Drop in gas, CO2 and European electricity markets prices in the first week of September.

Gas and CO2 prices fell in the first week of September, favouring the drop in prices in most European electricity markets, even though at the beginning of the week the French market reached €1021.73/MWh in one hour. The solar and wind energy production increased in some markets and the electricity demand fell in most of them, which contributed to the declines. However, in the MIBEL and Nord Pool markets, prices increased and each one registered the highest weekly value in its history.

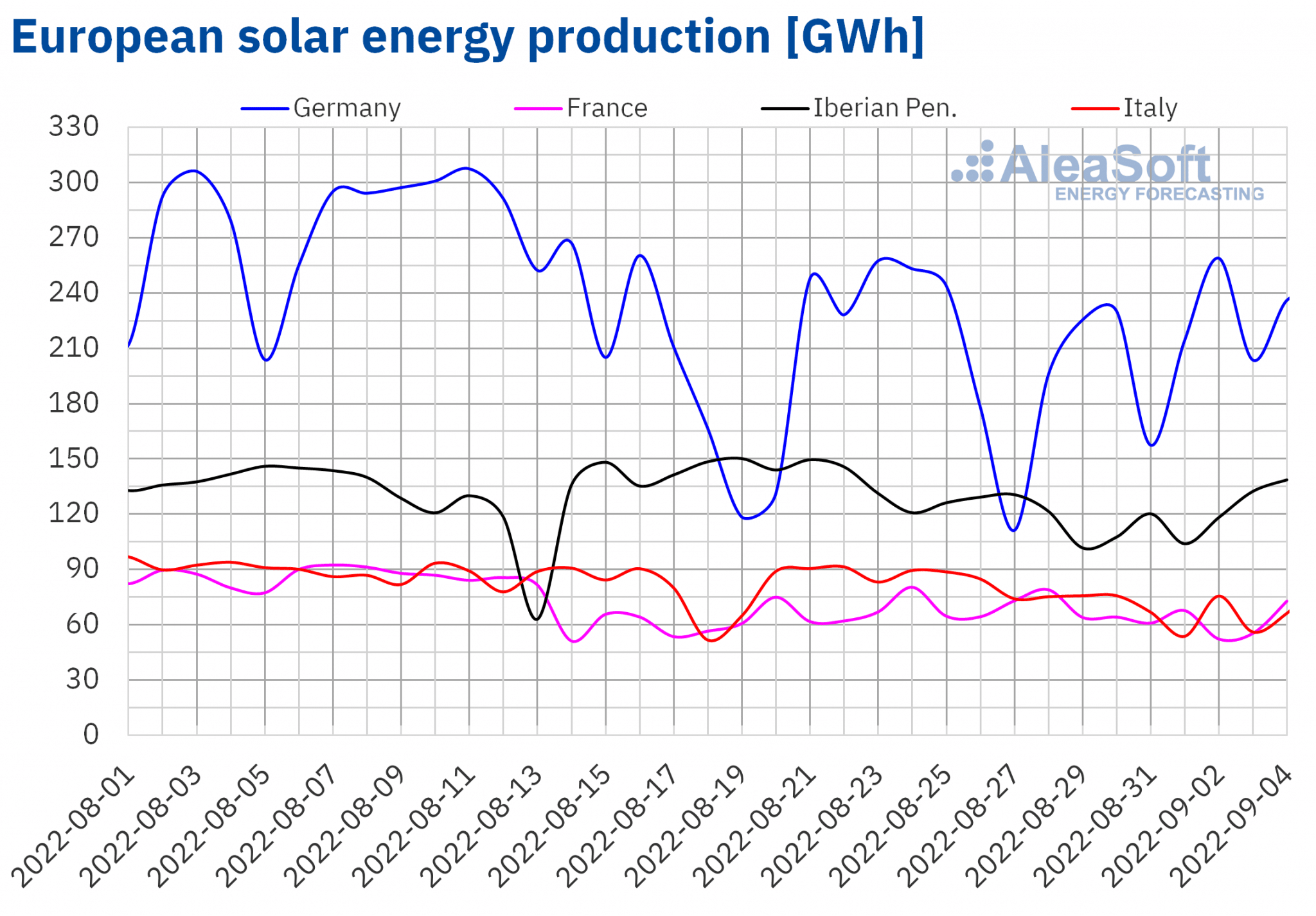

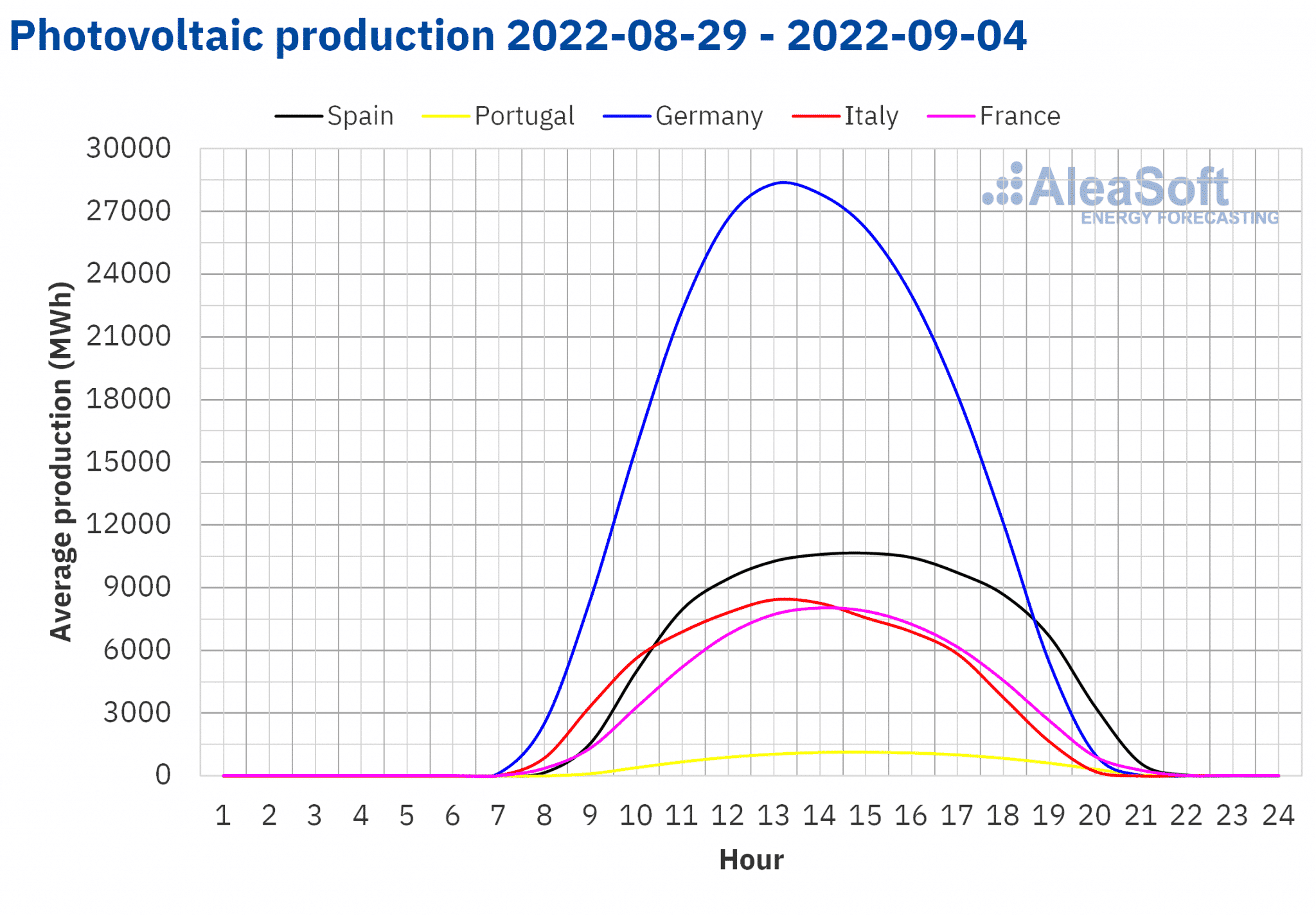

Solar photovoltaic and thermoelectric energy production and wind energy production

During the first week of September, the solar energy production increased by 5.2% in the Portuguese market and 4.0% in the German market compared to the previous week. However, in the rest of the markets analysed at AleaSoft Energy Forecasting, the solar energy production fell between 10% of the Spanish market and 20% of the Italian market.

