In the first week of April, the photovoltaic energy broke records in the Spanish, French and Italian markets. This technology and the wind energy contributed to lower the prices of most European electricity markets. Negative values or the lowest in recent months were registered in several of them. Gas prices fell, also favouring the drop in electricity markets prices. Spanish electricity futures for the next quarter registered a rise of more than 30%.

Photovoltaic and solar thermal energy production and wind energy production

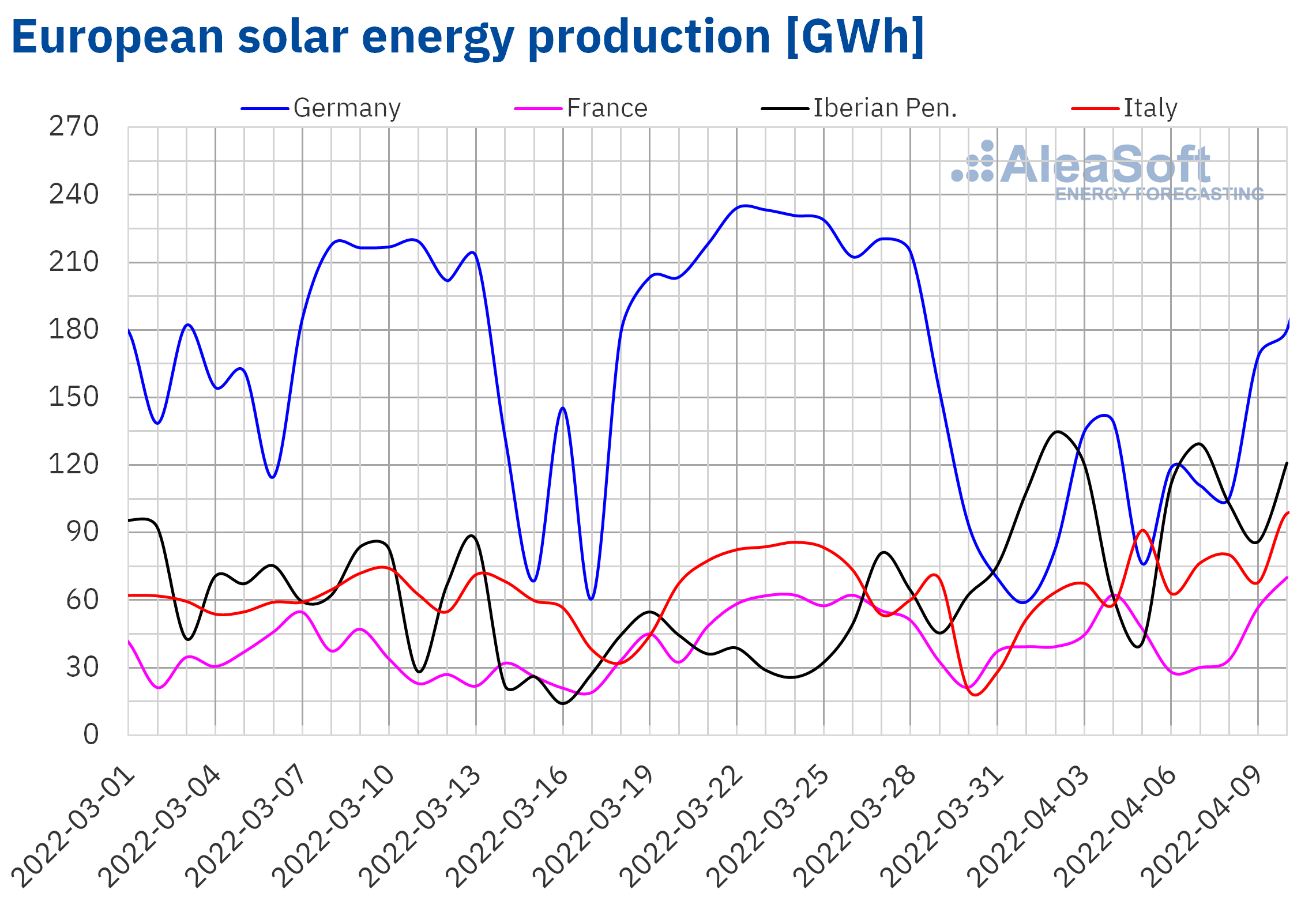

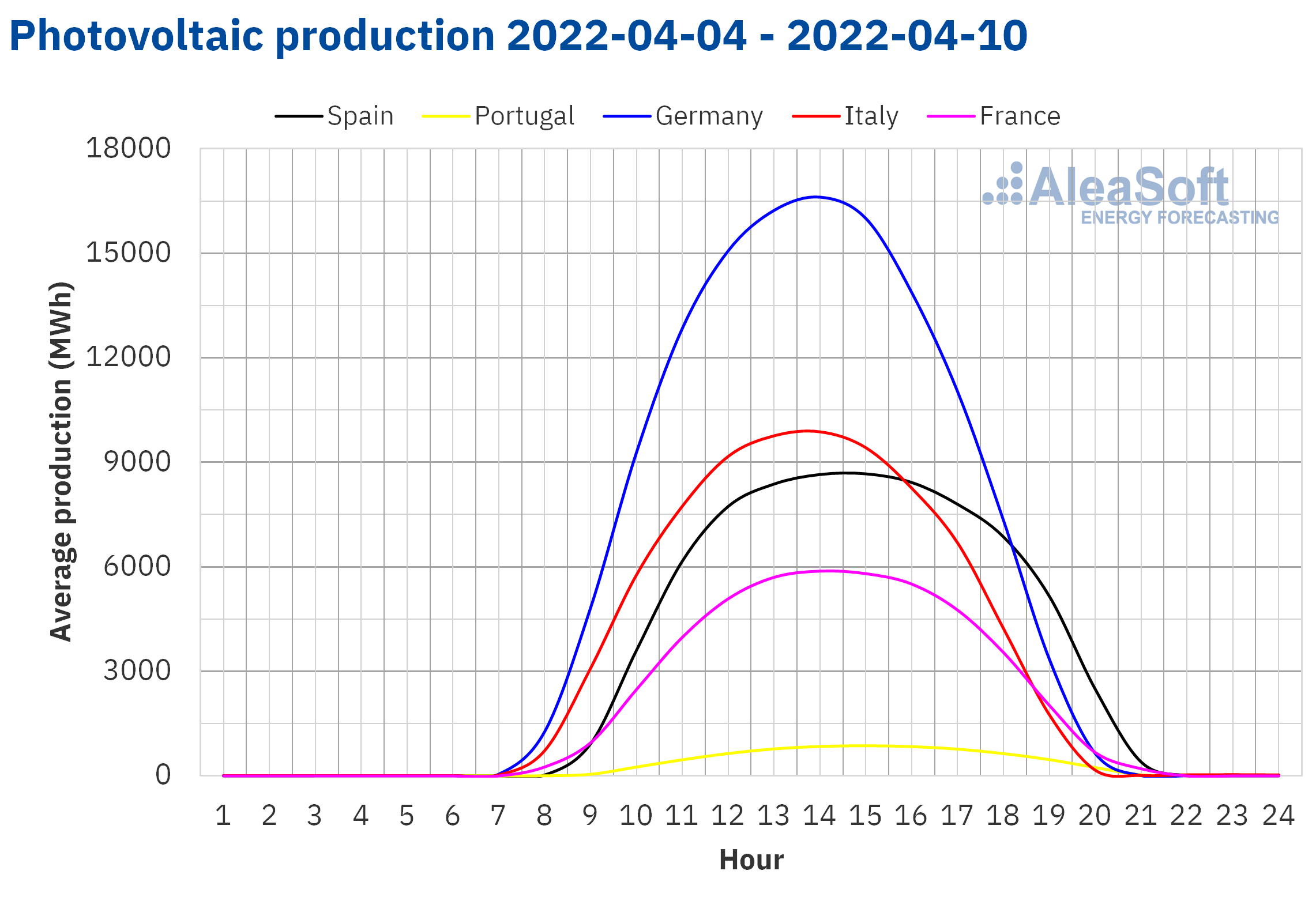

The week of April 4 ended with a general increase in solar energy production compared to the previous week. In the case of Spain, the hourly photovoltaic energy production record was broken on April 7 at 14:00 with 11 313 MWh. Similarly, on April 10, the highest production in history was registered in the French market, of 8788 MWh at 13:00, while the Italian market reached the highest production with this technology since July 2014, with 12 310 MWh at 12:00 of the same day.

