Low-carbon hydrogen has a critical role to play in the energy transition, particularly in decarbonising hard-to-abate sectors. In fact, we estimate the investable opportunity from hydrogen at up to US$2 trillion by 2050.

Having shaken off energy crisis related jitters, the sector is pushing forward with new project announcements and ambitious electrolyser manufacturing plans. So, what’s driving this renewed confidence and what do investors need to know to capitalise on hydrogen market growth?

Our?‘Q2 2023 Global Hydrogen Market Tracker’?draws on insight from?our Lens Hydrogen data analytics platform to provide detailed analysis of the growing hydrogen market opportunity. Read on for a quick overview of key sector developments, and fill in the form to download a complimentary copy of the report.

1. Supportive policy announcements abound in the wake of the US IRA

The momentum created by the US Inflation Reduction Act (IRA) has helped boost related sectors globally, with low-carbon hydrogen no exception. For investors, comparing the effect of hydrogen-related policy and legislation on costs and pricing will be a key element of making informed, data-driven investment decisions.

As well as the US Department of Energy’s finalised Clean Hydrogen Strategy and Roadmap and the EU’s long-awaited Delegated Acts, numerous other countries have announced vital policy support. Canada’s inclusion of clean?ammonia in its Clean Hydrogen Tax Credit stands out, and should make the country a focus for ammonia production. Other countries making recent policy announcements include Japan, Australia, India, South Korea, South Africa, Spain and Portugal.

In terms of project funding, the EU is in the lead, with around US$167 billion in financial support planned. However, Japan is the most ambitious single country, aiming to put US$107 billion into developing its hydrogen supply chain over 15 years, with money to come from both private and public investment.

2. The project pipeline continued to grow in Q2 2023

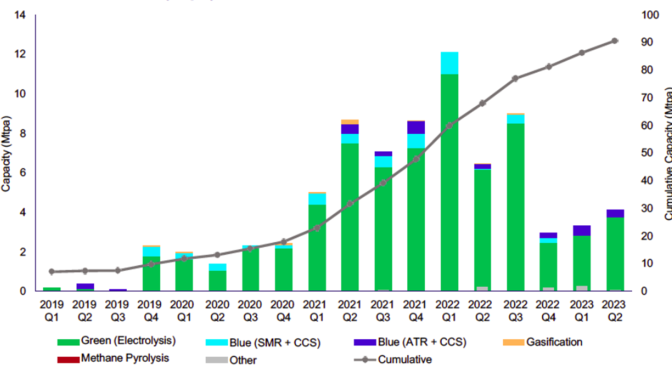

A consistent upward trend in newly announced project capacity in the first half of 2023 suggests fallout from the energy crisis has been temporary, boding well for the future. Over 4.0 Mtpa of additional capacity was announced in Q2 2023, bringing cumulative global proposed capacity to well over 80 Mtpa (see chart below).

Low-carbon hydrogen project announcements by quarter and type, Q1 2019 to Q2 2023

Low-carbon hydrogen project announcements by quarter and type, Q1 2019 to Q2 2023

Source: Wood Mackenzie Lens Hydrogen & Ammonia Service

*The GWe figure is obtained based on Wood Mackenzie’s internal conversion factors

Green hydrogen accounted for the vast majority of growth, with more than 20 GWe of electrolysis capacity announced. Significant announcements included the 5.4 GWe China General Nuclear Bahia project in Brazil, the 5.0 GWe Amp Energy Cape Hardy Hydrogen and Ammonia project in Australia, and the 2.0 GWe LEAG Green Hydrogen Hub in Germany.

3. Europe, the US and Australia account for over half of the pipeline

Thanks to the positive impact of the IRA, the US now has easily the largest hydrogen project pipeline of any country. It currently accounts for 18% of total announced capacity, pushing Australia firmly into second place with 14%. A further 20% is in mainland Europe and 9% in the UK, so that altogether these regions account for 61% of overall capacity.