For the week of September 5, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates a reduction in production in Germany and Spain, while an increase in production is expected in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

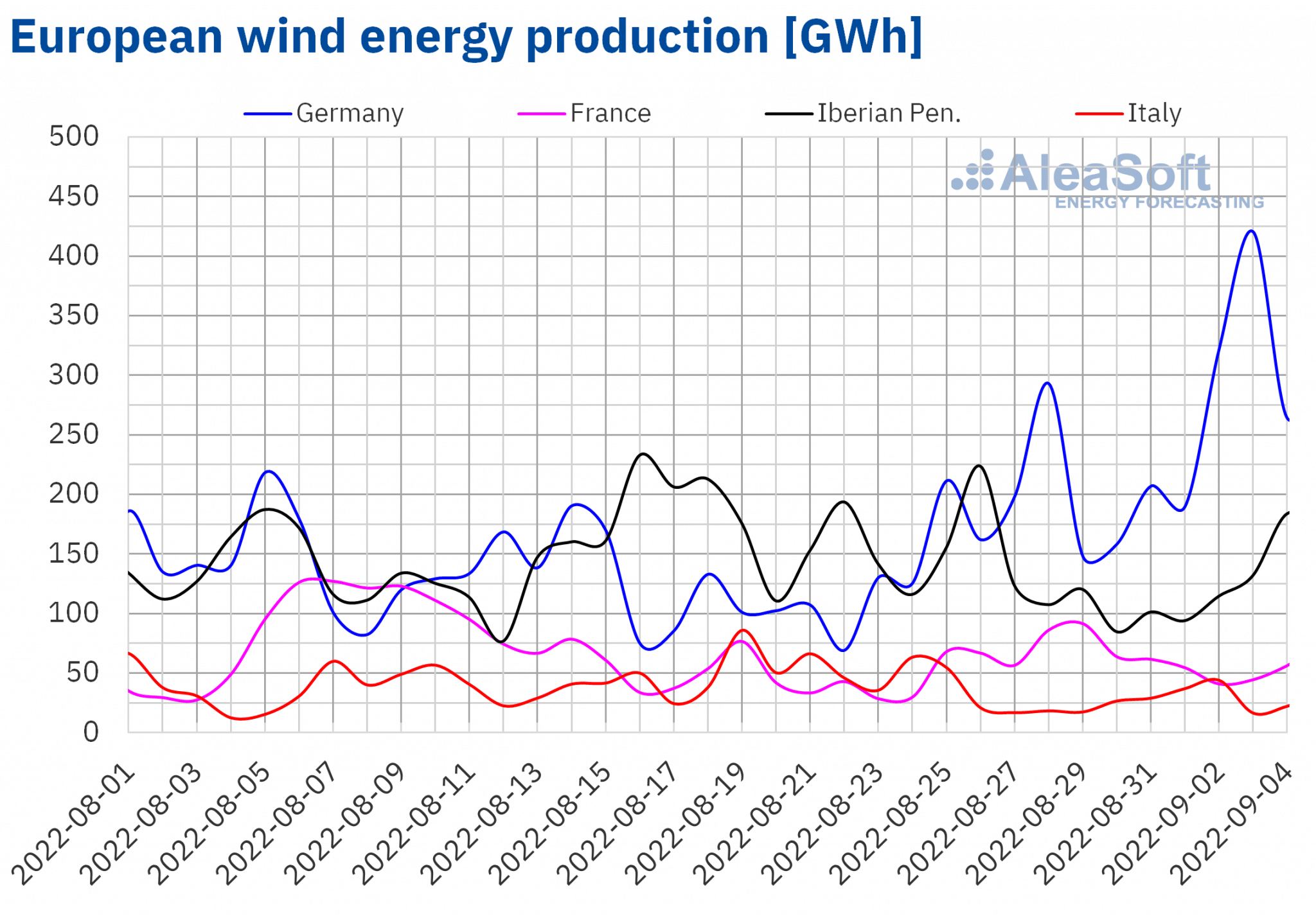

During the week of August 29, the wind energy production increased by 44% in the German market, 8.9% in the French market and 7.1% in the Portuguese market compared to the previous week. On the contrary, in the markets of Spain and Italy there was a reduction of 26% and 25%, respectively.

