Price records in European electricity markets after the highs reached by gas.

In the fourth week of August, gas prices continued their upward trend, exceeding €300/MWh in the last days of the week and setting a record on the 26th. In this context, prices of all European electricity spot markets increased and in many cases historical maximum hourly prices were registered on August 29. Futures markets also registered general rises. In France, futures for the next quarter and year exceeded €1100/MWh.

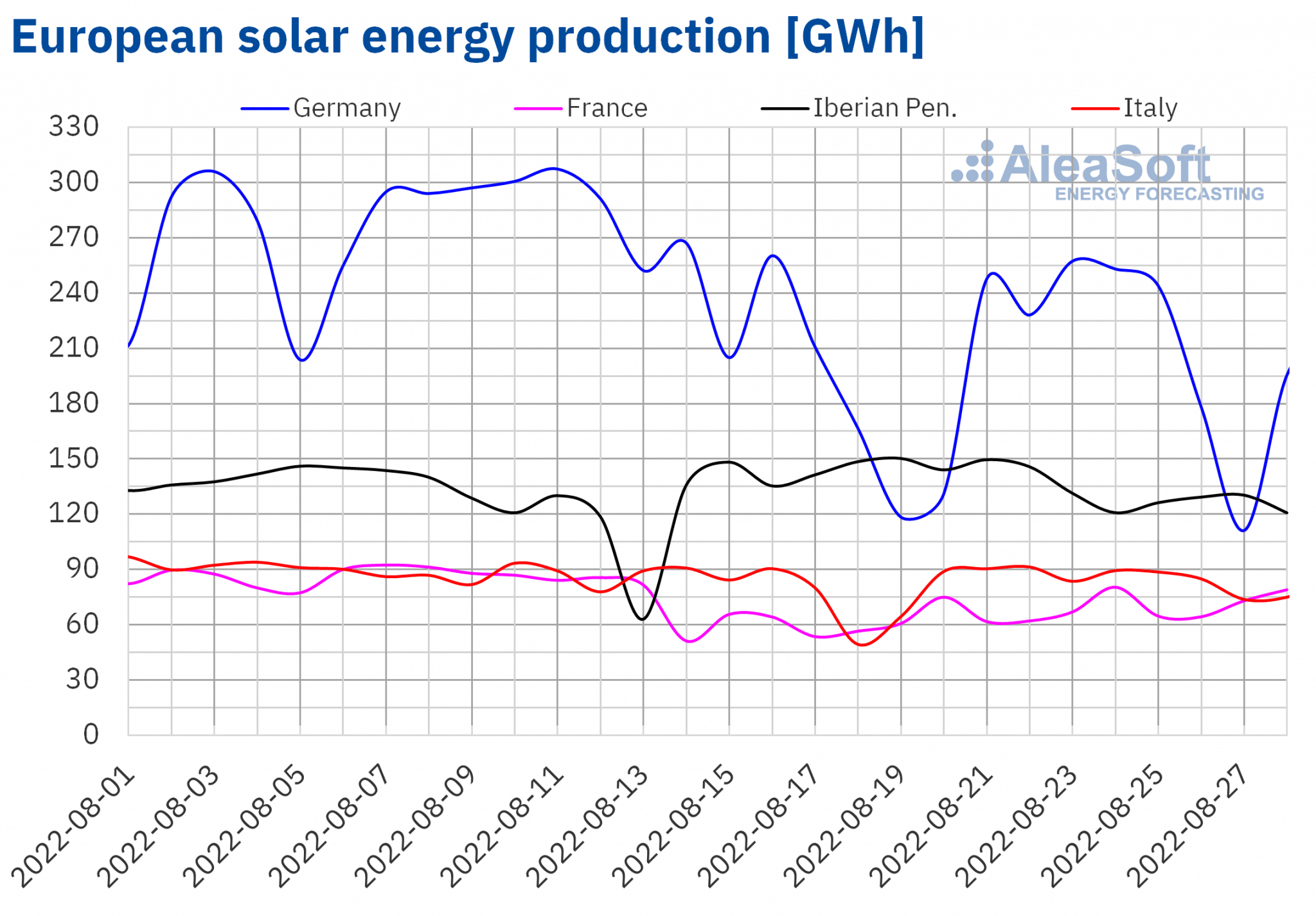

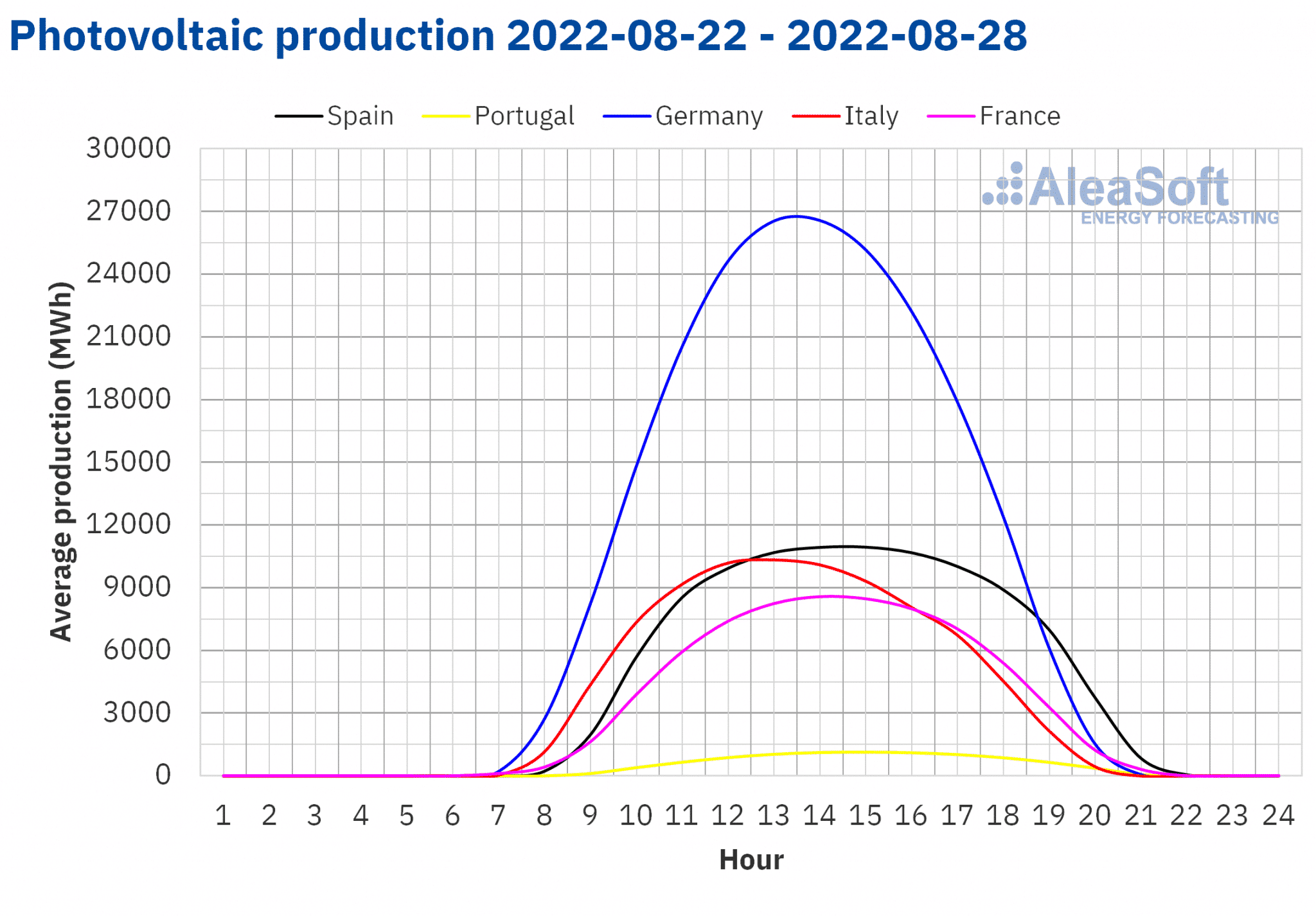

Solar photovoltaic and thermoelectric energy production and wind energy production

During the fourth week of August, the solar energy production increased by 12% in the French market, 9.5% in the German market and 7.1% in the Italian market compared to the previous week. On the contrary, in the Portuguese market the production fell by 10% and in the Spanish market by 11%.

