Demand and prices in European electricity markets rise due to low temperatures.

In the second week of January, most European electricity markets registered an increase in prices compared to the previous week. The increase in demand after the beginning of the year, in a week with colder temperatures than the first week of the year, favored this behavior. Solar energy production rose in several markets, but wind energy production fell in almost all markets. On January 12, CO2 futures reached the lowest value since March 8, 2022.

Solar photovoltaic, solar thermoelectric and wind energy production

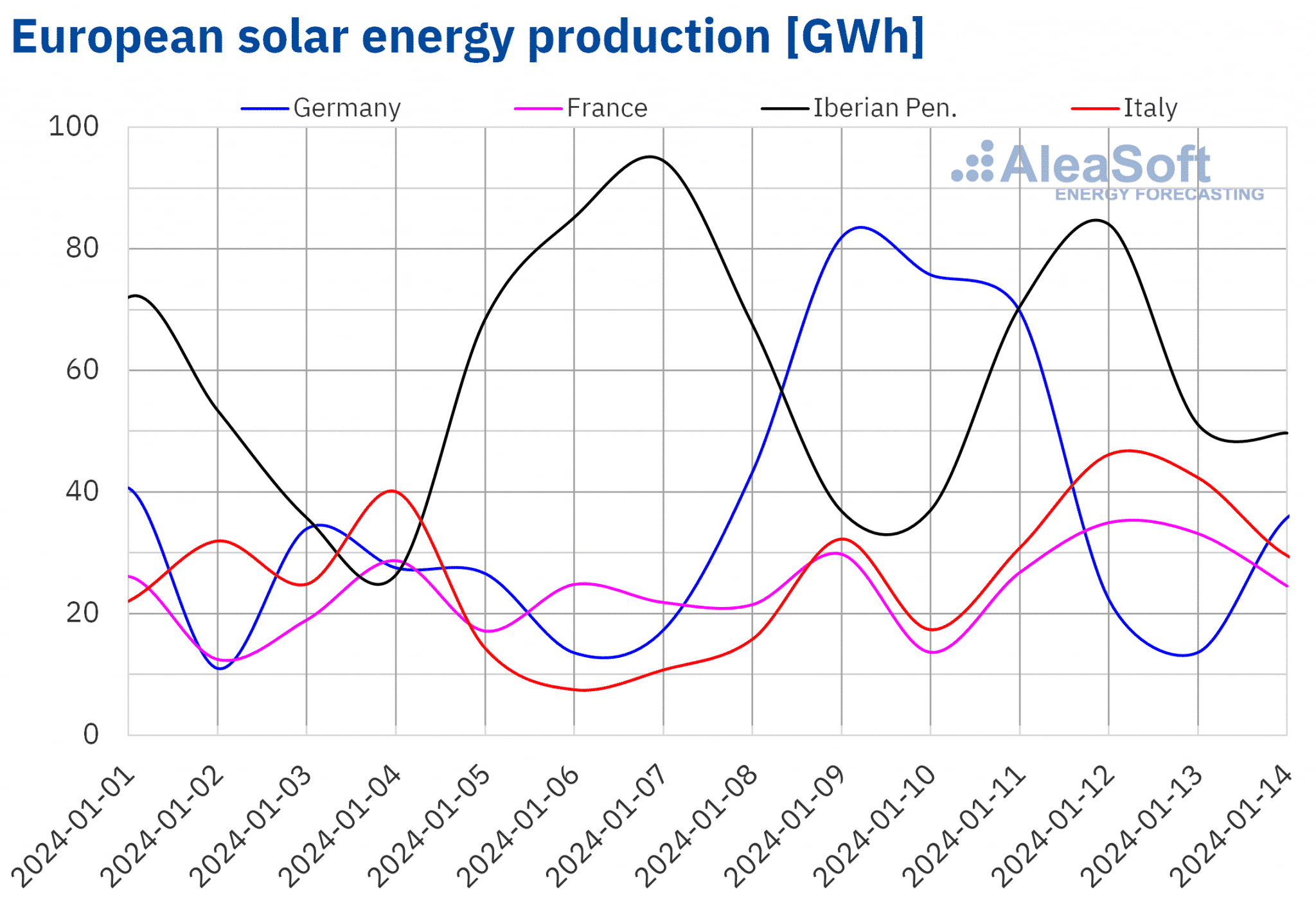

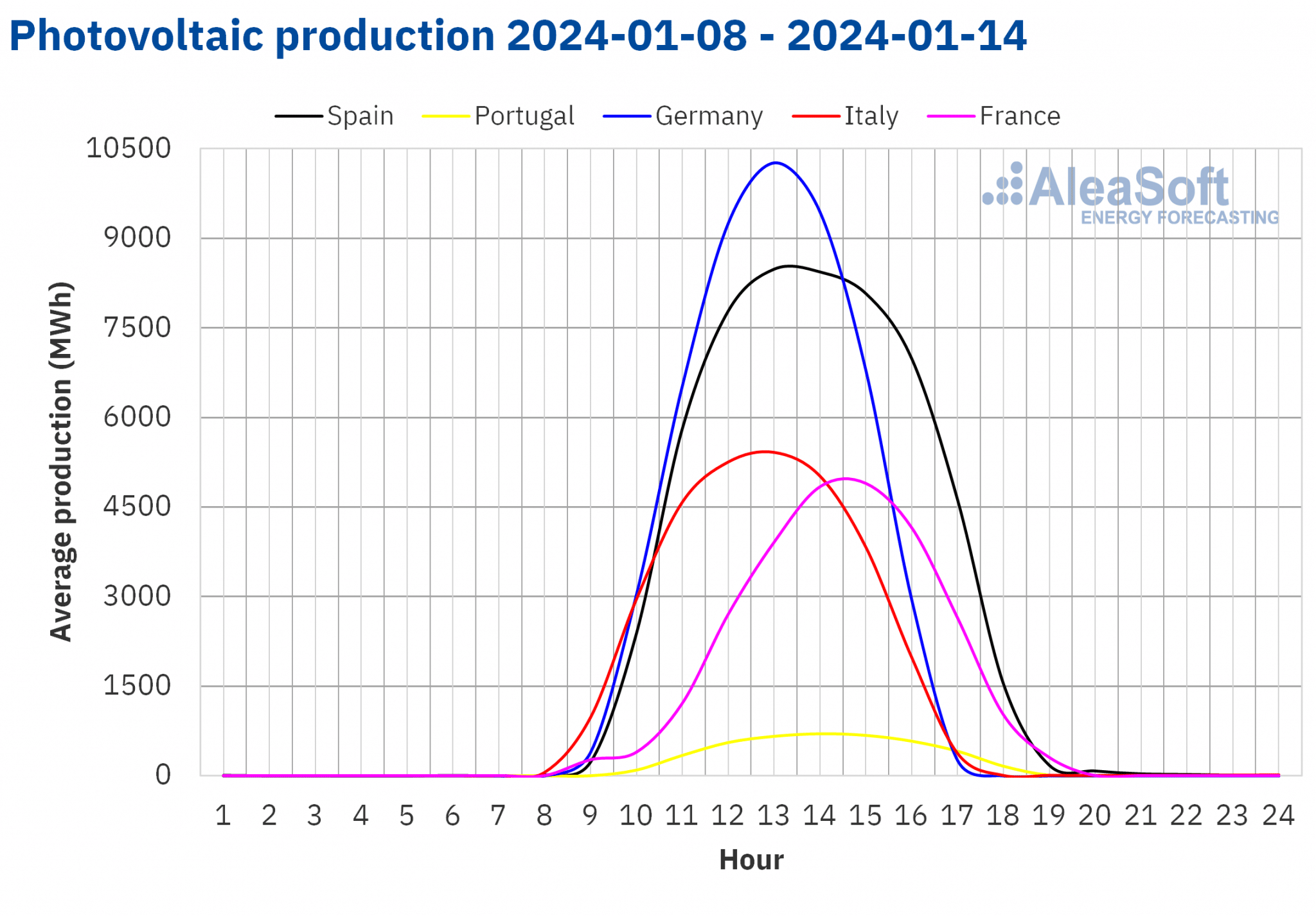

In the week of January 8, solar energy production increased in most major European electricity markets. The German market had the largest increase, up 101%, while the French market registered the smallest increase, up 23%. The exception was the Iberian Peninsula, where solar energy production decreased, by 29% in Portugal and 6.8% in Spain.

On January 9, the German market registered 82 GWh of solar energy generation, the highest value since early November 2023.

