European electricity market prices continued to fall due to less cold temperatures.

In the fourth week of January, European electricity market prices continued the downward trend that started in the previous week. Less cold temperatures drove down demand while gas and CO2 prices continued to fall. The exception was the Iberian market, where the decline in wind energy production led prices to rise above those of the previous week. Weekly photovoltaic energy production in Germany and Spain was the highest for a January month.

Solar photovoltaic and wind energy production

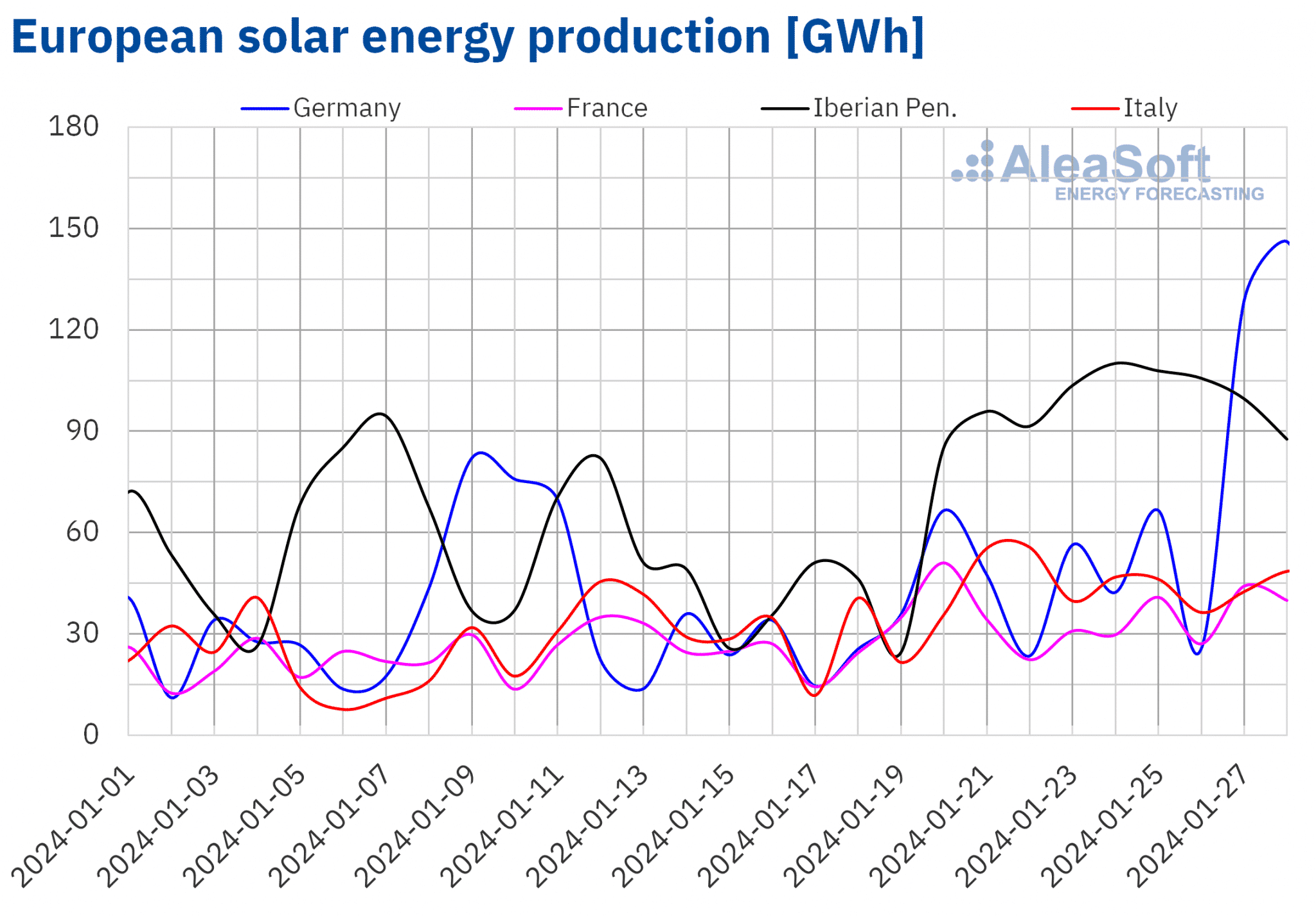

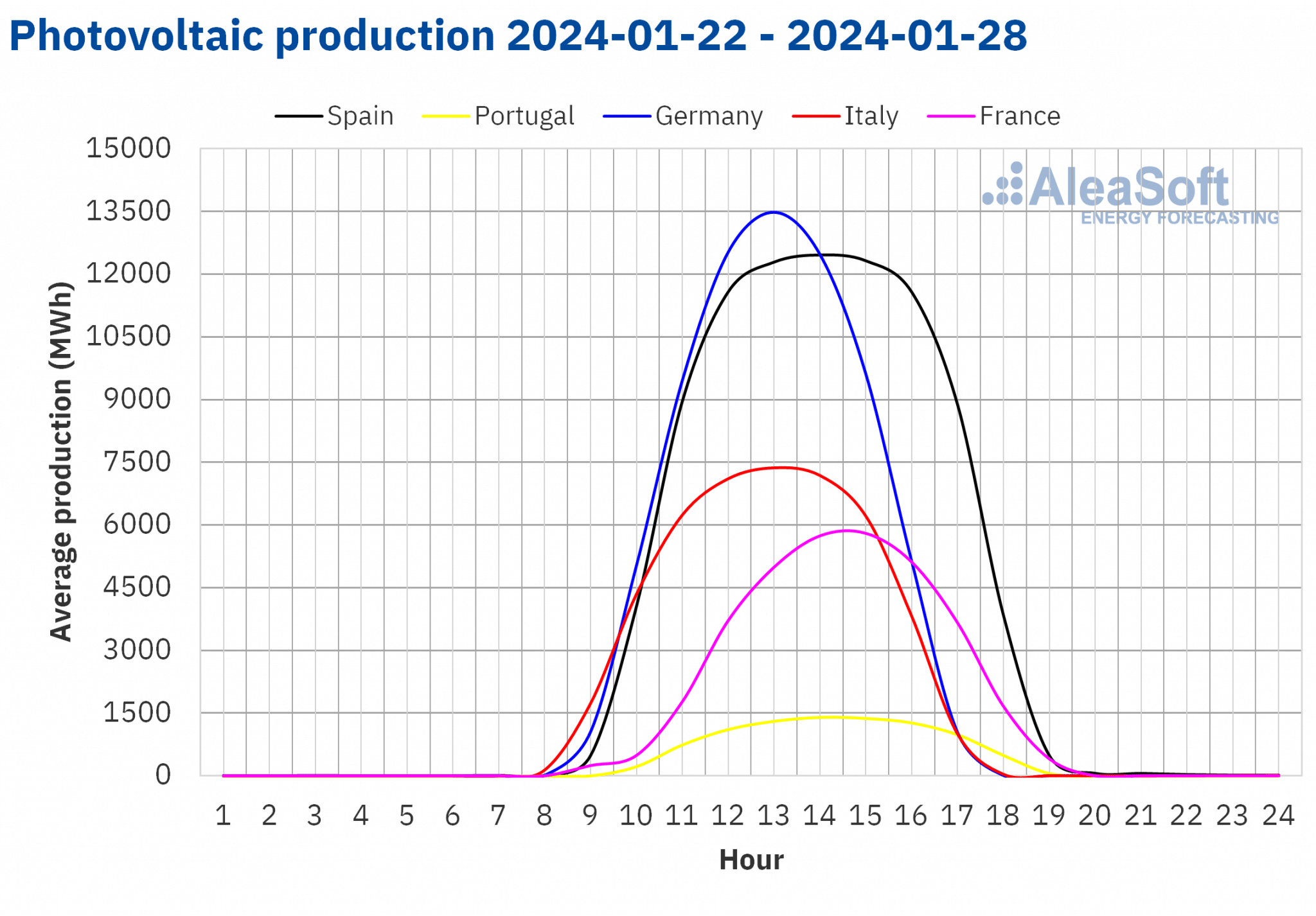

In the week of January 22, solar energy production increased in the main European markets compared to the previous week. The Italian and French markets continued their upward trend for the third consecutive week, this time with increases of 38% and 11%, respectively. In the case of the Portuguese market, it was for the second consecutive week, with an increase of 61%. In the German and Spanish markets, solar energy production increased by 98% in both cases after falling during the previous week.

The German market set a weekly solar energy production record for a January month of 488 GWh, representing a 43% increase over that registered in the week of January 8, 2024. The Spanish market also registered record weekly solar photovoltaic energy production of 594 GWh, 3.7% higher than the value registered in the week of January 30, 2023.

