The prices of the European electricity markets continued to rise in the second week of 2022.

In the second week of 2022, the prices of the European electricity markets rose, with most values averaging above €200/MWh. Demand increased across the board and wind energy fell, a combination that, together with high gas and CO2 prices, led to increases in market prices. However, the prices of electricity, gas and CO2 futures were lower than those of the first week of the year. Brent rose to values not seen since the end of October.

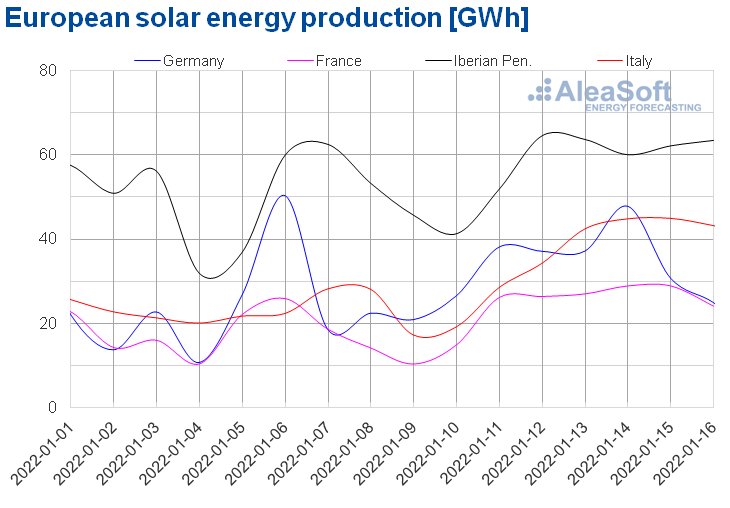

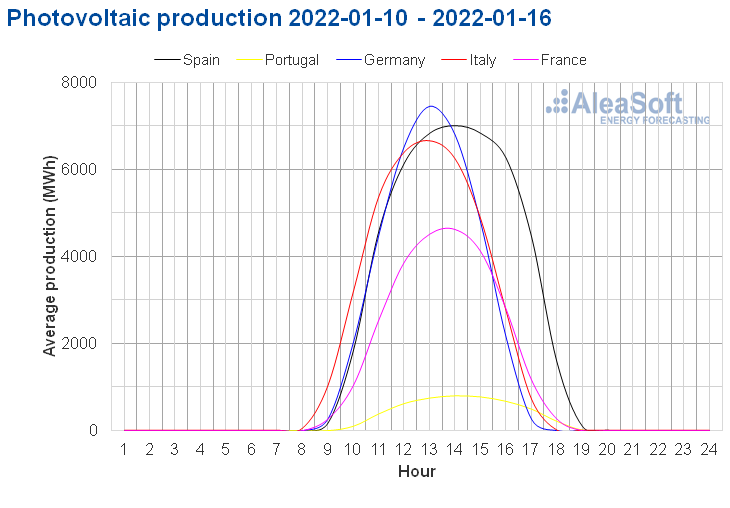

Photovoltaic and solar thermal energy production and wind energy production

Solar energy production increased across the board in the European electricity markets during the week of January 10 compared to the previous week. In this way, solar energy production increased for the second consecutive week in the European markets analysed by AleaSoft Energy Forecasting but this time to a greater extent, registering increases of at least 17%. The most notable increases were recorded in Italy, France and Germany, where generation with this technology rose by 62%, 50% and 47% respectively. In the markets of the Iberian Peninsula the increases were around 18%.

For the week of January 17, the solar energy production forecasts of AleaSoft Energy Forecasting point to a decrease in production in Spain and an increase in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

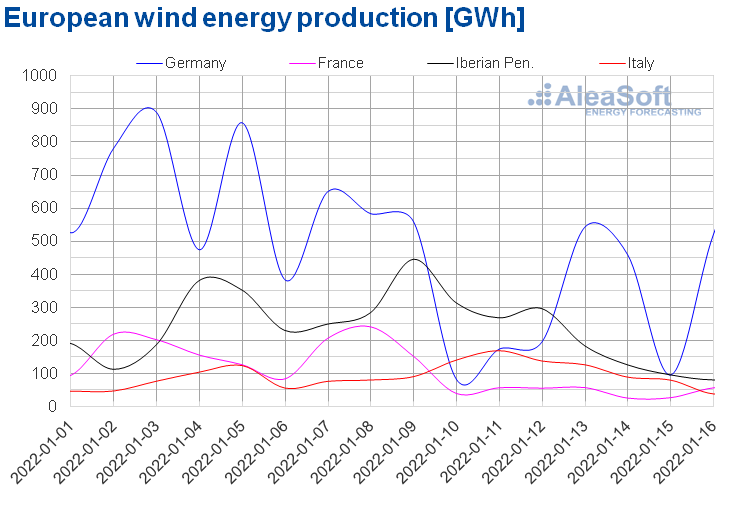

In the case of wind energy production, the generation from this renewable source decreased in most European markets in the week of January 10 compared to the week of January 3. In the French market the fall was 72% and in the German 53%. The falls registered were 27% and 37% in the markets of Spain and Portugal, respectively. However, in the Italian market a rise of 28% was registered.

