The new rise in gas prices and CO2 records bring futures to maximum prices again.

The consecutive CO2 prices records of recent weeks and a new rebound in gas prices are driving electricity futures prices to historical prices in markets of central Europe, or close to historical highs in others markets such as the Iberian. On the other hand, the decrease in photovoltaic energy, but also the accumulation of holidays in some countries, led to varied behaviour in the electricity markets in the second week of December.

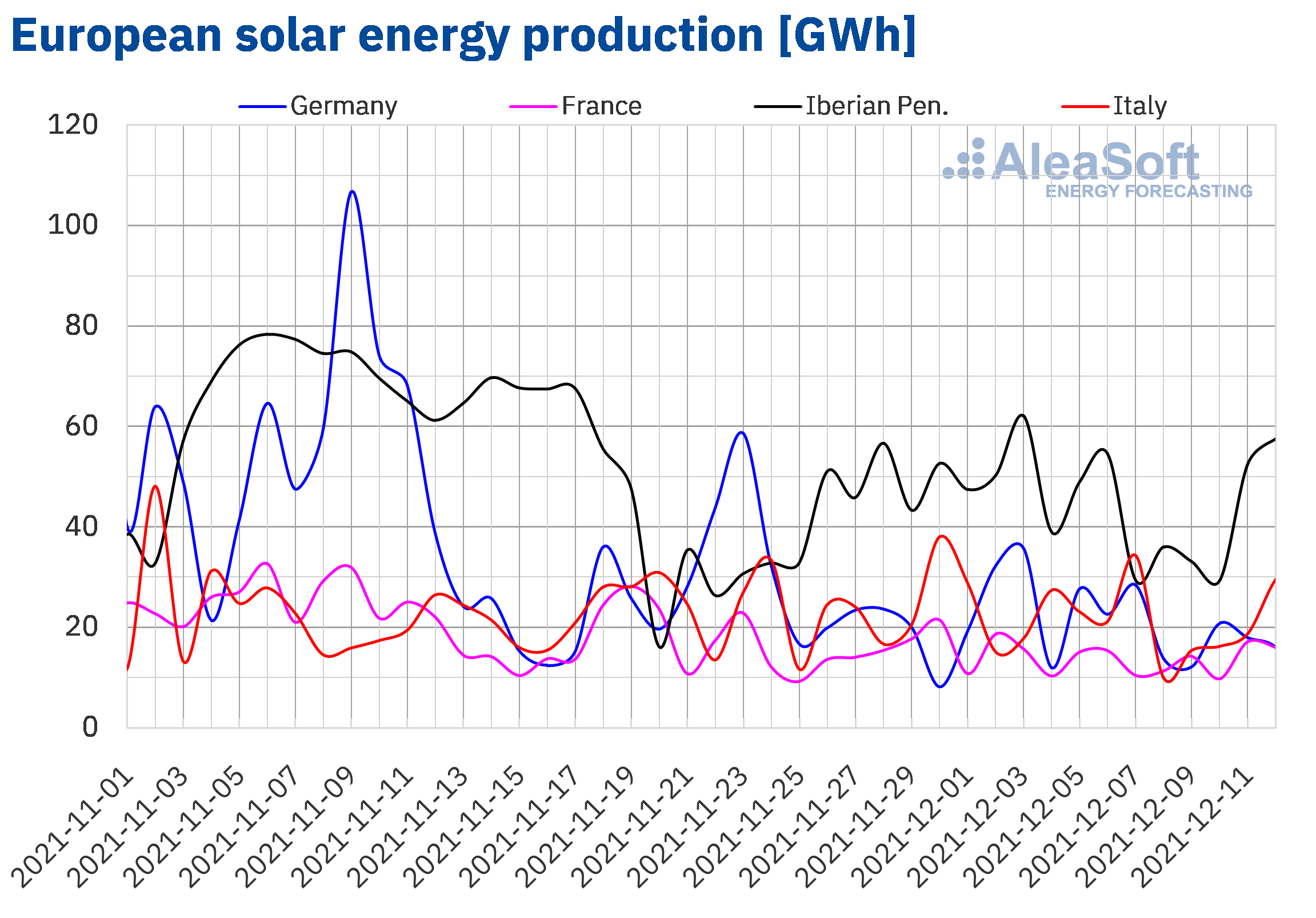

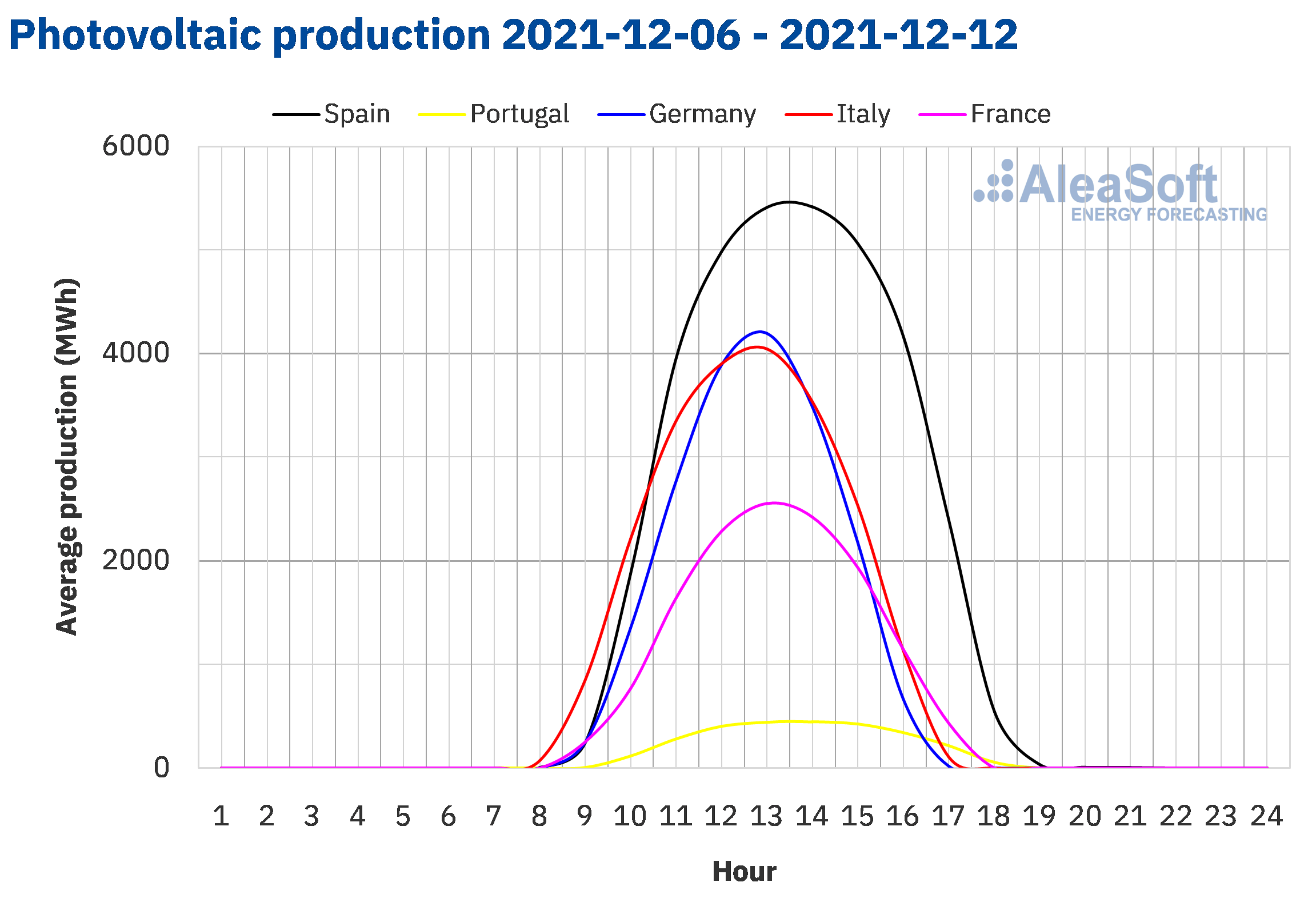

Photovoltaic and solar thermal energy production and wind energy production

During the week of December 6, the solar energy production fell in a generalised way in all markets analysed at AleaSoft Energy Forecasting compared to the previous week. In the markets of Spain, Germany and Italy, the production fell by 15%, while in the markets of France and Portugal decreases were 14% and 11% respectively.