According to AleaSoft Energy Forecasting’s solar energy production forecasts for the week of January 15, it will increase in Germany and Spain, while it will decrease in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

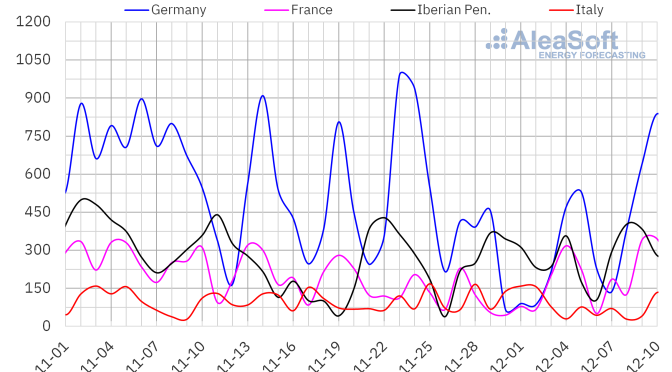

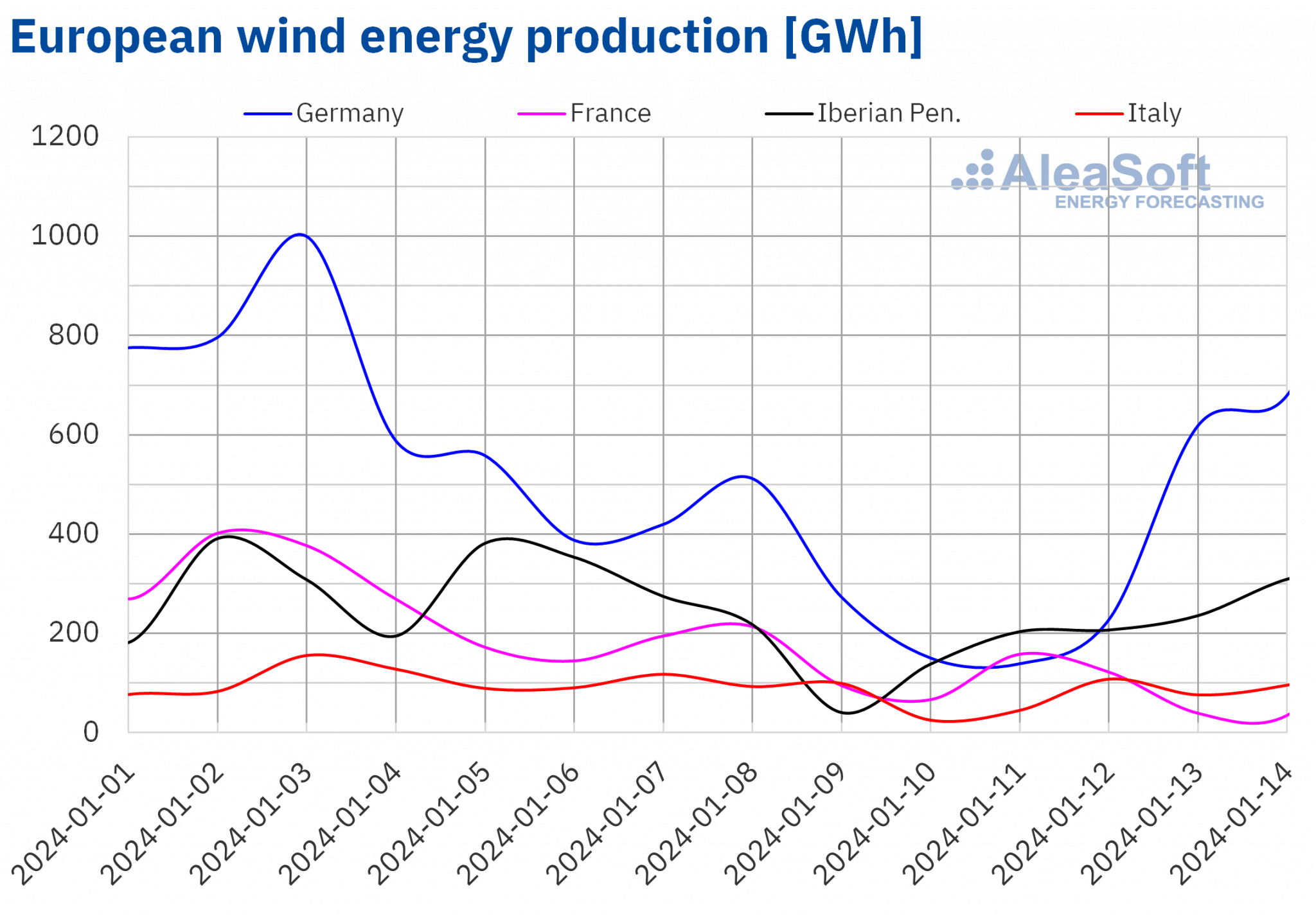

In the second week of January, wind energy production decreased in most major European electricity markets compared to the previous week. Falls ranged from 60% in the French market to 27% in the Italian market. Only Portugal registered a 13% increase in wind energy generation.

For the week of January 15, AleaSoft Energy Forecasting’s wind energy production forecasts indicate an increase in the analyzed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