For the week of January 17, the third of this month, the wind energy production forecasts by AleaSoft Energy Forecasting predict that the declines will continue in most European markets while recoveries are expected in the markets of Germany and France.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

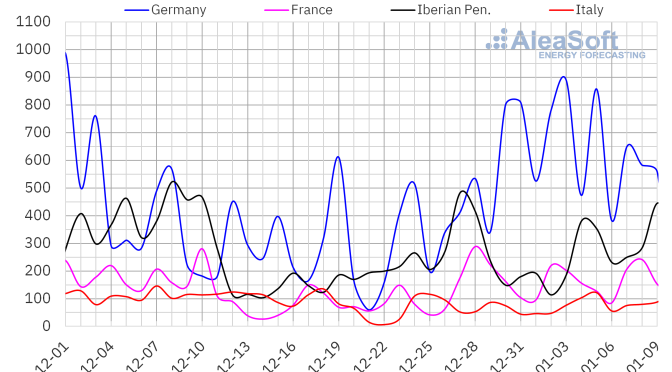

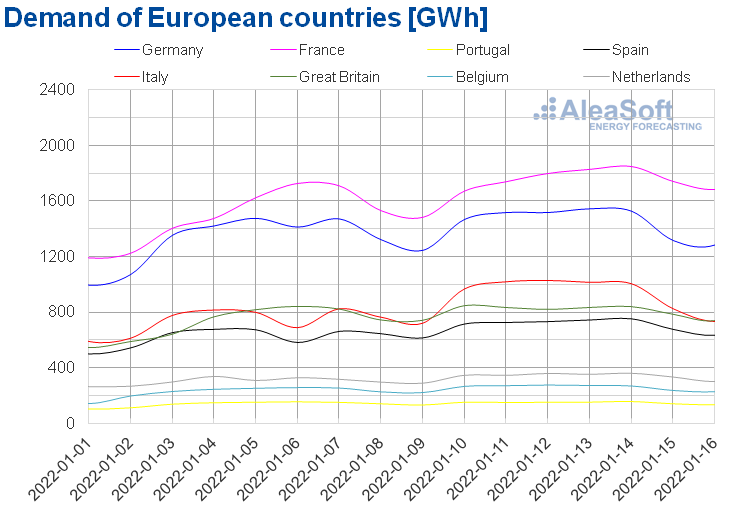

Electricity demand

The electricity demand registered increases in all European electricity markets in the week of January 10 compared to the previous week. Winter temperatures were one of the factors that most influenced these increases, as average temperatures fell in all markets except Great Britain, where they rose by 0.6 °C. Another cause was the recovery of labour activity in the week of January 10 compared to the decrease during the preceding week due to the holiday of January 6, Three Kings Day.

In Italy the weekly increase was 22%, the largest weekly increase since January 2019. On the other hand, in the French market the increase was 12% and in the Spanish 11%. In the rest of the markets, the increases were between 4.8% in Germany and 7.9% in Belgium, except in the case of the Portuguese market, where the increase was only 2.0%.

For the week of January 17, the demand is expected to increase in most European markets and to continue with similar values in the markets of France, Italy and Belgium, according to the electricity demand forecasting of AleaSoft Energy Forecasting.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

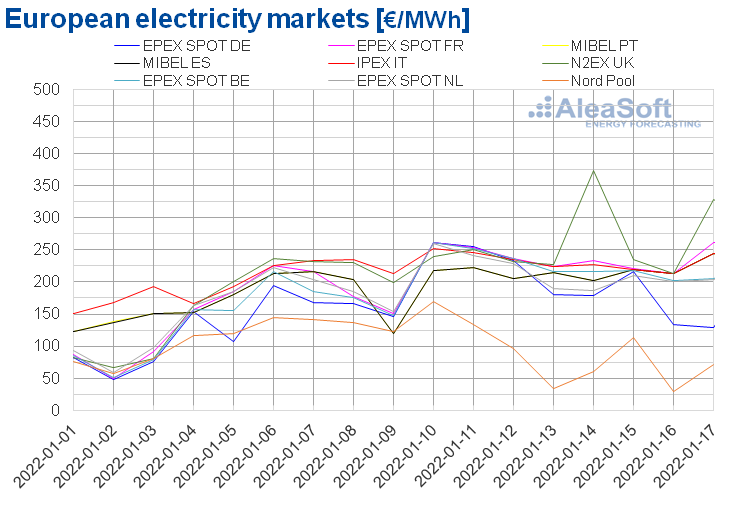

European electricity market

During the week of January 10, the prices increased compared to the previous week in the vast majority of the European electricity markets analysed at AleaSoft Energy Forecasting. The exception was the Nord Pool market of the Nordic countries, where prices fell by 26%. Regarding the increases, the EPEX SPOT market prices of Belgium and Germany were the ones that increased the most, 44% in both cases. On the other hand, the IPEX market in Italy was the one with the lowest increase, 11%. In the rest of the markets, the increases were between 21% of the MIBEL market of Spain and Portugal and 37% of the EPEX SPOT market of France.