For the week of August 29, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates a reduction in production in Germany, Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

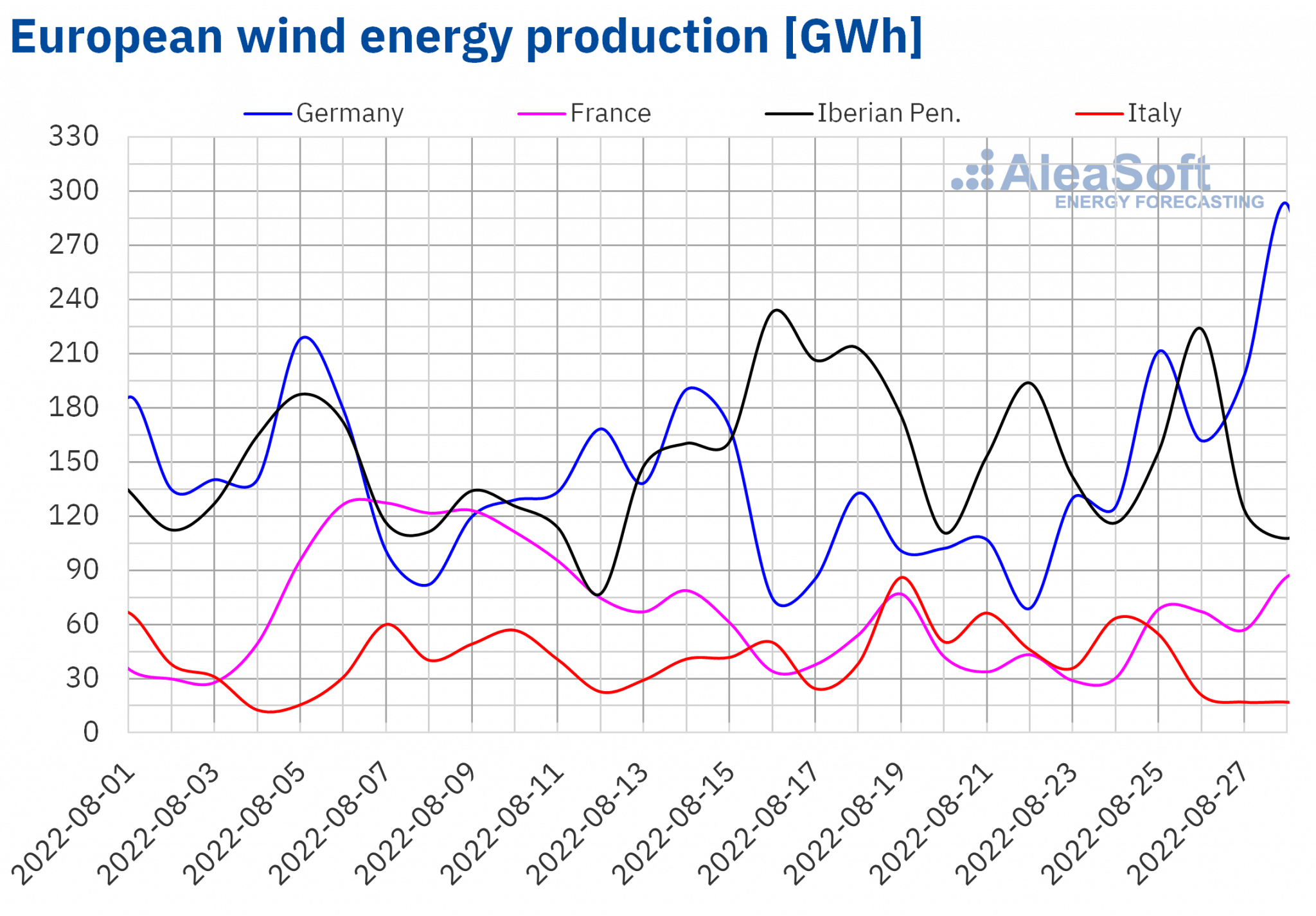

During the week of August 22, the wind energy production increased by 54% in the German market and 12% in the French market compared to the previous week. However, in the markets of Spain, Portugal and Italy there was a reduction of between 45% and 7%.