Although the seasonal trend is downward due to the decrease in solar radiation, for the week of December 13, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates a recovery in the markets of Italy, Germany and Spain compared to the previous week thanks to the expected weather conditions.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

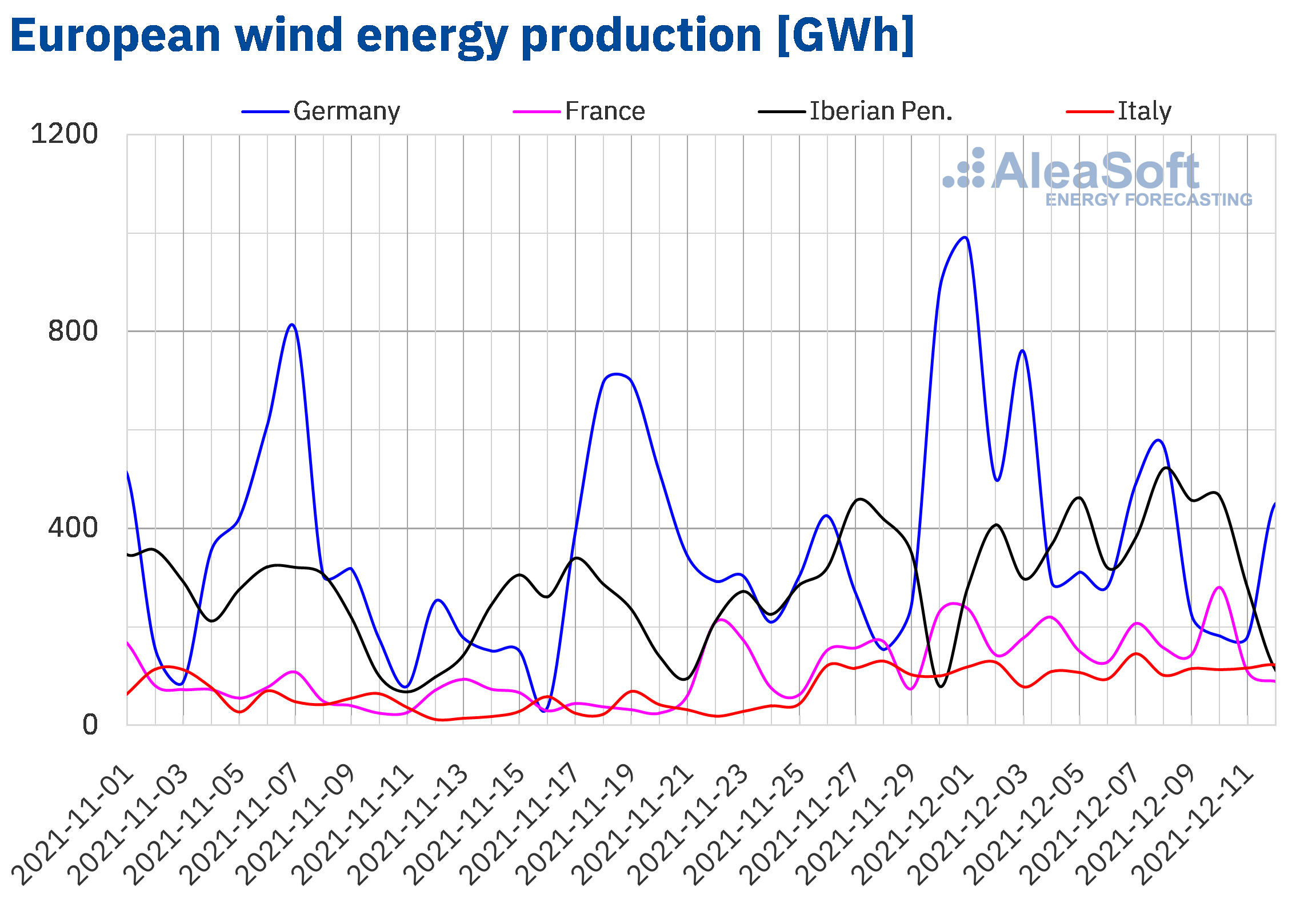

The wind energy production during the week of December 6 increased in the Iberian and Italian markets compared to the week of November 29. In the Italian market the increase was 8.9%, while in the Iberian market the increase was 13%, where on Wednesday, December 8, the highest wind energy production in Spain since the end of January of this year was registered and the historical record of instantaneous wind energy production was also registered, exceeding 20 000 MW for the first time. On the other hand, in the markets of Germany and France, the production with this technology reduced by 40% and 10%, respectively, for the same period.