While Europe is advancing the highest number of projects, North America offers early scale, with the generous tax credits available under the IRA helping a strong flow of US projects towards final investment decision (FID).

The majority of announced projects are for green hydrogen, which is produced using renewable energy and electrolysis and is the cleanest form of hydrogen production. However, it’s also expensive, making access to cheaper power in the form of excess renewable capacity highly desirable for project economics.

It’s worth noting that the most advanced projects are dominated by blue hydrogen, especially in the US. Blue hydrogen is mainly produced from natural gas and creates carbon dioxide as a by-product, so it’s a low carbon solution, but not strictly a ‘clean’ one. However, it enjoys a significant cost advantage over green hydrogen, particularly where natural gas is cheap, as in the US and Canada.

4. Ammonia’s net zero role makes it the key end use for low-carbon hydrogen

The leading end-use for hydrogen is in producing ammonia, an incredibly versatile compound of nitrogen and hydrogen that can be used as a feedstock, fuel and hydrogen carrier in a wide range of industries.

Currently, 70-80% of global ammonia supply is used in fertiliser production. However, it’s ammonia’s potential as a source of ‘clean’ energy that may become the strongest driver of future low-carbon hydrogen demand. Tracking developments in the ammonia sector will therefore be an important element of understanding hydrogen market dynamics.

5. More hydrogen projects are needed over the long term

The increasingly supportive policy and funding environment, including clear production capacity targets for 2030 from many countries, means around two-thirds of announced projects are targeting start-up by the end of the decade.

In our base-case scenario, if all projects progress as planned, supply would be considerably higher than demand at that point. However, as the energy transition accelerates, demand is likely to increase considerably, and many projects are likely to struggle to progress at the pace required to go live before 2030 anyway.

In the longer term, based on our demand forecasts there will be a substantial need for more projects to meet demand to 2050.

Maximising the opportunity

The market for low-carbon hydrogen is evolving rapidly. To make the most of the financial opportunity it presents, investors need to keep their finger on the pulse of market dynamics. As well as monitoring announced capacity and demand growth, it will be vital to be able to analyse project economics, tracking the evolution of costs and assessing the likely trajectory of future pricing. Armed with this information, investors will be well-positioned to capitalise on the sector’s future growth.

Murray Douglas

Head of Hydrogen Research

Low carbon hydrogen continues to recover convincingly from the energy crisis-driven slump at the end of 2022, with the second quarter of 2023 showing particularly strong movement from electrolysis projects.

Expansion is rapid, with more than 1000 projects now in progress across 70 countries, and 100 new roadmaps, policies and strategies in the works.

Europe, Australia and the US dominate the global pipeline, with 20%, 14% and 18% of the share, respectively, but the market is continually shifting, and activity is building around the world.

Our ‘Q2 2023 Global Hydrogen Market Tracker’ draws insight from Lens Hydrogen, covering over 1,000 low-carbon developments, and providing detailed analysis. Read on for a selection of high-level insights from the report. And if you’d like to learn more about the road ahead for hydrogen, fill in the form for a complimentary extract from our latest ‘Hydrogen strategic planning outlook’.