For the first week of September, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates an increase in production with this technology in the markets of Germany and France, while a decrease is expected in the markets of Portugal, Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

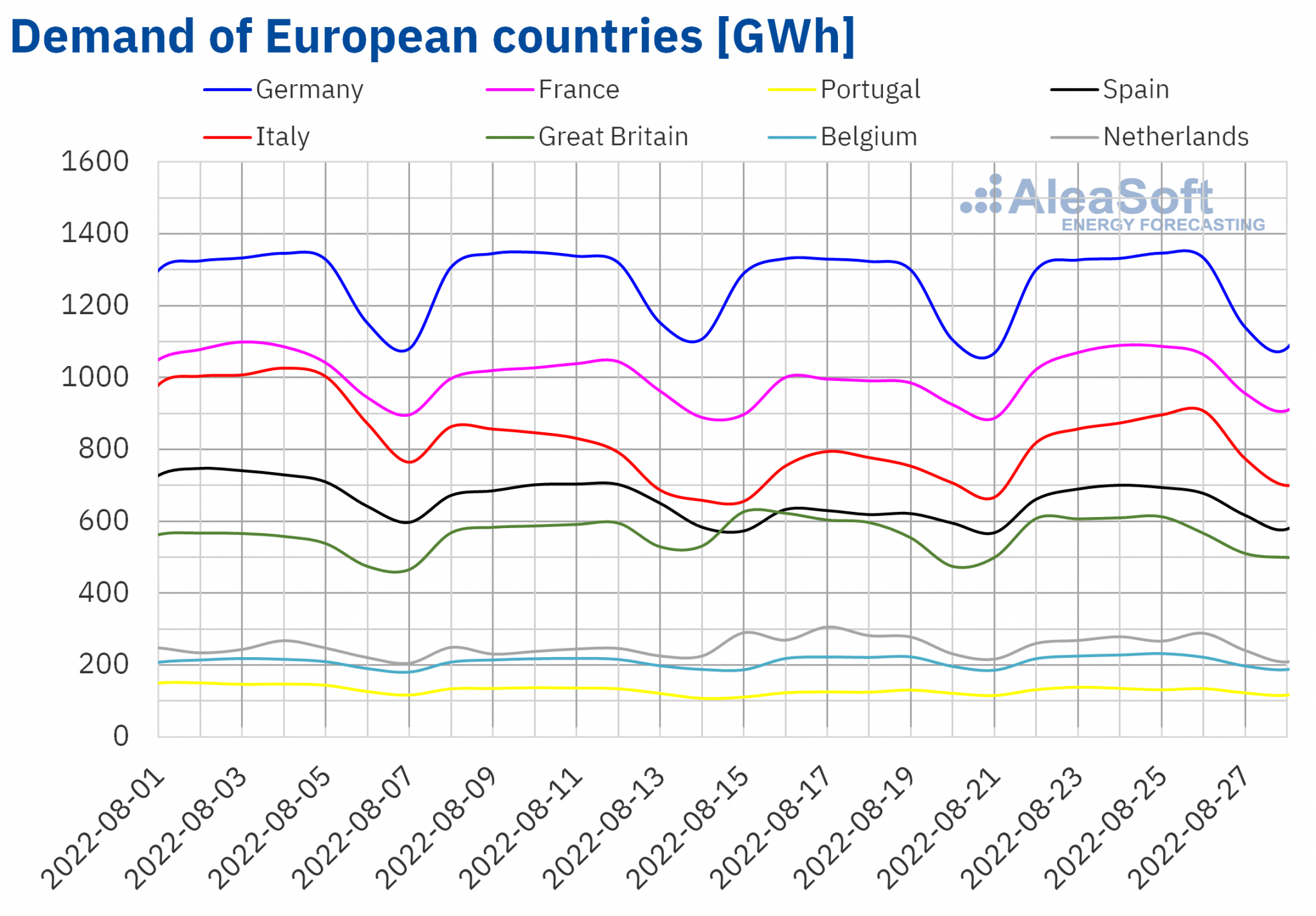

Electricity demand

During the week of August 22, the electricity demand increased in most analysed European electricity markets with respect to the previous week, mostly favoured by the recovery in labour after the Assumption of the Virgin holiday celebrated on August 15 in most countries. The exception was the market of the Netherlands, where the demand decreased by 3.3% for this period and in which the Assumption of the Virgin holiday is not celebrated.