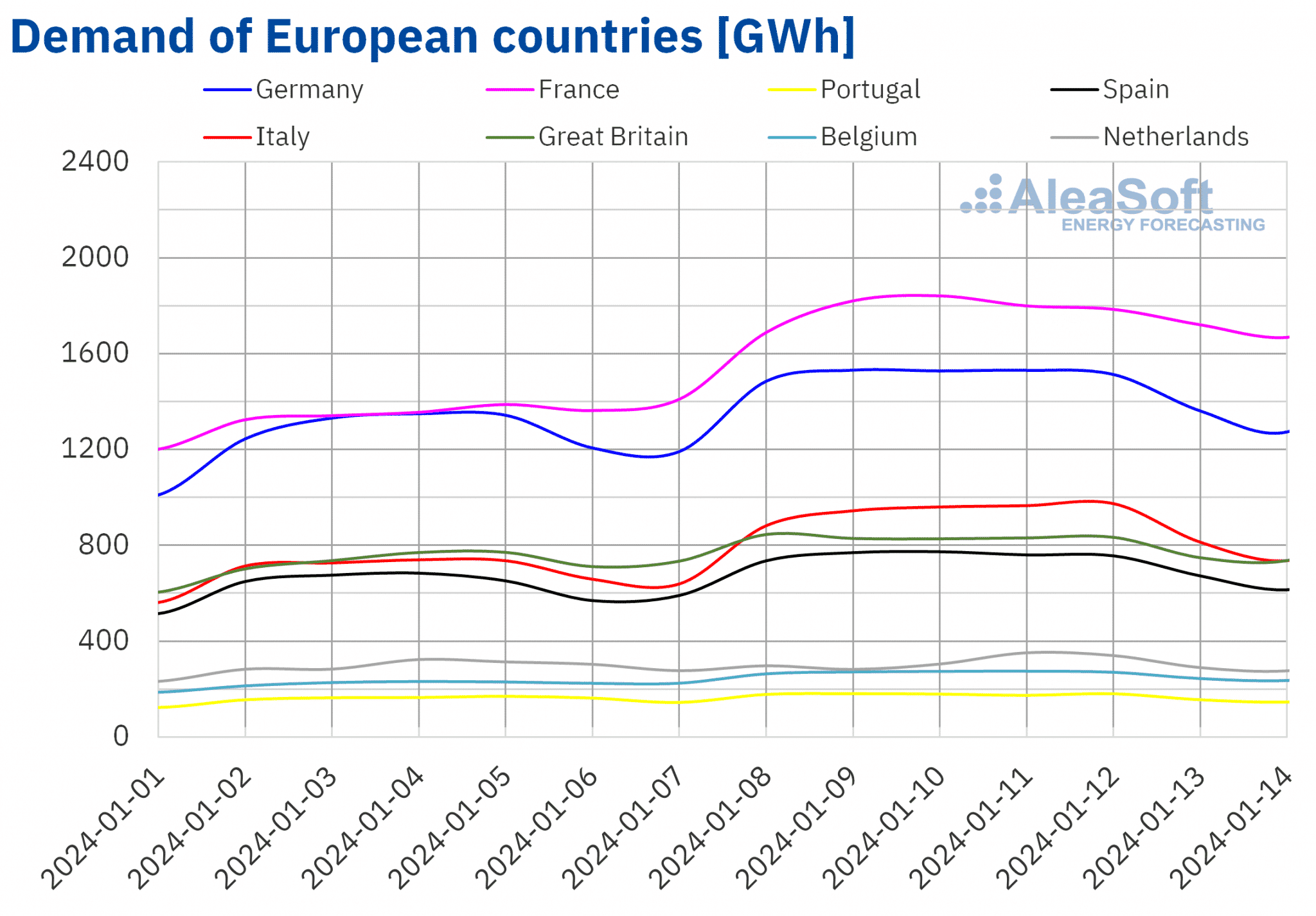

Electricity demand

In the week of January 8, all major European markets registered an increase in electricity demand compared to the previous week, recovering after the beginning of the year vacations. In most cases, demand registered a double?digit percentage increase, with the Italian and French markets leading the way with a 31% increase. Among all analyzed markets, the Dutch market had the smallest increase, 6.3%.

At the same time, in all analyzed markets, average temperatures decreased compared to the first week of the year. This also contributed to the increase in electricity demand. Average temperature decreases ranged from 8.2 °C in Belgium to 2.1 °C in Portugal.

According to AleaSoft Energy Forecasting’s demand forecasts for the week of January 15, the upward trend will continue in the German, Italian, British, Belgian and Dutch markets. On the other hand, the Iberian Peninsula and French markets will register a drop in demand.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

