The solar industry has shone brightly in recent years. Installation records have been set, and broken – and 2023 looks like no exception. But there is light and shade in the global outlook.

Our latest Global solar PV market outlook update explores the global trends and regional variations that inform our forecasts, helping the industry better understand this fast-paced sector and make more informed decisions. Fill in the form for a complimentary extract and read on for an introduction.

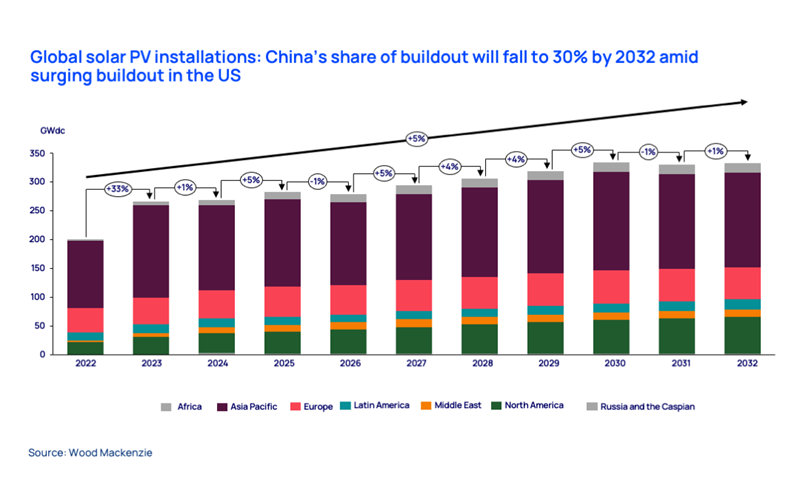

Solar buildout continues to accelerate in all regions

We expect to see PV buildout achieve record levels during 2023 at nearly 270 GWdc worldwide. This will continue to accelerate to an annual 330 GWdc by 2032, driven by:

- ambitious renewable energy targets

- increased electrification

- coal plant phaseouts

- energy security concerns

- expanding policy support

- falling solar levelised cost of energy (LCOE) levels.

China continues to dominate the solar supply chain

China will continue to lead PV manufacturing for at least the next five years. We expect the nation to shift the focus of their exports from modules to upstream cells and wafers. Policy incentives for local PV manufacturing in the US, Europe and India are not expected to significantly chip away at China’s market share in the near term.

Meanwhile, massive expansion of manufacturing capacity in China is pushing solar installations to record levels. Developers are taking advantage of plummeting polysilicon prices to rapidly expand utility-scale solar plants despite increased curtailment risks.

US solar is set to deliver a 39% year-on-year recovery in 2023

The US solar industry experienced its largest first quarter on record in Q1 2023. The Inflation Reduction Act (IRA) supported additions of more than 3 GW to US development pipelines, a 25% year-on-year increase. US solar is on course to deliver a 39% year-on-year recovery this year thanks to a healthy development pipeline and continued supply chain relief as importers make progress on Uyghur Forced Labor Prevention Act (UFLPA) compliance.

Utility-scale solar installations in the US achieved a strong 66% year-on-year rebound in Q1 thanks to previously delayed projects coming online – though headwinds such as interconnection delays and lingering supply chain challenges remain. And while residential solar also set a Q1 record in 2023, economic uncertainty is leading to a sales slowdown.

Meanwhile, the Americas region has seen solar asset transaction activity decline compared to 2022. IRA-driven excitement in the US has been followed by a relatively quiet Q1 on this front as developers assess new opportunities. Canada has helped partially offset this – increased interest in the growing Albertan solar market has drawn 2.3 GW of transactions in the province.

In Europe, the UK leads the pack for residential solar growth

European household and non-household electricity rates declined faster than expected in the first months of 2023, averaging a 27% decline due to a drop in natural gas demand in March. Q1 2023 solar installations haven’t reflected this yet, but combined with inflation and interest rate hikes, we expect growth will be much more muted compared to the staggering growth seen last year.

The UK saw the best results for quarterly residential PV installations in seven years in Q1 2023. Levels were double Q1 2022 volumes. We believe this is partly due to the contract backlog from 2022, when waiting times of up to a year were reported. If this pace continues, UK residential PV installed capacity will grow by at least 60% in 2023.

Meanwhile, Romania has become a top distributed PV emerging market in Europe. We expect it to hit 6.5 GWdc of cumulative distributed PV capacity by 2027. A €610 million subsidy programme is expected to support 150,000 home installations, driving 112% year-on-year growth in our residential forecast for the Eastern European market in 2023.

Get a closer look at global solar trends

Our Q2 Global solar PV market outlook update delivers much more data and considered analysis of key global trends and regional variations. Fill in the form at the top of the page for a complimentary extract.

Michelle Davis

Head of Global Solar

Juan Monge

Principal Analyst, Distributed Solar, Europe