In the third week of October, the wind energy production increased compared to the previous week in all analysed European markets. The largest increase, of 433%, was registered in the Portuguese market, followed by the 195% rise of the Spanish market. In the Spanish and Portuguese markets, hourly and daily values not seen since last spring were registered. On the other hand, the solar energy production fell in general compared to the second week of October.

Solar photovoltaic and thermoelectric energy production and wind energy production

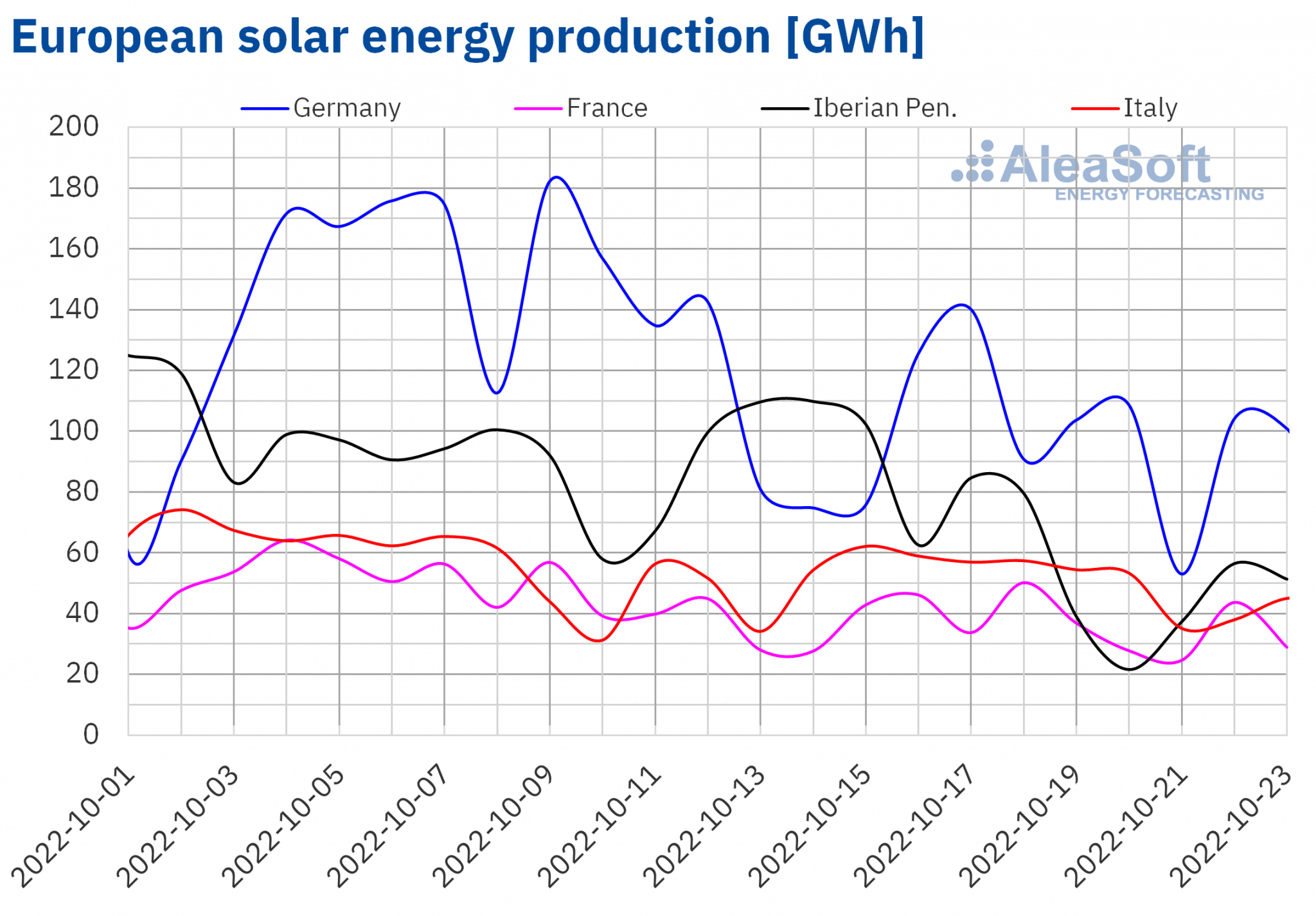

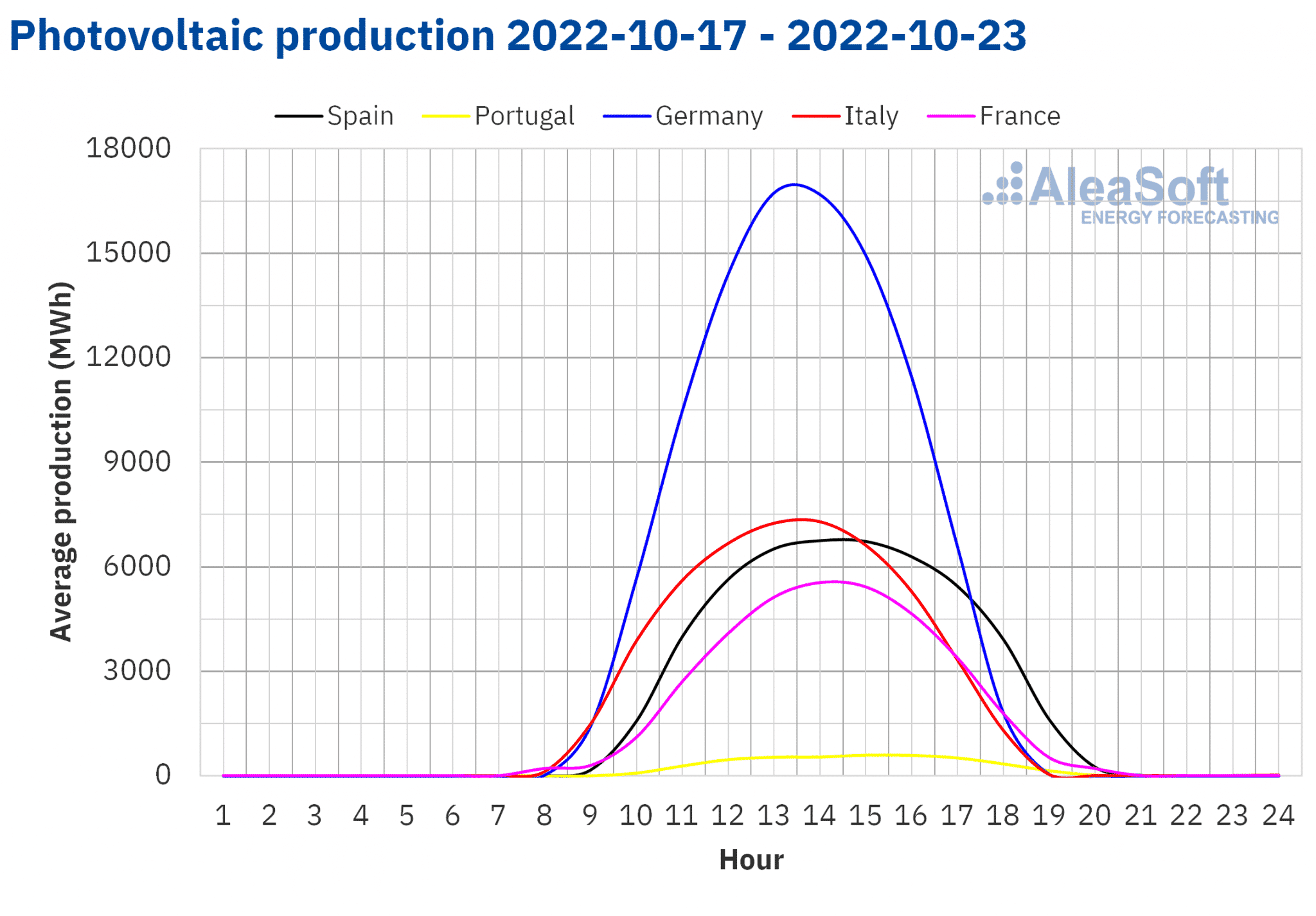

During the third week of October, the solar energy production decreased compared to the previous week in all European markets analysed at AleaSoft Energy Forecasting. The largest falls were those of the Portuguese and Spanish markets, of 43% and 39% respectively. In the German market, the decrease was 11% and in the French, 8.5%. The smallest decrease, of 2.5%, was that of the Italian market.

On the other hand, if the solar energy production of the first twenty?three days of October is compared with that of the same days of 2021, it increased in all analysed markets. The largest increase was that of the Portuguese market, of 18%. In the rest of the markets, the increases were between 4.0% of Spain and 14% of Italy.

For the fourth week of October, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates increases in production in Germany, Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