For the second week of September, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates a general increase in production with this technology in the analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

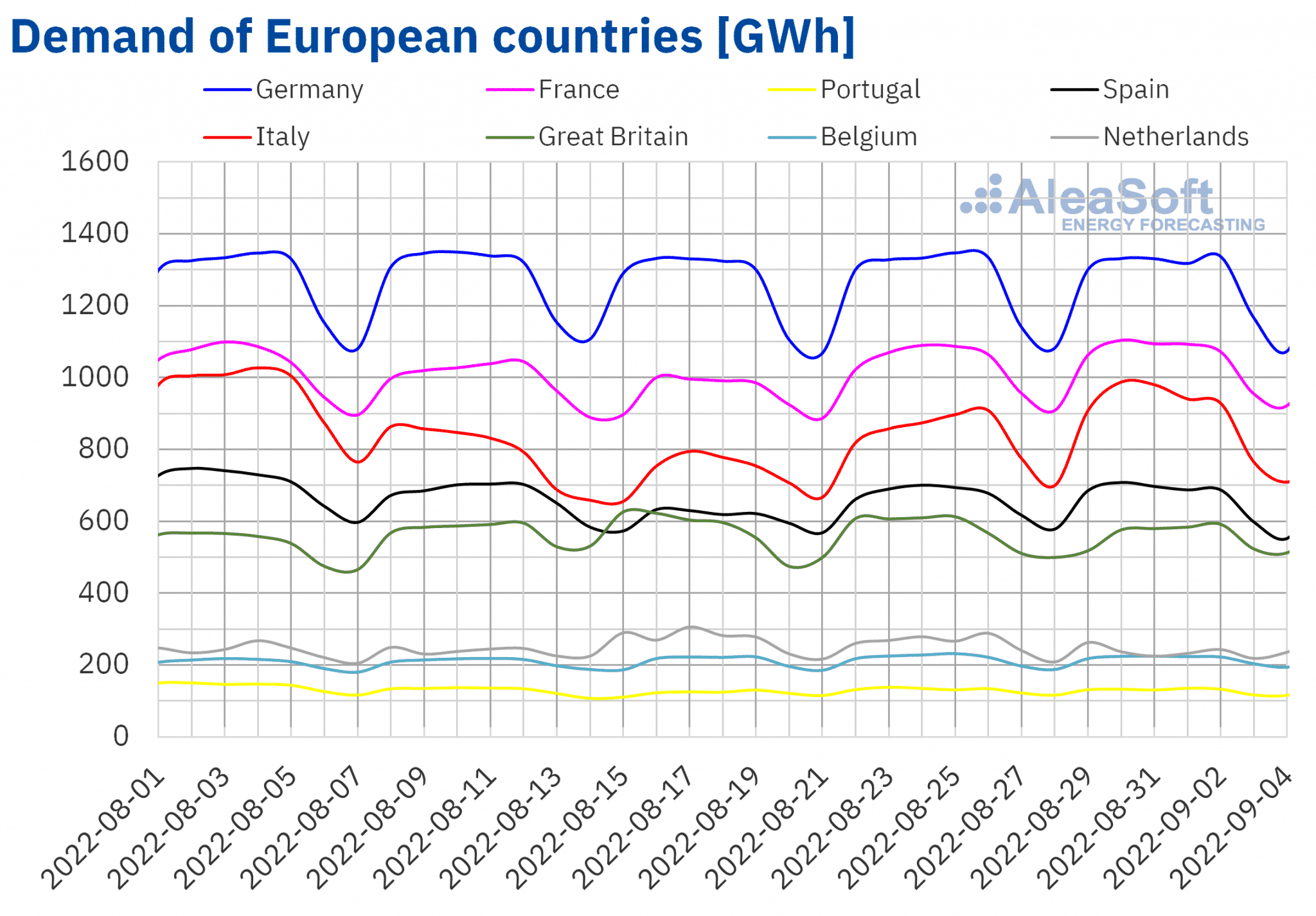

Electricity demand

In the week of August 29, the electricity demand decreased in most of the analysed European electricity markets with respect to the previous week, favoured by mostly less warm average temperatures. The largest decrease in demand was registered in the market of the Netherlands, which was 8.6%. In the British market the drop was 3.2%, benefited by the national holiday of Monday, August 29. In the Portuguese market the decrease was 1.4% and in the markets of Germany and Spain it was 0.1% in both cases.

On the other hand, in the markets of Italy, France and Belgium, the demand behaved upwards. In this case, the largest increase was registered in the Italian market, and was 6.6%. In France and Belgium the increases were 1.4% and 0.1% respectively.

For the week of September 5, according to the demand forecasting made at AleaSoft Energy Forecasting, the demand is expected to increase in most European markets, mostly favoured by the recovery in labour after the holiday period. Conversely, the demand is expected to decline in the Belgian and French markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