In the second week of January, the weekly average prices exceeded €200/MWh in almost all the analyzed markets. The exception was the Nord Pool market, with an average of €90.91/MWh. On the other hand, the highest weekly average price, of €252.75/MWh, was that of the N2EX market of Great Britain. In the rest of the markets, the prices were between €208.33/MWh in the German market and €234.68/MWh in the French market.

Regarding hourly prices, on Monday, January 10, the highest hourly prices were registered so far this year in the markets of Italy, Spain, Portugal and the Nord Pool market. In the Italian market, a price of €310.83/MWh was reached at 8:00 a.m., in the Nordic countries market the maximum price of €265.09/MWh was recorded at 9:00 a.m. and in the markets of Spain and Portugal reached €294.98/MWh at 7:00 p.m. In the EPEX SPOT markets of Belgium, France, Germany and the Netherlands, the maximum hourly price of the week of €316.40/MWh was reached on Tuesday, January 11, at 5:00 p.m. In the case of the British market, on Monday, January 17, the highest hourly price so far this year was recorded, of £1161.06/MWh at 18:00 CET, above that reached for the same time on Friday, January 14, £1149.28/MWh.

Regarding daily prices, during the second week of January the maximum daily prices so far in 2022 were reached in most markets. On Monday, January 10, maximum prices were registered in the markets of Germany, France, Belgium, the Netherlands, Italy and the Nordic countries, which ranged from €170.15/MWh in the Nord Pool market to €261.25/MWh in Germany and France. While, in the British market, a maximum daily price of €373.05/MWh was registered on Friday, January 14. On the other hand, in the Iberian market of Spain and Portugal, the maximum daily price was reached on Monday, January 17, and was €244.67/MWh.

The decrease in wind energy production in most of the electricity markets and the increase in demand in all the markets analysed during the second week of January compared to the previous week, joined the high prices of gas and CO2 to favour the increase of electricity market prices.

For the week of January 17, according to the prices will continue to increase in most European electricity markets, although a higher wind energy production is expected in the German market, which will lead to a drop in prices in the markets of Germany, Belgium and the Netherlands.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

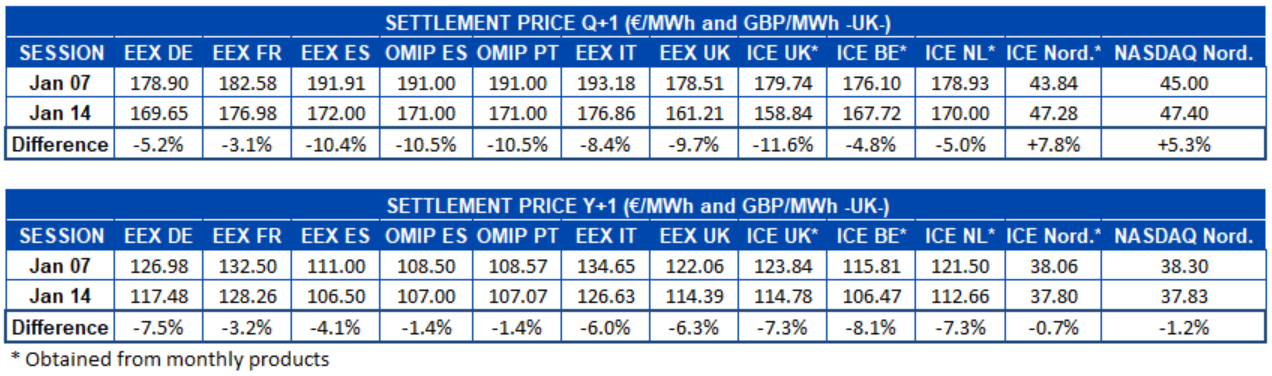

Electricity futures

At the end of the second week of the year, the electricity futures prices for the next quarter registered decreases in most of the electricity markets analysed at AleaSoft Energy Forecasting between the sessions of January 7 and 14. The exceptions were the ICE and NASDAQ markets of the Nordic countries, with increases of 7.8% and 5.3% respectively. In the rest of the markets, the decreases were between the 3.1% marked by the EEX market of France and the 12% of the ICE market of the United Kingdom, where the quarterly product data is offered in the table as an estimate based on monthly product negotiations. The market with the greatest decrease where the Q2-2022 product is traded purely was the OMIP market of Spain and Portugal, which registered a decrease of 11%.