For the week of December 13, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates a general decrease in production with this technology in the analysed European markets compared to that obtained during the second week of December.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

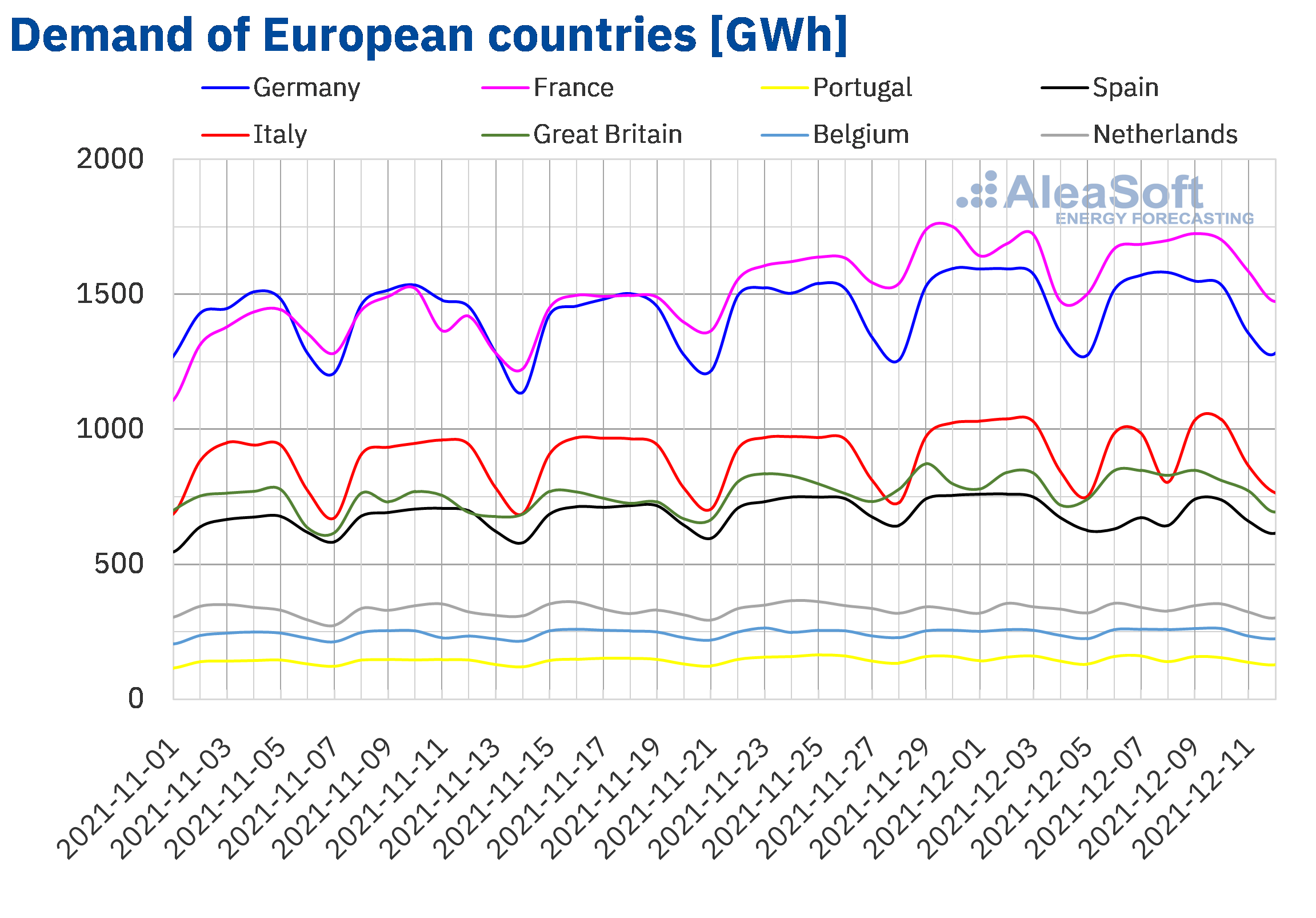

Electricity demand

The electricity demand fell in most European electricity markets during the week of December 6 compared to the previous week. The behaviour in the Spanish market was marked by the decrease in labour activity due to the holidays of December 6 and 8. These holidays caused Spanish demand to drop 7.2%. When correcting the effects of these holidays, the decrease in demand was 2.0%. In the Italian market there was a drop of 3.3% while in the rest of the markets the drops were lower than 2.0%.

On the other hand, the demand increased slightly in the markets of Belgium, Great Britain and France, with increases of 1.4%, 1.1% and 0.2% respectively. It should be noted that the Belgian and French markets registered increases for the sixth consecutive week, in an upward trend that began at the end of October with the drop in temperatures as the winter period progresses.