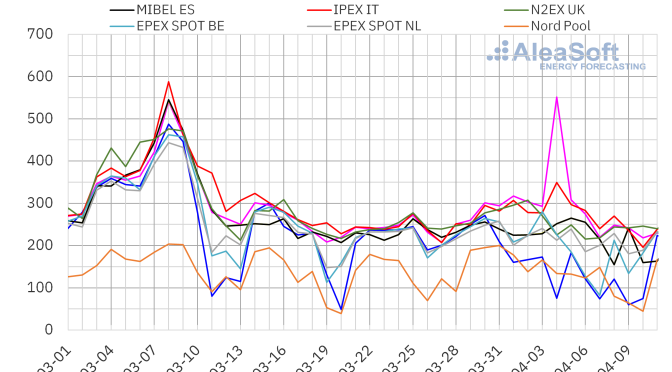

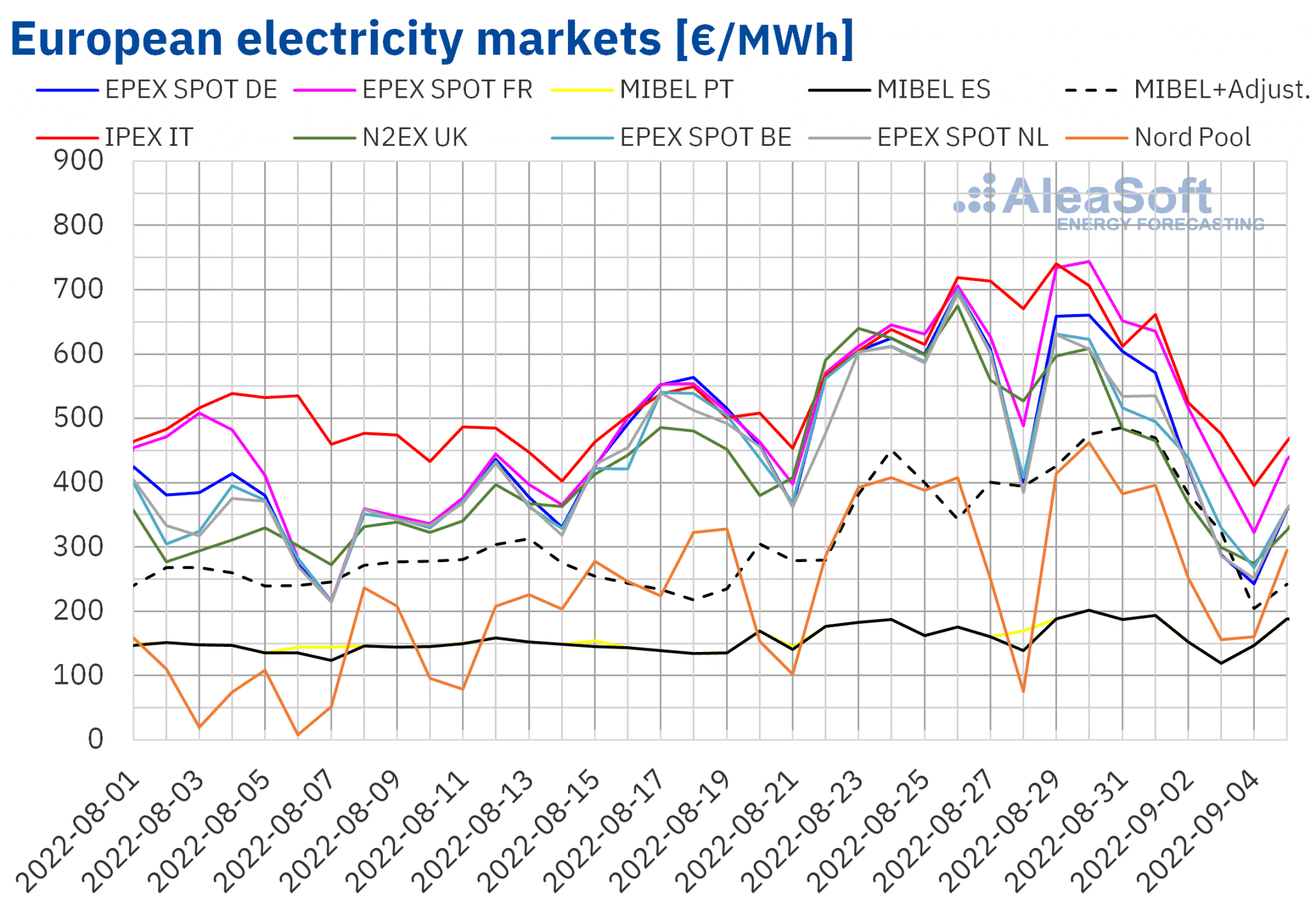

European electricity markets

In the week of August 29, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The exceptions were the MIBEL market of Spain and the Nord Pool market of the Nordic countries, with increases of 0.6% and 0.7%, respectively. On the other hand, the largest drop in prices was that of the N2EX market of the United Kingdom, of 26%. On the contrary, the smallest decreases, of 2.0% and 6.1%, were those of the MIBEL market of Portugal and the EPEX SPOT market of France, respectively. In the rest of the markets, the price drops were between 9.1% of the IPEX market of Italy and 19% of the EPEX SPOT market of Belgium.

In the first week of September, the highest average, of €587.98/MWh, was that of the Italian market, followed by that of the French market, of €574.42/MWh. On the other hand, the lowest weekly averages were those of the Spanish and Portuguese markets, of €169.86/MWh in both cases. This is due to the gas price cap applied in the MIBEL market. In the rest of the markets, prices were between €317.69/MWh of the Nord Pool market and €492.44/MWh of the German market. The price registered in the market of the Nordic countries, despite being among the lowest in the continent, is the highest in its history so far.

Despite the fact that the MIBEL market prices were the lowest compared to the rest of the European markets, part of the consumers must pay a higher price as compensation for the gas price limitation applied in this market. In the Spanish market, the average of this price increased to €395.37/MWh in the week of August 29, which is the highest value in history.

Regarding hourly prices, the highest price was registered in the French market. In this market, a price of €1021.73/MWh was reached on August 30 between 21:00 and 22:00, which was the highest since the beginning of April in France.

During the week of August 29, the drop in gas and CO2 prices favoured the drop in prices in most European electricity markets. In addition, the wind energy production increased compared to the previous week in Germany, France and Portugal. On the other hand, the drop in wind and solar energy production in the Spanish market contributed to the increase in prices in this market.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of September 5 prices of most European electricity markets might decrease, influenced by the general increase in wind energy production.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