Regarding the increases, the largest variation, of 14%, was registered in the Italian market, while the British market was the one with the smallest increase, of 0.9%. In the rest of the markets, the rises in demand were between 8.9% of the Spanish market and 1.3% of the German market.

According to the demand forecasting made by AleaSoft Energy Forecasting, it is expected that in the week of August 29, the demand will have a heterogeneous behaviour in the European markets. On the one hand, it is expected to increase in the markets of Portugal, Italy, Spain and Germany, while for the markets of Great Britain, the Netherlands, France and Belgium it is estimated to decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

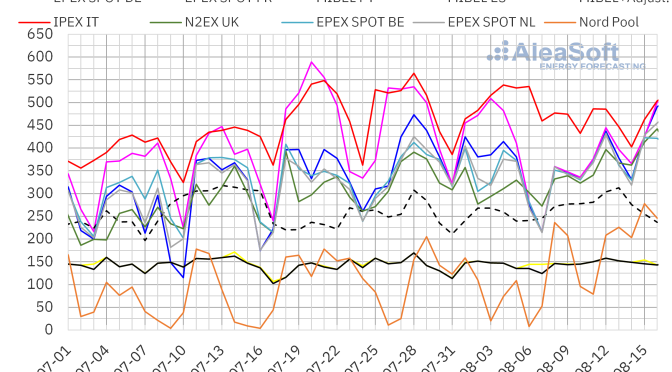

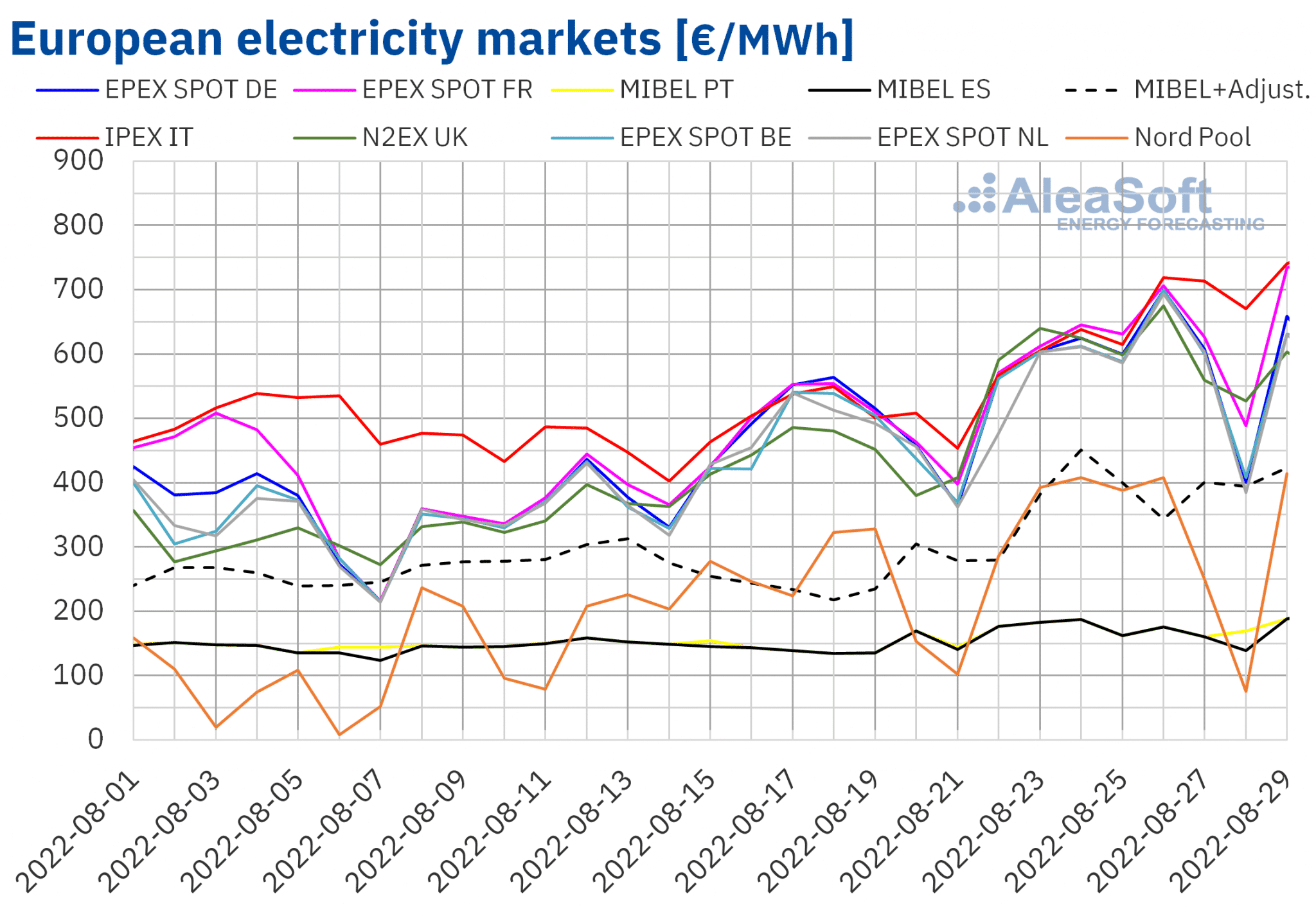

European electricity markets

In the week of August 22, prices of all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The largest price rise was that of the N2EX market of the United Kingdom, of 38%, followed by the 33% rise of the Nord Pool market of the Nordic countries. On the other hand, the smallest increases, of 17% and 19%, were those of the MIBEL market of Spain and Portugal, respectively. In the rest of the markets, the price increases were between 22% of the EPEX SPOT market of Germany and the Netherlands and 29% of the IPEX market of Italy.