AleaSoft Energy Forecasting’s solar energy production forecasts for the week of January 29 indicate that it will increase in Italy, Spain and Germany, following the increasing trend as days get longer.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

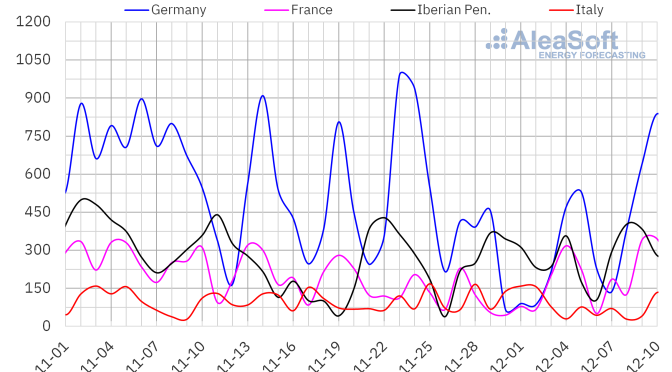

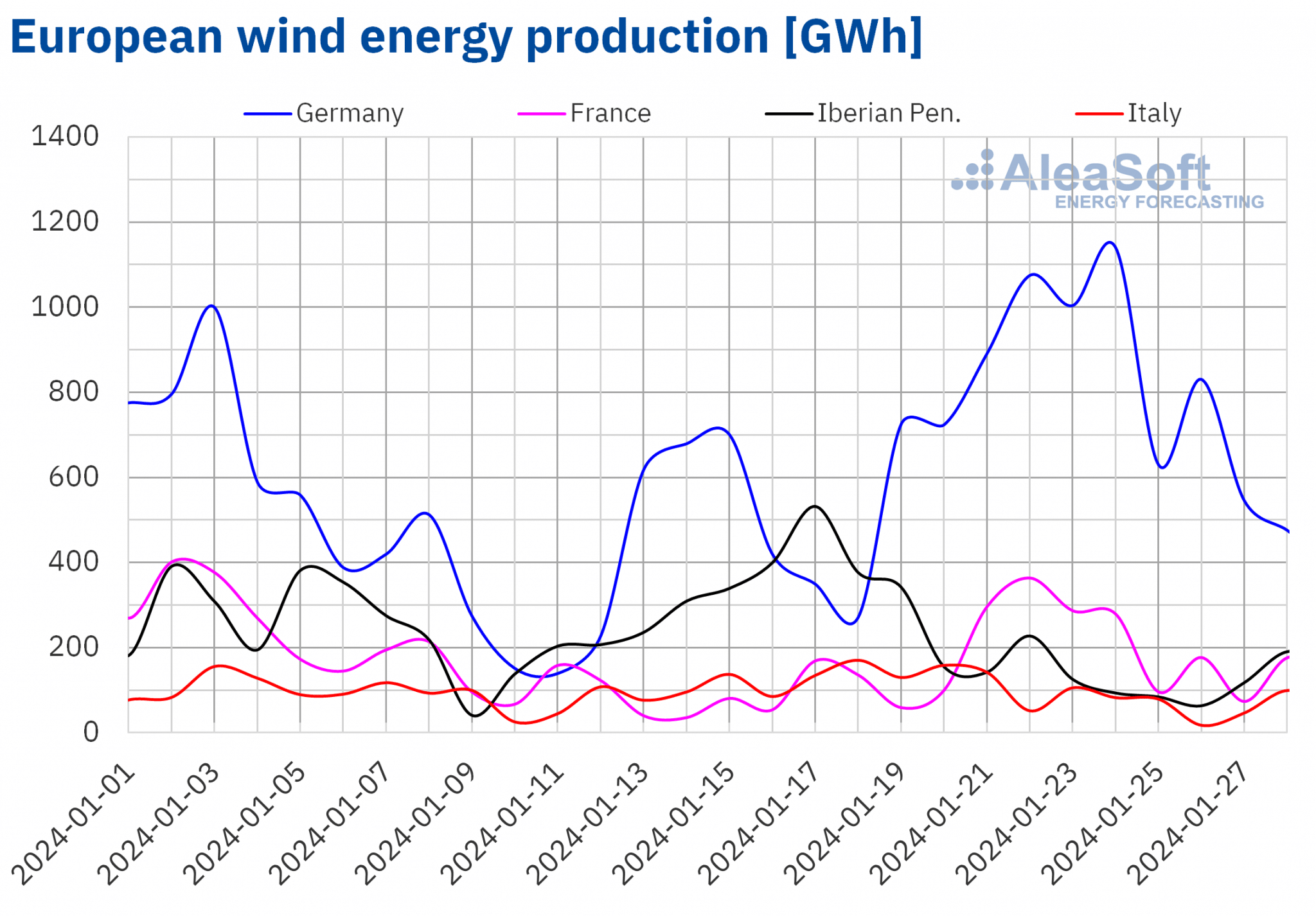

In the fourth week of January, wind energy production in the main European electricity markets registered values similar to those of the last week of 2023. In the French and German markets, the upward trend continued for the second consecutive week, with increases of 63% and 40%, respectively. On the other hand, in the Spanish, Portuguese and Italian markets, production decreased by 61% in the Iberian Peninsula and by 50% in Italy.

AleaSoft Energy Forecasting’s wind energy production forecasts for the week of January 29 indicate that the downward trend will continue in the Italian and Iberian markets, with the German and French markets joining them.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