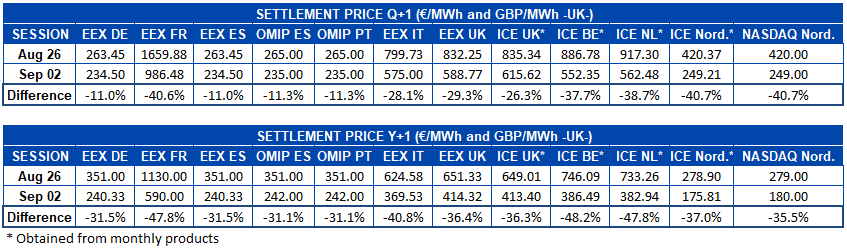

Electricity futures

In the week of August 29, electricity futures prices for the fourth quarter of 2022 registered significant falls in all European markets analysed at AleaSoft Energy Forecasting. The EEX market of France, the ICE market of the Nordic countries and the NASDAQ market also of the Nordic countries were the protagonists of the most pronounced declines, with decreases of 41% in each of them, if the settlement prices of the session of September 2 are compared with those of the session of August 26. In the case of the French market, it is a decrease of €673.40/MWh. In the rest of the markets the decreases were between 11% and 39%.

In the case of electricity futures for the next year 2023, a similar behaviour occurred. In the period between August 26 and September 2, prices fell in all analysed markets. The ICE market of Belgium led the percentage declines, with its price falling by 48%, followed closely by the ICE market of the Netherlands and the EEX market of France, which was the leader in absolute terms, with a drop of €540.00/MWh. The OMIP market of Spain and Portugal registered the least pronounced declines, with a decrease of 31%.

These drops in the futures prices are fundamentally due to the statements of Ursula von der Leyen, president of the European Commission, about the imminent possibility of making changes in the functioning of the European electricity markets given the excessively high prices that have been registered.