In the fourth week of August, the highest average, of €646.90/MWh, was that of the Italian market, followed by that of the French market, of €611.61/MWh. On the other hand, the lowest weekly averages were those of the Spanish and Portuguese markets, of €168.92/MWh and €173.26/MWh, respectively. These lower prices in the Iberian market are due to the cap that is being applied to the gas price that is used as a reference for the offers of electricity generating plants. In the rest of the markets, prices were between €315.41/MWh of the Nord Pool market and €602.09/MWh of the British market.

Despite the fact that the MIBEL market prices were the lowest, part of the consumers must pay a higher price as compensation for the gas price limitation applied in this market. In the Spanish market, the average of this price increased to €378.67/MWh in the week of August 22.

Regarding hourly prices, on Wednesday, August 24, from 19:00 to 20:00, hourly prices of €850.00/MWh were registered in the markets of Germany, Belgium, France and the Netherlands. But these prices were surpassed by those of Monday, August 29, which at that same hour reached €871.00/MWh in these markets. In the British market, on August 23 at the same hour, a price of £779.03/MWh was registered. In the case of Italy, a record price of €870.00/MWh was reached on Saturday, August 27, from 20:00 to 21:00, while in the case of the Nord Pool market, a historical maximum of €644.17/MWh was reached on Monday, August 29, from 19:00 to 20:00.

On the other hand, in the afternoon of Sunday, August 28, three hours with negative prices were registered in the Dutch market. The lowest price, of ?€37.25/MWh, was reached between 15:00 and 16:00 and was the lowest hourly price in this market since the second half of July.