The AleaSoft Energy Forecasting’s electricity demand forecasting, for the week of December 13, indicates a heterogeneous behaviour in the European markets, increasing in the Iberian Peninsula and decreasing in other markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

In the week of December 6, prices of some of the European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week, while in other markets prices fell. Among the price increases, the largest rise was that of the EPEX SPOT market of Germany, of 36%. On the other hand, the lowest price increase was that of the Nord Pool market of the Nordic countries, of 2.0%. Prices also increased by around 7% in the markets of Belgium and the Netherlands. In the rest of the markets, prices decreased between 2.7% of the EPEX SPOT market of France and 4.1% of the N2EX market of the United Kingdom.

In the second week of December, almost all analysed markets reached weekly average prices above €205/MWh. The exception was the Nord Pool market, which had the lowest average, of €160.02/MWh. On the other hand, the highest weekly average price, of €260.51/MWh, was that of the EPEX SPOT market of France. In the rest of the markets, prices were between €207.42/MWh of the MIBEL market of Spain and €255.49/MWh of the IPEX market of Italy.

Regarding daily prices, the highest of the week, of €287.50/MWh, was reached on Thursday, December 9, in the French market. On the other hand, the lowest daily price of the week, of €108.73/MWh, was registered in the MIBEL market of Spain and Portugal on Wednesday, December 8, a public holiday in these countries.

During the week of December 6, high gas and CO2 prices favoured high prices in the European electricity markets. However, in the second week of December, the decrease in demand and the increase in wind energy production in countries such as Spain, Italy or Portugal allowed prices to fall in these markets. The fact that nuclear energy production levels in Spain are recovering compared to previous weeks also contributed to this trend.

AleaSoft Energy Forecasting’s price forecasts indicate that the week of December 13, prices might increase in European electricity markets, favoured by the general decrease in wind energy production, the increase in demand in most markets and high levels of gas and CO2 prices.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

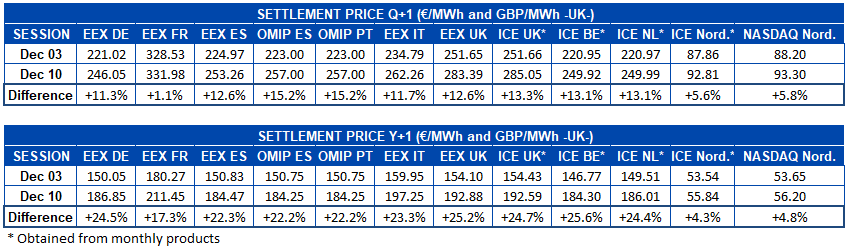

Electricity futures

When comparing settlement prices of the last session of the first two weeks of December, a general increase in electricity futures prices for the next quarter is observed in all markets analysed at AleaSoft Energy Forecasting. The largest increases were registered in the OMIP market of Spain and Portugal, with more than a 15% rise between Friday, December 3, and Friday, December 10. On the other hand, the EEX market of France was the one in which prices changed the least, with a 1.1% difference between the two sessions.

Considering electricity futures prices for the year 2022, the ICE market of Belgium is where the largest increases were registered, of more than 25%. It was closely followed by the EEX market of the United Kingdom. The Nordic region, both in the ICE market and in the NASDAQ market, was where these products increased the least, increasing between the analysed sessions by 4.3% and 4.8% respectively.