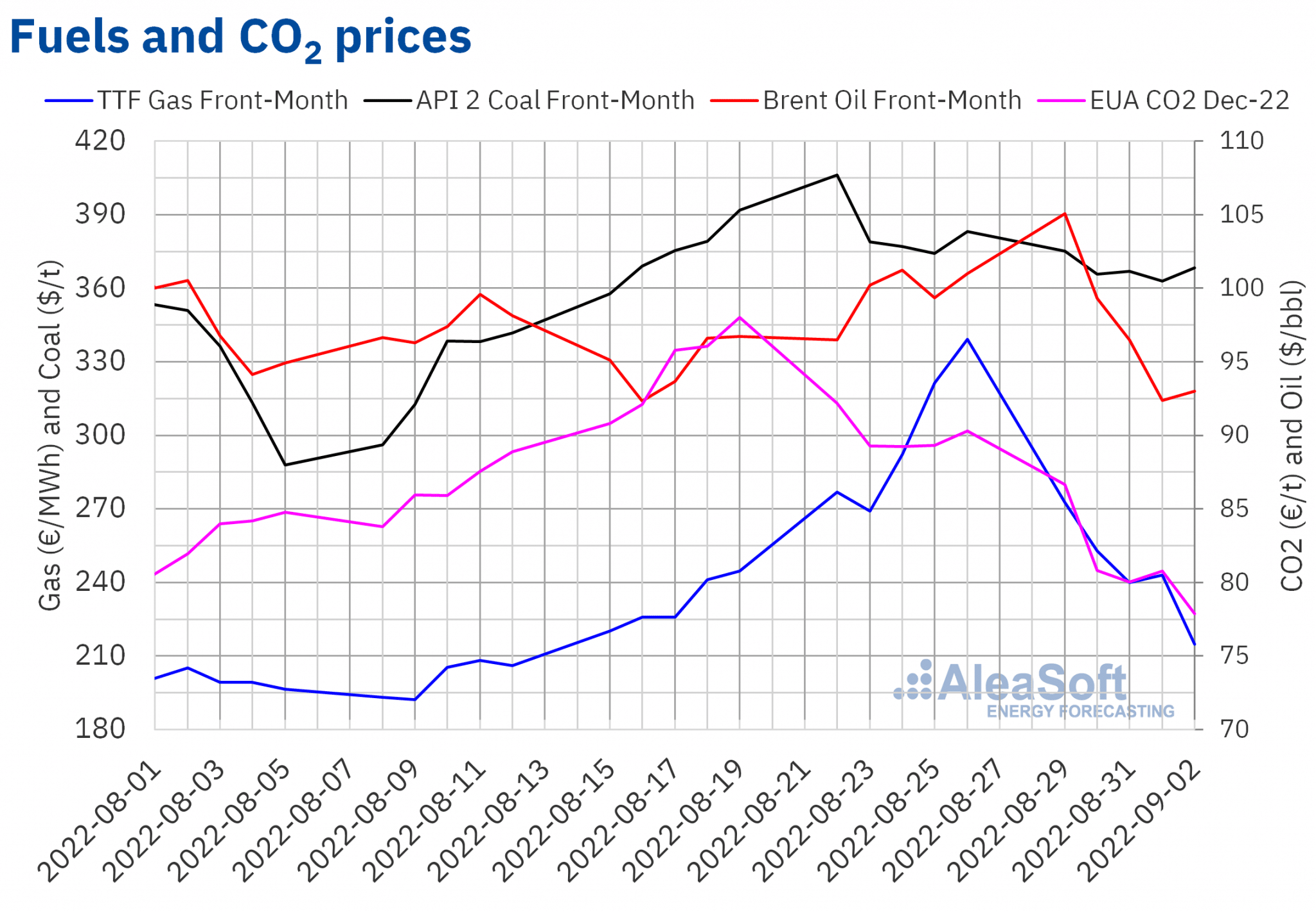

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market began the first week of September reaching the weekly maximum settlement price, of $105.09/bbl, on Monday, August 29. This price was 8.9% higher than that of the previous Monday and the highest since the end of July. However, subsequently, prices declined and remained below $100/bbl for the rest of the week. The weekly minimum settlement price, of $92.36/bbl, was registered on Thursday, September 1. This price was 7.0% lower than that of the previous Thursday.

Fears of a global recession and the new confinements in China due to COVID?19 generate concern about the evolution of the demand. Meanwhile, a possible revival of negotiations on the Iranian nuclear pact could lead to the lifting of sanctions on its oil exports. In this context, some OPEC+ member countries would be in favour of applying reductions in their production to keep prices around $100/bbl. Pending the results of the OPEC+ meeting of September 5, futures prices increased at the beginning of the second week of September.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, in the first week of September they registered decreases. As a result, on Friday, September 2, the weekly minimum settlement price, of €214.66/MWh, was reached. This price was 37% lower than that of the previous Friday.

After problems were detected during the maintenance work carried out on the Nord Stream 1 gas pipeline, it could not function again on Saturday, September 3, as planned. This fact increases fears of a total supply cut from Russia, which might favour an increase in prices. However, the reserves of European countries are reaching their objectives to get through the winter.