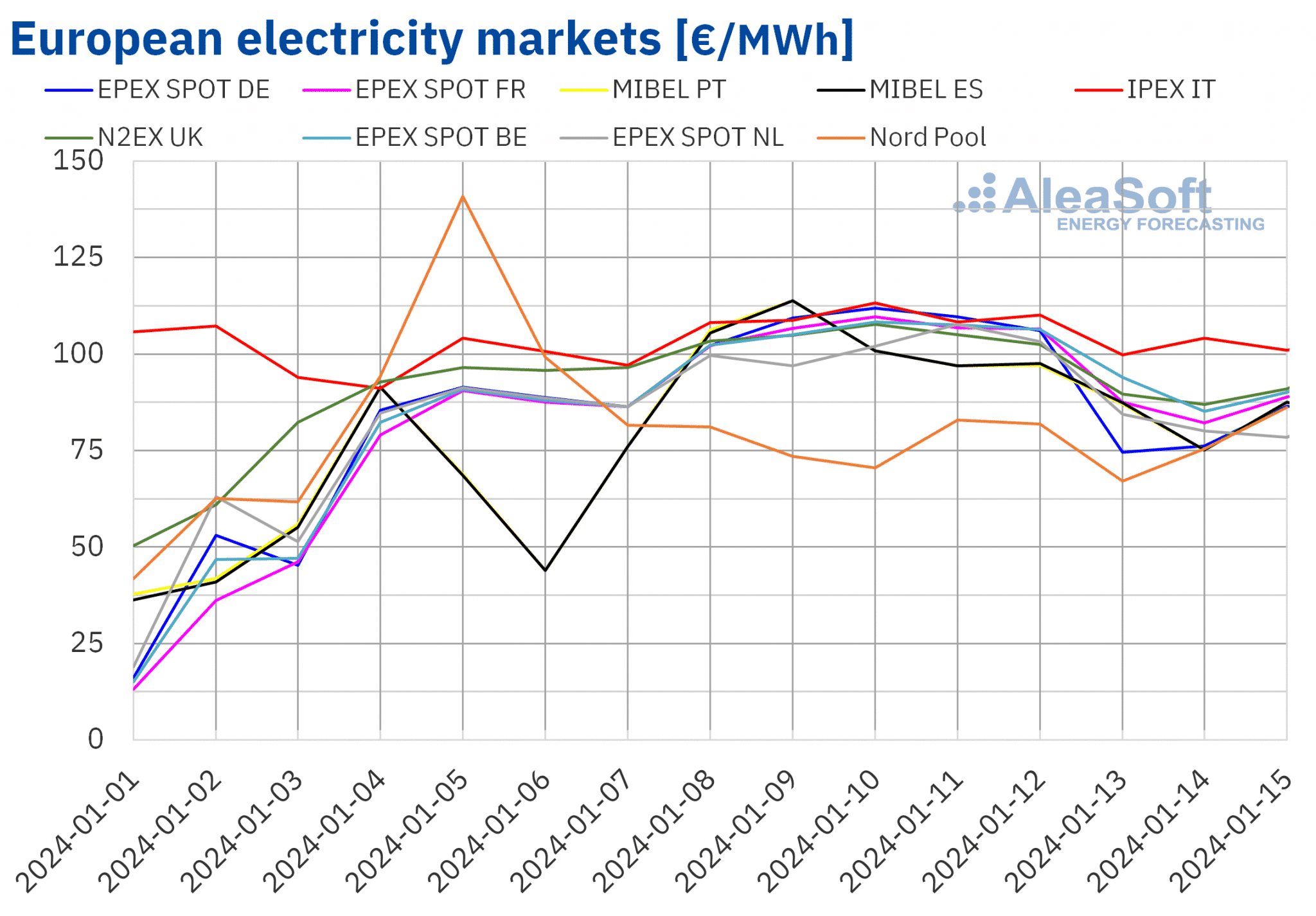

European electricity markets

In the week of January 8, prices in almost all major European electricity markets increased compared to the previous week. The exception was the Nord Pool market of the Nordic countries, with an 8.5% decrease. In contrast, the MIBEL market of Portugal and Spain reached the largest percentage price rises, 63% and 64%, respectively. The IPEX market of Italy registered the smallest increase of 7.5%. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices rose between 22% in the N2EX market of the United Kingdom and 60% in the EPEX SPOT market of France.

In the second week of January, weekly averages were above €95/MWh in almost all analyzed European electricity markets. The exception was the Nordic market, which registered the lowest average, €76.06/MWh. On the other hand, the Italian market reached the highest weekly price, €107.50/MWh. In the rest of analyzed markets, prices ranged from €96.26/MWh in the Dutch market to €101.24/MWh in the Belgian market.

As for hourly prices, on January 10, the Belgian, British and French markets registered the highest hourly prices since the first half of December, which were €143.79/MWh between 17:00 and 18:00 CET in France and Belgium, and €123.97/MWh between 18:00 and 19:00 CET in the N2EX market. Something similar happened on Thursday, January 11, between 17:00 and 18:00 CET, when the German and Dutch markets reached the highest prices since the first half of December, which were €150.09/MWh and €147.06/MWh, respectively.

During the week of January 8, the increase in electricity demand and the fall in wind energy production in most analyzed markets led to higher prices in the European electricity markets. The drop in solar energy production on the Iberian Peninsula also contributed to the price increase in the MIBEL market.

AleaSoft Energy Forecasting’s price forecasts indicate that in the third week of January prices might decrease in European electricity markets. Increased wind energy production might contribute to this behavior. In addition, solar energy production might increase in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