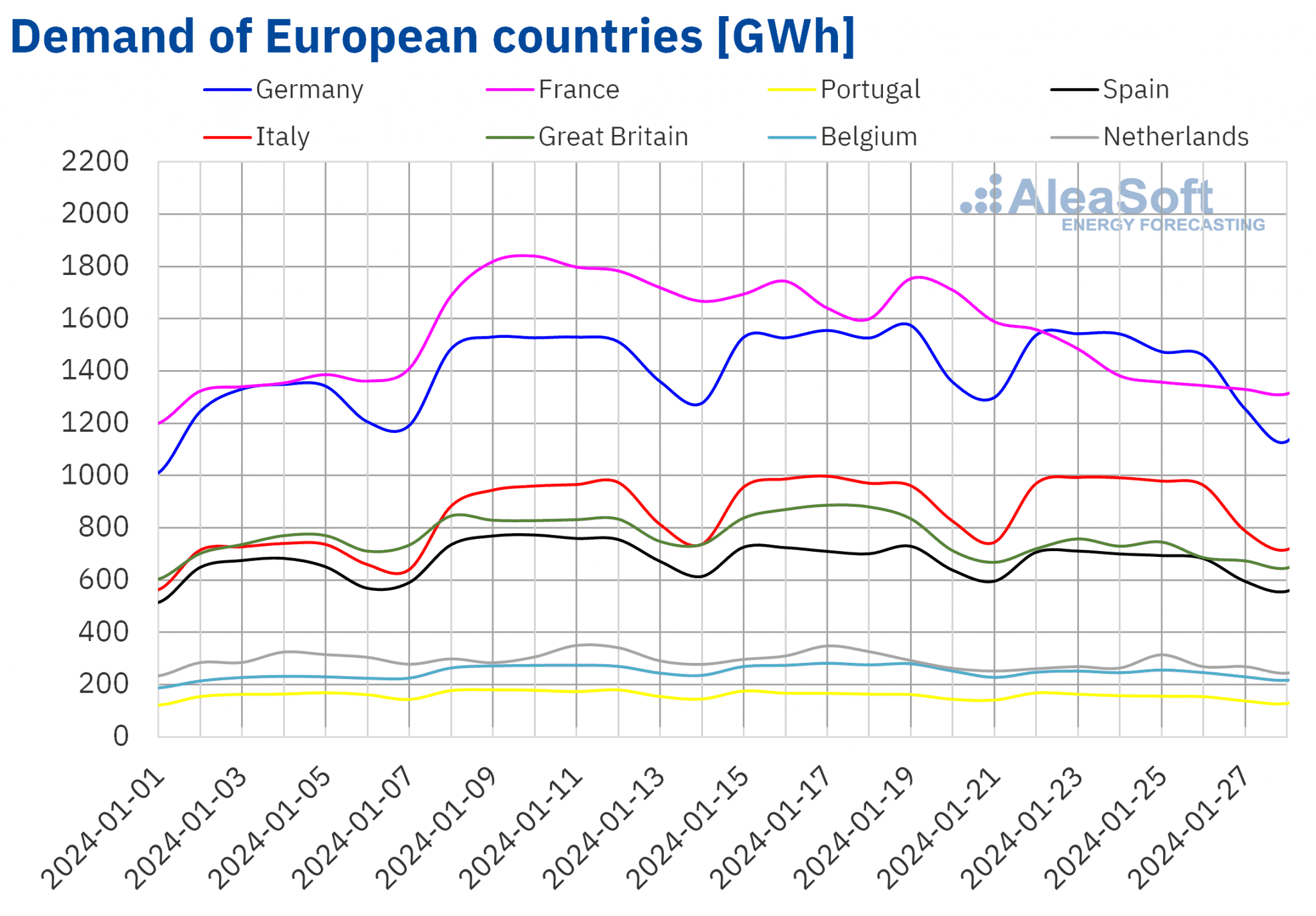

Electricity demand

During the week of January 22, the main European electricity markets registered a generalized decrease in electricity demand compared to the previous week. The levels of demand were similar to those registered in the first week of 2024. In the markets of France, the Netherlands, Portugal and Spain, demand decreased for the second consecutive week by 17%, 9.5%, 5.0% and 3.7%, respectively. The markets of Great Britain, Belgium, Germany and Italy registered declines ranging from 13% in the British market to 0.7% in the Italian market, after two consecutive weeks of demand increases.

Most analyzed markets registered an increase in average temperatures compared to the previous week. Belgium registered the largest increase, 8.4 °C, while Spain and Portugal registered the smallest increase, 0.2 °C in both cases. Italy was the exception, registering a decrease of 1.6 °C.

AleaSoft Energy Forecasting’s demand forecasts indicate that during the week beginning on January 29, electricity demand will remain at the levels observed in the previous week. It will increase in the markets of Portugal, the Netherlands, Great Britain, Italy, Belgium and Spain throughout the week. On the other hand, demand will decrease in Germany and France compared with the fourth week of the year.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