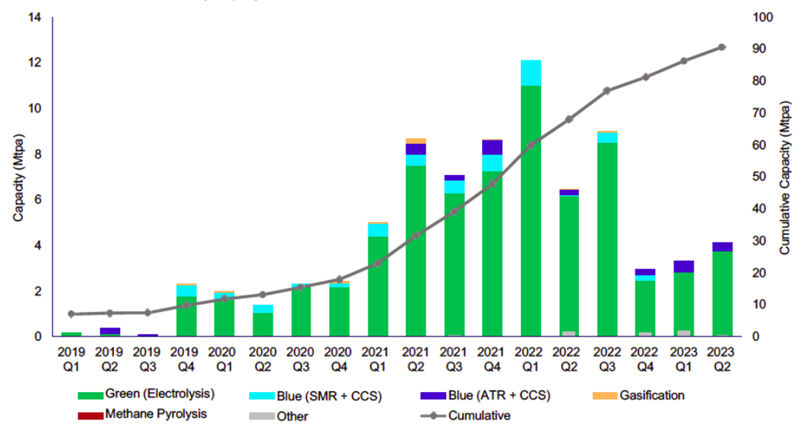

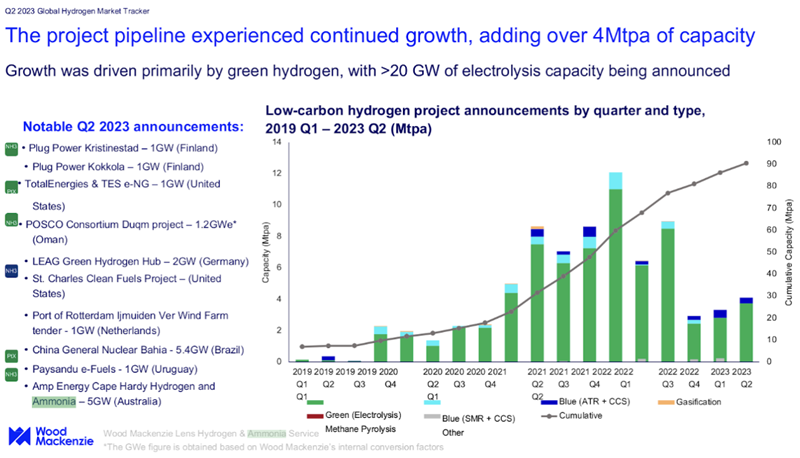

1. The project pipeline is recovering well

The rebound is continuing, albeit not yet at the record levels of 2021 and early 2022. Over 4 Mtpa of capacity was added in the second quarter of 2023, and global proposed low-carbon hydrogen capacity now exceeds 90 Mtpa.

Among the most notable announcements globally was Australia’s Amp Energy Cape Hardy Hydrogen and Ammonia, with 5GW of capacity. Other 1GW+ projects include Plug Power’s Kristinestad and Kokkola hubs in Finland (1GW each), TotalEnergies & TES e-NG in the United States (1GW), POSCO Consortium Duqm project in Oman (1.2GWe) and LEAG Green Hydrogen Hub in Germany (2GW).

2. Supportive policies are fuelling long-term projects globally

The market is scaling up as policies continue to emerge around the world, in the wake of the USA’s Inflation Reduction Act and the global drive to net zero. This heavily-funded push to back hydrogen is sending ripples through global supply chains.

The Biden administration’s ‘National Clean Hydrogen Strategy and Roadmap’ has three key priority areas: targeting “strategic, high-impact uses for clean hydrogen”; cutting the costs of low-carbon hydrogen production, and establishing regional clean hydrogen hubs. This strategy aims to focus hydrogen use into hard-to-abate sectors, rather than competing with other technologies.

Australia is also putting some federal budget behind hydrogen, with A$2 billion now set aside for the “Hydrogen Headstart” programme. According to the Australian Renewable Energy Agency (ARENA), the program will support two to three large projects and could provide 1GW of electrolyser capacity by 2030. The budget also announced it will commit A$38.2 million to develop a Guarantee of Origin (GO) Certificate.

In Japan, the government’s ‘Basic Hydrogen Strategy’ aims to attract $107 billion of investment over 15 years to develop the country’s hydrogen supply chain. The revised Basic Hydrogen Strategy increased the hydrogen supply target sixfold to 12Mtpa by 2040, to be supported by a CfD-like subsidy scheme. This new target serves as an interim step towards the previous goal of 3Mtpa by 2030 and 20Mtpa by 2050. The government has already spent $5.7 billion on hydrogen-related technology subsidies.

Portugal is more than doubling its capacity in the coming decades; the government has raised the 2030 national target for green hydrogen production from 2.5GW to 5.5GW. Download the Hydrogen strategic planning outlook to find out how the governments in other countries are responding and to find out more about the wider corporate landscape.