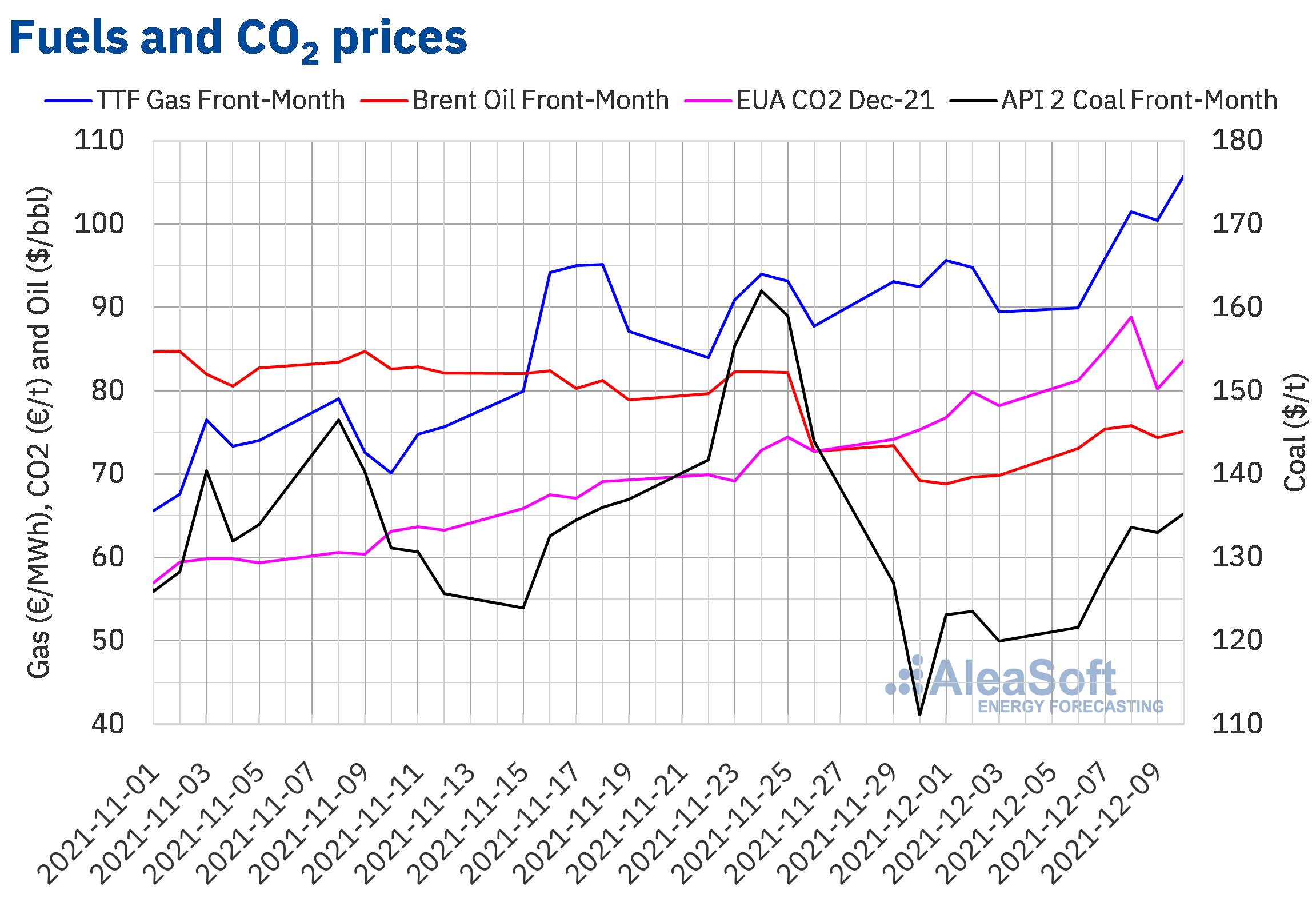

Brent, fuels and CO2

Brent oil futures prices for the Front?Month in the ICE market started the second week of December with increases. Thus, on Wednesday, December 8, the maximum settlement price of the week, of $75.82/bbl, was reached, which was 10% higher than that of the same day of the previous week. On Thursday the settlement price fell slightly. But on Friday, December 10, prices recovered to $75.15/bbl. This price was 7.5% higher than that of the previous Friday.

Expectations that the new variant of the coronavirus will not significantly affect the demand and the outlook for economic growth allowed Brent oil futures prices to rise during the second week of December. Increased international tensions due to Russian troop movements near the Ukrainian border also exerted an upward influence on prices. However, there are still certain fears about the effects of the expansion of the new Omicron variant on the evolution of the demand, while mobility restrictions increase in many countries due to the increase in infections.

As for TTF gas futures prices in the ICE market for the Front?Month, during the second week of December, they increased until reaching a settlement price of €105.78/MWh on Friday, December 10. This price was 18% higher than that of the previous Friday and the highest since the beginning of October. Low temperatures forecasts for the first quarter of 2022 contributed to the price increase.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2021, during the second week of December, they registered settlement prices above €80/t. On Wednesday, December 8, the maximum settlement price of the week of €88.88/t was reached. This price was 16% higher than that of the previous Wednesday and the new price record for CO2 emission rights futures.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

Prospects for energy markets prices for 2022 are suggesting that the situation of very high prices might extend beyond the first quarter of the year. In order to manage the market prices risk correctly, it is necessary to have price forecasts at all horizons. To carry out a hedging strategy in the futures markets, probabilistic price forecasts at the mid?term that reliably describe the spot prices probability distribution in the future are necessary.