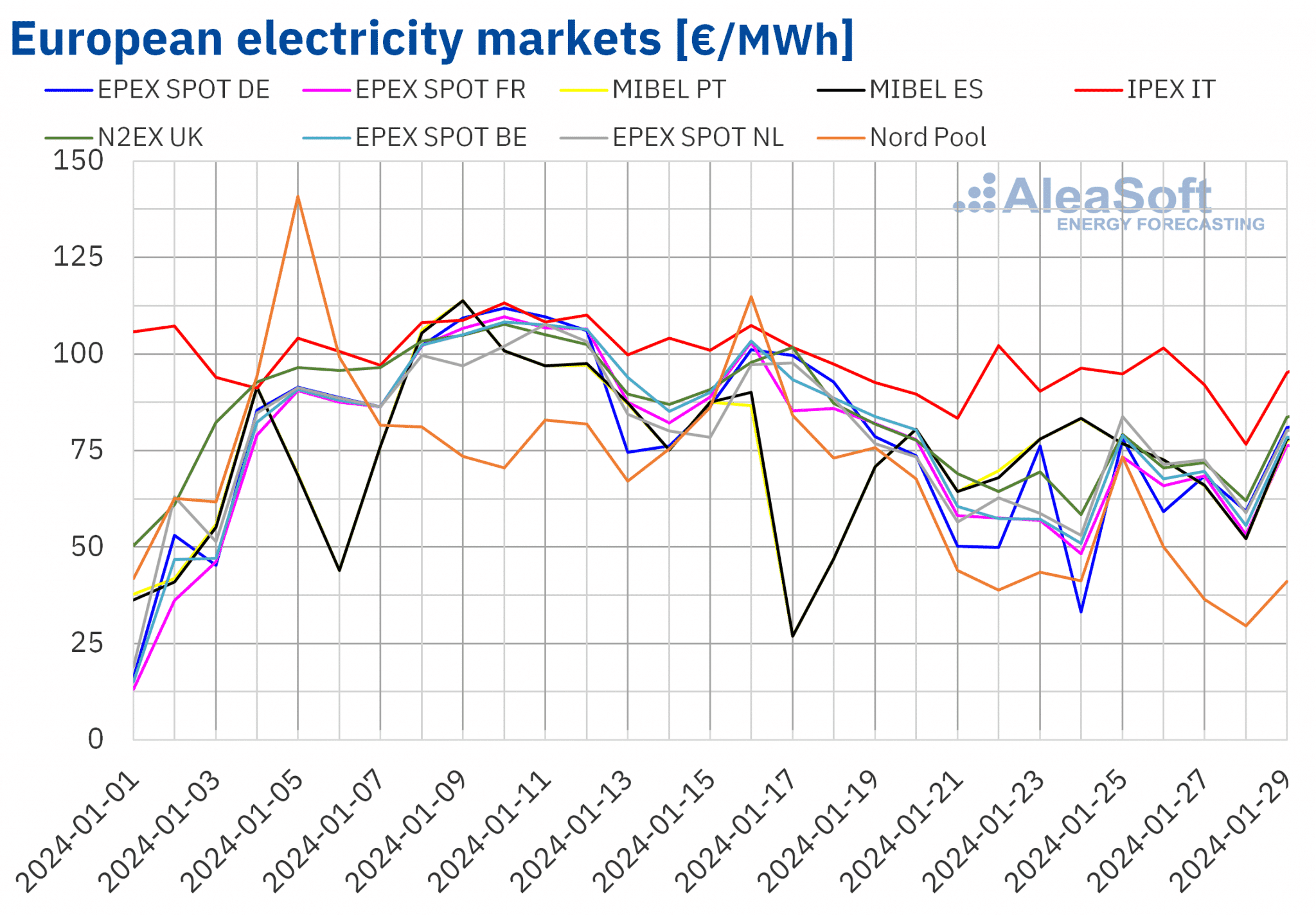

European electricity markets

During the week of January 22, prices in most major European electricity markets continued the downward trend that began the previous week. The exception was the MIBEL market of Spain and Portugal. After reaching the largest percentage price declines in the third week of January, the Spanish and Portuguese markets registered increases of 6.3% and 7.5%, respectively. In contrast, the Nord Pool market of the Nordic countries, which registered a slight price increase in the previous week, reached the largest drop, 43%, in the fourth week of January. On the other hand, the IPEX market of Italy registered the smallest decline, 2.8%. In the other markets analyzed at AleaSoft Energy Forecasting, prices fell between 19% in the EPEX SPOT market of the Netherlands and 27% in the EPEX SPOT market of Germany, Belgium and France.

In the fourth week of January, weekly averages were below €75/MWh in almost all analyzed European electricity markets. The exception was the Italian market, which registered the highest average, €93.43/MWh. In contrast, the Nordic market had the lowest weekly price, €44.72/MWh. In the rest of the analyzed markets, prices ranged from €60.50/MWh in the French market to €71.19/MWh in the Portuguese market.

During the week of January 22, weekly gas and CO2 emission rights prices continued to fall. This had a downward influence on European electricity market prices. The general decline in electricity demand, the increase in solar energy production, as well as the increase in wind energy production in some markets such as Germany and France, also contributed to price declines in European electricity markets during the fourth week of January. However, wind energy production decreased significantly in the Iberian Peninsula and Italy. This drop led to higher prices in the MIBEL market and limited their decline in the IPEX market.

AleaSoft Energy Forecasting’s price forecasts indicate that in the week of January 29, prices in European electricity markets might increase. The decline in wind energy production and the recovery of demand in most markets will lead to this behavior.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