For the week as a whole, the increase in production in the Italian market was 48% and in the French market 24%, compared to the previous week. In the German market, the increase in solar energy production was 11%, while in the Iberian Peninsula, where it includes the photovoltaic and solar thermal energy, it was 7.0%.

For the week that began on April 11, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates a reduction in the production of the Spanish and Italian markets, while on the contrary an increase in the production of Germany is expected.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

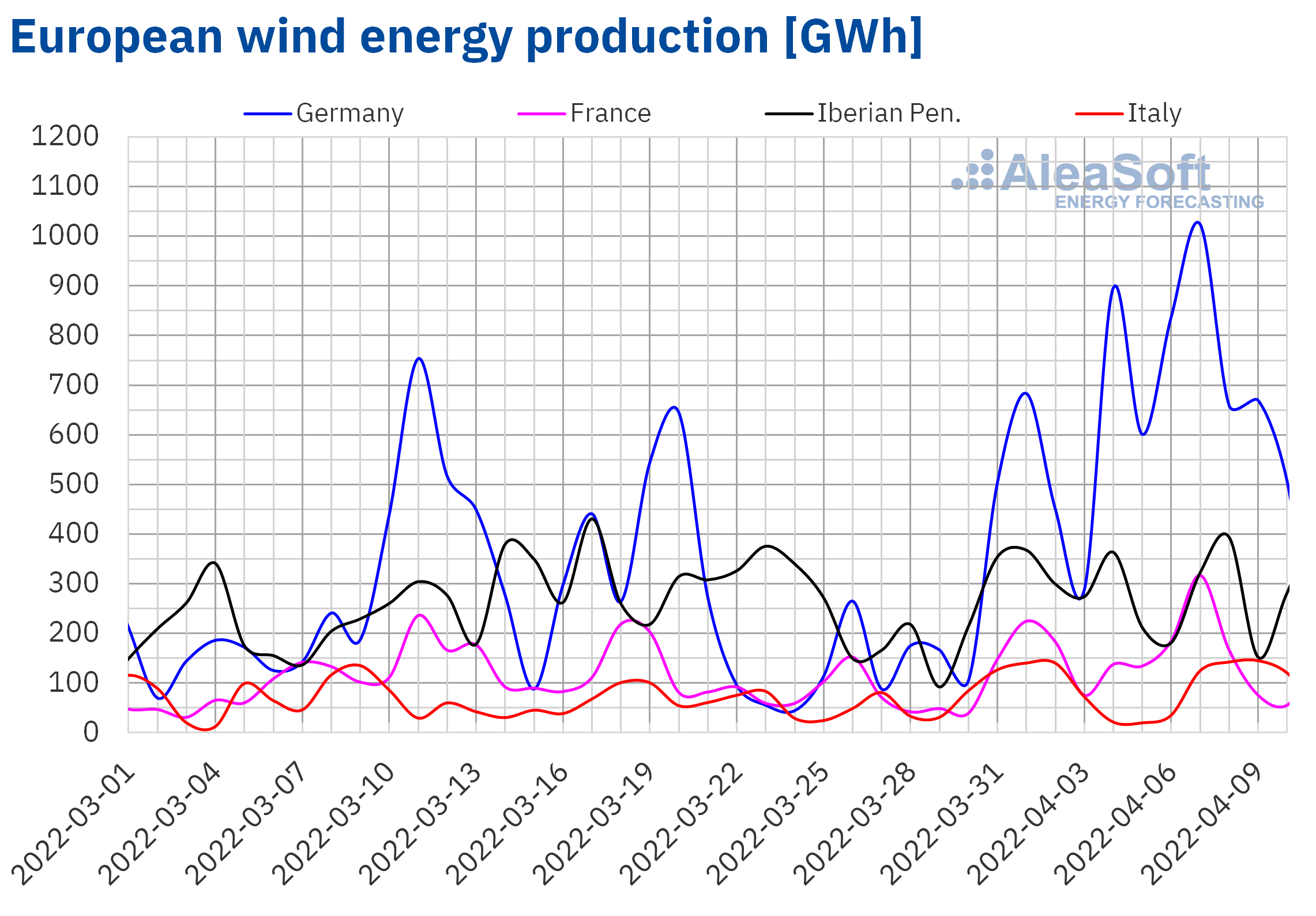

Similarly, in the first week of April, wind energy production increased in most of the markets analysed at AleaSoft Energy Forecasting compared to the previous week. The largest increase was registered in Germany and it was 119%. In the French market it also increased considerably, by 41%. In the case of the Iberian Peninsula, the increase was 4.8%, while in the Italian market the production with this technology fell by 3.0%.

For the second week of April, the AleaSoft Energy Forecasting’s forecasts indicate a general reduction in production with this technology.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