During the week of August 22, gas prices registered records that dragged the European electricity markets. In addition, the demand increased in most markets and the wind energy production fell compared to the previous week in Spain, Italy and Portugal. In the Iberian Peninsula, the solar energy production also decreased.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of August 29, prices of most European electricity markets might continue increasing, influenced by the evolution of gas prices, the recovery in demand and the decrease in renewable energy production in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

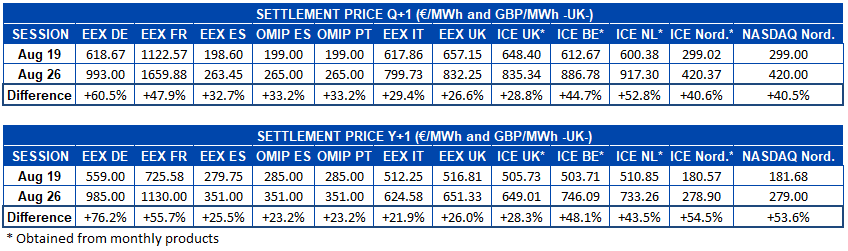

Electricity futures

Electricity futures prices for the next quarter continued to rise during the week of August 22. This is a considerable rise across the board. The largest percentage increase was registered in the EEX market of Germany, with a 61% rise between the sessions of August 19 and 26. The EEX market of the United Kingdom was where the smallest percentage increase, of 27%, was registered. The EEX market of France continues to attract attention, which not only reached four figures last week, but also continued to rise this week to the point of reaching the settlement price of €1659.88/MWh in the last session. In the EEX market of Spain and in the OMIP market of Spain and Portugal, prices also rose proportionally to the rest of the European markets, but the figures reached are much lower, due to the gas price cap mechanism in the Iberian Peninsula.

For its part, the electricity futures for the next year 2023 had a similar behaviour. In this case, the German market was also the one with the largest increase, with a rise of 76%. The EEX market of Italy was where prices rose the least, rising 22%. In the session of Friday, August 26, the price of this product in the French market also reached four figures, settling at €1130/MWh.