Looking at the futures for the following calendar year 2023, between the sessions of January 7 and January 14, the prices fell in all the markets analyzed. The ICE market of the Nordic countries was the one with the least variation, with a decrease of 0.7%. Meanwhile, the ICE market in Belgium saw the greatest decrease, with a ?8.1% difference between the two sessions.

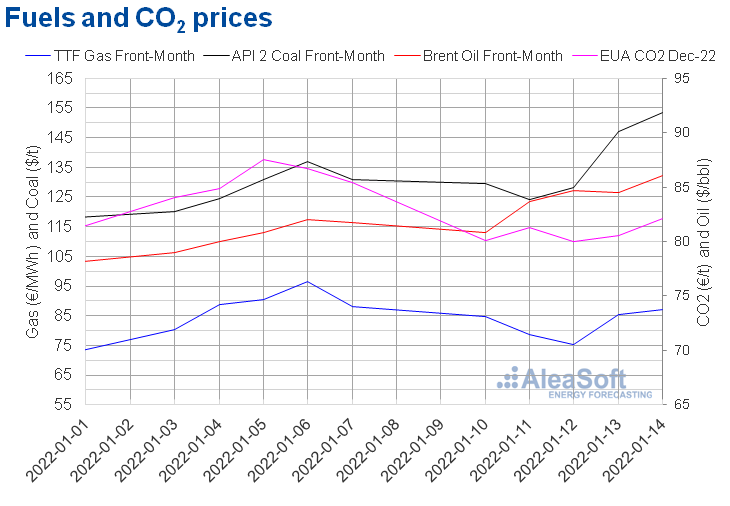

Brent, fuels and CO2

The Brent oil futures prices for the Front Month in the ICE market registered increases in the second week of 2022. The settlement price for Friday, January 14, stood at $86.06/bbl, which represents an increase of 5.3% compared to the previous Friday. This is the highest price for the following month’s product trading since the end of October 2021.

The insufficiency of OPEC+ supply to meet global demand and signs that the Omicron variant will not be as disruptive to fuel demand as feared have fuelled oil buying and consequently prices have risen. Due to this situation, it is to be expected that the rally in Brent futures could continue for some time.

As for the prices of TTF gas futures in the ICE market for the Front?Month, the week of January 10, 2022 ended with a lower price than the end of the previous week. On Friday the 14th, a settlement price of €86.97/MWh was registered, which represents a decrease of 1.4% compared to the settlement price of Friday, January 7. This is due to the drop registered until January 12, when the prices reached €75.15/MWh and despite the fact that the behaviour from that day was predominantly upward.

European gas reserves remain below the average of the last five years, so the arrivals of liquefied natural gas shipments continue to be insufficient to compensate for the limited flows of Russian gas pipelines.

Regarding the futures of CO2 emission rights in the EEX market for the reference contract of December 2022, during the second week of January behaviours without a marked trend were registered, although always with prices lower than those of the last week. Thus, on Friday, January 14, the market settlement price was set at €82.08/t. In general, it can be said that the prices for the week of January 10 were, on average, 5.7% lower than the prices of the previous week.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting analysis on the outlook for the energy markets in Europe and the financing of renewable projects

On January 13, the first AleaSoft Energy Forecasting webinar of the year was held, with the participation of guest speakers from PwC Spain. The webinar analyzed the evolution of the energy markets in recent months and discussed the outlook for 2022. In addition, it analyzed how the regulatory situation and the electricity market is impacting the development of PPAs, both off site and on if you. Customers and those interested in the forecasts of AleaSoft Energy Forecasting can request the recording of the webinar here.

The next AleaSoft Energy Forecasting webinar “The macrovolatility of the energy markets in Europe. Benefits of the PPAs for large consumers and electro-intensive” will be held on February 10. On this occasion, Fernando Soto, General Director of the Association of Large Energy Consumption Companies (AEGE), will participate in the analysis table of the Spanish version of the webinar, to analyze, among other topics, the guarantees that the CESCE will offer in renewable PPAs with electro-intensive within the framework of the Statute of Electro-intensive Consumers. In addition, the usual review of the evolution and perspective of the European energy markets will be carried out.

In AleaSoft Energy Forecasting, the long-term price reports of the European electricity markets have been updated coinciding with the beginning of the quarter and during the month of January a special promotion is being carried out when contracting the forecasts of multiple markets. These forecasts are hourly and cover a 30?year horizon, in addition to the confidence bands corresponding to the 15th and 85th percentiles of the simulations carried out, as well as the price captured by photovoltaic and wind power.