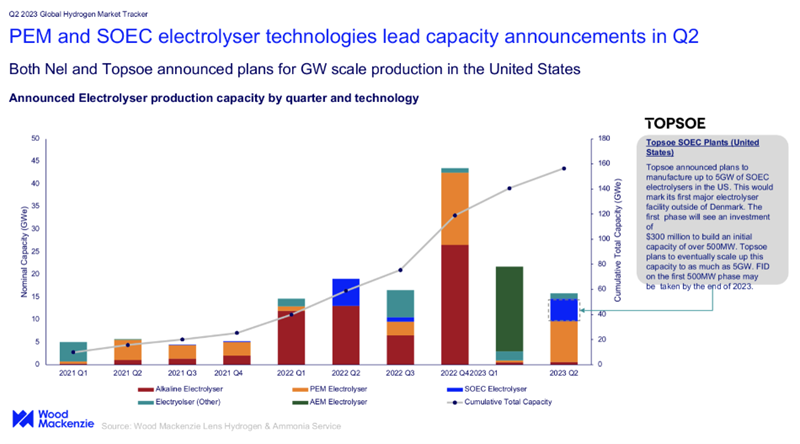

3. Electrolyser technologies now lead capacity announcements

PEM and SOEC electrolyser technologies dominated capacity announcements in the second quarter of 2023, with both Nel and Topsoe announcing plans to scale up production in the United States. Topsoe aims to manufacture up to 5GW of SOEC electrolysers in the US, marking its first major electrolyser facility outside of Denmark.

The first phase will see an investment of $300 million to build an initial capacity of over 500MW. Topsoe plans to eventually scale up this capacity to as much as 5GW. The final investment decision on the first 500MW phase may be taken by the end of 2023.

Capacity is increasing fast, and expected to double by this time next year, but no single country is emerging as the dominant manufacturer of electrolysers. Europe will retain its position as a manufacturing hub for many vendors, with China and the US potentially offering more potential to scale.

4. Hydrogen’s flexibility could allow prices to come down

Hydrogen is not just a carbon-free power, it may also have positive economic potential. It is currently significantly more expensive than natural gas, but one path to reducing the cost is to give electrolysers access to low-cost electricity. If electrolysis can be judiciously timed in response to prices or market forces, hydrogen could be created more affordably – but this will depend on the availability of the power required for the process.

Variable renewables could be put to use, here: they tend to complement electrolysers because both are able to make use of clean power when it’s available, and cut back when that power is needed by the grid. Renewables could in theory sell power to hydrogen hubs at a discount when demand is low, and switch to selling to utilities when demand is high.

Some believe the additional demand from electrolyzers, coupled with additional supply from clean projects could result in a sturdier, more reliable power system and a positive feedback loop that supports both industries.

Our Lens Hydrogen tool will allow you to optimise your hydrogen production and cost structure. You’ll gain an understanding of the full cycle of hydrogen costs, and get valuable insights into the future of the industry by exploring our forecast for the levelised cost of hydrogen up to 2050. Tailor your analysis by modelling key assumptions such as nameplate capacity, electricity feedstock, load factor, and tax incentives, to better understand the impact on the cost of hydrogen.

5. Ammonia continues to be the leading end-use

A versatile feedstock, fuel and carrier for hydrogen, ammonia continues to be the predominant end-use sector for low-carbon hydrogen.

You can monitor the ammonia supply and demand situation, pricing and LCOA within our Lens Hydrogen tool. Our tool allows you to explore ammonia assets on a map, see who is involved in each project, and delve into the specifics of over 850 plants.

We also offer a comprehensive ammonia dataset via the data grid and Lens Direct. With a comprehensive and seamless view of your hydrogen and ammonia assets, you can easily explore potential offtake opportunities.

Murray Douglas

Head of Hydrogen Research