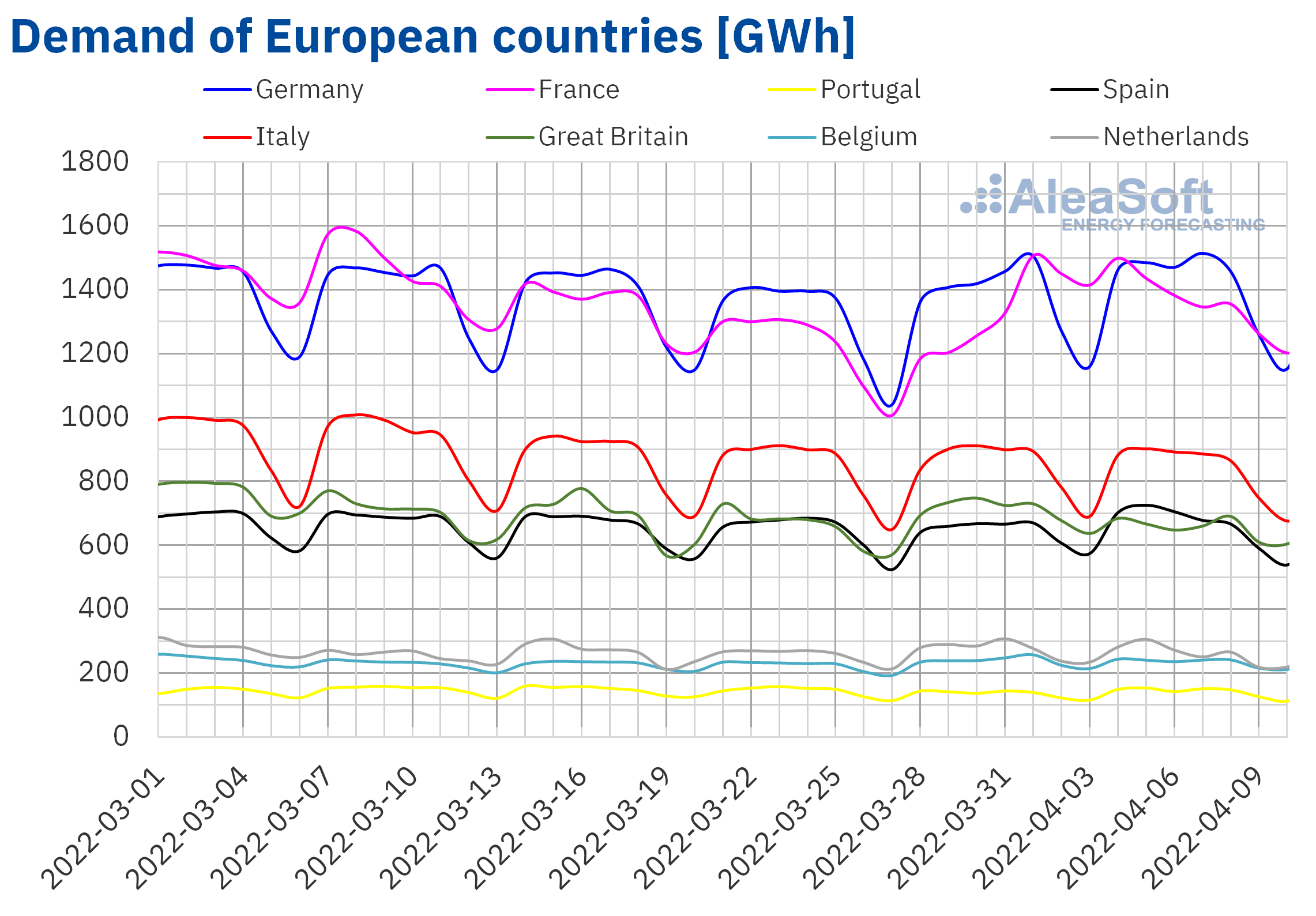

Electricity demand

The week of April 4 ended with an increase in electricity demand of between 1.5% and 4.2% compared to the previous week in the markets of France, Germany, Spain and Portugal. However, in the markets of Italy, Belgium, the Netherlands and Great Britain, the demand fell, with the latter registering the largest decrease, of 7.7%.

For the week of April 11, the AleaSoft Energy Forecasting’s forecasts indicate a reduction in demand in all markets analysed at AleaSoft Energy Forecasting in correspondence with the decrease in labour during Easter, as well as less cold temperatures.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