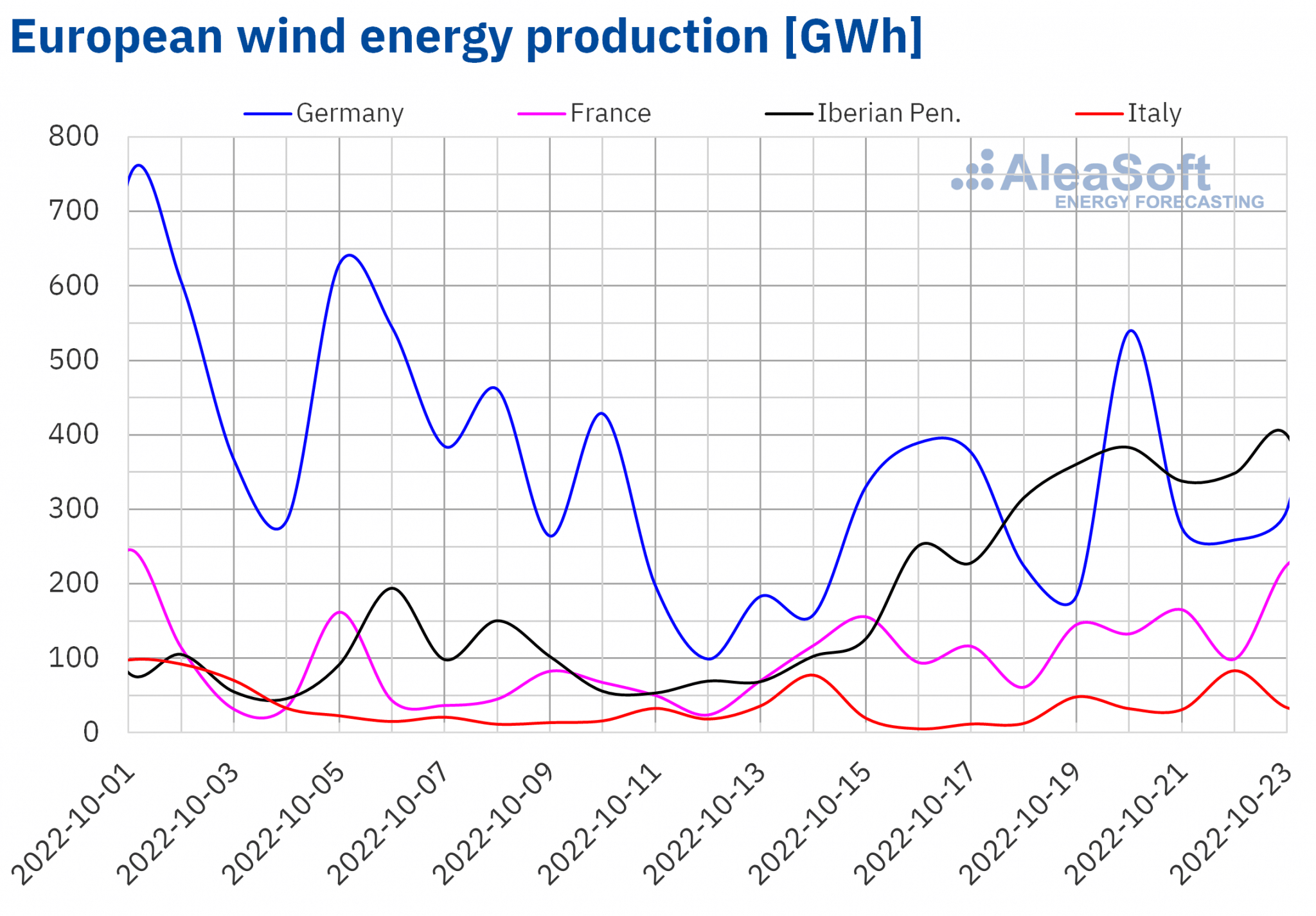

During the week of October 17, the wind energy production increased compared to the previous week in all markets analysed at AleaSoft Energy Forecasting. The largest increase, of 433%, was that of the Portuguese market, followed by that of the Spanish market, of 195%. In the rest of the markets, the increases in wind energy production were between 21% of the German market and 63% of the French market.

When comparing the wind energy production of the first twenty?three days of October with respect to that of the same period of the previous year, decreases were registered in the German and Italian markets, of 14% and 37% respectively. In the rest of the markets, the wind energy production increased. The largest rise, of 15%, was that of the Portuguese market.

Regarding the hourly wind energy production, on Wednesday, October 19, between 5:00 and 6:00 a value of 4483.15 MWh was reached in the Portuguese market, which was the highest since April 19. In the case of the Spanish market, on Thursday, October 20, between 15:00 and 16:00, the highest hourly wind energy production since April 24, of 15 124.27 MWh, was registered. On October 23, the highest daily wind energy production since April 23, of 317 GWh, was reached. In the case of the Portuguese market, the maximum daily wind energy production, of 90 GWh, was reached on Saturday, October 22, and it was the highest since April 19.

For the week of October 24, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates increases in production in Germany and France, while in Spain, Italy and Portugal the production with this technology might decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

At AleaSoft Energy Forecasting and AleaGreen, a personalised special promotion of the updated long?term price curve forecasting reports is being offered for some European markets. These reports have numerous advantages compared to other providers. For example, one of the characteristics that differentiates them is that they include hourly price forecasts covering a horizon of up to 30 years, a level of detail that is essential for the accounting of renewable energy projects, as was analysed in the webinar with speakers from Deloitte, AleaSoft Energy Forecasting and AleaGreen held on October 20.