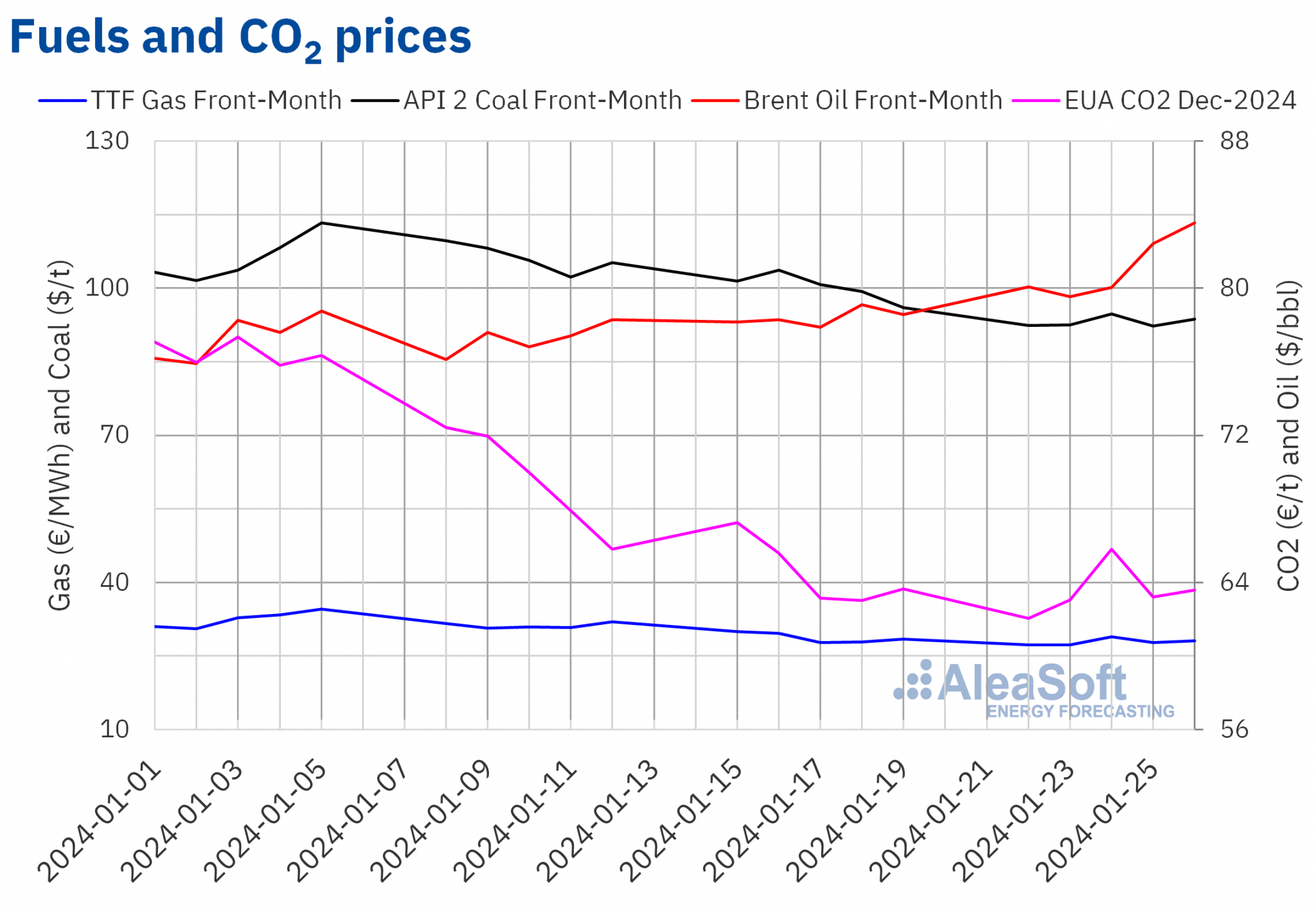

Brent, fuels and CO2

Prices of Brent oil futures for the Front?Month in the ICE market increased during the fourth week of January. In almost every session this week, settlement prices exceeded $80/bbl. The exception was on Tuesday, January 23, when these futures registered their weekly minimum settlement price, $79.55/bbl. As a result of the price rises registered during the week, on Friday, January 26, the settlement price was $83.55/bbl. This price was 6.4% higher than the previous Friday and the highest since the first half of November.

News on the evolution of the US economy and on measures to promote growth in the Chinese economy exerted their upward influence on Brent oil futures prices in the fourth week of January. Moreover, growing instability in the Middle East also contributed to the price increase.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, in the first sessions of the fourth week of January, they abandoned the upward trend of the second half of the previous week. As a consequence of the registered falls, on Tuesday, January 23, these futures reached their weekly minimum settlement price, €27.23/MWh. According to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since early August 2023. In contrast, on Wednesday, January 24, Front?Month TTF gas futures reached their weekly maximum settlement price, €28.93/MWh. After retreating on Thursday, the settlement price went back above €28/MWh on Friday, reaching €28.13/MWh. This price was 1.1% lower than the previous Friday.

During the fourth week of January, high European reserve levels, abundant supplies of liquefied natural gas and forecasts of milder temperatures in Europe exerted their downward influence on TTF gas futures prices.

As for CO2 emission rights futures in the EEX market for the reference contract of December 2024, on Monday, January 22, they registered the weekly minimum settlement price, €62.04/t. This settlement price was the lowest since March 8, 2022. On Tuesday and Wednesday, prices increased. As a result, these futures registered their weekly maximum settlement price, €65.82/t, on Wednesday, January 24. In the last sessions of the week, settlement prices remained below €64/t. On Friday, January 26, the settlement price was €63.59/t, only 0.1% lower than in the last session of the previous week.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.