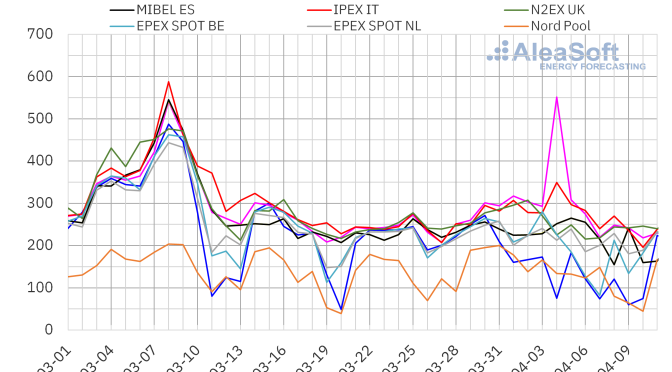

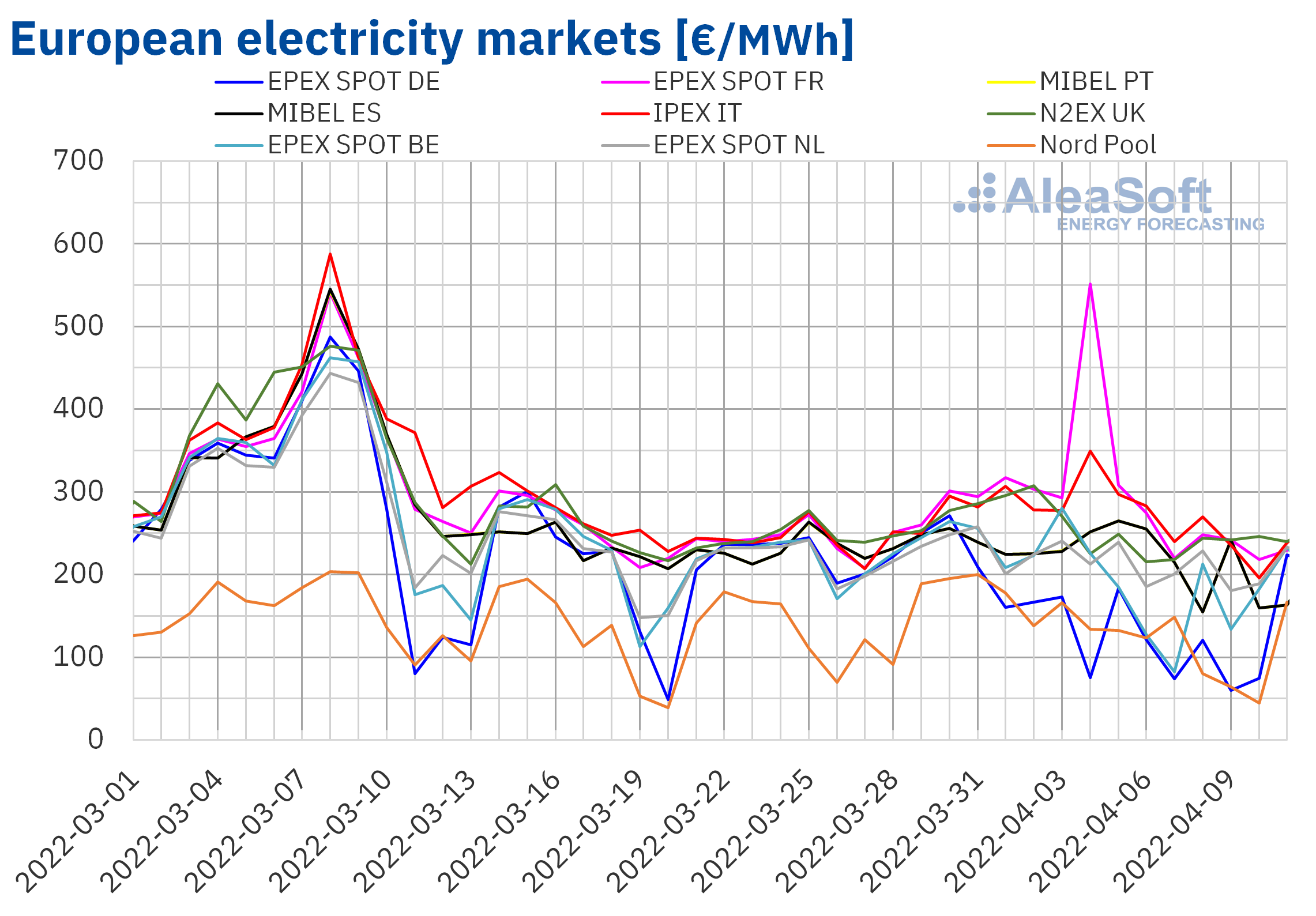

European electricity markets

In the week of April 4, the prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting fell compared to the previous week. The exception was the EPEX SPOT market of France, with a price rise of 2.1%. On the other hand, the largest drop in prices was that of the German market, of 51%. On the contrary, the smallest decrease was that of the IPEX market of Italy, of 3.7%. In the rest of the markets, the price decreases were between 6.7% of the MIBEL market of Spain and Portugal and 37% of the Nord Pool market of the Nordic countries.

In the first week of April, the average prices were lower than €295/MWh in all analysed electricity markets, although in almost all cases they exceeded €160/MWh. The exceptions were the German market and the Nord Pool market with weekly averages of €101.31/MWh and €103.93/MWh, respectively. On the other hand, the highest average was that of the French market, which reached a value of €294.47/MWh, followed by that of the Italian market, of €267.09/MWh. In the rest of the markets, the prices were between €164.17/MWh of the Belgian market and €234.16/MWh of the N2EX market of the United Kingdom.

Regarding hourly prices, on April 4, from 8:00 a.m. to 9:00 a.m., a price of €2987.78/MWh was reached in France, the highest since October 2009. This price was favoured by the low temperatures and the fact that a significant part of the French nuclear reactors were not in operation.

On the other hand, on Saturday, April 9, in the afternoon, negative hourly prices were reached in the markets of Germany, Belgium and the Netherlands. In the case of the Belgian market, there was also an hour with a negative price on Thursday, April 7.

In other markets there were no negative hourly prices, but the lowest values in recent months were reached on Sunday, April 10, in the afternoon. In Italy, the minimum price of €22.42/MWh was the lowest since May 2021. In Spain and Portugal, a minimum hourly price of €1.03/MWh was reached, which was the lowest since August of 2021. In the French market and in the Nord Pool market, the lowest prices since February 2022 were registered.