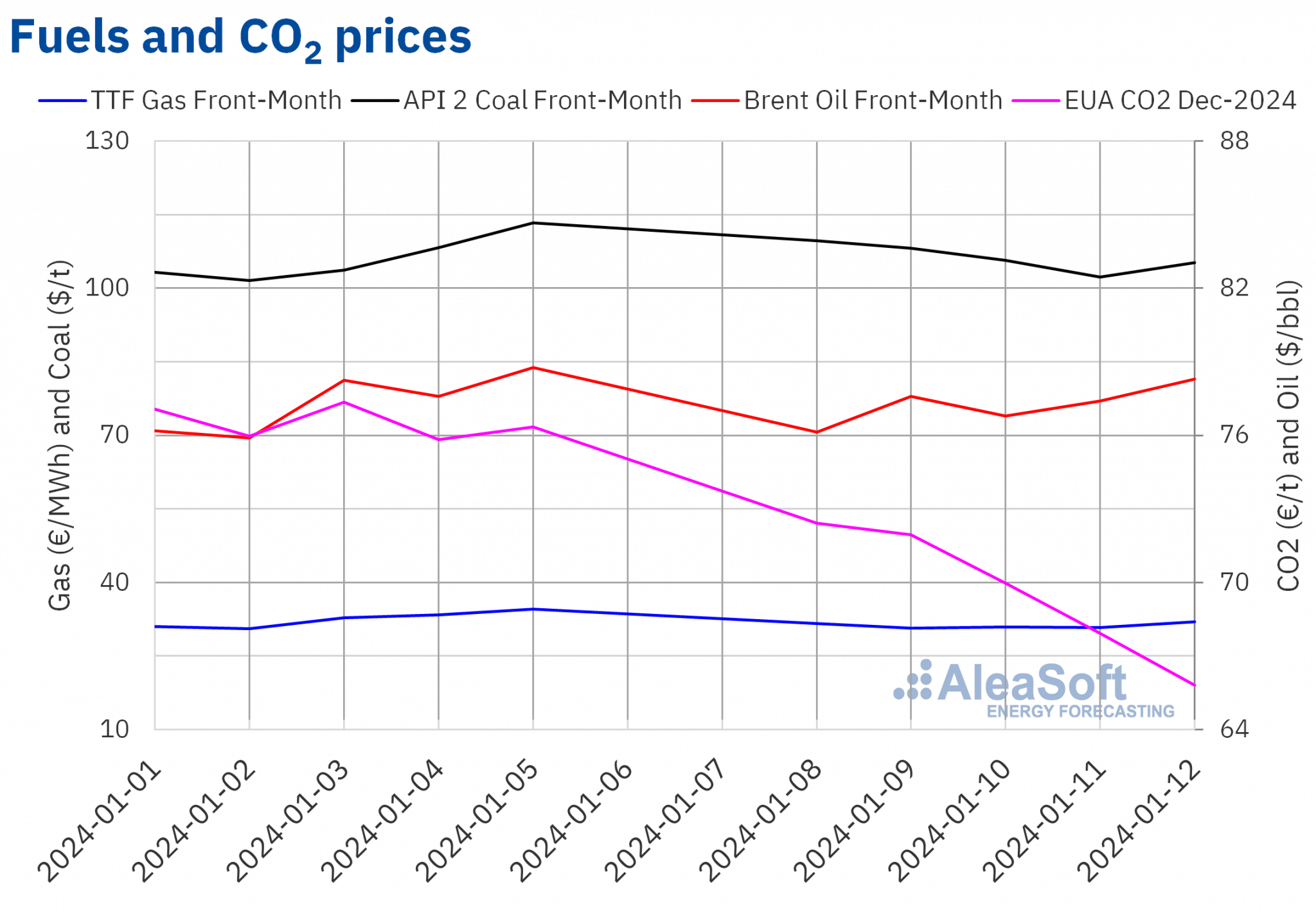

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market, on Monday, January 8, registered their weekly minimum settlement price of $76.12/bbl, after a 3.4% drop from the last session of the previous week. During the second week of January, prices recovered. In the last session, Brent oil futures reached their weekly maximum settlement price of $78.29/bbl. This price was only 0.6% lower than the previous Friday.

Increased instability in the Middle East contributed to the price increase at the end of the second week of January. However, supply levels were not affected by the conflict. This prevented further price rises. On the other hand, data on the increase in US crude oil stocks also exerted a downward influence on prices in the second week of January.

As for TTF gas futures in the ICE market for the Front?Month, on Monday, January 8, they registered an 8.6% drop compared to the last session of the previous week. The settlement price was €31.58/MWh. According to the data analyzed at AleaSoft Energy Forecasting, in the rest of the sessions of the week, settlement prices were also below €32/MWh. On Tuesday, January 9, these futures reached the weekly minimum settlement price, €30.64/MWh. On the other hand, on Friday, January 12, after a 3.8% rise, they registered their weekly maximum settlement price, €31.99/MWh. However, this price was still 7.4% lower than the previous Friday.

At the beginning of the second week of January, forecasts of milder temperatures than initially expected exerted their downward influence on prices of these futures. However, an unplanned decline in the gas flow from Norway, the worsening Middle East conflict and forecasts of low temperatures contributed to the price rise on Friday, January 12. Nevertheless, high levels of European reserves continued to limit price increases.

As for CO2 emission rights futures in the ICE market for the reference contract of December 2024, they reached their weekly maximum settlement price, €72.42/t, on Monday, January 8. This price was already 5.1% lower than on the previous Friday. The downward trend continued during the rest of the second week of January. As a result, on Friday, January 12, these futures registered their weekly minimum settlement price, €65.81/t. This price was the lowest since March 8, 2022. The proximity of the start of the 2024 emission rights auctions, scheduled for Monday, January 15, exerted a downward influence on prices of these futures during the second week of January.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe, the financing of renewable energy projects and PPA

This Thursday, January 18, the first webinar of 2024 of AleaSoft Energy Forecasting and AleaGreen will take place. This will be the fortieth in the monthly webinar series. In addition to the prospects for European energy markets for 2024, the topics analyzed in the webinar will be the current state of regulation on PPA and renewable energy and virtual PPA. Speakers from PwC Spain will participate for the fourth time in the webinar series.