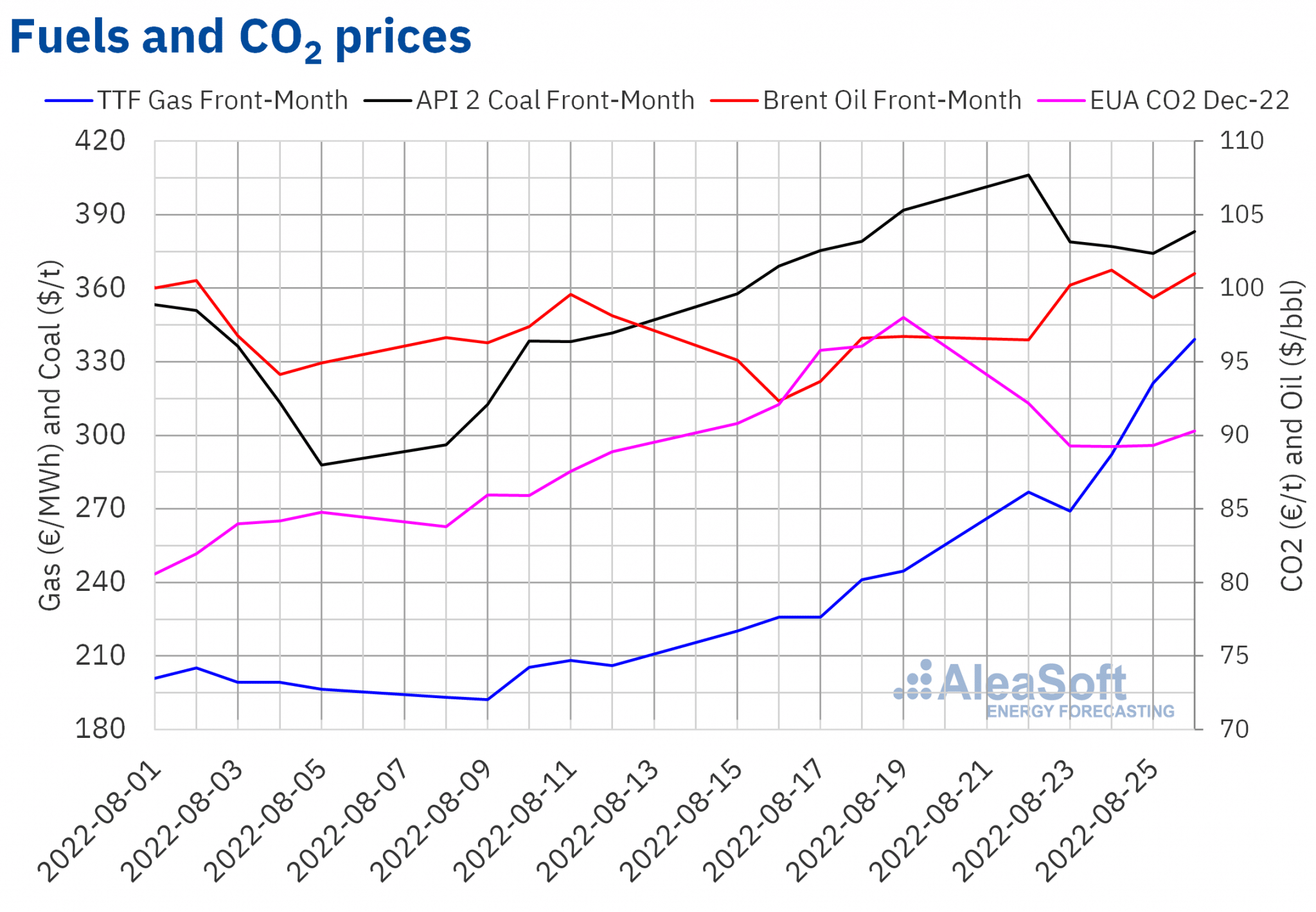

Brent, fuels and CO2

In the fourth week of August, settlement prices of Brent oil futures for the Front?Month in the ICE market exceeded $100/bbl most days, after more than two weeks without doing so. The weekly maximum settlement price, of $101.22/bbl, was reached on Wednesday, August 24. This price was 8.1% higher than that of the previous Wednesday and the highest since the end of July.

The expectations of a recovery in US demand and the announcement of measures by the Chinese government to favour the country’s economy are contributing to the recovery of Brent oil futures prices.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, in the fourth week of August they were higher than those of the same days of the previous week. In addition, the last days of the week they exceeded €300/MWh. On Friday, August 26, the weekly maximum settlement price, of €339.20/MWh, was reached. This price was 39% higher than that of the previous Friday and the highest in history.

According to Gazprom’s announcement, the gas supply from Russia through the Nord Stream 1 gas pipeline will be interrupted on August 31 to carry out maintenance on the only pumping equipment in operation. These tasks are planned to last three days. This announcement is favouring an upward trend in gas futures prices.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2022, they began the fourth week of August with a downward trend, influenced by concerns about the evolution of the demand. As a consequence, on Wednesday, August 24, the weekly minimum settlement price, of €89.24/t, was reached. This price was 6.8% lower than that of the previous Wednesday. However, in the last days of the week, prices recovered until registering a settlement price of €90.30/t on Friday, August 26, which was still 7.9% lower than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

At AleaSoft Energy Forecasting, special promotions are being carried out for the short?, mid? and long?term price forecasting services of European electricity markets. The long?term price forecasting is essential to obtain financing for renewable energy projects. The short?, mid? and long?term forecasting is necessary to responsibly manage an energy sales strategy based on the diversification with contracts and hedges over all time horizons when the plant is already in operation.

The next two editions of the monthly webinars of AleaSoft Energy Forecasting and AleaGreen on current issues of the European energy sector are already being organised. The September edition will be held on the 15th, with the participation of Jorge Simão, COO at OMIP and Pablo Villaplana, COO at OMIClear, who will analyse the importance of forward markets for the renewable energy development. Fernando Soto, Director?General of AEGE, will also participate in the analysis table of the Spanish version of the webinar to talk about the auction of renewable energy PPA with electro?intensive consumers that the association he presides over is organising. The next edition will be held on October 20, again with speakers from Deloitte, Carlos Milans del Bosch, Partner of Financial Advisory, and Luis Garcia Tasich, Manager of Global IFRS and Offerings Services, who will share their vision on the renewable energy projects financing and the importance of the forecasting in audits and portfolio valuation. Oriol Saltó i Bauzà, Associate Partner at AleaGreen and Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting will participate in both editions of the webinars.