During the week of April 4, the increase in wind and solar energy production in most markets favoured the fall in European electricity markets prices. In addition, although gas prices remain high, during the analysed week they registered a decrease that also contributed to lower electricity markets prices.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of April 11 prices might decrease in the markets of France, Spain, Italy and Portugal, while a significant decrease in wind energy production would favour the rise in prices in the German market.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

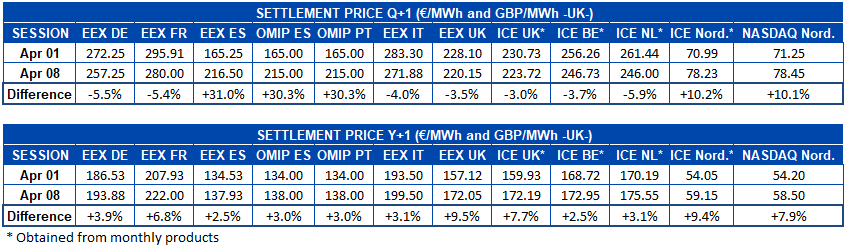

Electricity futures

The first week of April ended with falls in settlement prices of electricity futures for the third quarter of the year in most markets. The exceptions were the Nordic region and the Iberian region. Both in the ICE market and the NASDAQ market of the Nordic countries, rises of 10% were registered. However, the EEX market of Spain and the OMIP market of Spain and Portugal led the price increases for this product. They registered increases of more than 30%. Specifically, in the EEX market of Spain, the settlement price increased by €51.25/MWh between the sessions of April 1 and 8, being the market with the highest price increase in this period. In the rest of the markets, prices fell between 3% and 6% between these sessions.

For their part, electricity futures prices for the next year 2023 registered a general rise in all markets analysed at AleaSoft Energy Forecasting. The increases range from 2.5% of the EEX market of Spain to 9.5% of the EEX market of the United Kingdom.