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2022, in the first week of September they remained below €90/t, registering decreases almost every day. On Friday, September 2, the weekly minimum settlement price, of €77.89/t, was reached. This price was 14% lower than that of the previous Friday and the lowest since the end of July. News about possible measures to control the rise in energy prices exerted their downward influence on prices.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

On September 15, the monthly webinars of AleaSoft Energy Forecasting and AleaGreen are resumed, after the summer holidays. On this occasion, the invited speakers, Jorge Simão, COO at OMIP and Pablo Villaplana, COO at OMIClear, will analyse the importance of forward markets for the renewable energy development. The analysis table of the Spanish version of the webinar will also include the participation of Fernando Soto, Director?General of AEGE, who will speak about the auction of renewable energy PPA with electro?intensive consumers that the association he presides over is organising.

The webinar to be held on October 20 is also being prepared with guest speakers from Deloitte Carlos Milans del Bosch, Partner of Financial Advisory, and Luis Garcia Tasich, Manager of Global IFRS and Offerings Services. This will be the third time that speakers from this consulting firm will participate to analyse the renewable energy projects financing and the importance of the energy markets prices forecasting in audits and portfolio valuation. As usual, Oriol Saltó i Bauzà, Associate Partner at AleaGreen, and Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting, will participate in both editions of the webinars.

At AleaSoft Energy Forecasting, special promotions for short-, mid- and long?term price forecasting services for European electricity markets are being offered. The long?term price forecasting is necessary in the renewable energy projects financing. When the plant is already in operation, the short-, mid- and long?term forecasting is essential to manage a diversified energy sales strategy with contracts and coverage in all time horizons.