention being given to critical materials is warranted. The energy transition will affect minerals and metals consumption substantially. But the right policy frameworks and design decisions today can avoid scarcity problems in the future. The rapid expansion of electromobility in particular raises questions about materials scarcity, while renewable power generation and power grids contribute to a lesser degree. The rapid roll-out of electric vehicles and battery production witnessed today will certainly put a strain on minerals and metals supply in the years to come. But these problems can be resolved. The energy transition is here to stay and will create new economic opportunities.

While a long list of strategic minerals exists, not all of them are essential for the energy transition. Materials with unique properties such as neodymium, copper and lithium seem, for now, more critical than graphite, cobalt and indium, where alternatives exist. There is a need to better understand the materials requirements of the energy transition in light of rapid innovations that are taking place on the production side. On the supply side, long-term resource availability is less of a concern than the capability to ramp up supply in the near term.

Many of these critical resources are found in remote locations where mining can offer a welcome source of new, sustainable economic activity. But experience shows that this will not happen on its own – strong governance is needed. A more precise and transparent assessment of needs and government interventions is required. Every mineral and metal are different, and the specific issues need to be understood in order to manage the transition properly.

Individual vehicle manufacturers seeking to ensure their strategic supplies through contracts will not resolve the overarching geopolitical issues. Only a global approach to strategic minerals makes sense. Apart from national efforts – such as the US State Department’s Energy Resource Governance Initiative and the European raw materials alliance – there is a role for international agencies such as IRENA. As the world’s only energy transitions agency with truly global membership, IRENA is well placed to bring countries together on this topic, foster a higher level of transparency and facilitate the effective management of critical materials supply at the global level.

Download the short paper on the Materials for the Energy Transition.

Dolf Gielen Director, IRENA Innovation and Technology Center IRENA

Carlo Papa Managing Director Enel Foundation