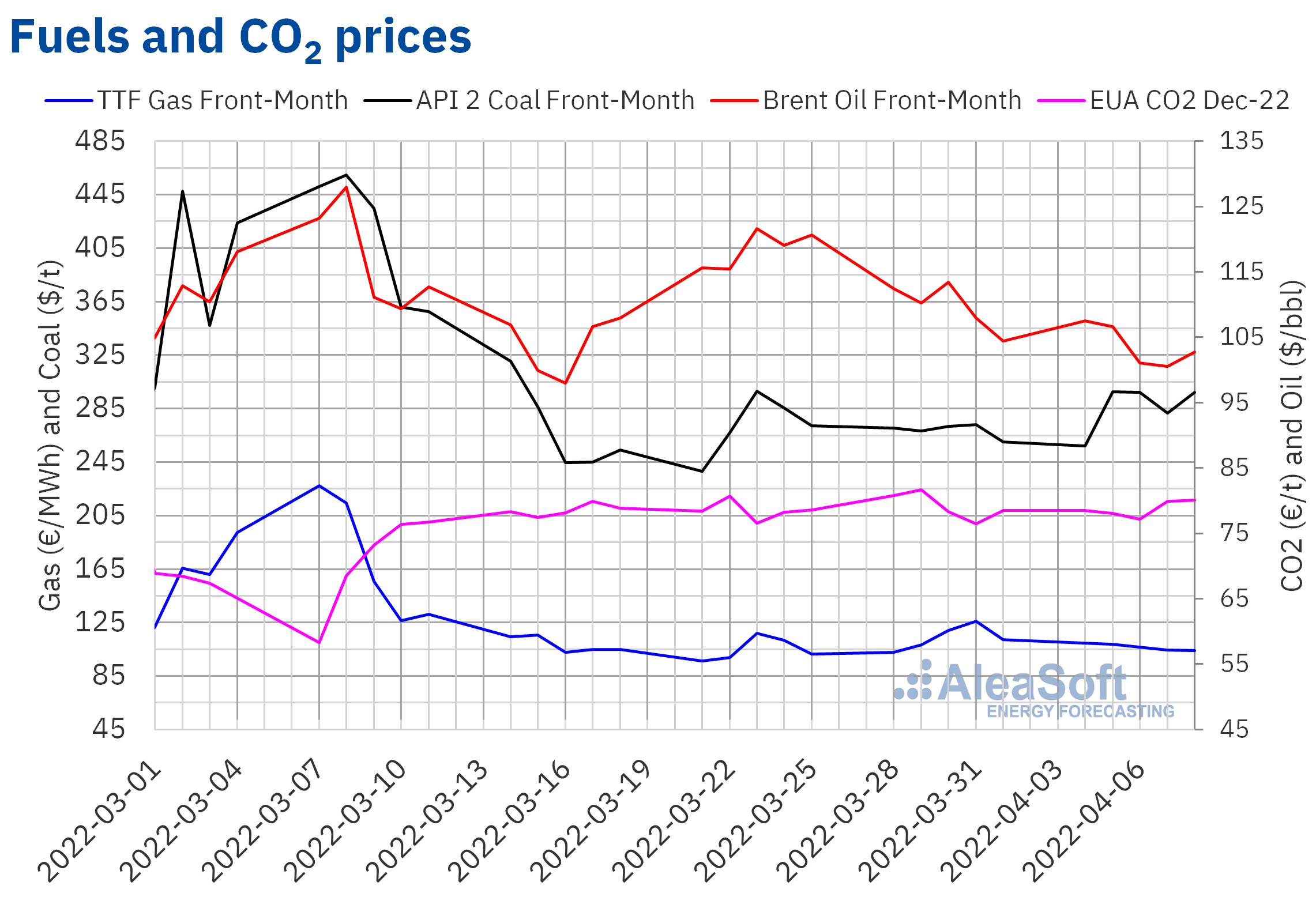

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market during the first week of April registered settlement prices lower than those of the same days of the previous week. The maximum settlement price of the week, of $107.53/bbl, was reached on Monday, April 4, and it was 4.4% lower than that of the previous Monday. While on Thursday, April 7, the weekly minimum settlement price, of $100.58/bbl, was registered, which was 6.8% lower than that of the previous Thursday.

Concerns about demand due to the increase in coronavirus cases and the confinements in China favoured the downward trend in Brent oil futures prices in the first week of April. In addition, the announcement of the amounts of oil to be released from the strategic reserves of the member countries of the International Energy Agency with the aim of reducing the tension caused by the Russian invasion of Ukraine in the market also contributed to the decreases in prices.

As for TTF gas futures in the ICE market for the Front?Month, in the first week of April they maintained a downward trend. On Monday, April 4, they registered a settlement price of €109.52/MWh, 6.8% higher than that of the previous Monday, but already 2.3% lower than that of the last session of the previous week. As a consequence of the decreases registered during the week, on Friday, April 8, the settlement price was €103.88/MWh. This price was 7.4% lower than that of the previous Friday.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2022, the settlement prices had values around €78.75/t in the first week of April. The uncertainty about the effects of the war in Ukraine on the economy and the demand kept the prices of these futures with values similar to those of previous weeks. On Wednesday, April 6, the weekly minimum settlement price, of €77.18/t, was registered, which was 1.4% lower than that of the previous Wednesday. But during the last days of the week, prices recovered and the weekly maximum settlement price, of €80.09/t, was reached on Friday, April 8. This price was 2.0% higher than that of the previous Friday, but €1.61/t lower than the maximum settlement price of the previous week, which corresponded to Tuesday, March 29.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

AleaGreen, the AleaSoft Energy Forecasting’s division specialised in long?term price curves forecasting reports for European markets, is offering the reports corresponding to the second quarter with a special promotion. The forecasts have hourly granularity throughout the forecasting horizon, they include the annual confidence bands corresponding to the P15 and P85 percentiles and the prices captured by solar photovoltaic and wind energy.

Those interested in energy storage and hybridisation, key issues in the energy transition, have an opportunity to delve into them in the next AleaSoft Energy Forecasting’s webinar “Prospects for energy markets in Europe. Vision of the future: energy storage”, which will take place on April 21. The webinar will also analyse the evolution of the European energy markets in recent weeks.